Notice of the 20 Annual Ordinary General Meeting of Shareholders TO

Notice of the 20 Annual Ordinary General Meeting of Shareholders TO

Notice of the 20 Annual Ordinary General Meeting of Shareholders TO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

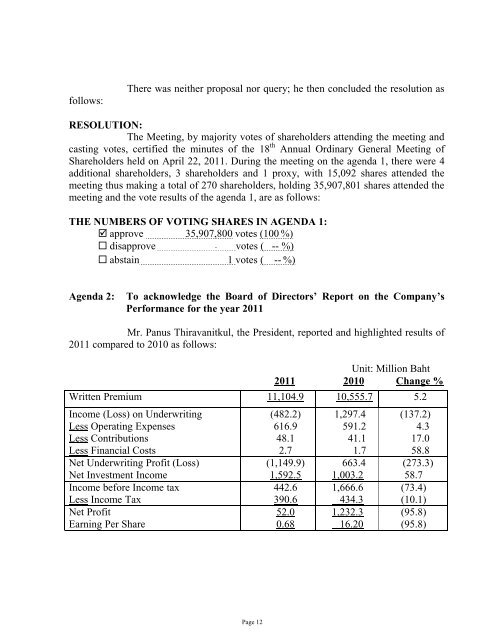

follows:There was nei<strong>the</strong>r proposal nor query; he <strong>the</strong>n concluded <strong>the</strong> resolution asRESOLUTION:The <strong>Meeting</strong>, by majority votes <strong>of</strong> shareholders attending <strong>the</strong> meeting andcasting votes, certified <strong>the</strong> minutes <strong>of</strong> <strong>the</strong> 18 th <strong>Annual</strong> <strong>Ordinary</strong> <strong>General</strong> <strong>Meeting</strong> <strong>of</strong><strong>Shareholders</strong> held on April 22, <strong>20</strong>11. During <strong>the</strong> meeting on <strong>the</strong> agenda 1, <strong>the</strong>re were 4additional shareholders, 3 shareholders and 1 proxy, with 15,092 shares attended <strong>the</strong>meeting thus making a total <strong>of</strong> 270 shareholders, holding 35,907,801 shares attended <strong>the</strong>meeting and <strong>the</strong> vote results <strong>of</strong> <strong>the</strong> agenda 1, are as follows:THE NUMBERS OF VOTING SHARES IN AGENDA 1: approve 35,907,800 votes (100 %) disapprove - votes ( -- %) abstain 1 votes ( -- %)Agenda 2:To acknowledge <strong>the</strong> Board <strong>of</strong> Directors’ Report on <strong>the</strong> Company’sPerformance for <strong>the</strong> year <strong>20</strong>11Mr. Panus Thiravanitkul, <strong>the</strong> President, reported and highlighted results <strong>of</strong><strong>20</strong>11 compared to <strong>20</strong>10 as follows:Unit: Million Baht<strong>20</strong>11 <strong>20</strong>10 Change %Written Premium 11,104.9 10,555.7 5.2Income (Loss) on Underwriting (482.2) 1,297.4 (137.2)Less Operating Expenses 616.9 591.2 4.3Less Contributions 48.1 41.1 17.0Less Financial Costs 2.7 1.7 58.8Net Underwriting Pr<strong>of</strong>it (Loss) (1,149.9) 663.4 (273.3)Net Investment Income 1,592.5 1,003.2 58.7Income before Income tax 442.6 1,666.6 (73.4)Less Income Tax 390.6 434.3 (10.1)Net Pr<strong>of</strong>it 52.0 1,232.3 (95.8)Earning Per Share 0.68 16.<strong>20</strong> (95.8)Page 12