annual report 2011/12 - Manitoba Agricultural Services Corporation

annual report 2011/12 - Manitoba Agricultural Services Corporation

annual report 2011/12 - Manitoba Agricultural Services Corporation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

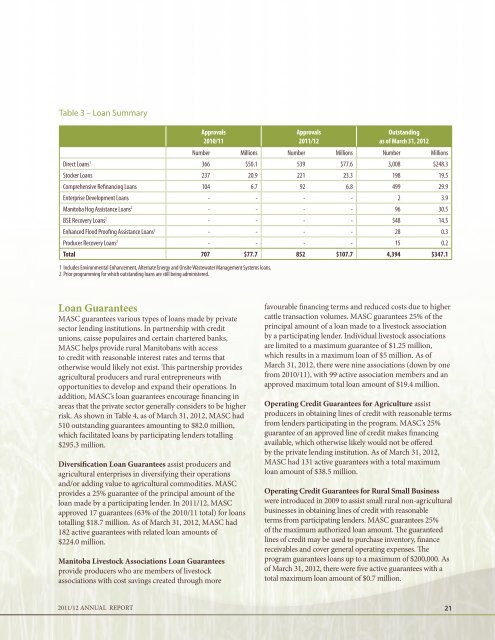

Table 3 – Loan SummaryApprovals2010/11Approvals<strong>2011</strong>/<strong>12</strong>Outstandingas of March 31, 20<strong>12</strong>Number Millions Number Millions Number MillionsDirect Loans 1 366 $50.1 539 $77.6 3,008 $248.3Stocker Loans 237 20.9 221 23.3 198 19.5Comprehensive Refinancing Loans 104 6.7 92 6.8 499 29.9Enterprise Development Loans - - - - 2 3.9<strong>Manitoba</strong> Hog Assistance Loans 2 - - - - 96 30.5BSE Recovery Loans 2 - - - - 548 14.5Enhanced Flood Proofing Assistance Loans 2 - - - - 28 0.3Producer Recovery Loans 2 - - - - 15 0.2Total 707 $77.7 852 $107.7 4,394 $347.11 Includes Environmental Enhancement, Alternate Energy and Onsite Wastewater Management Systems loans.2 Prior programming for which outstanding loans are still being administered.Loan GuaranteesMASC guarantees various types of loans made by privatesector lending institutions. In partnership with creditunions, caisse populaires and certain chartered banks,MASC helps provide rural <strong>Manitoba</strong>ns with accessto credit with reasonable interest rates and terms thatotherwise would likely not exist. This partnership providesagricultural producers and rural entrepreneurs withopportunities to develop and expand their operations. Inaddition, MASC’s loan guarantees encourage financing inareas that the private sector generally considers to be higherrisk. As shown in Table 4, as of March 31, 20<strong>12</strong>, MASC had510 outstanding guarantees amounting to $82.0 million,which facilitated loans by participating lenders totalling$295.3 million.Diversification Loan Guarantees assist producers andagricultural enterprises in diversifying their operationsand/or adding value to agricultural commodities. MASCprovides a 25% guarantee of the principal amount of theloan made by a participating lender. In <strong>2011</strong>/<strong>12</strong>, MASCapproved 17 guarantees (63% of the 2010/11 total) for loanstotalling $18.7 million. As of March 31, 20<strong>12</strong>, MASC had182 active guarantees with related loan amounts of$224.0 million.<strong>Manitoba</strong> Livestock Associations Loan Guaranteesprovide producers who are members of livestockassociations with cost savings created through morefavourable financing terms and reduced costs due to highercattle transaction volumes. MASC guarantees 25% of theprincipal amount of a loan made to a livestock associationby a participating lender. Individual livestock associationsare limited to a maximum guarantee of $1.25 million,which results in a maximum loan of $5 million. As ofMarch 31, 20<strong>12</strong>, there were nine associations (down by onefrom 2010/11), with 99 active association members and anapproved maximum total loan amount of $19.4 million.Operating Credit Guarantees for Agriculture assistproducers in obtaining lines of credit with reasonable termsfrom lenders participating in the program. MASC’s 25%guarantee of an approved line of credit makes financingavailable, which otherwise likely would not be offeredby the private lending institution. As of March 31, 20<strong>12</strong>,MASC had 131 active guarantees with a total maximumloan amount of $38.5 million.Operating Credit Guarantees for Rural Small Businesswere introduced in 2009 to assist small rural non-agriculturalbusinesses in obtaining lines of credit with reasonableterms from participating lenders. MASC guarantees 25%of the maximum authorized loan amount. The guaranteedlines of credit may be used to purchase inventory, financereceivables and cover general operating expenses. Theprogram guarantees loans up to a maximum of $200,000. Asof March 31, 20<strong>12</strong>, there were five active guarantees with atotal maximum loan amount of $0.7 million.<strong>2011</strong>/<strong>12</strong> Annual Report 21