annual report 2011/12 - Manitoba Agricultural Services Corporation

annual report 2011/12 - Manitoba Agricultural Services Corporation

annual report 2011/12 - Manitoba Agricultural Services Corporation

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

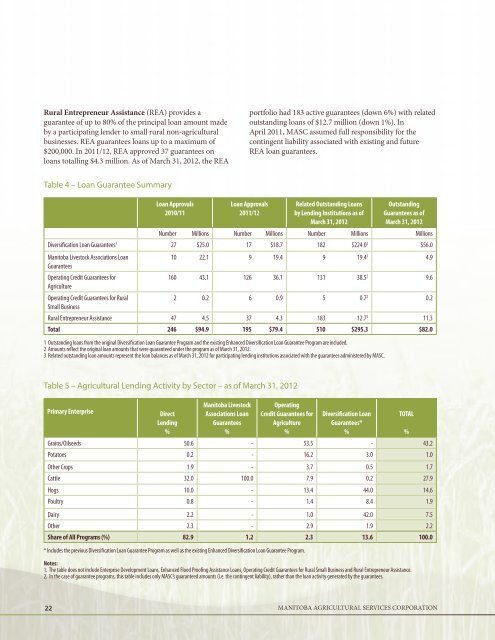

Rural Entrepreneur Assistance (REA) provides aguarantee of up to 80% of the principal loan amount madeby a participating lender to small rural non-agriculturalbusinesses. REA guarantees loans up to a maximum of$200,000. In <strong>2011</strong>/<strong>12</strong>, REA approved 37 guarantees onloans totalling $4.3 million. As of March 31, 20<strong>12</strong>, the REAportfolio had 183 active guarantees (down 6%) with relatedoutstanding loans of $<strong>12</strong>.7 million (down 1%). InApril <strong>2011</strong>, MASC assumed full responsibility for thecontingent liability associated with existing and futureREA loan guarantees.Table 4 – Loan Guarantee SummaryLoan Approvals2010/11Loan Approvals<strong>2011</strong>/<strong>12</strong>Related Outstanding Loansby Lending Institutions as ofMarch 31, 20<strong>12</strong>OutstandingGuarantees as ofMarch 31, 20<strong>12</strong>Number Millions Number Millions Number Millions MillionsDiversification Loan Guarantees 1 27 $25.0 17 $18.7 182 $224.0 2 $56.0<strong>Manitoba</strong> Livestock Associations Loan10 22.1 9 19.4 9 19.4 2 4.9GuaranteesOperating Credit Guarantees for160 43.1 <strong>12</strong>6 36.1 131 38.5 2 9.6AgricultureOperating Credit Guarantees for Rural2 0.2 6 0.9 5 0.7 2 0.2Small BusinessRural Entrepreneur Assistance 47 4.5 37 4.3 183 <strong>12</strong>.7 3 11.3Total 246 $94.9 195 $79.4 510 $295.3 $82.01 Outstanding loans from the original Diversification Loan Guarantee Program and the existing Enhanced Diversification Loan Guarantee Program are included.2 Amounts reflect the original loan amounts that were guaranteed under the program as of March 31, 20<strong>12</strong>.3 Related outstanding loan amounts represent the loan balances as of March 31, 20<strong>12</strong> for participating lending institutions associated with the guarantees administered by MASC.Table 5 – <strong>Agricultural</strong> Lending Activity by Sector – as of March 31, 20<strong>12</strong>Primary EnterpriseDirectLending%<strong>Manitoba</strong> LivestockAssociations LoanGuarantees%OperatingCredit Guarantees forAgriculture%Diversification LoanGuarantees*%Grains/Oilseeds 50.6 - 53.5 - 43.2Potatoes 0.2 - 16.2 3.0 1.0Other Crops 1.9 - 3.7 0.5 1.7Cattle 32.0 100.0 7.9 0.2 27.9Hogs 10.0 - 13.4 44.0 14.6Poultry 0.8 - 1.4 8.4 1.9Dairy 2.2 - 1.0 42.0 7.5Other 2.3 - 2.9 1.9 2.2Share of All Programs (%) 82.9 1.2 2.3 13.6 100.0* Includes the previous Diversification Loan Guarantee Program as well as the existing Enhanced Diversification Loan Guarantee Program.Notes:1. The table does not include Enterprise Development Loans, Enhanced Flood Proofing Assistance Loans, Operating Credit Guarantees for Rural Small Business and Rural Entrepreneur Assistance.2. In the case of guarantee programs, this table includes only MASC’s guaranteed amounts (i.e. the contingent liability), rather than the loan activity generated by the guarantees.TOTAL%22<strong>Manitoba</strong> <strong>Agricultural</strong> SeRVICes <strong>Corporation</strong>