2 Alcoholic Beverages (Beer, Wine, Whisky, etc.) - ASEAN-Japan ...

2 Alcoholic Beverages (Beer, Wine, Whisky, etc.) - ASEAN-Japan ...

2 Alcoholic Beverages (Beer, Wine, Whisky, etc.) - ASEAN-Japan ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, <strong>Wine</strong>, <strong>Whisky</strong>, <strong>etc</strong>.)<br />

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

1. Market Conditions in <strong>Japan</strong><br />

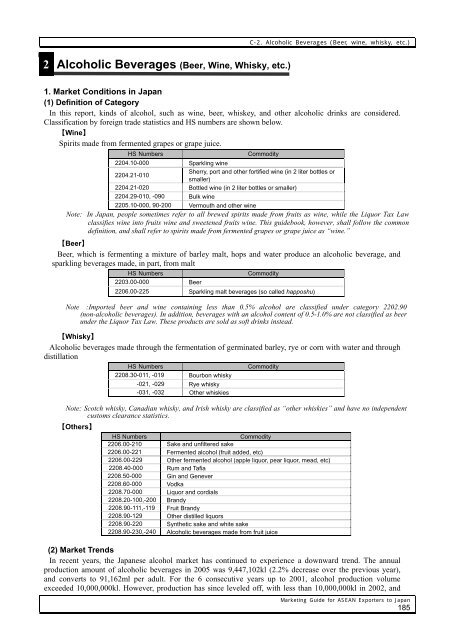

(1) Definition of Category<br />

In this report, kinds of alcohol, such as wine, beer, whiskey, and other alcoholic drinks are considered.<br />

Classification by foreign trade statistics and HS numbers are shown below.<br />

【<strong>Wine</strong>】<br />

Spirits made from fermented grapes or grape juice.<br />

HS Numbers Commodity<br />

2204.10-000 Sparkling wine<br />

2204.21-010<br />

Sherry, port and other fortified wine (in 2 liter bottles or<br />

smaller)<br />

2204.21-020 Bottled wine (in 2 liter bottles or smaller)<br />

2204.29-010, -090 Bulk wine<br />

2205.10-000, 90-200 Vermouth and other wine<br />

Note: In <strong>Japan</strong>, people sometimes refer to all brewed spirits made from fruits as wine, while the Liquor Tax Law<br />

classifies wine into fruits wine and sweetened fruits wine. This guidebook, however, shall follow the common<br />

definition, and shall refer to spirits made from fermented grapes or grape juice as “wine.”<br />

【<strong>Beer</strong>】<br />

<strong>Beer</strong>, which is fermenting a mixture of barley malt, hops and water produce an alcoholic beverage, and<br />

sparkling beverages made, in part, from malt<br />

HS Numbers Commodity<br />

2203.00-000 <strong>Beer</strong><br />

2206.00-225 Sparkling malt beverages (so called happoshu)<br />

Note :Imported beer and wine containing less than 0.5% alcohol are classified under category 2202.90<br />

(non-alcoholic beverages). In addition, beverages with an alcohol content of 0.5-1.0% are not classified as beer<br />

under the Liquor Tax Law. These products are sold as soft drinks instead.<br />

【<strong>Whisky</strong>】<br />

<strong>Alcoholic</strong> beverages made through the fermentation of germinated barley, rye or corn with water and through<br />

distillation<br />

HS Numbers Commodity<br />

2208.30-011, -019 Bourbon whisky<br />

-021, -029 Rye whisky<br />

-031, -032 Other whiskies<br />

Note: Scotch whisky, Canadian whisky, and Irish whisky are classified as “other whiskies” and have no independent<br />

customs clearance statistics.<br />

【Others】<br />

HS Numbers Commodity<br />

2206.00-210 Sake and unfiltered sake<br />

2206.00-221 Fermented alcohol (fruit added, <strong>etc</strong>)<br />

2206.00-229 Other fermented alcohol (apple liquor, pear liquor, mead, <strong>etc</strong>)<br />

2208.40-000 Rum and Tafia<br />

2208.50-000 Gin and Genever<br />

2208.60-000 Vodka<br />

2208.70-000 Liquor and cordials<br />

2208.20-100,-200 Brandy<br />

2208.90-111,-119 Fruit Brandy<br />

2208.90-129 Other distilled liquors<br />

2208.90-220 Synthetic sake and white sake<br />

2208.90-230,-240 <strong>Alcoholic</strong> beverages made from fruit juice<br />

(2) Market Trends<br />

In recent years, the <strong>Japan</strong>ese alcohol market has continued to experience a downward trend. The annual<br />

production amount of alcoholic beverages in 2005 was 9,447,102kl (2.2% decrease over the previous year),<br />

and converts to 91,162ml per adult. For the 6 consecutive years up to 2001, alcohol production volume<br />

exceeded 10,000,000kl. However, production has since leveled off, with less than 10,000,000kl in 2002, and<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

185

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

has decreased 6.5% over the past 5 years, with consumption per adult decreasing 8.3%.<br />

Causes for the downward trend in the market in recent years include change in lifestyle, the economic<br />

depression over the past several years, notably reduction of prices, lite-conscious trend, and diversification of<br />

tastes. The number of young people who do not drink alcoholic beverages at all, or only drink low-alcoholic<br />

beverages, has increased.<br />

Among alcoholic beverages, beer is most favored by the <strong>Japan</strong>ese, occupying 38.2% of the total annual<br />

alcohol production amount. However, after the sale of happoshu began in 1994, the production amount and<br />

total share of beer has continued to decrease with a 7.9% decrease in 2005 over the previous year. Furthermore,<br />

sparkling malt beverage, so-called happoshu which increased production amount at the expense of beer, has<br />

fallen into the negative area since the tax increase of happoshu in May 2005, and has decreased immensely<br />

since that time, with a 25% decrease over the previous year. Instead, “beer-tasting drinks of the third<br />

generation” (the so-called third beer that statistically corresponds to a hybrid), which do not use malt or oats,<br />

have replaced the consumption amount of happoshu. Following the big hit of “Draft-One" by Sapporo <strong>Beer</strong>,<br />

Suntory, Kirin <strong>Beer</strong>, and Asahi <strong>Beer</strong> also entered into the third beer market, and in 2004, the production amount<br />

greatly expanded to 16 times that of the previous year, then 3.6 times in 2005.<br />

Liqueurs and spirits also steadily increased, since they are necessary to make cocktails, which are popular<br />

among women and shochu-based canned beverage. Shochu (distilled spirits)-based beverages are original to<br />

<strong>Japan</strong> where fruit flavored soda water, such as lemon, grapefruit, or orange, is added to a distilled alcoholic<br />

base such as shochu, neutral spirits (raw material alcohol), or vodka. These beverages are sold at a low-price<br />

(approximately 120-150 yen for a 350ml can), and have a low-alcohol content (about 5-7% alcohol). For<br />

example, Kirin began sale of “Hyoketsu” in 2001, which soon became popular among young people and<br />

women, and other companies soon followed. Each company seeks to differentiate itself from its competitors<br />

in one way or another in order to increase its market share by adding low-calorie products in response to health<br />

trends or seasonal products.<br />

For several years, a downward trend in the consumption volume of wine (fruit wine) could be seen, but in<br />

2005, a positive increase of 2.2% over the previous year was experienced, due in part by a boom in sparkling<br />

wines, including champagne.<br />

The peak of the shochu boom also seems to have passed, but sales are still steady (0.0% increase over the<br />

previous year), and the market is led by popular large-volume bottles in A Class that focus on low-price<br />

products, and potato shochu and Awamori in B Class.<br />

Fig. 1 <strong>Japan</strong>ese consumption of alcoholic beverages (2005)<br />

Total annual<br />

consumption<br />

(kl)<br />

Percentag<br />

e of total<br />

Per capita<br />

consumption<br />

(ml)<br />

Yearly<br />

change<br />

<strong>Beer</strong> 3,606,826 38.2 34,805 92.1<br />

Happoshu 1,782,154 18.9 17,197 75.0<br />

Miscellaneous<br />

liquor<br />

887,349 9.4 8,563 361.4<br />

<strong>Japan</strong>ese sake 737,676 7.8 7,118 96.7<br />

<strong>Japan</strong>ese<br />

shochu<br />

1,047,193 11.1 10,105 100.0<br />

Liqueur 778,244 8.2 7,510 109.7<br />

Spirits 78,289 0.8 755 99.0<br />

Fruit wine 259,683 2.7 2,506 102.2<br />

<strong>Whisky</strong> 95,234 1,0 919 95.9<br />

Others 174,454 1.9 1,684 ――<br />

TOTAL 9,447,102 100.0 91,162 97.8<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

186<br />

On the other hand, the consumption amount of<br />

high-alcohol content whisky and sake has decreased,<br />

influenced by the trend for low-alcohol, with a 4.1%<br />

and 3.3% decrease, respectively, over the previous year.<br />

However, the industry assumes that the downward<br />

trend over the past several years has eased due to<br />

single malt whisky gaining popularity and the boom in<br />

<strong>Japan</strong>ese sake, especially with women.<br />

In contrast to the trend towards low-price, the number<br />

of people who still demand genuine quality, even at a<br />

higher price, has also increased, not just for single malt<br />

whisky as mentioned above, but also for premium beer<br />

and premium shochu products, with a steady expansion<br />

of the support base. As a result, a polarization of the<br />

market has developed.<br />

Source: Bureau of Statistics, Ministry of Internal Affairs and Communications.<br />

Note) Production amount of alcohol is based on the taxable amount, according to the Tax Administration Agency (total amount of products<br />

produced in <strong>Japan</strong> or imported).<br />

Consumption volume per person is calculated based on the adult population.

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

[<strong>Wine</strong>]<br />

The domestic market of wine has continued to slide after a peak in 1998, due to various factors such as the<br />

liquidation of excess inventory, increased competition with other alcohols, diversification of consumer tastes,<br />

and the cooling off of the red wine boom by health-conscious persons.<br />

According to customs clearance statistics of imported alcohol by the Bureau of Customs, Ministry of Finance,<br />

the importation of the bottled wine category (in a container less than 2l) in 2005 decreased 6.3% over previous<br />

year. However, on the bright side, there was a boom in Beaujolais Nouveau and increased popularity in<br />

sparkling wines, including champagne.<br />

The boom in sparkling wine was sparked by the sale of wine at restaurants by the glass, at department stores,<br />

and at wine specialty shops, and became popular with women due in part to the appearance of smaller sizes,<br />

such as half and quarter, and easy-to-drink products, such as fruit-flavored wines. Growth was steady in 2005,<br />

focusing on the promotion of products with a price around 1,000 yen for a full-size bottle, brand champagnes<br />

around 3,000-5,000 yen, especially the rosé type. Sparkling wine has steadily increased from the wine drunk at<br />

a restaurant or on special occasions, to the wine occasionally enjoyed at home.<br />

On the other hand, individual companies have been focusing on the business market by expanding the market<br />

through sales by the glass. Since so many kinds of wines are on the market, it is hard to convey information to<br />

consumers except by brand promotion. As such, sale by the glass is an effective method to advertise the taste of<br />

a wine to a wide audience, and if liked, leads to greater consumption. And from the consumer side, since many<br />

different kinds can be sampled, it is very popular regardless of sex or age.<br />

[<strong>Beer</strong>]<br />

The beer beverage (beer, happoshu, third beer) market in <strong>Japan</strong> is monopolized by four companies, big brands<br />

Asahi and Kirin, and Sapporo and Suntory. The taxable shipping volume of beer beverages, which combines<br />

beer, happoshu, third beer, was 6,328,932kl in 2005, 96.8% of the previous year.<br />

The volume of beer consumption has continued its downward trend since 1994, as consumers are lost to<br />

low-price products such as happoshu, third beer, and chuhai cans. However, consumption of premium beer<br />

supported by genuine-conscious consumers, who enjoy the original taste and flavor of beer even if it is a little<br />

more expensive, has continued upward since 2003. In addition to "The Premium Malts” by Suntory, “Yebisu”<br />

by Sapporo and chilled beer by Kirin <strong>Beer</strong> (quality of the beer is maintained by low-temperature delivery,<br />

unfiltered after maturation), others have also increased sales, with the industry seeing an expansion in the<br />

percentage of the premium beer in the beer market from a 2% increase in 2001 to a 4% increase in 2005.<br />

Furthermore, although half of the beer is said to be for the business market, draft beer by the keg, for use in<br />

businesses, is also doing well.<br />

Under such conditions, overseas brand beers are faring poorly, although some are experiencing upward sales.<br />

Imported beer has an alcohol content about 4-8%, and many have their own characteristics due to various<br />

production methods. On the wave of premium beer popularity, people who demand bottled imported beer that<br />

has a characteristic taste, a special way to drink, and brand label, even if the price is a little higher, have<br />

increased. Manufacturers promote sales in the business market, by pioneering fields such as restaurants<br />

inclined towards the characteristics of a specific country or brand. According to the monthly statistics report of<br />

alcohol and foods (August 2006), the share of imported beer is in an upward trend, with a 1.78% increase when<br />

5 brands (Budweiser, Heineken, Miller Special, Lowenbrau, Carlsberg) produced in <strong>Japan</strong>, are included.<br />

Also, third beer (does not use malt or oats, listed as miscellaneous alcohol according to the Liquor Tax Law,<br />

and has a lower liquor tax than happoshu) could be competitively sold with the increase in tax for happoshu<br />

since May 2003. Starting with sale of "Draft One” by Sapporo <strong>Beer</strong> in February 2004, at 125 yen for 350ml, 20<br />

yen lower than regular happoshu, third beer had a major impact on the market. Soon after, the other 3 major<br />

beer manufacturers entered the market. With an increase of 3.61 times over the previous year in 2005, it<br />

captured the market segment that had switched from beer to happoshu by its inexpensive price.<br />

On the other hand, demand for happoshu greatly decreased, with a 25% decrease in 2005 over the previous<br />

year, as its economical merit was lost with the appearance of low price third beer.<br />

According to the aforementioned survey of the monthly statistics report of alcohol and foods, the percentage<br />

of the above three in the current beer beverage market is beer 56.26%, happoshu 27.86%, third beer 15.89%,<br />

with attention focused on how much the share of third beer will increase in the future.<br />

[<strong>Whisky</strong>]<br />

The whisky market has continued to decline over the past 7 years since 1998, and in 2005, fell to one fourth<br />

of its peak. Main consumers of whisky are middle-aged males, but consumption volume has faced hard times<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

187

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

both for business use and home use, due to the failure to recruit new consumers into the aging market,<br />

decreased demand by businesses due to the economic depression, as well as the popularity of low-price and<br />

low-alcohol beverages.<br />

As a bright spot in the whisky market, single-malt whisky using 100% malt from a single distillery can be<br />

considered. Demand has expanded for several years among 30-year-old males. Since 2004, one major<br />

manufacturer after another has developed campaigns and began sale of premium single malts. According to<br />

Suntory, the largest whisky manufacturer, imported single malts underwent a smooth transition following this<br />

trend, with a total of 64,000 boxes (1 box =12 bottles) in 2005, a 116% increase over the previous year. This<br />

has become the focus of business demand, and the consumption at hotels and standing-bars, <strong>etc</strong>., is also<br />

expected to lead to more female customers.<br />

The major beer manufacturers in <strong>Japan</strong> are seeking to establish comprehensive alcohol enterprises, by<br />

actively pursuing business partnerships and buyouts domestically and internationally. Kirin <strong>Beer</strong> acquired<br />

global distributorship of “Four Roses”(U.S.A), and domestic distributorship of liquor handled by Pernod<br />

Ricard (France), as well as direct handling of "Chivas Regal" (England), by merging its subsidiaries which had<br />

functioned as importers. Also, Asahi <strong>Beer</strong> has made strategic moves to recover its leading status in the whisky<br />

market, such as acquisition of Nikka <strong>Whisky</strong> as a complete subsidiary, and by exchanging contracts with<br />

Maxxium Worldwide (Holland) in <strong>Japan</strong>.<br />

(3) Distribution System and Business Practices in <strong>Japan</strong><br />

Distribution of alcohol can only be carried out by anyone or an entity that has obtained a liquor sales license<br />

based on the Liquor Tax Law.<br />

Since the relaxation of requirements for a general liquor retail business license as of September 2003, stores<br />

handling alcohol expanded to include supermarkets, convenience stores, drug stores, <strong>etc</strong>. Furthermore,<br />

businesses in a wider range have entered the alcohol sales business, even unrelated business types, such as<br />

electrical household appliance stores seeking to attract more customers, rental video shops, gasoline stations,<br />

transport companies which have a delivery network to general households, and pizza delivery chains. While<br />

growth can be seen in the aggregate demand in the entire alcohol market, competition has increased along with<br />

the expansion of the distribution channel.<br />

In response to these conditions, major beer manufacturers in <strong>Japan</strong> seek to establish alcohol businesses that<br />

can handle not only beer and happoshu, but also wine, shochu, spirits, chuhai, whisky, liquor, <strong>etc</strong>., as well as<br />

seek to establish comprehensive alcohol enterprises by actively pursuing business alliances and buyouts<br />

domestically and internationally. Also, efforts by food and alcohol wholesale dealers towards joint tie-ups and<br />

mergers for comprehensive wholesale functions have become noticeable.<br />

[<strong>Wine</strong>]<br />

Domestic wines are normally distributed from the wine maker through primary liquor wholesalers, secondary<br />

liquor wholesalers to retailers, then finally to consumers or commercial users such as restaurants, bars <strong>etc</strong>.<br />

Most of these wines are made by blending with imported bulk wines and must. A variety of channels are<br />

available to the imported wines, including direct imports by <strong>Japan</strong>ese wine makers, indirect imports via<br />

specialized trading companies, or joint imports. Some leading wholesalers and large retailers buy direct from<br />

abroad and distribute through their own sales channels, bypassing importers altogether.<br />

Also some wine specialty importers sell directly to consumers. <strong>Japan</strong>ese wine makers often serve as the sole<br />

import agent for leading brands of French and Italian wine.<br />

Many major trading firms, which previously imported bulk wine and bottled wine according to the intention<br />

and strategy of the manufacturers and wholesale dealers, have begun to concentrate on wine importation and<br />

sales under their own brand.<br />

Also, website shopping over the Internet has spread throughout <strong>Japan</strong> and is expected to continue to expand<br />

in future.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

188

Commercial<br />

liquor vendors<br />

Fig. 2 Distribution channels for imported wine<br />

Overseas wine makers<br />

(of bulk wine)<br />

<strong>Japan</strong>ese wine makers<br />

Primary wholesalers<br />

General<br />

liquor stores<br />

Food service establishments<br />

Secondary wholesalers<br />

Discount<br />

liquor stores<br />

Consumers<br />

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Overseas wine makers<br />

(of bottled wine)<br />

Liquor retailers<br />

Import trading<br />

company<br />

Supermarkets,<br />

department stores<br />

Convenience<br />

stores<br />

[<strong>Beer</strong>]<br />

According to industry viewpoint, while half the demand for beer is for household use and the other half is for<br />

business, most of the demand for happoshu is for household use.<br />

After the relaxation of regulations for a general alcohol retail license as of September 2003, stores handling<br />

beer and happoshu steadily increased, although they are reluctant to newly handle wine and whisky. New<br />

licenses were acquired not only by traditional liquor discount stores and general liquor stores, but also by<br />

supermarkets and convenience stores. Although beer and happoshu have a low profit margin, their ability to<br />

attract customers is attractive, and as such, competition along these channels is expected to intensify in the<br />

future.<br />

Regarding beer sales, as of January 2005, Kirin <strong>Beer</strong> no longer employs the three grade price system,<br />

traditionally comprised of the shipping, wholesale, and retail levels, in an effort to equalize business<br />

transactions in response to previously excessive cost competition and the problem of rebates that was<br />

associated with it, and to ensure fair profit by intermediary distribution. Kirin also discontinued volume rebates<br />

associated with sales volume, and function rebates based on services in the distribution function, and switched<br />

over to an "open price system." With the adoption of this new transaction system, wholesalers along with<br />

manufactures requested retailers to raise the delivery price, but most major supermarkets and general<br />

merchandise stores refused to do so. According to Kirin <strong>Beer</strong>, 90% of the companies accepted new delivery<br />

prices, but the sales quantity is estimated to have remained at 60%.<br />

In this environment, most imported beer and overseas brand beer produced in <strong>Japan</strong>, have a stronger tendency<br />

to focus business demand in sales and at general merchandise stores in big cities and restaurants. The strategy<br />

is to first pioneer restaurants that will accept their own brand, next develop their own brand image and solidify<br />

the customers, and then gradually expand into the household market. Meanwhile, draft beer in the barrel has<br />

been effective in opening up the business market and useful for differentiation at restaurants.<br />

[<strong>Whisky</strong>]<br />

Regarding the channels of distribution of imported whisky, overseas manufacturers set the licensed import<br />

route, and parallel importers set the parallel import route.<br />

Parallel-import volumes are affected by market conditions, including overseas distribution volumes and<br />

exchange rates. In recent years, the trend has been downward.<br />

According to industry sources, retail outlets for whisky are divided among commercial liquor vendors (30%),<br />

discount liquor stores (25%), ordinary liquor stores (16%), supermarkets (15%) and convenience stories (12%).<br />

Channel competition is increasing.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

189

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

< <strong>Beer</strong> ><br />

Licensed<br />

production<br />

Fig. 3 Distribution channels for imported beer and whisky<br />

Sole import agencies<br />

(Importers / <strong>Japan</strong>ese makers)<br />

Primary wholesalers<br />

Commercial<br />

liquor vendors<br />

General<br />

liquor stores<br />

Food service establishments<br />

Overseas manufacturers<br />

Secondary wholesalers<br />

Discount<br />

liquor stores<br />

Consumers<br />

Liquor retailers<br />

Overseas wholesalers<br />

Supermarkets,<br />

department stores<br />

Parallel importers<br />

Convenience<br />

stores<br />

2. Trade Trends<br />

(1) Import Trends in <strong>Japan</strong><br />

Importation of all alcoholic beverages in 2005 was 415,765kl and 194,567 million yen, with a decrease in<br />

both the import volume and import value since 2002, reflecting the stagnation of the domestic alcohol<br />

consumption volume.<br />

<strong>Wine</strong> gained the largest share among imported alcohol, at 160,152kl, for a 38.5% share of the volume base,<br />

and 113,443 million yen, a 58.3% share of the value base. This is followed by other distilled alcoholic<br />

beverages including shochu (94,471kl, share 22.7%), beer and happoshu (62,764kl, share 15.1%) in the volume<br />

base, and whisky (23,430 million yen, share 12.0%), other distilled alcoholic beverages (14,080 million yen,<br />

share 7.2%) in the value base, this ranking has remained the same for several years.<br />

Among the imported alcoholic beverage market, imports of other types of alcoholic beverages (fruit-based<br />

alcoholic beverages) increased in 2005 to 694 million yen in the value base, a 25.8% increase over the previous<br />

year, and to 5,896kl in the volume base, a 26.7% increase over the previous year. This is considered to be the<br />

result of the popularity of the low-alcohol boom in recent years.<br />

On the other hand, beer and happoshu was 62,764kl in volume base, a 2.1% decrease over the previous year,<br />

although the value base was 7,383 million yen, a 5.9% increase over the previous year. This is thought to be a<br />

result of progress made in the expansion of beer from Europe, which has a high single price. Also, the sale of<br />

vodka, as a basic ingredient in low-alcoholic beverages, such as the popular chuhai cans, has slowed the<br />

downward trend experienced in the past several years in the import value, at 1,214 million yen, a 17% increase<br />

in the value base.<br />

Fig. 4 Trends in <strong>Japan</strong>’s alcohol imports<br />

(\ million)<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

[Total import value] [Import value by category]<br />

2001 2002 2003 2004 2005<br />

(year)<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

190<br />

(\ million)<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

<strong>Beer</strong> and happoshu<br />

<strong>Wine</strong><br />

Others<br />

<strong>Whisky</strong><br />

2001 2002 2003 2004 2005<br />

(year)

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Value Volume<br />

2001 2002 2003 2004 2005 2001 2002 2003 2004 2005<br />

<strong>Wine</strong> 95,651 100,231 104,254 113,532 113,443 171,833 170,042 162,938 167,900 160,152<br />

<strong>Beer</strong> and Happoshu 7,867 8,784 8,514 6,971 7,383 75,987 78,934 79,117 64,117 62,764<br />

<strong>Whisky</strong> 44,340 38,100 31,540 24,468 23,430 49,671 42,368 27,552 19,728 17,926<br />

Others (subtotal) 55,627 56,326 53,812 54,932 50,311 152,102 158,679 171,870 187,380 174,923<br />

Other distilled liquors 12,271 13,464 14,566 15,550 14,080 75,680 83,980 91,663 103,892 94,471<br />

Brandy 23,404 21,559 16,562 15,457 13,183 8,877 7,509 6,798 6,106 5,264<br />

Liquor and cordials 9,049 9,745 11,362 12,256 12,125 14,340 13,583 18,469 18,973 18,714<br />

Fermented alcohol<br />

(f ruit added, <strong>etc</strong>.)<br />

Other f ermented<br />

930 1,286 1,840 2,463 2,456 3,709 4,666 9,170 12,271 12,972<br />

bev erages (apple<br />

liquor, pear liquor, <strong>etc</strong>.)<br />

3,545 3,907 3,377 3,004 2,432 17,229 16,894 14,190 13,141 10,307<br />

Sy nthetic sake and<br />

white sake<br />

1,831 1,697 1,533 1,496 1,447 19,528 17,703 17,534 18,116 17,449<br />

Gin and genever 1,885 1,858 1,773 1,724 1,320 3,524 3,433 3,190 2,976 2,485<br />

Vodka 1,075 1,139 1,082 1,037 1,214 2,707 2,903 2,758 2,669 2,384<br />

Rum and tafia 1,019 968 968 1,115 1,051 2,114 2,025 1,859 1,977 1,966<br />

Other alcoholic beverages 317 404 470 552 694 1,991 3,458 3,701 4,652 5,896<br />

Sake and unfiltered sake 301 299 279 277 307 2,403 2,527 2,537 2,608 3,016<br />

Total 203,486 203,441 198,121 199,904 194,567 449,592 450,024 441,477 439,125 415,765<br />

Unit : value = \ million, volume = kl Source : Trade Statistics, Ministry of Finance<br />

Fig. 5 Trends in alcohol imports by category in 2005<br />

Value Volume Average unit price<br />

Value Share<br />

Yearly<br />

change Volume Share<br />

Yearly<br />

change<br />

2004 2005<br />

<strong>Wine</strong> 113,443 58.3% 99.9 160,152 38.5% 95.4 676 708<br />

Whiskey 23,430 12.0% 95.8 17,926 4.3% 90.9 1,240 1,307<br />

Other distilled liquors 14,080 7.2% 90.5 94,471 22.7% 90.9 150 149<br />

Brandy 13,183 6.8% 85.3 5,264 1.3% 86.2 2,532 2,505<br />

Liquor and cordials 12,125 6.2% 98.9 18,714 4.5% 98.6 646 648<br />

<strong>Beer</strong> and happoshu 7,383 3.8% 105.9 62,764 15.1% 97.9 109 118<br />

Fermented alcohol (fruit added, <strong>etc</strong>.) 2,456 1.3% 99.7 12,972 3.1% 105.7 201 189<br />

Other f ermented bev erages<br />

(apple liquor, pear liquor, <strong>etc</strong>.)<br />

2,432 1.3% 81.0 10,307 2.5% 78.4 229 236<br />

Synthetic sake and white sake 1,447 0.7% 96.7 17,449 4.2% 96.3 83 83<br />

Gin and genever 1,320 0.7% 76.5 2,485 0.6% 83.5 579 531<br />

Vodka 1,214 0.6% 117.0 2,384 0.6% 89.3 389 509<br />

Rum and tafia 1,051 0.5% 94.3 1,966 0.5% 99.4 564 535<br />

Other alcoholic beverages 694 0.4% 125.8 5,896 1.4% 126.7 119 118<br />

Sake and unfiltered sake 307 0.2% 110.9 3,016 0.7% 115.6 106 102<br />

Total 194,567 100.0% 97.3 415,765 100.0% 94.7 455 468<br />

Unit : value = \ million, volume = kl, yearly change over previous year = %, average unit price = \ per kl<br />

Source : Trade Statistics, Ministry of Finance<br />

(2) Principal Exporters to JAPAN and <strong>ASEAN</strong>’s Position<br />

Among countries exporting to <strong>Japan</strong>, imports from France were the largest in the value base for all alcoholic<br />

beverages, with a dominant share of 48.2% (93,809 million yen). This mainly consists of wine, with the results<br />

of the high price of French wine outstanding (refer to Fig. 6. Average unit price). Imports from Italy ranked<br />

second, largely consisting of wine, similar to France (share 8.1%, 15,764 million yen), Imports from Korea<br />

ranked third overall, and ranked first for beer, (share 7.1%, 13,795 million yen), this rank has not changed for<br />

several years. Imports from the whole EU district, which includes a variety of alcoholic beverages such as wine,<br />

beer, whisky, and gin, gained a 73.8% share in the value base.<br />

Meanwhile, imports from the entire <strong>ASEAN</strong> region gained a 1.0% share in the value base, consisting of beer,<br />

synthetic sake, white sake, and other alcohol beverages, gin and genever. (⇒Fig.11)<br />

On the other hand, imports from Korea had the largest share in the volume base, occupying 24.2%<br />

(100,414kl). (⇒Fig. 6) A large amount of shochu is imported from Korea, in addition to private brand<br />

products, and the development and import of beer by <strong>Japan</strong>. This is followed by France ranking second with an<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

191

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

18.6% share (77,416kl), China ranking third with a 9.7% share (40,217kl). Imports from China, similar to<br />

Korea, were mainly basic alcohol ingredients, in addition to private brand products and development and<br />

import products.<br />

(\ million)<br />

120,000<br />

100,000<br />

80,000<br />

60,000<br />

40,000<br />

20,000<br />

0<br />

Fig. 6 Principal exporting countries and regions of alcohols to <strong>Japan</strong><br />

[Import value from major countries] [Share of import value in 2005]<br />

France<br />

Italy<br />

Korea<br />

2001 2002 2003 2004 2005<br />

(year)<br />

Korea<br />

7.1%<br />

Others<br />

18.1%<br />

<strong>ASEAN</strong><br />

1.0%<br />

EU<br />

73.8%<br />

Value Value Value Value Volume Value Volume<br />

Averaga<br />

unit price<br />

France 85,608 88,804 88,162 96,745 83,692 93,809 48.2% 77,416 18.6% 1,212<br />

Italy 14,743 15,883 17,830 16,842 34,460 15,764 8.1% 31,071 7.5% 507<br />

Korea 11,891 12,778 13,800 14,362 105,981 13,795 7.1% 100,414 24.2% 137<br />

China 3,499 3,976 4,515 5,208 40,191 5,265 2.7% 40,217 9.7% 131<br />

Australia 3,492 4,169 4,934 4,991 16,798 5,248 2.7% 16,891 4.1% 311<br />

Germany 4,738 4,730 4,472 4,027 9,094 3,963 2.0% 8,640 2.1% 459<br />

Chile 3,929 3,595 3,342 3,426 13,670 3,456 1.8% 12,681 3.1% 273<br />

Ireland 1,099 1,284 1,413 1,522 5,639 1,984 1.0% 7,337 1.8% 270<br />

Mexico 1,796 1,908 1,842 1,678 7,031 1,693 0.9% 7,034 1.7% 241<br />

Netherland 1,357 1,772 1,693 1,919 6,290 1,607 0.8% 5,867 1.4% 274<br />

Canaka 1,558 2,213 1,382 1,080 4,259 1,106 0.6% 4,006 1.0% 276<br />

Others 72,691 66,316 57,809 51,102 122,569 49,590 25.5% 114,064 27.4% 435<br />

Total 203,486 203,441 198,121 199,904 439,125 194,567 100.0% 415,765 100.0% 468<br />

(E U) 149,678 148,710 145,057 148,707 171,968 143,530 73.8% 162,475 39.1% 883<br />

(<strong>ASEAN</strong>) 1,810 2,045 2,052 2,011 20,200 1,949 1.0% 18,968 4.6% 103<br />

Unit : value = \ million, volume = kl, average unit price = \ per kl Source : Trade Statistics, Ministry of Finance<br />

[<strong>Wine</strong>]<br />

After an outstanding increase in red wine in 1998, wine export to <strong>Japan</strong> continued to decrease until 2000 due<br />

to inventory adjustment, then temporarily recovered in 2001. However since then, a downward trend has been<br />

experienced in both volume and value.<br />

Viewed by country, imports from France were outstanding at 73,434 million yen(share 64.7%)in the value<br />

base, and 63,132kl (share 39.4%)in the volume base, followed by Italy (value 13,825 million yen, share<br />

12.2%, volume 26,863kl, share16.8%), and then the U.S.(value 6,530 million yen, share 5.8%, volume<br />

19,133kl, share 11.9%).<br />

<strong>Wine</strong> exports from Australia to <strong>Japan</strong> have quickly grown over the past several years, the only 2 digit increase<br />

among the top 5 countries (value 4,409 million yen, 20% increase over the previous year, volume 9,358kl,<br />

24% increase over the previous year), climbing to fifth, passing Chili. This is considered to be the result of<br />

being the first to introduce and expand internationally the screw cap to preserve wine quality, wine with a good<br />

balance of label, taste, price, and ease in purchasing by consumers. “Yellow Tail”, handled by Sapporo <strong>Beer</strong>, is<br />

considered to be the forerunner.<br />

Beaujolais Nouveau was also in good form in 2005, but was insufficient to raise the overall level of wine<br />

imports to <strong>Japan</strong>.<br />

Also, by type, popularity of the rosé type was outstanding among all the sparkling wines, including<br />

champagne. Imports from France gained 45.6% of the total volume of sparkling wines, and when combined<br />

with Italy at 22.2% and Spain at 19.7%, the 3 countries gained nearly 90% of all shares.<br />

Conversely, hardly any wine was exported to <strong>Japan</strong> from <strong>ASEAN</strong> at present.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

192

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Fig.7 Principal exporting countries and regions of wine to <strong>Japan</strong><br />

2001 2002 2003<br />

2004 2005<br />

Value Value Value Value Volume Value Volume<br />

Average<br />

Unit Price<br />

France 57,534 61,498 65,400 74,476 68,635 73,434 64.7% 63,132 39.4% 1,163<br />

Italy 13,623 14,887 15,217 14,244 28,364 13,825 12.2% 26,863 16.8% 515<br />

U.S.A. 7,266 7,099 6,850 6,432 19,249 6,530 5.8% 19,133 11.9% 341<br />

Spain 3,349 3,519 3,787 4,317 10,817 5,123 4.5% 12,000 7.5% 427<br />

Australia 2,000 2,245 2,714 3,649 7,482 4,409 3.9% 9,358 5.8% 471<br />

Chile 3,926 3,584 3,338 3,389 13,505 3,389 3.0% 12,496 7.8% 271<br />

Germany 3,859 3,803 3,568 3,320 6,516 3,182 2.8% 5,718 3.6% 556<br />

Argentina 818 691 677 737 6,127 686 0.6% 4,436 2.8% 155<br />

Portugal 574 515 600 596 829 592 0.5% 806 0.5% 735<br />

Others 2,702 2,389 2,103 2,371 6,376 2,273 2.0% 6,210 3.9% 366<br />

Total 95,651 100,231 104,254 113,532 167,900 113,443 100.0% 160,152 100.0% 708<br />

(E U) 79,145 84,491 88,815 97,615 116,263 96,587 85.1% 109,160 68.2% 885<br />

(<strong>ASEAN</strong>) 12 11 10 8 17 9 0.0% 23 0.0% 389<br />

Unit : value = \ million, volume = kl, averaga unit price = \ per kl Source : Trade Statistics, Ministry of Finance<br />

[<strong>Beer</strong>]<br />

The volume of imported beer in 2005 was 62,764kl, a 2.1% decrease over the previous year. When viewed by<br />

country, imports from Korea were the largest, with 32.2% of the volume base, and 20% of the total value base.<br />

It is suggested that this is caused by the large percentage OEM happoshu from <strong>Japan</strong>.<br />

Imports from Ireland were second as the rich flavor of “Guinness <strong>Beer</strong>" ignited the business market by the<br />

sales promotion carried out by Sapporo <strong>Beer</strong>, the import company, with the amount of imports tripling in 5<br />

years on the wave of the premium beer boom.<br />

Also, Mexico ranked third in the value base, with “Corona" the staple merchandise. The drinking style of<br />

squeezing a lime and drinking straight from the bottle is gaining popularity. Furthermore, imports from each of<br />

the top 5 countries have an upward trend. For example, imports of “Foster’s" by Australia have steadily<br />

increased.<br />

As for <strong>ASEAN</strong>, imports from Thai, Vietnam, and the Philippines, <strong>etc</strong>., can be mentioned. Among them<br />

exports by Vietnam to <strong>Japan</strong> greatly expanded, with a 93.1% increase over the previous year. The main force<br />

from Thai is “Singha," and has steadily grown in the business market through Thai and ethnic food restaurants,<br />

as well as "Chang <strong>Beer</strong>," by a local top manufacturer, and premium "Phuket <strong>Beer</strong>." Also, brands such as “San<br />

Miguel” from the Philippines, "333 <strong>Beer</strong>” and “Saigon <strong>Beer</strong>” from Vietnam, “Bintang,” “Bali-Hai” from<br />

Indonesia and "Tiger <strong>Beer</strong>" from Singapore, have quietly become popular through mail order sales, <strong>etc</strong>.<br />

(\ million)<br />

Fig.8 Principal exporting countries and regions of beer to <strong>Japan</strong><br />

[Import value from major countries] [Share of import value in 2005]<br />

1,600<br />

1,400<br />

Korea<br />

1,200<br />

1,000<br />

800 Mexico<br />

600<br />

Ireland<br />

400<br />

200<br />

0<br />

Australia<br />

2001 2002 2003 2004 2005<br />

(year)<br />

Ireland<br />

17.5%<br />

Others<br />

14.9%<br />

Korea<br />

20.6%<br />

<strong>ASEAN</strong><br />

3.0%<br />

EU<br />

44.1%<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

193

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

2001 2002 2003<br />

2004 2005<br />

Value Value Value Value Volume Value Volume<br />

Average<br />

unit price<br />

Korea 1,109 1,067 1,310 1,379 19,337 1,520 20.6% 20,195 32.2% 75<br />

Ireland 427 758 726 1,011 5,197 1,289 17.5% 6,498 10.4% 198<br />

Mexico 866 953 834 762 5,866 806 10.9% 5,891 9.4% 137<br />

Australia 237 465 977 489 5,479 626 8.5% 6,658 10.6% 94<br />

Belgium 282 506 378 439 1,695 562 7.6% 2,340 3.7% 240<br />

U.K. 293 535 702 418 1,466 439 5.9% 1,698 2.7% 259<br />

Netherland 541 606 618 491 4,464 436 5.9% 4,383 7.0% 99<br />

U.S.A. 2,820 2,273 1,119 453 4,992 356 4.8% 3,242 5.2% 110<br />

Germany 382 371 415 240 1,725 339 4.6% 2,157 3.4% 157<br />

Others 909 1,250 1,435 1,289 13,895 1,012 13.7% 9,702 15.5% 104<br />

Total 7,867 8,784 8,514 6,971 64,117 7,383 100.0% 62,764 100.0% 118<br />

(E U) 2,066 2,935 2,989 2,761 15,603 3,255 44.1% 18,236 29.1% 178<br />

(<strong>ASEAN</strong>) 217 275 382 214 1,823 219 3.0% 1,844 2.9% 119<br />

Unit : value = \ million, valume = kl, average unit price = \ per kl Source : Trade Statistics, Ministry of Finance<br />

[<strong>Whisky</strong>]<br />

A downward trend in whisky exported to <strong>Japan</strong> has continued since 2001, due to the decrease in alcohol<br />

consumption in <strong>Japan</strong>, trends toward low-price and low-alcohol, and the decline in corporate and restaurant<br />

demand, falling to 52.8% in the value base, 36.1% in the volume base in the past 5 years. In 2005, there was a<br />

4.2% decrease over the previous year in value and about a 10% decrease in volume.<br />

When viewed by country, imports from England, the origin of Scotch whisky, outclassed its competitors,<br />

taking a 73.1% share in the value base, 59% share in the volume base. Imports from the U.S. ranked second<br />

with bourbon whisky and rye whisky. Imports from these 2 countries occupy 97.5% of all whisky imports. The<br />

remaining imports include Canadian whisky from Canada and Irish whisky from Ireland.<br />

In recent years, single-malt whisky has gained popularity in the whisky market in <strong>Japan</strong>, and according to<br />

Suntory, imports of “The McCarran” produced in Scotland increased 17% over the previous year, and premium<br />

whisky, such as "Yamazaki" produced in <strong>Japan</strong>, are also in good form. The downward trend is not considered to<br />

continue.<br />

Among countries of <strong>ASEAN</strong>, Thai exports whisky to <strong>Japan</strong> in a very small quantity.<br />

Fig.9 Principal exporting countries and regions of whiskey to <strong>Japan</strong><br />

2001 2002 2003<br />

2004 2005<br />

Value Value Value Value Volume Value Volume<br />

Average<br />

unit price<br />

U.K. 34,134 28,364 23,415 18,717 12,240 17,126 73.1% 10,578 59.0% 1,619<br />

U.S.A. 8,763 7,640 6,699 5,199 6,729 5,709 24.4% 6,659 37.1% 857<br />

Canada 753 1,771 897 419 587 446 1.9% 567 3.2% 787<br />

Ireland 534 272 494 86 90 97 0.4% 92 0.5% 1,054<br />

France 37 23 11 23 50 24 0.1% 7 0.0% 3,456<br />

Korea 89 1 - - - 13 0.1% 3 0.0% 5,244<br />

Netherland 8 6 0 1 0 6 0.0% 10 0.1% 576<br />

Thailand - - 1 0 0 2 0.0% 3 0.0% 584<br />

Brazil - - - - - 1 0.0% 1 0.0% 2,150<br />

Others 23 23 23 24 32 6 0.0% 7 0.0% 804<br />

Total 44,340 38,100 31,540 24,468 19,728 23,430 100.0% 17,926 100.0% 1,307<br />

(E U) 34,718 28,676 23,935 18,832 12,386 17,256 73.6% 10,692 59.6% 1,614<br />

(<strong>ASEAN</strong>) - 3 6 0 0 2 0.0% 4 0.0% 508<br />

Unit : value = \ million, volume = kl, average unit price = \ per kl Source : Trade Statistics, Ministry of Finance<br />

[Other <strong>Alcoholic</strong> <strong>Beverages</strong>]<br />

When viewing the importation of alcoholic beverages other than the aforementioned according to the value<br />

base, imports from Korea have a dominant share of nearly 80% for other distilled alcoholic beverages, included<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

194

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

shochu. It is suggested that in addition to the stable demand at restaurants, and the stable popularity of Korean<br />

food, consumption will increase through the shochu boom. Furthermore, imports from <strong>ASEAN</strong> reached 300<br />

million yen (share 2.1%), although not ranking among the top 5 countries.<br />

France has a virtual monopoly on Brandy, with a 98.1% share (12,931 million yen).<br />

France also has the highest share for liquor cordial at 50% (6,132 million yen), and is followed by Italy with a<br />

14.2% share (1,726 million yen), depending largely on the price difference of the average unit price.<br />

Regarding fermented alcohol, France ranks first (1,034 million yen, share 42.1%), China ranks second<br />

(38.9% share), the U.S. third (9.2% share), with France outclassing its competitors with a higher average unit<br />

price.<br />

China ranks first (1,810 million yen) for apple liquor and pear liquor, with a 74.4% share. Korea ranks second<br />

(6.6% share), Taiwan third (4.1% share), and these three Asian countries occupy a 85.1% share, although most<br />

is considered to be development and import products by <strong>Japan</strong>ese manufacturers and private brand products.<br />

Regarding synthetic alcohol and white sake, imports from China are the highest, with China holding a 49.7%<br />

share (720 million yen), followed by Thailand with a 25.8% share (373 million yen), Malaysia with a 15.6%<br />

share (226 million yen) and Vietnam with an 8.9% share (129 million yen). <strong>ASEAN</strong> has a 50.3% share. There<br />

is a high demand for Thai, Malaysian, Vietnamese restaurants, <strong>etc</strong>., as well as for ingredients.<br />

Regarding imports of gin and genever, England ranks first with a 87.8% share (1,158 million yen). England<br />

has many internationally recognized manufacturers such as Gilbey, Gordon, Beefeater, Bombay Sapphire, <strong>etc</strong>.,<br />

and many of these are imported. The Philippines ranks second (9.9% share, 131 million yen), so <strong>ASEAN</strong> has a<br />

9.9% share.<br />

Regarding imports of vodka, Korea has a 49.7% share (603 million yen), followed by Poland, production<br />

origin of vodka, with a 10.3% share (125 million yen), the U.S. with a 9.0% share (109 million yen), and the<br />

Philippines (8.7% share, 106 million yen). Furthermore Korea is ranked first due to the affiliation by Sapporo<br />

<strong>Beer</strong> with Smirnoff, a world famous American vodka brand, and Sapporo <strong>Beer</strong> imports and uses developed and<br />

imported products from Korea.<br />

Regarding rum and tafia, most imports are from Central South America, with Jamaica ranking first (42.6%<br />

share, 448 million yen), Puerto Rico second (21.7% share, 228 million yen), France third (7.5% share, 79<br />

million yen), Guatemala fourth, and Cuba fifth. In particular, Guatemala has an outstanding average unit price,<br />

with <strong>Japan</strong> importing rare premium rum (Ron Zacapa Centenario).<br />

For other alcoholic beverages, Malaysia ranks first (43.9% share, 305 million yen), followed by China<br />

(40.8% share), Vietnam (12.2% share), and Thailand (2.7% share), with <strong>ASEAN</strong> occupying a 59.1% share. It is<br />

suggested that this is due to the large quantity of imported private <strong>Japan</strong>ese brand low-alcohol beverages,<br />

which are very popular in the domestic market, and the importation of basic ingredients used in production in<br />

<strong>Japan</strong>.<br />

Regarding sake and unrefined sake, Korea occupies a 76.6% share at 235 million yen, with Makkori,<br />

traditional unrefined Korean sake, considered to be a majority item. This is followed by Australia ranking<br />

second (14.8% share, 45 million yen), China third (7.1% share, 22 million yen), and Vietnam fourth (1.6%<br />

share, 5 million yen).<br />

Fig.10 Principal exporting countries and regions of alcoholic beverages by category<br />

(2005, in value basis)<br />

Other distilled liquors Brandy<br />

Country/<br />

Region<br />

Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 Korea 11,149 79.2% 89.0 147 France 12,931 98.1% 85.0 2,584<br />

2 China 1,050 7.5% 101.6 110 Italy 132 1.0% 113.8 2,978<br />

3 Mexico 807 5.7% 98.6 782 Chile 47 0.4% 208.1 324<br />

4 Canada 350 2.5% 79.6 145 U.K. 20 0.2% 92.4 10,968<br />

5 Taiw an 338 2.4% 107.7 164 Spain 12 0.1% 66.1 307<br />

(<strong>ASEAN</strong> Total) 300 2.1% 101.6 83 1 0.0% 102.7 703<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

195

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 France 6,132 50.6% 106.6 848 France 1,034 42.1% 110.7 765<br />

2 Italy 1,726 14.2% 71.6 466 China 956 38.9% 101.4 112<br />

3 U.S.A. 1,253 10.3% 119.1 910 U.S.A. 227 9.2% 77.1 96<br />

4 Netherland 1,144 9.4% 83.1 795 Germany 102 4.1% 77.6 271<br />

5 Ireland 593 4.9% 140.6 808 Spain 80 3.2% 84.4 340<br />

20 0.2% 32.6 117 8 0.3% 57.5 174<br />

Other fermented beverages (apple liquor, pear liquor, <strong>etc</strong>.) Synthetic sake and w hite sake<br />

Country/<br />

Region<br />

Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 China 1,810 74.4% 101.5 230 China 720 49.7% 106.5 86<br />

2 Korea 160 6.6% 107.9 265 Thailand 373 25.8% 98.4 68<br />

3 Taiw an 101 4.1% 94.0 316 Malaysia 226 15.6% 76.5 119<br />

4 Australia 98 4.0% 14.1 246 Vietnam 129 8.9% 89.5 74<br />

5 Canada 66 2.7% 188.9 122<br />

4 0.2% 66.9 311 727 50.3% 88.7 80<br />

Gin and genever Vodka<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 U.K. 1,158 87.8% 76.4 586 Korea 603 49.7% - 642<br />

2 Philippines 131 9.9% 78.4 307 Poland 125 10.3% 95.2 508<br />

3 U.S.A. 17 1.3% 89.7 301 U.S.A. 109 9.0% 22.0 364<br />

4 Germany 5 0.3% 103.2 611 Philippines 106 8.7% 81.6 326<br />

5 France 4 0.3% 76.1 637 Sw eden 83 6.8% 109.0 513<br />

131 9.9% 78.4 307 108 8.9% 83.1 326<br />

Rum and tafia Other spirituous beverages<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 Jamaica 448 33.9% 92.6 512 Malaysia 305 25.1% 157.1 152<br />

2 Puerto Rico 228 17.3% 109.9 548 China 283 23.3% 108.2 111<br />

3 France 79 6.0% 77.2 407 Vietnam 85 7.0% 125.0 79<br />

4 Guatemala 55 4.1% 102.5 2,285 Thailand 19 1.6% 109.1 72<br />

5 Cuba 42 3.2% 79.3 471 Mexico 2 0.1% - 2,329<br />

4 0.3% 61.3 537 410 33.8% 146.2 122<br />

Sake and unfiltered sake<br />

Country Value Share<br />

Yearly<br />

change<br />

Average<br />

unit price<br />

1 Korea 235 17.8% 132.9 96<br />

2 Australia 45 3.4% 64.6 173<br />

3 China 22 1.6% 91.1 91<br />

4 Vietnam 5 0.4% 83.6 78<br />

5<br />

(<strong>ASEAN</strong> Total)<br />

(<strong>ASEAN</strong> Total)<br />

(<strong>ASEAN</strong> Total)<br />

(<strong>ASEAN</strong> Total)<br />

(<strong>ASEAN</strong> Total)<br />

Liqueor and cordials Fermented alcohol (fruit added, <strong>etc</strong>.)<br />

5 0.4% 83.6 78<br />

Unit : value = \ million, yearly change over previous year = %, average unit price = \ per kl<br />

Source : Trade Statistics, Ministry of Finance<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

196

(\ million)<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

<strong>ASEAN</strong><br />

Total<br />

Vietnam<br />

1,810<br />

Fig. 11 Alcohol imports from <strong>ASEAN</strong> by country /category<br />

2,045 2,052 2,011 1,949<br />

2001 2002 2003 2004 2005 (year)<br />

(kl)<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

0<br />

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

[Value] [Volume]<br />

17,754<br />

19,603 20,275 20,200<br />

18,968<br />

2001 2002 2003 2004 2005<br />

Value Volume<br />

(year)<br />

Average<br />

unit price<br />

2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2005<br />

<strong>Wine</strong> 12 11 10 8 9 15 28 27 17 23 389<br />

<strong>Beer</strong> and happoshu 217 275 382 214 219 1,608 2,141 4,165 1,823 1,844 119<br />

<strong>Whisky</strong> - 3 6 0 2 - 6 12 0 4 508<br />

liquors 237 402 266 295 300 3,157 5,600 3,495 3,875 3,602 83<br />

Brandy<br />

Liquor and<br />

- 2 1 1 1 - 2 1 1 1 703<br />

cordials<br />

Fermented<br />

alcohol (fruit<br />

- 1 40 63 20 - 1 370 737 174 117<br />

added, <strong>etc</strong>.)<br />

Other<br />

fermented<br />

8 9 7 13 8 47 47 40 72 44 174<br />

beverages<br />

8 5 2 6 4 33 16 4 18 13 311<br />

Synthetic sake<br />

and w hite sake 1,017 894 767 820 727 11,041 9,581 9,208 10,345 9,078 80<br />

Gin and genever 150 209 210 167 131 625 760 748 553 427 307<br />

Vodka 85 127 136 130 108 335 444 462 413 331 326<br />

Rum and tafia 3 4 3 7 4 5 8 8 18 8 537<br />

Other alcoholic<br />

beverages<br />

Sake and<br />

63 97 221 280 410 778 901 1,701 2,263 3,356 122<br />

unfiltered sake 10 6 3 6 5 109 68 33 63 63 78<br />

Total 1,810 2,045 2,052 2,011 1,949 17,754 19,603 20,275 20,200 18,968 103<br />

Share in Total 0.9% 1.0% 1.0% 1.0% 1.0% 3.9% 4.4% 4.6% 4.6% 4.6%<br />

<strong>Wine</strong> 0 5 6 3 4 2 18 18 8 12 301<br />

<strong>Beer</strong> and happoshu 25 26 25 22 46 237 245 245 230 444 103<br />

liquors<br />

Liquor and<br />

136 307 199 261 271 1,954 4,775 3,121 3,783 3,516 77<br />

cordials - 1 13 33 7 - 1 215 569 111 61<br />

Synthetic sake<br />

and w hite sake 180 139 142 144 129 2,286 1,644 1,910 2,004 1,732 74<br />

Vodka - 1 1 0 2 - 3 5 1 6 350<br />

Other alcoholic<br />

beverages<br />

Sake and<br />

unfiltered<br />

48 43 55 68 85 601 466 529 757 1,079 79<br />

sake 10 6 3 6 5 109 68 33 63 63 78<br />

Total 400 530 444 538 549 5,188 7,220 6,076 7,415 6,964 79<br />

Share in Total 0.2% 0.3% 0.2% 0.3% 0.3% 1.2% 1.6% 1.4% 1.7% 1.7%<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

197

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Malaysia<br />

Thailand<br />

Philippines<br />

Value Volume<br />

Average<br />

unit price<br />

2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2005<br />

Brandy - 1 0 - - - 1 0 - - -<br />

Liquors and<br />

cordials - 0 27 29 10 - 0 155 167 54 178<br />

Fermented<br />

alcohol (fruit<br />

added, <strong>etc</strong>.) - 1 0 0 1 - 2 1 1 1 402<br />

Synthetic<br />

sake and<br />

w hite sake 424 387 298 295 226 3,593 3,129 2,472 2,466 1,902 119<br />

Other alcoholic<br />

beverages - 36 148 194 305 - 219 921 1,254 2,007 152<br />

Total 424 425 473 519 541 3,593 3,351 3,549 3,888 3,965 136<br />

Share in Total 0.2% 0.2% 0.2% 0.3% 0.3% 0.8% 0.7% 0.8% 0.9% 1.0%<br />

<strong>Wine</strong> 6 5 4 5 5 14 10 9 9 11 490<br />

<strong>Beer</strong> and happoshu 109 124 96 102 98 747 839 690 803 768 128<br />

<strong>Whisky</strong> - - 1 0 2 - - 2 0 3 584<br />

Other distilled<br />

liquors 72 48 17 2 6 1,147 722 268 8 19 344<br />

Brandy<br />

Liquors and<br />

- 1 1 1 1 - 1 1 1 1 703<br />

cordials<br />

Fermented<br />

alcohol (fruit<br />

8 9 7 13 8 47 47 40 72 44 174<br />

added, <strong>etc</strong>.) 5 2 - 4 3 24 10 - 14 11 288<br />

Synthetic sake<br />

and w hite sake 316 341 326 379 373 4,010 4,519 4,808 5,839 5,443 68<br />

Rum and tafia 3 4 3 3 2 5 8 8 8 6 342<br />

Other alcoholic<br />

beverages 16 18 19 18 19 178 216 252 252 270 72<br />

Total 536 551 474 528 518 6,170 6,373 6,079 7,008 6,576 79<br />

Share in Total 0.3% 0.3% 0.2% 0.3% 0.3% 1.4% 1.4% 1.4% 1.6% 1.6%<br />

<strong>Beer</strong> and happoshu 45 78 225 62 48 322 691 2,941 541 373 128<br />

<strong>Whisky</strong><br />

Other distilled<br />

- 3 5 - - - 6 10 - - -<br />

liquors<br />

Liquor and<br />

22 41 46 28 16 46 93 96 76 50 329<br />

cordials<br />

Other<br />

fermented<br />

- - - - 4 - - - - 9 431<br />

beverages 2 2 2 1 0 7 4 2 2 1 578<br />

Synthetic sake<br />

and w hite sake 97 26 1 2 - 1,152 288 18 36 - -<br />

Gin and genever 150 209 210 167 131 625 760 748 553 427 307<br />

Vodka 85 127 134 130 106 335 441 457 412 325 326<br />

Rum and tafia - - - 4 2 - - - 9 2 834<br />

Total 401 486 622 394 307 2,487 2,283 4,272 1,630 1,187 259<br />

Share in Total 0.2% 0.2% 0.3% 0.2% 0.2% 0.6% 0.5% 1.0% 0.4% 0.3%<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

198

Value Volume<br />

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

Average<br />

unit price<br />

2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2005<br />

<strong>Beer</strong> and happoshu 20 27 18 13 11 147 202 149 123 108 104<br />

<strong>Whisky</strong> - - - - 0 - - - - 1 240<br />

liquors<br />

Liqueor and<br />

7 6 2 4 4 11 10 7 7 8 433<br />

cordials - - - 0 - - - - 1 - -<br />

Indonesia Other<br />

fermented<br />

beverages 0 - 0 - - 2 - 1 - - -<br />

Rum and tafia - - - - 1 - - - - 0 2,744<br />

Total 27 32 20 17 16 160 212 157 132 117 134<br />

Share in Total 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%<br />

Singapore<br />

18 14 13 11 12 115 114 102 91 105 112<br />

Laos<br />

1 1 3 1 4 11 8 22 6 36 120<br />

Myanmar<br />

3 6 3 3 2 21 42 19 21 17 144<br />

Cambodia<br />

1 - - 1 - 8 - - 8 - -<br />

Brunei<br />

- - - - - - - - - - -<br />

Unit : value = \ million, volume = kl, aveage unit price = \ per kl Source : Trade Statistics, Ministry of Finance<br />

(3) Market Share of Imports in <strong>Japan</strong><br />

<strong>Wine</strong> has the highest importation share in the alcohol market in <strong>Japan</strong>, with more than 60%. In addition to the<br />

importation of a wide variety of bottled wines from different countries, this is due in part to the fact that many<br />

<strong>Japan</strong>ese wines are blended with imported bulk wine during production, and as such, imported wine is essential<br />

for the wine market.<br />

On the other hand, beer has the highest volume share in the alcohol market (38.2%, refer to Fig.1), and is<br />

monopolized by 4 domestic manufacturers (Asahi <strong>Beer</strong>, Kirin <strong>Beer</strong>, Sapporo <strong>Beer</strong>, Suntory), with the share of<br />

imported products at 0.7%. Regarding happoshu, the share of imported products is slightly higher, because<br />

<strong>Japan</strong>ese private products, and developed and imported products, which are used as ingredients in production,<br />

are imported from Korea, <strong>etc</strong>.<br />

Also, some domestic manufacturers have concluded license contracts for overseas whisky brand products and<br />

manufacture the whisky in <strong>Japan</strong>, so the share of imported products remains at approximately 20%. This can be<br />

seen as the result of the good sale of domestic brand single malt whisky.<br />

<strong>Wine</strong><br />

<strong>Beer</strong><br />

Happoshu<br />

<strong>Whisky</strong><br />

Fig. 12 Share of imported alcoholic beverages in the <strong>Japan</strong>ese market<br />

FY2000 FY2001 FY2002 FY2003 FY2004<br />

Yearly<br />

change<br />

Domestic products 103,321 100,692 104,823 88,998 80,270 90.2%<br />

Imported products 165,588 158,418 164,855 158,996 160,521 101.0%<br />

Total 268,909 259,105 269,678 247,994 240,791 97.1%<br />

Imports’ share 61.6% 61.1% 61.1% 64.1% 66.7%<br />

Domestic products 5,388,686 4,777,006 4,270,694 3,929,359 3,810,116 97.0%<br />

Imported products 26,947 30,115 28,350 26,118 27,297 104.5%<br />

Total 5,415,633 4,807,121 4,299,044 3,955,477 3,837,413 97.0%<br />

Imports’ share 0.5% 0.6 % 0.7% 0.7% 0.7%<br />

Domestic products 1,696,412 2,344,669 2,603,407 2,533,199 2,538,877 100.2%<br />

Imported products 60,755 51,587 54,251 47,853 40,272 84.2%<br />

Total 1,757,167 2,396,256 2,657,658 2,581,052 2,579,149 99.9%<br />

Imports’ share 3.5% 2.2% 2.0% 1.9% 1.6%<br />

Domestic products 99,668 88,943 82,188 77,050 69,288 89.9%<br />

Imported products 25,787 23,167 23,492 19,615 16,829 85.2%<br />

Total 125,455 112,110 105,680 96,665 86,177 89.1%<br />

Imports’ share 20.6% 20.7% 22.2% 20.3% 19.5%<br />

Unit: kiloliters Source: National Tax Administration<br />

Note :These figures are calculated based on taxable volume and differ from the import figures above.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

199

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

The taxable volume is regarded as equivalent to the volume of liquors distributed and sold in <strong>Japan</strong>. Liquor taxes are collected<br />

on domestic liquor when it is shipped from the factory, and on imported liquor when it is taken from the bonded warehouse.<br />

happoshu uses less malt than beer, they are classified as miscellaneous liquors under the Liquor Tax Law, and thus are subject<br />

to lower liquor taxes than beer.<br />

3. Key Considerations with regard to exports to <strong>Japan</strong><br />

(1) Regulations and Procedural Requirements at the time of Importing in <strong>Japan</strong><br />

<strong>Alcoholic</strong> beverage imports are subject to the provisions of the Food Sanitation Law and the Liquor Tax<br />

Law.<br />

1) Food Sanitation Law<br />

All food products to be imported for the purpose of sales and marketing are subject to the procedures of<br />

Food Sanitation Law. The Importers must submit a “Notification Form for Importation of Food, <strong>etc</strong>.” together<br />

with other necessary documents as ingredients list and production process chart when the processed food is<br />

the case, to the quarantine station at the port of entry. Upon examination of the documents, when the products<br />

are judged as subject to sanitary inspection, the inspection will be carried out inside bonded area and then<br />

decision will be made for import. The procedures required under the Food Sanitation Law is shown below.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

200<br />

Fig. 13 Procedures required under the Food Sanitation Law<br />

Advance consultation service<br />

Advance information acquisition (regarding production methods, content of ingredients, <strong>etc</strong>.)<br />

Advance inspection (by the competent government agency of the exporting country,<br />

or the official laboratory registered with the Minister of Health, Labor and Welfare)<br />

Submission to the Quarantine Station<br />

(“Notification Form for Importation of Foods, <strong>etc</strong>.” and other related documents)<br />

Examination of documents<br />

Cargo required inspection Cargo not required inspection<br />

Failure Pass<br />

Reshipment, destruction,<br />

conversion to other purposes<br />

Certificate of notification processing, or<br />

certificate of passing inspection<br />

Customs declaration<br />

On May 29, 2006, the new positive list system was introduced and came into force. The system stipulates<br />

all food products, if detected agricultural pesticides, feed additives, animal veterinary drugs to remain in<br />

excess of certain quantity, importation and sales of such food products will be in principle prohibited. In this<br />

system, for the agricultural pesticides <strong>etc</strong>. recognized to use and remain in the product, the maximum residual<br />

level is fixed, and for other chemicals uniform standard of 0.01ppm residual level is applicable (quantity<br />

understood as hardly affect human health).<br />

All food products, including processed food products, are subject to the positive list system, and of course<br />

alcoholic beverages are also subject to the system. For more detail, refer to the Ministry of Health, Labor,<br />

and Welfare website. (⇒http://www.mhlw.go.jp/english/topics/foodsafety/positivelist060228/index.html)<br />

It is required for the importers to gather abundant and enough information on the projected import foods to<br />

study whether the products meets the requirement of the Food Sanitation Law in their specifications and<br />

standards by obtaining, in advance, ingredients lists and production process charts or by making consultation<br />

with the quarantine office.<br />

Prior to importing, the importer may take a sample of forthcoming imports to laboratories registered with<br />

the Ministry of Health, Labor and Welfare or the competent governmental agencies of the exporting countries.<br />

Those test results may be substituted for the corresponding inspection at the port of entry, which expedites the<br />

quarantine process.<br />

In addition, importers who wish to submit their notification by computer may make use of the computerized<br />

FAINS (Food Automated Import Notification and Inspection Network System) for processing import-related

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

documentation. Importers who have possessed hardware and software may apply for a security code from the<br />

Minister of Health, Labor and Welfare to access the system.<br />

2) Liquor Tax Law<br />

The Liquor Tax Law requires a business license from the competent tax office in order to manufacture or<br />

sell liquors. Any person or entity may import liquors without restriction, but without a liquor vendor’s license,<br />

it is not permitted to ship imported liquors out of the bonded area. Therefore, it is essential to first obtain a<br />

liquor vendor’s license to sell imported liquors.<br />

In addition to customs duties, liquor taxes are collected when the liquors are shipped from the bonded area.<br />

In <strong>Japan</strong>, the Liquor Tax Law subjects all forms of beverages with an alcohol content of 1% or higher to<br />

taxation. <strong>Beer</strong>, wine and other beverages containing less than 1% alcohol are not classified as alcoholic<br />

beverages under the Liquor Tax Law. These products are sold as soft drinks instead, thus they are not subject<br />

to the Liquor Tax Law. In addition, please be aware that the Liquor Tax Law limits additives can be used as<br />

preservative mixtures by type of liquor.<br />

(2) Regulations and Procedural Requirements at the Time of Sale<br />

The domestic sale of liquor is subject to the Liquor Tax Law, the Liquor Business Association Law, the Food<br />

Sanitation Law, the Measurement Law, the Act Against Unjustifiable Premiums and Misleading<br />

Representations. Products that infringe intellectual property rights are regulated by the various intellectual<br />

property laws (Trademark Law, Patent Law, Unfair Competition Prevention Law, <strong>etc</strong>.). Prospective exporters to<br />

<strong>Japan</strong> must be aware of these considerations, as rights holders may initiate legal action.<br />

Containers and packaging may also be subject to identifier labeling provisions of the Law for Promotion of<br />

Effective Utilization of Resources, and recycling provisions of the Containers and Packaging Recycling Law.<br />

Please contact one of the agencies listed below for more complete information.(see (6)Regulatory Agent<br />

Contact)<br />

1) Liquor Tax Law<br />

All those engaged in the business of selling liquors must obtain a license for each sales location from the tax<br />

office with jurisdiction over the sales location. Applicants must conform to personal and location<br />

qualifications, <strong>etc</strong>. No license is required for restaurants that serve the liquor at their own restaurants and do<br />

not sell to other restaurants or to customers. The 3-Year Deregulation Plan (1999) relaxed qualifications for<br />

obtaining a general liquor retailer’s license (see below). Beginning September 1, 2003, limitations were<br />

abolished on grants of general liquor retailer’s licenses by retail sales area (annual license limits).<br />

Note: An emergency measure was issued in July 2003, regulating that, in a district where there is a noticeably high<br />

percentage of alcohol retailers with management difficulties, the director of the taxation office of a district shall<br />

not to grant authorization for the issue / transfer of a new license for certain period. 1,274 districts (37.7% of<br />

entire district) were designated as “emergency regulating districts" in the 2004 licensing year (September 1,<br />

2004 - August 31, 2005), regulating that in these districts where there is a noticeably high percentage of alcohol<br />

retailers with management difficulties, the director of the taxation office shall not to grant authorization for the<br />

issue / transfer of a new license for certain period. This measure was cancelled after the available period was<br />

postponed to August 31, 2006.<br />

There are several kinds of licenses for the sale of alcohol, depending on the category of business (wholesale<br />

business, retail business), and product line (full range, only imported products, <strong>etc</strong>.). The licenses required to<br />

handle imported alcohol are listed below.<br />

<br />

License for Wholesale of Alcohol<br />

a) General liquor wholesaler’s license<br />

Holders of this license are authorized to sell all liquors, regardless of domestic or imported, as a<br />

wholesaler to liquor retailers, but not to consumers or restaurants as a retailer.<br />

b) Western-style liquor wholesaler’s license<br />

Holders of this license are authorized to sell western-style liquors (wine, whisky, spirits, liqueur,<br />

and miscellaneous spirits only), as a wholesaler to liquor retailers, but not to consumers or<br />

restaurants as a retailer. The holders also are not authorized to wholesale beer.<br />

c) <strong>Beer</strong> wholesaler’s license<br />

Holders of this license are authorized to wholesale beer only, but not to consumers or restaurants<br />

as a retailer.<br />

Marketing Guide for <strong>ASEAN</strong> Exporters to <strong>Japan</strong><br />

201

C-2. <strong>Alcoholic</strong> <strong>Beverages</strong> (<strong>Beer</strong>, wine, whisky, <strong>etc</strong>.)<br />

d) Imported liquor wholesaler’s license<br />

Holders of this license are authorized to sell all imported liquors, as a wholesaler to liquor<br />

retailers, but not to consumers or restaurants as a retailer. The holders also are not authorized to<br />

wholesale liquors made in <strong>Japan</strong>.<br />

License for Retail Sale of Alcohol<br />

e) General liquor retailer’s license<br />

Holders of this license are authorized to sell all liquors to consumers or restaurants as a retailer<br />

within the sales territory. The holders also are authorized to import liquors directly and retail<br />

them. In order to exhibit imported liquor at a trade fair, holders must apply to the local tax office<br />

with jurisdiction over the trade fair venue for temporary permission to sell at a location other<br />

than the license holder’s regular sales location.<br />

f) Mail order liquor vendor’s license<br />

Holders of this license are authorized to sell specific liquors by mail order to consumers or<br />

restaurants.<br />

2) Liquor Business Association Law<br />

(Law Concerning Liquor Business Association and Measures for Securing Revenue from Liquor Tax)<br />

When alcoholic beverages are sold, it must be labeled in accordance with provisions of the Liquor Business<br />

Association Law. (see (3)Labeling)<br />

“Liquor sales manager system” was established. The purpose of the program is to assure appropriate retail<br />

control over alcoholic beverages, including proper container recycling, and prevent underage drinking. Under<br />

this program, liquor retailers must appoint liquor sales manager for each sales location no later than the date<br />

upon which alcoholic beverage sales commences. Within two weeks of appointment, the retailer must submit<br />

the “Sales Manager Appointment Notification” form to the competent tax office. For more complete<br />

information, please consult with the competent tax office with jurisdiction over the sales location.<br />

3) Food Sanitation Law<br />

The Food Sanitation Law prohibits the sale of foods containing toxic or harmful substances and foods that<br />