Contents - Equity Bank Group

Contents - Equity Bank Group

Contents - Equity Bank Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

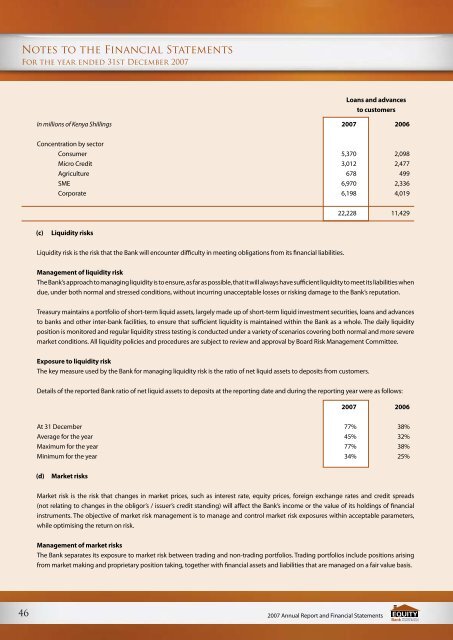

Notes to the Financial StatementsFor the year ended 31st December 2007Loans and advancesto customersIn millions of Kenya Shillings 2007 2006Concentration by sectorConsumer 5,370 2,098Micro Credit 3,012 2,477Agriculture 678 499SME 6,970 2,336Corporate 6,198 4,01922,228 11,429(c)Liquidity risksLiquidity risk is the risk that the <strong>Bank</strong> will encounter difficulty in meeting obligations from its financial liabilities.Management of liquidity riskThe <strong>Bank</strong>’s approach to managing liquidity is to ensure, as far as possible, that it will always have sufficient liquidity to meet its liabilities whendue, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the <strong>Bank</strong>’s reputation.Treasury maintains a portfolio of short-term liquid assets, largely made up of short-term liquid investment securities, loans and advancesto banks and other inter-bank facilities, to ensure that sufficient liquidity is maintained within the <strong>Bank</strong> as a whole. The daily liquidityposition is monitored and regular liquidity stress testing is conducted under a variety of scenarios covering both normal and more severemarket conditions. All liquidity policies and procedures are subject to review and approval by Board Risk Management Committee.Exposure to liquidity riskThe key measure used by the <strong>Bank</strong> for managing liquidity risk is the ratio of net liquid assets to deposits from customers.Details of the reported <strong>Bank</strong> ratio of net liquid assets to deposits at the reporting date and during the reporting year were as follows:2007 2006At 31 December 77% 38%Average for the year 45% 32%Maximum for the year 77% 38%Minimum for the year 34% 25%(d)Market risksMarket risk is the risk that changes in market prices, such as interest rate, equity prices, foreign exchange rates and credit spreads(not relating to changes in the obligor’s / issuer’s credit standing) will affect the <strong>Bank</strong>’s income or the value of its holdings of financialinstruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters,while optimising the return on risk.Management of market risksThe <strong>Bank</strong> separates its exposure to market risk between trading and non-trading portfolios. Trading portfolios include positions arisingfrom market making and proprietary position taking, together with financial assets and liabilities that are managed on a fair value basis.462007 Annual Report and Financial Statements