COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

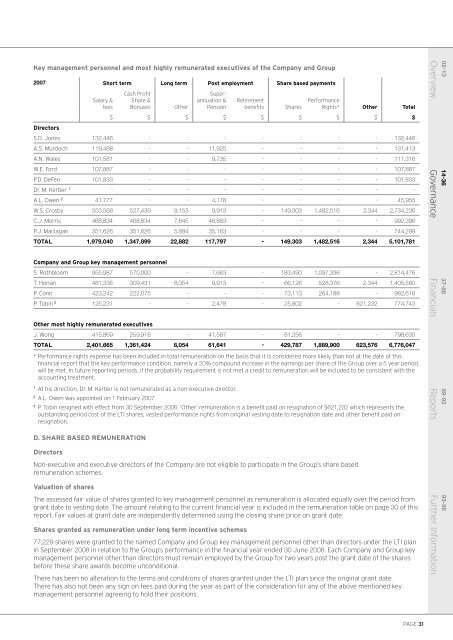

Key management personnel and most highly remunerated executives of the Company and Group2007 Short term Long term Post employment Share based paymentsSalary &feesCash ProfitShare &BonusesOtherSuperannuation&PensionRetirementbenefitsSharesPerformanceRights* Other Total$ $ $ $ $ $ $ $ $DirectorsS.D. Jones 132,446 - - - - - - - 132,446A.S. Murdoch 119,488 - - 11,925 - - - - 131,413A.N. Wales 101,581 - - 9,735 - - - - 111,316W.E. Ford 107,887 - - - - - - - 107,887P.D. DeFeo 101,833 - - - - - - - 101,833Dr. M. Kerber 1 - - - - - - - - -A.L. Owen 2 41,777 - - 4,178 - - - - 45,955W.S. Crosby 553,568 527,439 9,153 9,913 - 149,303 1,482,516 2,344 2,734,236C.J. Morris 468,834 468,834 7,845 46,883 - - - - 992,396P.J. Maclagan 351,626 351,626 5,884 35,163 - - - - 744,299TOTAL 1,979,040 1,347,899 22,882 117,797 - 149,303 1,482,516 2,344 5,101,78102-13Overview14-36GovernanceCompany and Group key management personnelS. Rothbloom 955,987 570,000 - 7,663 - 183,490 1,097,336 - 2,814,476T. Honan 481,336 309,431 8,054 9,913 - 66,126 528,376 2,344 1,405,580P. Conn 423,242 222,075 - - - 73,113 264,188 - 982,618P. Tobin 3 125,231 - - 2,478 - 25,802 - 621,232 774,743Other most highly remunerated executivesJ. Wong 415,869 259,918 - 41,587 - 81,256 - - 798,630TOTAL 2,401,665 1,361,424 8,054 61,641 - 429,787 1,889,900 623,576 6,776,047* Performance rights expense has been included in total remuneration on the basis that it is considered more likely than not at the date of thisfinancial report that the key performance condition, namely a 20% compound increase in the earnings per share of the Group over a 5 year period,will be met. In future reporting periods, if the probability requirement is not met a credit to remuneration will be included to be consistent with theaccounting treatment.1At his direction, Dr. M. Kerber is not remunerated as a non-executive director.2A.L. Owen was appointed on 1 February 20073P. Tobin resigned with effect from 30 September 2006. ‘Other’ remuneration is a benefit paid on resignation of $621,232 which represents theoutstanding period cost of the LTI shares, vested performance rights from original vesting date to resignation date and other benefit paid onresignation.37-88Financials89-92ReportsD. SHARE BASED REMUNERATIONDirectorsNon-executive and executive directors of the Company are not eligible to participate in the Group’s share basedremuneration schemes.Valuation of sharesThe assessed fair value of shares granted to key management personnel as remuneration is allocated equally over the period fromgrant date to vesting date. The amount relating to the current financial year is included in the remuneration table on page 30 of thisreport. Fair values at grant date are independently determined using the closing share price on grant date.Shares granted as remuneration under long term incentive schemes77,229 shares were granted to the named Company and Group key management personnel other than directors under the LTI planin September <strong>2008</strong> in relation to the Group’s performance in the financial year ended 30 June <strong>2008</strong>. Each Company and Group keymanagement personnel other than directors must remain employed by the Group for two years post the grant date of the sharesbefore these share awards become unconditional.There has been no alteration to the terms and conditions of shares granted under the LTI plan since the original grant date.There has also not been any sign on fees paid during the year as part of the consideration for any of the above mentioned keymanagement personnel agreeing to hold their positions.93-96Further InformationPAGE 31