COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

COMPUTERSHARE ANNUAL REPORT 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

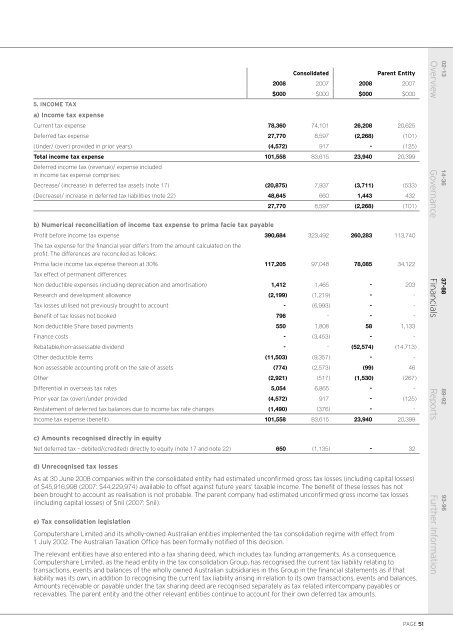

5. INCOME TAXa) Income tax expenseConsolidatedParent Entity<strong>2008</strong> 2007 <strong>2008</strong> 2007$000 $000 $000 $000Current tax expense 78,360 74,101 26,208 20,625Deferred tax expense 27,770 8,597 (2,268) (101)(Under/ (over) provided in prior years) (4,572) 917 - (125)Total income tax expense 101,558 83,615 23,940 20,399Deferred income tax (revenue)/ expense includedin income tax expense comprises:Decrease/ (increase) in deferred tax assets (note 17) (20,875) 7,937 (3,711) (533)(Decrease)/ increase in deferred tax liabilities (note 22) 48,645 660 1,443 43227,770 8,597 (2,268) (101)b) Numerical reconciliation of income tax expense to prima facie tax payableProfit before income tax expense 390,684 323,492 260,283 113,740The tax expense for the financial year differs from the amount calculated on theprofit. The differences are reconciled as follows:Prima facie income tax expense thereon at 30% 117,205 97,048 78,085 34,122Tax effect of permanent differences:Non deductible expenses (including depreciation and amortisation) 1,412 1,465 - 203Research and development allowance (2,199) (1,219) - -Tax losses utilised not previously brought to account - (6,993) - -Benefit of tax losses not booked 796 - - -Non deductible Share based payments 550 1,808 58 1,133Finance costs - (3,453) - -Rebatable/non-assessable dividend - - (52,574) (14,713)Other deductible items (11,503) (9,357) - -Non assessable accounting profit on the sale of assets (774) (2,573) (99) 46Other (2,921) (517) (1,530) (267)Differential in overseas tax rates 5,054 6,865 - -Prior year tax (over)/under provided (4,572) 917 - (125)Restatement of deferred tax balances due to income tax rate changes (1,490) (376) - -Income tax expense (benefit) 101,558 83,615 23,940 20,39902-13Overview14-36Governance37-88Financials89-92Reportsc) Amounts recognised directly in equityNet deferred tax – debited/(credited) directly to equity (note 17 and note 22) 650 (1,135) - 32d) Unrecognised tax lossesAs at 30 June <strong>2008</strong> companies within the consolidated entity had estimated unconfirmed gross tax losses (including capital losses)of $45,916,998 (2007: $44,229,974) available to offset against future years’ taxable income. The benefit of these losses has notbeen brought to account as realisation is not probable. The parent company had estimated unconfirmed gross income tax losses(including capital losses) of $nil (2007: $nil).e) Tax consolidation legislationComputershare Limited and its wholly-owned Australian entities implemented the tax consolidation regime with effect from1 July 2002. The Australian Taxation Office has been formally notified of this decision.The relevant entities have also entered into a tax sharing deed, which includes tax funding arrangements. As a consequence,Computershare Limited, as the head entity in the tax consolidation Group, has recognised the current tax liability relating totransactions, events and balances of the wholly owned Australian subsidiaries in this Group in the financial statements as if thatliability was its own, in addition to recognising the current tax liability arising in relation to its own transactions, events and balances.Amounts receivable or payable under the tax sharing deed are recognised separately as tax related intercompany payables orreceivables. The parent entity and the other relevant entities continue to account for their own deferred tax amounts.93-96Further InformationPAGE 51