Transfer pricing perspectives: Winds of Change - PwC

Transfer pricing perspectives: Winds of Change - PwC

Transfer pricing perspectives: Winds of Change - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

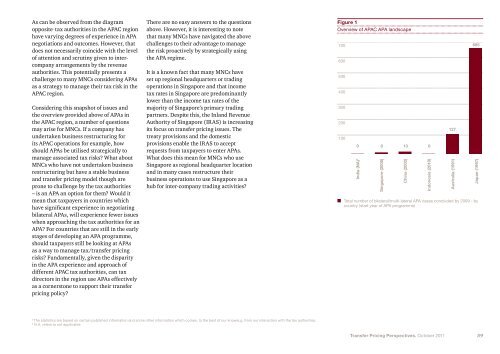

As can be observed from the diagramopposite . tax authorities in the APAC regionhave varying degrees <strong>of</strong> experience in APAnegotiations and outcomes. However, thatdoes not necessarily coincide with the level<strong>of</strong> attention and scrutiny given to intercompanyarrangements by the revenueauthorities. This potentially presents achallenge to many MNCs considering APAsas a strategy to manage their tax risk in theAPAC region.Considering this snapshot <strong>of</strong> issues andthe overview provided above <strong>of</strong> APAs inthe APAC region, a number <strong>of</strong> questionsmay arise for MNCs. If a company hasundertaken business restructuring forits APAC operations for example, howshould APAs be utilised strategically tomanage associated tax risks? What aboutMNCs who have not undertaken businessrestructuring but have a stable businessand transfer <strong>pricing</strong> model though areprone to challenge by the tax authorities– is an APA an option for them? Would itmean that taxpayers in countries whichhave significant experience in negotiatingbilateral APAs, will experience fewer issueswhen approaching the tax authorities for anAPA? For countries that are still in the earlystages <strong>of</strong> developing an APA programme,should taxpayers still be looking at APAsas a way to manage tax/transfer <strong>pricing</strong>risks? Fundamentally, given the disparityin the APA experience and approach <strong>of</strong>different APAC tax authorities, can taxdirectors in the region use APAs effectivelyas a cornerstone to support their transfer<strong>pricing</strong> policy?There are no easy answers to the questionsabove. However, it is interesting to notethat many MNCs have navigated the abovechallenges to their advantage to managethe risk proactively by strategically usingthe APA regime.It is a known fact that many MNCs haveset up regional headquarters or tradingoperations in Singapore and that incometax rates in Singapore are predominantlylower than the income tax rates <strong>of</strong> themajority <strong>of</strong> Singapore’s primary tradingpartners. Despite this, the Inland RevenueAuthority <strong>of</strong> Singapore (IRAS) is increasingits focus on transfer <strong>pricing</strong> issues. Thetreaty provisions and the domesticprovisions enable the IRAS to acceptrequests from taxpayers to enter APAs.What does this mean for MNCs who useSingapore as regional headquarter locationand in many cases restructure theirbusiness operations to use Singapore as ahub for inter-company trading activities?Figure 1Overview <strong>of</strong> APAC APA landscape7006005004003002001000 8 13 0India (NA) 3Singapore (2006)China (2002)Indonesia (2010)127Total number <strong>of</strong> bilateral/multi-lateral APA cases concluded by 2009 - bycountry (start year <strong>of</strong> APA programme)Australia (1991)685Japan (1997)2The statistics are based on certain published information and some other information which comes, to the best <strong>of</strong> our knowle.g. from our interaction with the tax authorities.3N.A. refers to not applicable.<strong>Transfer</strong> Pricing Perspectives. October 201159