2013 Annual Report - Investor Relations - Darden Restaurants

2013 Annual Report - Investor Relations - Darden Restaurants

2013 Annual Report - Investor Relations - Darden Restaurants

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

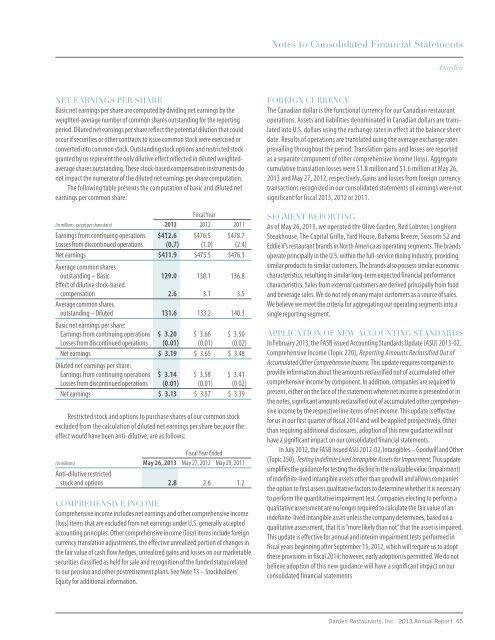

Notes to Consolidated Financial Statements<strong>Darden</strong>Net Earnings per ShareBasic net earnings per share are computed by dividing net earnings by theweighted-average number of common shares outstanding for the reportingperiod. Diluted net earnings per share reflect the potential dilution that couldoccur if securities or other contracts to issue common stock were exercised orconverted into common stock. Outstanding stock options and restricted stockgranted by us represent the only dilutive effect reflected in diluted weightedaverageshares outstanding. These stock-based compensation instruments donot impact the numerator of the diluted net earnings per share computation.The following table presents the computation of basic and diluted netearnings per common share:Fiscal Year(in millions, except per share data) <strong>2013</strong> 2012 2011Earnings from continuing operations $412.6 $476.5 $478.7Losses from discontinued operations (0.7) (1.0) (2.4)Net earnings $411.9 $475.5 $476.3Average common sharesoutstanding – Basic 129.0 130.1 136.8Effect of dilutive stock-basedcompensation 2.6 3.1 3.5Average common sharesoutstanding – Diluted 131.6 133.2 140.3Basic net earnings per share:Earnings from continuing operations $ 3.20 $ 3.66 $ 3.50Losses from discontinued operations (0.01) (0.01) (0.02)Net earnings $ 3.19 $ 3.65 $ 3.48Diluted net earnings per share:Earnings from continuing operations $ 3.14 $ 3.58 $ 3.41Losses from discontinued operations (0.01) (0.01) (0.02)Net earnings $ 3.13 $ 3.57 $ 3.39Restricted stock and options to purchase shares of our common stockexcluded from the calculation of diluted net earnings per share because theeffect would have been anti-dilutive, are as follows:Fiscal Year Ended(in millions) May 26, <strong>2013</strong> May 27, 2012 May 29, 2011Anti-dilutive restrictedstock and options 2.8 2.6 1.2Comprehensive IncomeComprehensive income includes net earnings and other comprehensive income(loss) items that are excluded from net earnings under U.S. generally acceptedaccounting principles. Other comprehensive income (loss) items include foreigncurrency translation adjustments, the effective unrealized portion of changes inthe fair value of cash flow hedges, unrealized gains and losses on our marketablesecurities classified as held for sale and recognition of the funded status relatedto our pension and other postretirement plans. See Note 13 – Stockholders’Equity for additional information.Foreign CurrencyThe Canadian dollar is the functional currency for our Canadian restaurantoperations. Assets and liabilities denominated in Canadian dollars are translatedinto U.S. dollars using the exchange rates in effect at the balance sheetdate. Results of operations are translated using the average exchange ratesprevailing throughout the period. Translation gains and losses are reportedas a separate component of other comprehensive income (loss). Aggregatecumulative translation losses were $1.8 million and $1.6 million at May 26,<strong>2013</strong> and May 27, 2012, respectively. Gains and losses from foreign currencytransactions recognized in our consolidated statements of earnings were notsignificant for fiscal <strong>2013</strong>, 2012 or 2011.Segment <strong>Report</strong>ingAs of May 26, <strong>2013</strong>, we operated the Olive Garden, Red Lobster, LongHornSteakhouse, The Capital Grille, Yard House, Bahama Breeze, Seasons 52 andEddie V’s restaurant brands in North America as operating segments. The brandsoperate principally in the U.S. within the full-service dining industry, providingsimilar products to similar customers. The brands also possess similar economiccharacteristics, resulting in similar long-term expected financial performancecharacteristics. Sales from external customers are derived principally from foodand beverage sales. We do not rely on any major customers as a source of sales.We believe we meet the criteria for aggregating our operating segments into asingle reporting segment.Application of New Accounting StandardsIn February <strong>2013</strong>, the FASB issued Accounting Standards Update (ASU) <strong>2013</strong>-02,Comprehensive Income (Topic 220), <strong>Report</strong>ing Amounts Reclassified Out ofAccumulated Other Comprehensive Income. This update requires companies toprovide information about the amounts reclassified out of accumulated othercomprehensive income by component. In addition, companies are required topresent, either on the face of the statement where net income is presented or inthe notes, significant amounts reclassified out of accumulated other comprehensiveincome by the respective line items of net income. This update is effectivefor us in our first quarter of fiscal 2014 and will be applied prospectively. Otherthan requiring additional disclosures, adoption of this new guidance will nothave a significant impact on our consolidated financial statements.In July 2012, the FASB issued ASU 2012-02, Intangibles – Goodwill and Other(Topic 350), Testing Indefinite Lived Intangible Assets for Impairment. This updatesimplifies the guidance for testing the decline in the realizable value (impairment)of indefinite-lived intangible assets other than goodwill and allows companiesthe option to first assess qualitative factors to determine whether it is necessaryto perform the quantitative impairment test. Companies electing to perform aqualitative assessment are no longer required to calculate the fair value of anindefinite-lived intangible asset unless the company determines, based on aqualitative assessment, that it is “more likely than not” that the asset is impaired.This update is effective for annual and interim impairment tests performed infiscal years beginning after September 15, 2012, which will require us to adoptthese provisions in fiscal 2014; however, early adoption is permitted. We do notbelieve adoption of this new guidance will have a significant impact on ourconsolidated financial statements<strong>Darden</strong> <strong>Restaurants</strong>, Inc. <strong>2013</strong> <strong>Annual</strong> <strong>Report</strong> 45