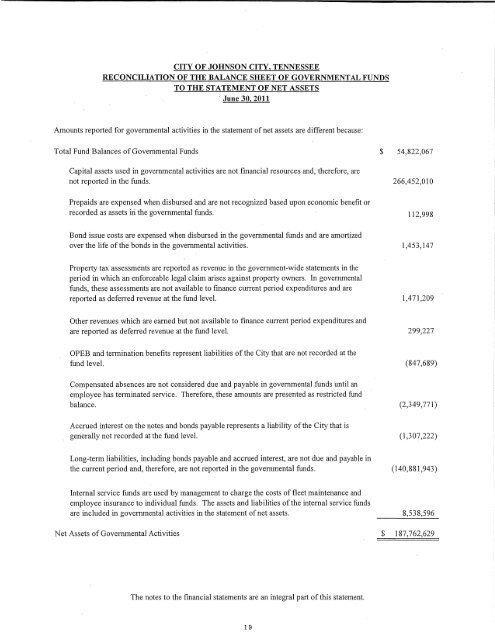

CITY OF JOHNSON CITY, TENNESSEERECONCILIATION OF THE.BALANCE SHEET OF GOVERNMENTAL FUNDSTO THE STATEMENT OF NET ASSETS· June 30, 2011Amounts reported for governmental activities in the statement of net assets are different because:Total Fund Balances ofGovemmental FundsCapital assets used in governmental activities are not fmancial resources and, therefore, arenot reported in the funds.Prepaids are expensed when disbursed and are not recognized based upon economic benefit orrecorded as assets iri the governmental funds.Bond issue costs are expensed when disbursed in the governmental funds and are amortizedover the life of the bonds in the governmental activities.$ 54,822,067266,452,010112,9981,453,147Property tax assessments are reported as revenue in the government-wide statements in theperiod in which an enforceable legal claim arises against property owners. In governmentalfunds, these assessments are not available to fmance current period expenditures and arereported as deferred revenue at the fund level.1,471,209Other revenues which are earned but not available to fmance current period expenditures andare reported as deferred revenue at the fund level.299,227OPEB and termination benefits represent liabilities of the <strong>City</strong> that are not recorded at thefund level.Compensated absences are not considered due and payable in governmental funds until anemployee has terminated service. Therefore, these amounts are presented as restricted fundbalance.Accrued interest on the notes and bonds payable represents a liability ofthe <strong>City</strong> that isgenerally not recorded at the fund level.(847,689)(2,349,771)(1,307,222)Long-term liabilities, including bonds payable and accrued interest, are not due and payable inthe current period and, therefore, are not reported in the governmental funds.(140,881 ,943)Internal service funds are used by management to charge the costs of fleet maintenance andemployee insurance to individual funds. The assets and liabilities of the internal service fundsare included in governmental activities in the statement of net assets.8,538,596Net Assets of Governmental Activities $ 187,762,629The notes to the financial statements are an integral part of this statement.19

CITY OF JOHNSON CITY, TENNESSEESTATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCESGOVERNMENTAL FUNDSFor the Fiscal Year Ended June 30, 2011NGeneral Debt Educational School Other TotalGeneral Purpose Service Facilities Debt Capital Governmental GovernmentalFund Schoo1Fund Fund Service Fund Project Fund Funds FundsRevenues:Taxes $ 53,988,571 20,522,410 1,948,851 76,459,832Licenses and Permits 790,124 1,361 791,485Intergovernmental Revenue 9,083,628 25,128,658 782,436 12,315,453 47,310,175Charges for Services 875,949 1,177,845 998,344 3,052,138Fines and Forfeitures 2,148,594 459,306 2,607,900Revenue from Use of Property 1,054,790 1,395,570 2,450,360Investment Earnings 311,323 79,716 405,114 8,975 294,682 92,186 1,191,996Miscellaneous 849,936 171,923 163,40 I 358,407 1,543,667Total Revenues 69,102,915 47,081,913 405,114 1,957,826 1,240,519 15,619,266 135,407,553Expenditures:Current:0 General Government 11,368,365 11,368,365Public Safety 22,452,606 1,036,148 23,488,754Public Works 11,008,160 11,008,160Public Welfare 6,117,409 582,020 6,699,429<strong>City</strong> Services 2,019,303 2,019,303Education 53,164,991 11,039,846 64,204,837Miscellaneous 6,500 6,500Capital OutlayGeneral Govermnent 11,972 9,966,325 9,978,297Public Works 259,332 1,303,634 1,562,966<strong>City</strong> Services 753,260 753,260Education 62,548 34,911,018 361,148 35,334,714Debt Service:Principal Retirement 6,332,024 644,846 6,976,870Interest and Fiscal Charges 4,236,330 3,493,012 7,729,342Total Expenditures 51,217,844 53,227,539 10,568,354 4,137,858 34,911,018 27,068,184 181,130,797Excess (Deficiency) of RevenuesOver (Under) Expenditures 17,885,071 (6, 145,626) (10,163,240) (2, 180,032) (33,670,499) (I 1,448,918) (45,723,244)(Continued)

- Page 1 and 2: Ciity ofJohnson City,TennesseeCompr

- Page 3 and 4: CITY OF JOHNSON CITY, TENNESSEEBASI

- Page 5 and 6: CITY OF JOHNSON CITY, TENNESSEECOMP

- Page 7 and 8: CITY OF JOHNSON CITY, TENNESSEECOMP

- Page 9 and 10: Budgeting Controls. In addition, th

- Page 11 and 12: Certificate ofAchievementfor Excell

- Page 13 and 14: CITY OF JOHNSON CITY, TENNESSEECITY

- Page 15 and 16: Honorable Mayor and Board of Commis

- Page 17 and 18: Both of the government-wide financi

- Page 19 and 20: City of Johnson City's Net AssetsGo

- Page 21 and 22: Financial Analysis of the City's Fu

- Page 23 and 24: Final Amended Budget and Actual Amo

- Page 25 and 26: Economic Factors and Next Year's Bu

- Page 27 and 28: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 29 and 30: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 31: CITY OF JOHNSON CITY 2 TENNESSEEBAL

- Page 35 and 36: CITY OF JOHNSON CITY, TENNESSEERECO

- Page 37 and 38: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 39 and 40: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 41 and 42: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 43 and 44: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 45 and 46: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 47 and 48: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 49 and 50: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 51 and 52: CITY OF JOHNSON CITY, TENNESSEESTAT

- Page 53 and 54: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 55 and 56: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 57 and 58: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 59 and 60: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 61 and 62: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 63 and 64: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 65 and 66: CITY OF JOHNSON CITY 1 TENNESSEENOT

- Page 67 and 68: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 69 and 70: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 71 and 72: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 73 and 74: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 75 and 76: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 77 and 78: CITY OF JOHNSON CITY 2 TENNESSEENOT

- Page 79 and 80: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 81 and 82: CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 83 and 84:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 85 and 86:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 87 and 88:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 89 and 90:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 91 and 92:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 93 and 94:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 95 and 96:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 97 and 98:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 99 and 100:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 101 and 102:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 103 and 104:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 105 and 106:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 107 and 108:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 109 and 110:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 111 and 112:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 113 and 114:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 115 and 116:

CITY OF JOHNSON CITY 2 TENNESSEENOT

- Page 117 and 118:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 119 and 120:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 121 and 122:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 123 and 124:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 125 and 126:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 127 and 128:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 129 and 130:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 131 and 132:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 133 and 134:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 135 and 136:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 137 and 138:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 139 and 140:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 141 and 142:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 143 and 144:

CITY OF JOHNSON CITY, TENNESSEE·NO

- Page 145 and 146:

CITY OF JOHNSON CITY, TENNESSEENOTE

- Page 147 and 148:

CITY OF JOHNSON CITY, TENNESSEEREQU

- Page 149 and 150:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 151 and 152:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 153 and 154:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 155 and 156:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 157 and 158:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 159 and 160:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 161 and 162:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 163 and 164:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 165 and 166:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 167 and 168:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 169 and 170:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 171 and 172:

NONMAJOR PROPRIETARY FUNDSProprieta

- Page 173 and 174:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 175 and 176:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 177 and 178:

CITY OF JO~NSON CITY, TENNESSEECOMB

- Page 179 and 180:

CITY OF JOHNSON CITY, TENNESSEECOMB

- Page 181 and 182:

CITY OF JOHNSON CITY, TENNESSEECAPI

- Page 183 and 184:

I This schedule presents only the c

- Page 185 and 186:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 187 and 188:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 189 and 190:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 191 and 192:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 193 and 194:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 195 and 196:

STATISTICAL SECTIONThis part of the

- Page 197 and 198:

CITY OF JOHNSON CITY, TENNESSEECHAN

- Page 199 and 200:

CITY OF JOHNSON CITY, TENNESSEECHAN

- Page 201 and 202:

CITY OF JOHNSON CITY, TENNESSEEFUND

- Page 203 and 204:

CITY OF JOHNSON CITY, TENNESSEECHAN

- Page 205 and 206:

CITY OF JOHNSON CITY, TENNESSEEPROP

- Page 207 and 208:

CITY OF JOHNSON CITY, TENNESSEEPROP

- Page 209 and 210:

CITY OF JOHNSON CITY, TENNESSEERATI

- Page 211 and 212:

CITY OF JOHNSON CITY, TENNESSEELEGA

- Page 213 and 214:

CITY OF JOHNSON CITY, TENNESSEEPLED

- Page 215 and 216:

CITY OF JOHNSON CITY, TENNESSEEPRIN

- Page 217 and 218:

CITY OF JOHNSON CITY, TENNESSEEOPER

- Page 219 and 220:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 221 and 222:

CITY OF JOHNSON CITY~ TENNESSEESCHE

- Page 223 and 224:

CITY OF JOHNSON CITY, TENNESSEEUTIL

- Page 225 and 226:

~ ~~~~-li--~-B~kbur~ Childers&Steag

- Page 227 and 228:

CERTIFIED P uBLIC A ccouNTANTS AND

- Page 229 and 230:

CITY OF JOHNSON CITY, TENNESSEESCHE

- Page 231 and 232:

CITY OF JOHNSON CITY, TENNESSEESCHE