Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

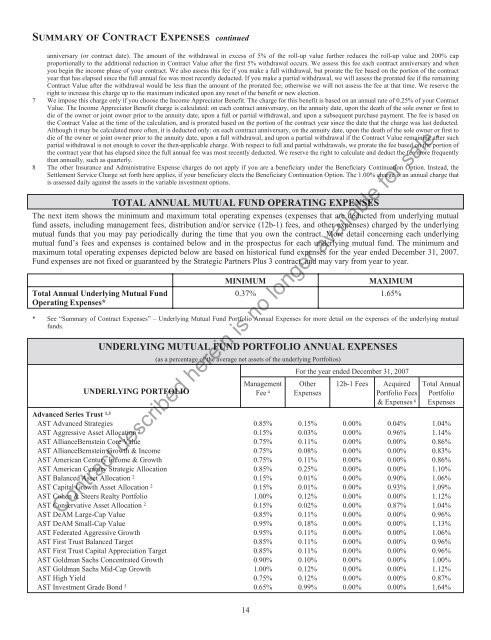

SUMMARY OF CONTRACT EXPENSES continuedanniversary (or contract date). The amount of the withdrawal in excess of 5% of the roll-up value further reduces the roll-up value and 200% capproportionally to the additional reduction in Contract Value after the first 5% withdrawal occurs. We assess this fee each contract anniversary and whenyou begin the income phase of your contract. We also assess this fee if you make a full withdrawal, but prorate the fee based on the portion of the contractyear that has elapsed since the full annual fee was most recently deducted. If you make a partial withdrawal, we will assess the prorated fee if the remainingContract Value after the withdrawal would be less than the amount of the prorated fee; otherwise we will not assess the fee at that time. We reserve theright to increase this charge up to the maximum indicated upon any reset of the benefit or new election.7 We impose this charge only if you choose the Income Appreciator Benefit. The charge for this benefit is based on an annual rate of 0.25% of your ContractValue. The Income Appreciator Benefit charge is calculated: on each contract anniversary, on the annuity date, upon the death of the sole owner or first todie of the owner or joint owner prior to the annuity date, upon a full or partial withdrawal, and upon a subsequent purchase payment. The fee is based onthe Contract Value at the time of the calculation, and is prorated based on the portion of the contract year since the date that the charge was last deducted.Although it may be calculated more often, it is deducted only: on each contract anniversary, on the annuity date, upon the death of the sole owner or firsttodie of the owner or joint owner prior to the annuity date, upon a full withdrawal, and upon a partial withdrawal if the Contract Value remaining after suchpartial withdrawal is not enough to cover the then-applicable charge. With respect to full and partial withdrawals, we prorate the fee based on the portion ofthe contract year that has elapsed since the full annual fee was most recently deducted. We reserve the right to calculate and deduct the fee more frequentlythan annually, such as quarterly.8 The other Insurance and Administrative Expense charges do not apply if you are a beneficiary under the Beneficiary Continuation Option. Instead, theSettlement Service Charge set forth here applies, if your beneficiary elects the Beneficiary Continuation Option. The 1.00% charge is an annual charge thatis assessed daily against the assets in the variable investment options.TOTAL ANNUAL MUTUAL FUND OPERATING EXPENSESThe next item shows the minimum and maximum total operating expenses (expenses that are deducted from underlying mutualfund assets, including management fees, distribution and/or service (12b-1) fees, and other expenses) charged by the underlyingmutual funds that you may pay periodically during the time that you own the contract. More detail concerning each underlyingmutual fund’s fees and expenses is contained below and in the prospectus for each underlying mutual fund. The minimum andmaximum total operating expenses depicted below are based on historical fund expenses for the year ended December 31, 2007.Fund expenses are not fixed or guaranteed by the <strong>Strategic</strong> <strong>Partners</strong> <strong>Plus</strong> 3 contract, and may vary from year to year.Total Annual Underlying Mutual FundOperating Expenses*MINIMUMMAXIMUM0.37% 1.65%* See “Summary of Contract Expenses” – Underlying Mutual Fund Portfolio Annual Expenses for more detail on the expenses of the underlying mutualfunds.UNDERLYING MUTUAL FUND PORTFOLIO ANNUAL EXPENSES(as a percentage of the average net assets of the underlying Portfolios)For the year ended December 31, 2007Management Other 12b-1 Fees AcquiredUNDERLYING PORTFOLIOFee 4 ExpensesPortfolio Fees& Expenses 6Total AnnualPortfolioExpensesAdvanced Series Trust 1,3AST Advanced Strategies 0.85% 0.15% 0.00% 0.04% 1.04%AST Aggressive Asset Allocation 2 0.15% 0.03% 0.00% 0.96% 1.14%AST AllianceBernstein Core Value 0.75% 0.11% 0.00% 0.00% 0.86%AST AllianceBernstein Growth & Income 0.75% 0.08% 0.00% 0.00% 0.83%AST American Century Income & Growth 0.75% 0.11% 0.00% 0.00% 0.86%AST American Century <strong>Strategic</strong> Allocation 0.85% 0.25% 0.00% 0.00% 1.10%AST Balanced Asset Allocation 2 0.15% 0.01% 0.00% 0.90% 1.06%AST Capital Growth Asset Allocation 2 0.15% 0.01% 0.00% 0.93% 1.09%AST Cohen & Steers Realty Portfolio 1.00% 0.12% 0.00% 0.00% 1.12%AST Conservative Asset Allocation 2 0.15% 0.02% 0.00% 0.87% 1.04%AST DeAM Large-Cap Value 0.85% 0.11% 0.00% 0.00% 0.96%AST DeAM Small-Cap Value 0.95% 0.18% 0.00% 0.00% 1.13%AST Federated Aggressive Growth 0.95% 0.11% 0.00% 0.00% 1.06%AST First Trust Balanced Target 0.85% 0.11% 0.00% 0.00% 0.96%AST First Trust Capital Appreciation Target 0.85% 0.11% 0.00% 0.00% 0.96%AST Goldman Sachs Concentrated Growth 0.90% 0.10% 0.00% 0.00% 1.00%AST Goldman Sachs Mid-Cap Growth 1.00% 0.12% 0.00% 0.00% 1.12%AST High Yield 0.75% 0.12% 0.00% 0.00% 0.87%AST Investment Grade Bond 5 0.65% 0.99% 0.00% 0.00% 1.64%Contract described herein is no longer available for sale.14