Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

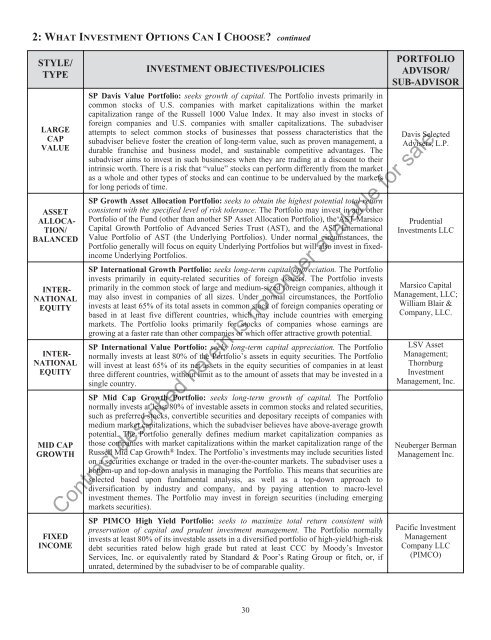

2: WHAT INVESTMENT OPTIONS CAN ICHOOSE? continuedSTYLE/TYPELARGECAPVALUEASSETALLOCA-TION/BALANCEDINTER-NATIONALEQUITYINTER-NATIONALEQUITYMID CAPGROWTHFIXEDINCOMEINVESTMENT OBJECTIVES/POLICIESSP Davis Value Portfolio: seeks growth of capital. The Portfolio invests primarily incommon stocks of U.S. companies with market capitalizations within the marketcapitalization range of the Russell 1000 Value Index. It may also invest in stocks offoreign companies and U.S. companies with smaller capitalizations. The subadviserattempts to select common stocks of businesses that possess characteristics that thesubadviser believe foster the creation of long-term value, such as proven management, adurable franchise and business model, and sustainable competitive advantages. Thesubadviser aims to invest in such businesses when they are trading at a discount to theirintrinsic worth. There is a risk that “value” stocks can perform differently from the marketas a whole and other types of stocks and can continue to be undervalued by the marketsfor long periods of time.SP Growth Asset Allocation Portfolio: seeks to obtain the highest potential total returnconsistent with the specified level of risk tolerance. The Portfolio may invest in any otherPortfolio of the Fund (other than another SP Asset Allocation Portfolio), the AST MarsicoCapital Growth Portfolio of Advanced Series Trust (AST), and the AST InternationalValue Portfolio of AST (the Underlying Portfolios). Under normal circumstances, thePortfolio generally will focus on equity Underlying Portfolios but will also invest in fixedincomeUnderlying Portfolios.SP International Growth Portfolio: seeks long-term capital appreciation. The Portfolioinvests primarily in equity-related securities of foreign issuers. The Portfolio investsprimarily in the common stock of large and medium-sized foreign companies, although itmay also invest in companies of all sizes. Under normal circumstances, the Portfolioinvests at least 65% of its total assets in common stock of foreign companies operating orbased in at least five different countries, which may include countries with emergingmarkets. The Portfolio looks primarily for stocks of companies whose earnings aregrowing at a faster rate than other companies or which offer attractive growth potential.SP International Value Portfolio: seeks long-term capital appreciation. The Portfolionormally invests at least 80% of the Portfolio’s assets in equity securities. The Portfoliowill invest at least 65% of its net assets in the equity securities of companies in at leastthree different countries, without limit as to the amount of assets that may be invested in asingle country.SP Mid Cap Growth Portfolio: seeks long-term growth of capital. The Portfolionormally invests at least 80% of investable assets in common stocks and related securities,such as preferred stocks, convertible securities and depositary receipts of companies withmedium market capitalizations, which the subadviser believes have above-average growthpotential. The Portfolio generally defines medium market capitalization companies asthose companies with market capitalizations within the market capitalization range of theRussell Mid Cap Growth ® Index. The Portfolio’s investments may include securities listedon a securities exchange or traded in the over-the-counter markets. The subadviser uses abottom-up and top-down analysis in managing the Portfolio. This means that securities areselected based upon fundamental analysis, as well as a top-down approach todiversification by industry and company, and by paying attention to macro-levelinvestment themes. The Portfolio may invest in foreign securities (including emergingmarkets securities).SP PIMCO High Yield Portfolio: seeks to maximize total return consistent withpreservation of capital and prudent investment management. The Portfolio normallyinvests at least 80% of its investable assets in a diversified portfolio of high-yield/high-riskdebt securities rated below high grade but rated at least CCC by Moody’s InvestorServices, Inc. or equivalently rated by Standard & Poor’s Rating Group or fitch, or, ifunrated, determined by the subadviser to be of comparable quality.PORTFOLIOADVISOR/SUB-ADVISORDavis SelectedAdvisers, L.P.<strong>Prudential</strong>Investments LLCMarsico CapitalManagement, LLC;William Blair &Company, LLC.LSV AssetManagement;ThornburgInvestmentManagement, Inc.Neuberger BermanManagement Inc.Contract described herein is no longer available for sale.Pacific InvestmentManagementCompany LLC(PIMCO)30