Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

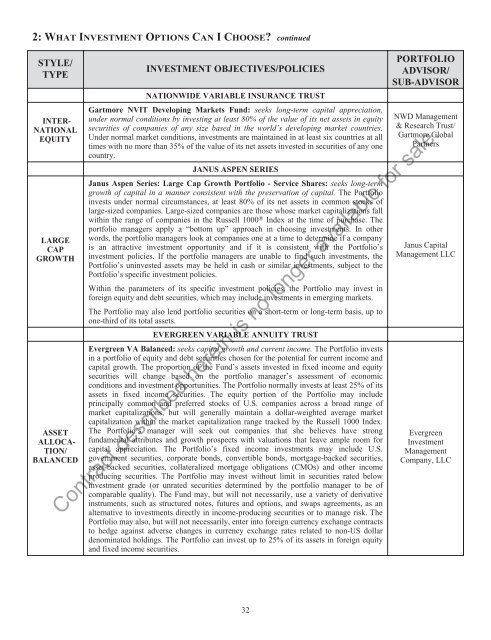

2: WHAT INVESTMENT OPTIONS CAN ICHOOSE? continuedSTYLE/TYPEINTER-NATIONALEQUITYLARGECAPGROWTHASSETALLOCA-TION/BALANCEDINVESTMENT OBJECTIVES/POLICIESNATIONWIDE VARIABLE INSURANCE TRUSTGartmore NVIT Developing Markets Fund: seeks long-term capital appreciation,under normal conditions by investing at least 80% of the value of its net assets in equitysecurities of companies of any size based in the world’s developing market countries.Under normal market conditions, investments are maintained in at least six countries at alltimes with no more than 35% of the value of its net assets invested in securities of any onecountry.JANUS ASPEN SERIESJanus Aspen Series: Large Cap Growth Portfolio - Service Shares: seeks long-termgrowth of capital in a manner consistent with the preservation of capital. The Portfolioinvests under normal circumstances, at least 80% of its net assets in common stocks oflarge-sized companies. Large-sized companies are those whose market capitalizations fallwithin the range of companies in the Russell 1000 ® Index at the time of purchase. Theportfolio managers apply a “bottom up” approach in choosing investments. In otherwords, the portfolio managers look at companies one at a time to determine if a companyis an attractive investment opportunity and if it is consistent with the Portfolio’sinvestment policies. If the portfolio managers are unable to find such investments, thePortfolio’s uninvested assets may be held in cash or similar investments, subject to thePortfolio’s specific investment policies.Within the parameters of its specific investment policies, the Portfolio may invest inforeign equity and debt securities, which may include investments in emerging markets.The Portfolio may also lend portfolio securities on a short-term or long-term basis, up toone-third of its total assets.EVERGREEN VARIABLE ANNUITY TRUSTEvergreen VA Balanced: seeks capital growth and current income. The Portfolio investsin a portfolio of equity and debt securities chosen for the potential for current income andcapital growth. The proportion of the Fund’s assets invested in fixed income and equitysecurities will change based on the portfolio manager’s assessment of economicconditions and investment opportunities. The Portfolio normally invests at least 25% of itsassets in fixed income securities. The equity portion of the Portfolio may includeprincipally common and preferred stocks of U.S. companies across a broad range ofmarket capitalizations, but will generally maintain a dollar-weighted average marketcapitalization within the market capitalization range tracked by the Russell 1000 Index.The Portfolio’s manager will seek out companies that she believes have strongfundamental attributes and growth prospects with valuations that leave ample room forcapital appreciation. The Portfolio’s fixed income investments may include U.S.government securities, corporate bonds, convertible bonds, mortgage-backed securities,asset-backed securities, collateralized mortgage obligations (CMOs) and other incomeproducing securities. The Portfolio may invest without limit in securities rated belowinvestment grade (or unrated securities determined by the portfolio manager to be ofcomparable quality). The Fund may, but will not necessarily, use a variety of derivativeinstruments, such as structured notes, futures and options, and swaps agreements, as analternative to investments directly in income-producing securities or to manage risk. ThePortfolio may also, but will not necessarily, enter into foreign currency exchange contractsto hedge against adverse changes in currency exchange rates related to non-US dollardenominated holdings. The Portfolio can invest up to 25% of its assets in foreign equityand fixed income securities.PORTFOLIOADVISOR/SUB-ADVISORNWD Management& Research Trust/Gartmore Global<strong>Partners</strong>Janus CapitalManagement LLCEvergreenInvestmentManagementCompany, LLCContract described herein is no longer available for sale.32