Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

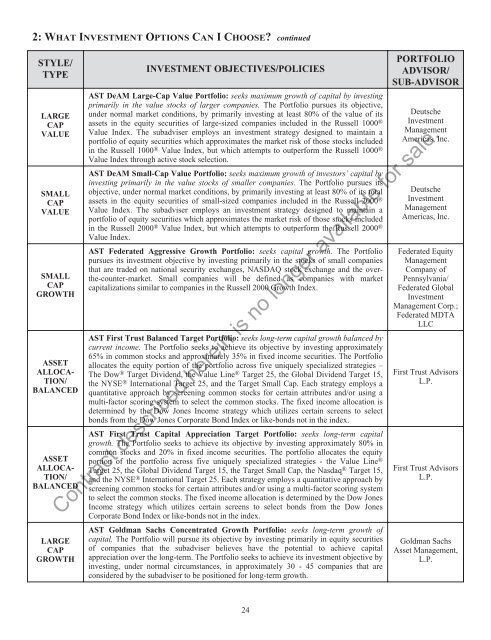

2: WHAT INVESTMENT OPTIONS CAN ICHOOSE? continuedSTYLE/TYPELARGECAPVALUESMALLCAPVALUESMALLCAPGROWTHASSETALLOCA-TION/BALANCEDASSETALLOCA-TION/BALANCEDLARGECAPGROWTHINVESTMENT OBJECTIVES/POLICIESAST DeAM Large-Cap Value Portfolio: seeks maximum growth of capital by investingprimarily in the value stocks of larger companies. The Portfolio pursues its objective,under normal market conditions, by primarily investing at least 80% of the value of itsassets in the equity securities of large-sized companies included in the Russell 1000 ®Value Index. The subadviser employs an investment strategy designed to maintain aportfolio of equity securities which approximates the market risk of those stocks includedin the Russell 1000 ® Value Index, but which attempts to outperform the Russell 1000 ®Value Index through active stock selection.AST DeAM Small-Cap Value Portfolio: seeks maximum growth of investors’ capital byinvesting primarily in the value stocks of smaller companies. The Portfolio pursues itsobjective, under normal market conditions, by primarily investing at least 80% of its totalassets in the equity securities of small-sized companies included in the Russell 2000 ®Value Index. The subadviser employs an investment strategy designed to maintain aportfolio of equity securities which approximates the market risk of those stocks includedin the Russell 2000 ® Value Index, but which attempts to outperform the Russell 2000 ®Value Index.AST Federated Aggressive Growth Portfolio: seeks capital growth. The Portfoliopursues its investment objective by investing primarily in the stocks of small companiesthat are traded on national security exchanges, NASDAQ stock exchange and the overthe-counter-market.Small companies will be defined as companies with marketcapitalizations similar to companies in the Russell 2000 Growth Index.AST First Trust Balanced Target Portfolio: seeks long-term capital growth balanced bycurrent income. The Portfolio seeks to achieve its objective by investing approximately65% in common stocks and approximately 35% in fixed income securities. The Portfolioallocates the equity portion of the portfolio across five uniquely specialized strategies –The Dow ® Target Dividend, the Value Line ® Target 25, the Global Dividend Target 15,the NYSE ® International Target 25, and the Target Small Cap. Each strategy employs aquantitative approach by screening common stocks for certain attributes and/or using amulti-factor scoring system to select the common stocks. The fixed income allocation isdetermined by the Dow Jones Income strategy which utilizes certain screens to selectbonds from the Dow Jones Corporate Bond Index or like-bonds not in the index.AST First Trust Capital Appreciation Target Portfolio: seeks long-term capitalgrowth. The Portfolio seeks to achieve its objective by investing approximately 80% incommon stocks and 20% in fixed income securities. The portfolio allocates the equityportion of the portfolio across five uniquely specialized strategies - the Value Line ®Target 25, the Global Dividend Target 15, the Target Small Cap, the Nasdaq ® Target 15,and the NYSE ® International Target 25. Each strategy employs a quantitative approach byscreening common stocks for certain attributes and/or using a multi-factor scoring systemto select the common stocks. The fixed income allocation is determined by the Dow JonesIncome strategy which utilizes certain screens to select bonds from the Dow JonesCorporate Bond Index or like-bonds not in the index.AST Goldman Sachs Concentrated Growth Portfolio: seeks long-term growth ofcapital. The Portfolio will pursue its objective by investing primarily in equity securitiesof companies that the subadviser believes have the potential to achieve capitalappreciation over the long-term. The Portfolio seeks to achieve its investment objective byinvesting, under normal circumstances, in approximately 30 - 45 companies that areconsidered by the subadviser to be positioned for long-term growth.PORTFOLIOADVISOR/SUB-ADVISORDeutscheInvestmentManagementAmericas, Inc.DeutscheInvestmentManagementAmericas, Inc.Federated EquityManagementCompany ofPennsylvania/Federated GlobalInvestmentManagement Corp.;Federated MDTALLCFirst Trust AdvisorsL.P.First Trust AdvisorsL.P.Contract described herein is no longer available for sale.Goldman SachsAsset Management,L.P.24