EconS 301 â Intermediate Microeconomics Review Session #13 ...

EconS 301 â Intermediate Microeconomics Review Session #13 ...

EconS 301 â Intermediate Microeconomics Review Session #13 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

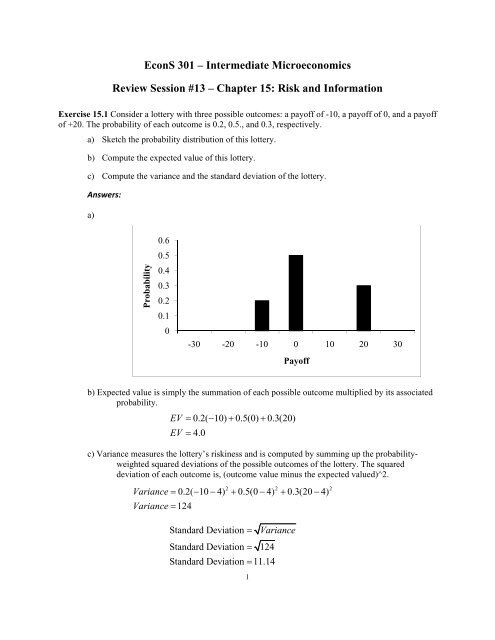

<strong>EconS</strong> <strong>301</strong> – <strong>Intermediate</strong> <strong>Microeconomics</strong><strong>Review</strong> <strong>Session</strong> <strong>#13</strong> – Chapter 15: Risk and InformationExercise 15.1 Consider a lottery with three possible outcomes: a payoff of -10, a payoff of 0, and a payoffof +20. The probability of each outcome is 0.2, 0.5., and 0.3, respectively.a) Sketch the probability distribution of this lottery.b) Compute the expected value of this lottery.c) Compute the variance and the standard deviation of the lottery.Answers:a)Probability0.60.50.40.30.20.10-30 -20 -10 0 10 20 30Payoffb) Expected value is simply the summation of each possible outcome multiplied by its associatedprobability.EV 0.2( 10) 0.5(0) 0.3(20)EV 4.0c) Variance measures the lottery’s riskiness and is computed by summing up the probabilityweightedsquared deviations of the possible outcomes of the lottery. The squareddeviation of each outcome is, (outcome value minus the expected valued)^2.2 2 2Variance 0.2( 10 4) 0.5(0 4) 0.3(20 4)Variance 124Standard Deviation VarianceStandard Deviation 124Standard Deviation 11.141

Exercise 15.6 You have a utility function given by U = 2I + 10√. You are considering two jobopportunities. The first pays a salary of $40,000 for sure. The other pays a base salary of$20,000, but offers the possibility of a $40,000 bonus on top of your base salary. Youbelieve that there is a 0.50 probability that you will earn the bonus.a) What is the expected salary under each offer?b) Which offer gives you the higher expected utility?c) Based on your answer to (a) and (b), are you risk averse?Answers:a) The expected salary under the first job offer is $40,000 (i.e. 1.0*($40,000)). The expectedsalary under the second job offer is also $40,000: 0.5($20,000) + 0.5($60,000) = $40,000.b) Your expected utility under the first offer is found by simply using the utility levelsassociated with each level of income instead of the income value itself, and then findingthe expected value using those numbers. So, your first offer expected utility is…U 2(40000)1040000 82,000Your expected utility under the second offer is 1020000 .52(60000)1060000 81,932.U . 5 2(20000)The first offer gives you the higher expected utility.c) The two offers have the same expected value. Since you prefer the certain salary to therisky salary, it follows that you are risk averse. Notice that utility allows us to addpreference to the raw numbers. Expected value is a raw salary here, but expected utilityallows us to compare two equal outcomes by including preference (utility) in theequation.Exercise 15.7 Consider two lotteries, A and B. With lottery A, there is a 0.90 chance that you receive apayoff of $0 and a 0.10 chance that you receive a payoff of $400. With lottery B, there is a 0.50chance that you receive a payoff of $30 and a 0.50 chance that you receive a payoff of $50.a) Verify that these two lotteries have the same expected value but that lottery A has a biggervariance than lottery B.b) Suppose that your utility function is U = √ 500. Compute the expected utility of eachlottery. Which lottery has the higher expected utility? Why?c) Suppose that your utility function is U = I +500. Compute the expected utility of each lottery.If you have this utility function, are you risk averse, risk neutral, or risk loving?d) Suppose that your utility function is U = 500 . Compute the expected utility of eachlottery. If you have this utility function are you risk averse, risk neutral, or risk loving?Answers:2

a)EVEVAA 0.90(0) 0.10(400) 40EVEVBB0.50(30) 0.50(50) 40Thus, both lotteries have the same expected value. But…variances give us a clearerpicture…VarianceVarianceAA0.90(0 40) 0.10(400 40) 14,4002 2VarianceVarianceBB0.50(30 40) 0.50(50 40) 1002 2Thus, Lottery B has a smaller variance than Lottery A.b)Expected Utility 0.90 0 500 0.10 400 500Expected Utility 23.13AAExpected UtilityB0.50 30 500 0.50 50 500Expected Utility 23.24BThus, Lottery B has the higher expected utility. In general, when two lotteries have thesame expected value but different variance, a risk-averse decision maker will have ahigher expected utility from the lottery with the lower variance. That is, a risk averseperson will desire a lottery with less chance of deviation from the expected value ofplaying.c)Expected Utility 0.90(0 500) 0.10(400 500)Expected Utility 540AAExpected Utility 0.50(30 500) 0.50(50 500)Expected Utility 540BB3

With this utility function both lotteries have the same expected value and same expectedutility. In general, when two lotteries have the same expected value and differentvariances, a risk-neutral decision maker will be indifferent between the two lotteries, i.e.,will have the same expected utility for both lotteries. Thus, this utility functioncorresponds with a risk-neutral decision maker.d)Expected Utility 0.90(0 500) 0.10(400 500)Expected Utility 306,000AA2 2Expected UtilityB0.50(30 500) 0.50(50 500)Expected Utility 291,700B2 2With this utility function the decision maker has a higher expected utility for Lottery Athan for Lottery B. In general, when two lotteries have the same expected value butdifferent variances, a risk-loving decision maker will prefer the lottery with the highervariance, Lottery A in this case.Exercise 15.12 Suppose you are a risk averse decision maker with a utility function given by 110 , where I denotes your monetary payoff from an investment in thousands. You are considering aninvestment that will give you a payoff of $10,000 (thus, I=10) with probability 0.6 and a payoff of $5,000(I=5) with probability 0.4. It will cost you $8,000 to make the investment. Should you make theinvestment? Why or why not?Answer:Let’s simply compare the payoff of not making the investment versus the payoff of making theinvestment…If you do not make the investment, your utility is: 1 – 10(8) -2 = 0.84375If you make the investment, your utility is:(0.6)(1 – 10(10) -2 ) + (0.4)(1-10(5) -2 )= (0.6)(0.9) + (0.4)(0.6) = 0.78Since the expected utility from the investment is less than the utility from not making the investment, youshould not make the investment.Exercise 15.18 Consider a market of risk-averse decision makers, each with a utility function √.Each decision maker has an income of $90,000, but faces the possibility of a catastrophic loss of$50,000 in income. Each decision maker can purchase an insurance policy that fully compensateshere for her loss. This insurance policy has a cost of $5,900. Suppose each decision makerpotentially has a different probability q of experiencing the loss.a) What is the smallest value of q so that a decision maker purchases insurance?4

) What would happen to this smallest value of q if the insurance company were to raise theinsurance premium from $5,900 to $27,500?Answers:a) If an individual purchases insurance, her (certain) utility is90,000 5,900 290.If an individual does not purchase insurance, her expected utility isq90,000 50,000 (1 q)90,000 200q 300(1 q) 300 100q(the possibility of experiencing the loss plus probability of not)An individual will purchase insurance if290 300 100q,orq 0.10.In other words, individuals that are 90 percent or more certain that they will notexperience the loss will not purchase insurance. Or conversely, individuals 10% or morecertain that they will incur the loss will purchase the insurance.b) If the insurance premium is increased to $27,500, an individual who purchases insurancewill achieve a certain utility of90,000 27,500 250.The individual still receives an expected utility of 300 – 100q if it does not purchaseinsurance. Thus, an individual will purchase insurance if250 300 100q,orq 0.50.Under this new price, they will have to be much more certain that they will incur the lossin order to induce them to purchase the insurance.Exercise 15.21 A large defense contractor is considering making a specialized investment in a facility tomake helicopters. The firm currently has a contract with the government, which, over thelifetime of the contract, is worth $100 million to the firm. It is considering building a newproduction costs to the company, increasing the value of the contact from $100 million to$200 million. The cost of the plant will be $60 million. However, there is the possibilitythat the government will cancel the contract. If that happens, the value of the contract willfall to zero. The problem (from the company’s point of view) is that it will only find outabout the cancellation after it completes the new plant. At this point, it appears that theprobability that the government will cancel the contract is 0.45.a) Draw a decision tree reflecting the decisions the firm can make and the payoffs fromthose decisions. Carefully distinguish between chance nodes and decision nodes inthe tree.5

) Assuming that the firm is a risk-neutral decision maker, should the firm build a newplant? What is the expected value associated with the optimal decision?c) Suppose instead of finding out about the contract cancellation after it builds the plant,the firm finds out about cancellation before it builds the plant. Draw a new decisiontree corresponding to this new sequence of decisions and events. Again assuming thatthe firm is a risk-neutral decision maker, should the firm build the new plant?Answers:a & b) The decision tree for this situation is shown below. The chance nodes are circular, andthe decision node is square.Contract is cancelled(probability = 0.45)$0 - $60 million = -$60 millionBuildContract is not cancelled(probability = 0.55)$200 - $60 million = $140 millionDo not buildContract is cancelled(probability = 0.45)Contract is not cancelled(probability = 0.55)$0$100 millionSince the decision maker is risk neutral, we can evaluate payoffs using expected values.The expected value if you build the plant is:(0.45)(-$60 million) + (0.55)($140 million) = $50 millionThe expected value if you do not build the plant:(0.45)($0) + (0.55)($100 million) = $55 million.Not building the plant is the best course of action.c) The answer to question of whether the firm should build the plant is: it depends! Thedecision tree for the revised sequence of decisions and event is shown below.6

Contract is cancelled(probability = 0.45)Build$0 - $60 million = -$60 millionDo not build$0Contract is not cancelled(probability = 0.55)Build$200 - $60 million = $140 millionDo not build$100 millionWe see from the tree that if the contract is cancelled, the best action is not to build the plant, which resultsin a payoff of $0. However, if the contract is not cancelled, it’s better to build the plant than to not buildthe plant. Hence, the decision to build the plant depends on the circumstances the firm faces, in particularwhether the contract is cancelled.To finish the decision tree analysis, the picture below shows the folded back tree. There are no furtherdecisions to be evaluated so all that needs to be done is to compute the expected value associated with thissituation. That expected value is:(0.45)($0) + (0.55)($140) = $77 million.Note that the firm’s expected value when the plant-building decision is made after the status of thecontract is know is bigger ($77 million versus $55 million) than its value when the plant decision must bemade when the contract status is still uncertain. This difference reflects the value of having perfectinformation about the status of the contract in the second situation.7

C ontract is cancelled(probability = 0.45)Do not build$0Contract is not cancelled(probability = 0.55)$200 - $60 million = $140 millionFolded back decision tree8