Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Research<br />

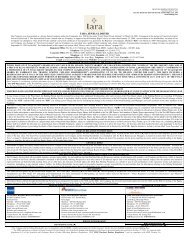

INCOME STATEMENT ` mn<br />

Particulars Mar11 Mar12 Mar13E Mar14E<br />

Net Interest In<strong>com</strong>e 43,828 50,850 57,746 66,791<br />

CXB 4,422 5,514 6,775 7,090<br />

Profits on sale of investments 352 888 400 300<br />

Profits on foreign exchange 979 1,166 1,310 1,511<br />

Other operating in<strong>com</strong>e 3,398 3,192 3,565 4,827<br />

Total other in<strong>com</strong>e 9,151 10,759 12,050 13,728<br />

Total In<strong>com</strong>e 52,979 61,609 69,796 80,519<br />

Salaries 17,733 18,915 21,100 25,064<br />

Other operating costs 7,748 9,226 10,770 12,648<br />

Total Overheads 25,481 28,141 31,870 37,712<br />

Profit before provisions 27,498 33,468 37,926 42,807<br />

Bad Debt Provisions 9,290 13,997 13,855 14,782<br />

Stnd. Asset Provision 246 2,628 2,546 3,465<br />

Investment Provisions 387 385 650 700<br />

Other provision 4,720 2,184 1,063 1,380<br />

Total provisions 14,644 19,195 18,114 20,327<br />

Profit before tax 12,854 14,273 19,812 22,480<br />

Tax 2,375 1,139 3,160 4,673<br />

Reported Net profit 10,479 13,134 16,652 17,807<br />

BALANCE SHEET<br />

Particulars Mar11 Mar12 Mar13E Mar14E<br />

Cash with RBI 104,431 88,086 100,512 119,157<br />

Cash at call 15,225 50,756 33,296 30,580<br />

Total Cash 119,657 138,843 133,808 149,737<br />

Govt. securities 303,025 365,005 413,049 476,020<br />

Other investments 47,651 43,145 67,241 77,492<br />

Total Investments 350,676 408,151 480,290 553,512<br />

Bills discounted 15,093 12,860 29,092 34,477<br />

Cash credit 229,677 235,229 320,017 379,249<br />

Term loans 823,050 988,113 1,105,513 1,310,132<br />

Total Credit 1,067,819 1,236,202 1,454,622 1,723,858<br />

Gross Fixed Assets 13,478 20,753 16,597 17,710<br />

Accumulated Depreciation 6,707 7,475 7,855 8,390<br />

Net Fixed Assets 6,770 13,278 8,742 9,320<br />

Capital work in progress 157 237 0 0<br />

Other Assets 20,309 27,970 48,093 66,537<br />

Total Assets 1,565,388 1,824,681 2,125,555 2,502,965<br />

Demand Deposits 107,388 122,214 134,047 158,213<br />

Savings Deposits 312,066 342,959 388,273 458,273<br />

Term Deposits 936,507 1,114,238 1,326,600 1,565,767<br />

Total Deposits 1,355,961 1,579,411 1,848,920 2,182,253<br />

Perpetual Debts (IPDI) 7,730 7,730 11,730 14,230<br />

Upper Tier II Capital 8,197 8,197 9,197 12,697<br />

Subordinate Debt 19,250 19,250 20,750 22,500<br />

Other Borrowings 60,099 70,722 80,520 97,883<br />

Total Borrowings 95,276 105,899 122,197 147,310<br />

Other liabilities 43,642 48,960 50,723 55,580<br />

Equity 5,733 6,020 6,020 6,020<br />

Reserves 64,776 84,392 97,696 111,802<br />

Total Equity 70,508 90,412 103,715 117,822<br />

Total Liab & Equity<br />

E-estimates<br />

1,565,388 1,824,681 2,125,555 2,502,965<br />

IMPORTANT RATIOS<br />

DOLAT CAPITAL<br />

Particulars Mar11 Mar12 Mar13E Mar14E<br />

DPS (`) 3.7 3.8 4.8 5.3<br />

Book Value (`) 116.1 133.5 166.6 190.4<br />

Adjusted Book Value (`) 101.5 115.4 147.5 169.3<br />

EPS (`) 20.0 21.8 27.7 29.6<br />

EPS Growth (%) 28.5 8.9 26.8 6.9<br />

Payout (%) 18.5 17.4 17.2 17.7<br />

Net interest margin (%) 3.0 3.1 3.0 3.0<br />

Spread (%) 2.7 2.6 2.6 2.6<br />

Cost-to-in<strong>com</strong>e (%) 48.1 45.7 45.7 46.8<br />

ROAA<br />

Net Interest In<strong>com</strong>e 3.0 3.0 2.9 2.9<br />

Other In<strong>com</strong>e 0.6 0.6 0.6 0.6<br />

Less Overheads (1.7) (1.7) (1.6) (1.6)<br />

Less Provisions (1.0) (1.1) (0.9) (0.9)<br />

Less Tax (0.2) (0.1) (0.2) (0.2)<br />

ROAA 0.7 0.8 0.8 0.8<br />

ROAE 17.6 17.9 18.4 16.6<br />

Valuation<br />

Price Earnings (x) 5.2 4.8 3.8 3.5<br />

Price to Book Value (x) 0.9 0.8 0.6 0.5<br />

Price to Adjusted BV (x) 1.0 0.9 0.7 0.6<br />

Dividend Yield (%) 3.6 3.7 4.6 5.0<br />

Asset Quality<br />

Gross NPLs 25,990 31,827 36,910 42,529<br />

Restructured standard Loans 45,285 60,620 98,000 112,110<br />

Gross Impaired Loans 71,275 92,447 134,910 154,639<br />

Net NPLs 10,308 11,854 13,662 16,062<br />

Provision coverage ratio (%) 60.3 62.8 63.0 62.2<br />

Gross NPLs (%) 2.4 2.5 2.5 2.4<br />

Net NPLs (%) 1.0 1.0 0.9 0.9<br />

Assumptions<br />

Yield on Advances (%) 9.3 10.7 10.2 10.0<br />

Yield on Investment (%) 6.5 7.2 6.8 6.8<br />

Cost of Deposits (%) 4.9 6.4 6.1 6.0<br />

Interest Inc. on Cash (%) 0.1 1.2 0.4 0.5<br />

CRAR (%) 13.0 12.2 11.4 10.8<br />

Growth in credit book (%) 18.1 15.8 17.7 18.5<br />

Growth in Deposits (%) 15.9 16.5 17.1 18.0<br />

Growth in Investments (%) 6.2 16.4 17.7 15.2<br />

Gross slippages ratio (%) 1.6 2.7 2.5 2.5<br />

Credit Cost (%)<br />

E-estimates<br />

0.9 1.2 1.0 0.9<br />

July 13, 2012 <strong>Syndicate</strong> <strong>Bank</strong><br />

10