Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

India Research<br />

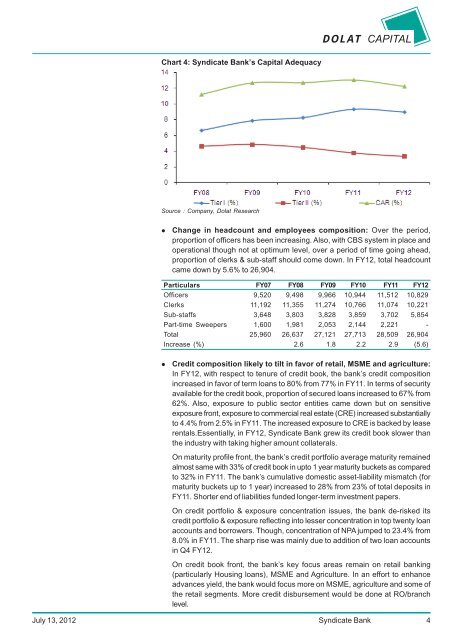

Chart 4: <strong>Syndicate</strong> <strong>Bank</strong>’s Capital Adequacy<br />

Source : Company, Dolat Research<br />

DOLAT CAPITAL<br />

� Change in headcount and employees <strong>com</strong>position: Over the period,<br />

proportion of officers has been increasing. Also, with CBS system in place and<br />

operational though not at optimum level, over a period of time going ahead,<br />

proportion of clerks & sub-staff should <strong>com</strong>e down. In FY12, total headcount<br />

came down by 5.6% to 26,904.<br />

Particulars FY07 FY08 FY09 FY10 FY11 FY12<br />

Officers 9,520 9,498 9,966 10,944 11,512 10,829<br />

Clerks 11,192 11,355 11,274 10,766 11,074 10,221<br />

Sub-staffs 3,648 3,803 3,828 3,859 3,702 5,854<br />

Part-time Sweepers 1,600 1,981 2,053 2,144 2,221 -<br />

Total 25,960 26,637 27,121 27,713 28,509 26,904<br />

Increase (%) 2.6 1.8 2.2 2.9 (5.6)<br />

� Credit <strong>com</strong>position likely to tilt in favor of retail, MSME and agriculture:<br />

In FY12, with respect to tenure of credit book, the bank’s credit <strong>com</strong>position<br />

increased in favor of term loans to 80% from 77% in FY11. In terms of security<br />

available for the credit book, proportion of secured loans increased to 67% from<br />

62%. Also, exposure to public sector entities came down but on sensitive<br />

exposure front, exposure to <strong>com</strong>mercial real estate (CRE) increased substantially<br />

to 4.4% from 2.5% in FY11. The increased exposure to CRE is backed by lease<br />

rentals.Essentially, in FY12, <strong>Syndicate</strong> <strong>Bank</strong> grew its credit book slower than<br />

the industry with taking higher amount collaterals.<br />

On maturity profile front, the bank’s credit portfolio average maturity remained<br />

almost same with 33% of credit book in upto 1 year maturity buckets as <strong>com</strong>pared<br />

to 32% in FY11. The bank’s cumulative domestic asset-liability mismatch (for<br />

maturity buckets up to 1 year) increased to 28% from 23% of total deposits in<br />

FY11. Shorter end of liabilities funded longer-term investment papers.<br />

On credit portfolio & exposure concentration issues, the bank de-risked its<br />

credit portfolio & exposure reflecting into lesser concentration in top twenty loan<br />

accounts and borrowers. Though, concentration of NPA jumped to 23.4% from<br />

8.0% in FY11. The sharp rise was mainly due to addition of two loan accounts<br />

in Q4 FY12.<br />

On credit book front, the bank’s key focus areas remain on retail banking<br />

(particularly Housing loans), MSME and Agriculture. In an effort to enhance<br />

advances yield, the bank would focus more on MSME, agriculture and some of<br />

the retail segments. More credit disbursement would be done at RO/branch<br />

level.<br />

July 13, 2012 <strong>Syndicate</strong> <strong>Bank</strong><br />

4