You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

India Research<br />

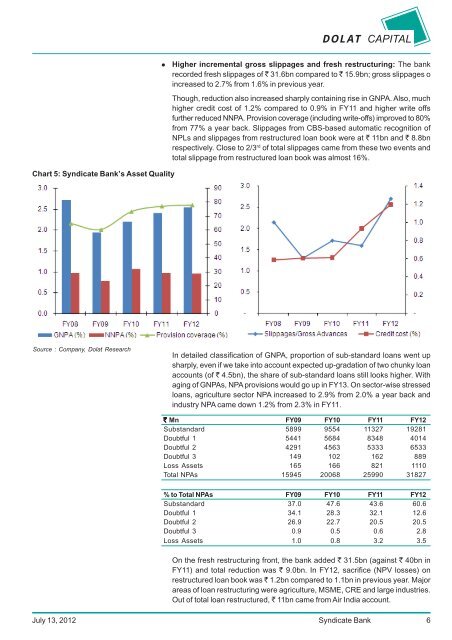

Chart 5: <strong>Syndicate</strong> <strong>Bank</strong>’s Asset Quality<br />

Source : Company, Dolat Research<br />

DOLAT CAPITAL<br />

� Higher incremental gross slippages and fresh restructuring: The bank<br />

recorded fresh slippages of ` 31.6bn <strong>com</strong>pared to ` 15.9bn; gross slippages o<br />

increased to 2.7% from 1.6% in previous year.<br />

Though, reduction also increased sharply containing rise in GNPA. Also, much<br />

higher credit cost of 1.2% <strong>com</strong>pared to 0.9% in FY11 and higher write offs<br />

further reduced NNPA. Provision coverage (including write-offs) improved to 80%<br />

from 77% a year back. Slippages from CBS-based automatic recognition of<br />

NPLs and slippages from restructured loan book were at ` 11bn and ` 8.8bn<br />

respectively. Close to 2/3 rd of total slippages came from these two events and<br />

total slippage from restructured loan book was almost 16%.<br />

In detailed classification of GNPA, proportion of sub-standard loans went up<br />

sharply, even if we take into account expected up-gradation of two chunky loan<br />

accounts (of ` 4.5bn), the share of sub-standard loans still looks higher. With<br />

aging of GNPAs, NPA provisions would go up in FY13. On sector-wise stressed<br />

loans, agriculture sector NPA increased to 2.9% from 2.0% a year back and<br />

industry NPA came down 1.2% from 2.3% in FY11.<br />

` Mn FY09 FY10 FY11 FY12<br />

Substandard 5899 9554 11327 19281<br />

Doubtful 1 5441 5684 8348 4014<br />

Doubtful 2 4291 4563 5333 6533<br />

Doubtful 3 149 102 162 889<br />

Loss Assets 165 166 821 1110<br />

Total NPAs 15945 20068 25990 31827<br />

% to Total NPAs FY09 FY10 FY11 FY12<br />

Substandard 37.0 47.6 43.6 60.6<br />

Doubtful 1 34.1 28.3 32.1 12.6<br />

Doubtful 2 26.9 22.7 20.5 20.5<br />

Doubtful 3 0.9 0.5 0.6 2.8<br />

Loss Assets 1.0 0.8 3.2 3.5<br />

On the fresh restructuring front, the bank added ` 31.5bn (against ` 40bn in<br />

FY11) and total reduction was ` 9.0bn. In FY12, sacrifice (NPV losses) on<br />

restructured loan book was ` 1.2bn <strong>com</strong>pared to 1.1bn in previous year. Major<br />

areas of loan restructuring were agriculture, MSME, CRE and large industries.<br />

Out of total loan restructured, ` 11bn came from Air India account.<br />

July 13, 2012 <strong>Syndicate</strong> <strong>Bank</strong><br />

6