OLP Connect Data Application Form (W11904) - Legal & General

OLP Connect Data Application Form (W11904) - Legal & General

OLP Connect Data Application Form (W11904) - Legal & General

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

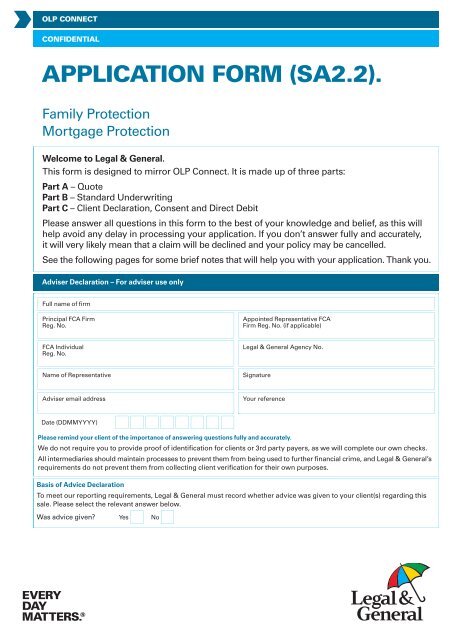

<strong>OLP</strong> CONNECTCONFIDENTIALAPPLICATION FORM (SA2.2).Family ProtectionMortgage ProtectionWelcome to <strong>Legal</strong> & <strong>General</strong>.This form is designed to mirror <strong>OLP</strong> <strong>Connect</strong>. It is made up of three parts:Part A – QuotePart B – Standard UnderwritingPart C – Client Declaration, Consent and Direct DebitPlease answer all questions in this form to the best of your knowledge and belief, as this willhelp avoid any delay in processing your application. If you don’t answer fully and accurately,it will very likely mean that a claim will be declined and your policy may be cancelled.See the following pages for some brief notes that will help you with your application. Thank you.Adviser Declaration – For adviser use onlyFull name of firmPrincipal FCA FirmReg. No.Appointed Representative FCAFirm Reg. No. (if applicable)FCA IndividualReg. No.<strong>Legal</strong> & <strong>General</strong> Agency No.Name of RepresentativeSignatureAdviser email addressYour referenceDate (DDMMYYYY)Please remind your client of the importance of answering questions fully and accurately.We do not require you to provide proof of identification for clients or 3rd party payers, as we will complete our own checks.All intermediaries should maintain processes to prevent them from being used to further financial crime, and <strong>Legal</strong> & <strong>General</strong>’srequirements do not prevent them from collecting client verification for their own purposes.Basis of Advice DeclarationTo meet our reporting requirements, <strong>Legal</strong> & <strong>General</strong> must record whether advice was given to your client(s) regarding thissale. Please select the relevant answer below.Was advice given? Yes No

Tips for completing this application formPlease be aware of the following:This form has been designed so that you can complete it on screen. You can then save the answers on your computerso that you have an electronic record of your application. Please note, at the end of each section, you have the optionto print.• Blue parts must be completed.• Green parts are additional questionnaires which only need to be completed if you are instructed to do so within the form.• For joint life plans, please complete Client 1 and Client 2 sections, each client must fill out their own details.• If your financial adviser is going to complete this form on your behalf using the information you have provided, youmust read all of the questions and answers carefully before signing the Client Declaration and Consent at the end.Your financial adviser is acting on your behalf in this respect.To help you complete this application you will need:• Information relating to existing or previous life insurance.• Details of medication or treatment that you are currently having.• Your doctor’s name and the practice name and address (including their postcode).• Your bank account details.Please be aware of the following points before proceeding with this application:Why it’s important that you give us the right informationYou must tell <strong>Legal</strong> & <strong>General</strong> everything they ask for as all answers may be taken into account when assessingacceptance of the application and in calculating the premium.<strong>Legal</strong> & <strong>General</strong> will try to rely on the information that you tell them and you must not assume that they will always clarifythat information with your doctor (GP). However, <strong>Legal</strong> & <strong>General</strong> may, as part of their administrative procedures, requesta copy of your full health records from your doctor (GP) to check the medical information you provide.If any of your answers change AFTER you have completed the questions in this application form, but BEFORE your policystarts (see section opposite) you must tell <strong>Legal</strong> & <strong>General</strong> immediately. This is just as important as giving full, accurateand truthful answers in the first place. If you have given the information in the past please provide it again.How we safeguard the information you give usConfidentiality<strong>Legal</strong> & <strong>General</strong> follow a strict confidentiality code about all medical information they hold. This means that your medicalinformation is held securely and access is limited to authorised individuals who need to see it.A copy of the confidentiality policy is available on request.The information you give <strong>Legal</strong> & <strong>General</strong>They will only use the information provided, for the purposes of underwriting, processing and administering the policyor policies requested, or any subsequent policy(ies) and for statistical analysis. <strong>Legal</strong> & <strong>General</strong> will keep the informationfor the duration of any policy issued and for a period after the policy has ceased. They may also use the information inprocessing any claim under the policy or policies. If the application does not go ahead, the information will only be heldfor a limited period of time from the date of cancellation.Page 2<strong>Application</strong> <strong>Form</strong>

Your personal and medical information<strong>Legal</strong> & <strong>General</strong> will not pass any personal or medical information to a third party without your consent. This willonly be necessary in the following circumstances:• If <strong>Legal</strong> & <strong>General</strong> ask you to attend a medical screening or they need to get a copy of your full health recordsfrom your doctor.• If <strong>Legal</strong> & <strong>General</strong> need to send your personal and medical information to their reinsurer for its opinion oragreement on the acceptance terms to be offered, and/or, at a later stage, for the purpose of administering yourpolicy. This will only be in accordance with <strong>Legal</strong> & <strong>General</strong>’s reinsurance business principles, details of whichare available on request.• If you ask <strong>Legal</strong> & <strong>General</strong> to send your medical information to another insurance provider to whom you areapplying, or that provider asks <strong>Legal</strong> & <strong>General</strong> for your medical information.• If <strong>Legal</strong> & <strong>General</strong> need to share information, at the time of a claim, with other insurance companies to preventfraudulent claims. This would be via a Register of Claims and a list of participants is available on request.If you would prefer, you may complete the medical questions in private and return the answers in a sealedenvelope directly to the Medical Officer at <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited, Brunel House,2 Fitzalan Road, Cardiff CF24 0EB.Confirming your identityTo protect the client and <strong>Legal</strong> & <strong>General</strong> from financial crime, <strong>Legal</strong> & <strong>General</strong> may need to confirm the client’sidentity. <strong>Legal</strong> & <strong>General</strong> may do this using reference agencies to search sources of information about the client (anidentity search). This will not affect the client’s credit rating. If this identity search fails, <strong>Legal</strong> & <strong>General</strong> may need toask the client for documents to confirm the client’s identity.Please be aware of the following informationWhen your policy startsThe benefits provided by the policy or policies will not start until <strong>Legal</strong> & <strong>General</strong> have assessed and accepted yourapplication, you have agreed to any revised premium or revised policy conditions, the chosen start date has beenreached and the first premium has been paid.Complaints procedure<strong>Legal</strong> & <strong>General</strong> have a formal complaints procedure and details will be given to you when you receive your policydocumentation.The Contract will be governed by the law of England and Wales.CHECKING YOUR DETAILS<strong>Legal</strong> & <strong>General</strong> will post a Checking Your Details pack to each life assured reiterating the application details submitted tothem, and asking for any errors or omissions to be notified to them. For joint life applications, each life assured will only besent the medical details applicable to him or her. Failure to notify <strong>Legal</strong> & <strong>General</strong> of any errors or omissions may mean that aclaim under the policy or policies may not be paid.Page 3<strong>Application</strong> <strong>Form</strong>

Page 4<strong>Application</strong> <strong>Form</strong>

APPLICATION FORM – PART A<strong>OLP</strong> CONNECT – QUOTE.Family ProtectionMortgage ProtectionPart A is designed to mirror the quote section in <strong>OLP</strong> <strong>Connect</strong> so that you can capture yourclient’s requirements in advance and complete the quote in <strong>OLP</strong> <strong>Connect</strong>.BASIC DETAILSFull name and titlePlease ensure you giveall of your middle names.Client oneMr/Mrs/Miss/Ms/Dr/Rev/OtherOtherClient twoMr/Mrs/Miss/Ms/Dr/Rev/OtherOtherForename(s) and middle name(s) in fullForename(s) and middle name(s) in fullSurnameSurnameGenderWe only use your gender forpurposes that comply withrequirements under theEquality Act.MaleFemaleMaleFemaleDate of birth (DDMMYYYY)During the last 12 monthshave you smoked anycigarettes, cigars, a pipe orused nicotine replacements?Yes –regularlyYes –occasionallyNone at allA simple medical test may be required to check youranswer.If you smoke cigarettes, cigars, a pipe or use nicotinereplacements weekly or more often you shouldanswer ‘Yes – regularly’.Yes –regularlyYes –occasionallyNone at allA simple medical test may be required to check youranswer.If you smoke cigarettes, cigars, a pipe or use nicotinereplacements weekly or more often you shouldanswer ‘Yes – regularly’.Employment statusFull time employeePart time employeeFull time employeePart time employeeContract workerSelf employedContract workerSelf employedRetiredStudentRetiredStudentUnemployedHousepersonUnemployedHouseperson<strong>Application</strong> <strong>Form</strong> – Part A Page 5

APPLICATION FORM – PART AOCCUPATION DETAILSOnly applicable for applications which include Income Protection Benefit or Critical Illness Cover.You don’t need to answer this question if you are a Houseperson, retired, a student or unemployed.Client oneClient twoPlease indicate youroccupation type from thecategories listed opposite.If your occupation doesn’t fitinto one of these categories,tick ‘Another category’.Working in an office-type environment for at least 75% of yourtypical working dayRetail – for example, salesperson, retailer, shop worker ormanager, (except market traders)Catering – for example, caterer, chef, cook, waiter, waitress,kitchen staffEducation – for example, teacher, lecturer, head teacher,classroom assistant, nursery workerHealthcare – for example, nursing, medical, surgical, carerAnother category (including market traders)If ‘Healthcare’, please select:Nurse, staff nurse, charge nurse, sister, matron, auxiliary,paramedic, practice nurse, dental nurse, district nurse, midwifeSurgeon, anaesthetist, obstetrician, gynaecologist, dentist,dental hygienist, carer, care assistant, social worker,physiotherapistPhysician, medical or general practitioner, hospital doctor (otherthan surgeon, anaesthetist, obstetrician or gynaecologist – seeabove), psychiatrist, osteopathClient oneIf ‘Another category’, please give details:Occupation*Client twoIf ‘Another category’, please give details:Occupation*The occupation class is to becompleted by your financialadviser.Occupation class12 3 4*Please complete for main occupation only.Occupation class12 3 4*Please complete for main occupation only.Page 6<strong>Application</strong> <strong>Form</strong> – Part A

PRODUCT SELECTION AND PRODUCT DETAILS – LIFE AND CRITICAL ILLNESS COVER PRODUCTSPlease note:• Term Assurance is <strong>Legal</strong> & <strong>General</strong>’s product name for life cover and CIC stands for Critical Illness Cover throughout this application.• Start date. If this plan replaces another, please consider the premium collection date of your existing plan, to reduce the possibility of double cover.PRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPage 7<strong>Application</strong> <strong>Form</strong> – Part A

PRODUCT SELECTION AND PRODUCT DETAILS – LIFE AND CRITICAL ILLNESS PRODUCTS continuedPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPage 8<strong>Application</strong> <strong>Form</strong> – Part A

PRODUCT SELECTION AND PRODUCT DETAILS – LIFE AND CRITICAL ILLNESS PRODUCTS continuedPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPRODUCT SELECTIONPRODUCT DETAILSReason for PurchaseFamilyProtectionMortgageProtectionSelect a ProductTermAssuranceCritical IllnessCover (reviewable)Family Protection onlySum Assured/Monthly Benefit£or Premium£PremiumFrequencyMonthlyAnnualPolicy TermyrsLevel orDecreasingLevelMortgageProtectiononlyPolicy InterestRateDecreasing onlyIndexationNot availableif ‘Decreasing’or ‘ConversionOption’ selectedNoWaiver of PremiumBenefitNoClient 1 onlyClient 2 onlyFamily and PersonalIncome PlanDecreasing%YesBothSelect ClientClient 1 only (single life)Conversion OptionNot available if ‘Decreasing’or ‘Indexation’ is selected,or on plans including CICCritical Illness CoverNo – Life cover onlyTotal and Permanent DisabilityCoverPlans including CICNoGuaranteedor ReviewablePremiumsGuaranteedStart date (DDMMYYYY)Client 2 only (single life)NoYes – Life with CICYes – Own OccupationPlans including CICBoth (joint life)Yes(FPIP) CIC onlyYes – Specified WorkTasksReviewableOr not knownPage 9<strong>Application</strong> <strong>Form</strong> – Part A

INCOME PROTECTION BENEFITPRODUCT SELECTIONPRODUCT DETAILSReason for PurchasePremiumFrequencyAnnual EarningsDo you work morethan 16 hours perweek?Type of coverMonthly Benefit(stage 1)Deferred period(stage 1)Age at expiryFamily ProtectionMonthly£YesStandard£4 weeksyrsMortgage ProtectionAnnualEarnings are defined as yourannual pre tax earnings forPAYE assessment purposes andcan include your P11d benefits.Please refer to your Key FeaturesDocument for full information.NoIf ‘No’, youroccupation willbe classed as a‘Houseperson’Low Cost13 weeks26 weeks52 weeksSelect ClientStepped BenefitsStage 2 (only if Stepped Benefits selected)Deferred periodIndexationStart date (DDMMYYYY)Client 1 (only)Yes13 weeksYesClient 2 (only)NoMonthly benefit26 weeksNoOr not knownOption not available for low cost£52 weeksPRODUCT SELECTIONPRODUCT DETAILSReason for PurchasePremiumFrequencyAnnual EarningsDo you work morethan 16 hours perweek?Type of coverMonthly Benefit(stage 1)Deferred period(stage 1)Age at expiryFamily ProtectionMonthly£YesStandard£4 weeksyrsMortgage ProtectionAnnualEarnings are defined as yourannual pre tax earnings forPAYE assessment purposes andcan include your P11d benefits.Please refer to your Key FeaturesDocument for full information.NoIf ‘No’, youroccupation willbe classed as a‘Houseperson’Low Cost13 weeks26 weeks52 weeksSelect ClientStepped BenefitsStage 2 (only if Stepped Benefits selected)Deferred periodIndexationStart date (DDMMYYYY)Client 1 (only)Yes13 weeksYesClient 2 (only)NoMonthly benefit26 weeksNoOr not knownOption not available for low cost£52 weeksPRINTClick here to print Part A – Quote (only).Page 10<strong>Application</strong> <strong>Form</strong> – Part A

APPLICATION FORM – PART B<strong>OLP</strong> CONNECT –STANDARD UNDERWRITING (SA2.2).Family ProtectionMortgage ProtectionPart B is designed to mirror the Standard Underwriting route in <strong>OLP</strong> <strong>Connect</strong> so that you cancapture your client’s answers in advance and complete the application in <strong>OLP</strong> <strong>Connect</strong>. Thisform cannot be used with the Interactive Underwriting route.CUSTOMER CONTACT DETAILSClient oneClient twoWhat is your contact address,including postcode?Please check that you’ve filledin your postcode as this isessential for processing theapplication more quickly.As Client 1PostcodePostcodeWhat is your home address,including postcode, if differentfrom the contact addressprovided above?Please check that you’vefilled in your postcode.As Client 1PostcodePostcodeWhat are your contact details?Please ensure that youcomplete all details.Work phoneHome phoneMobile phoneEmail addressWork phoneHome phoneMobile phoneEmail addressIt may be necessary for us tocontact you to discuss yourapplication, which might includediscussing matters of a sensitivenature. Are you happy for us totelephone you in this event?Please note, we may recordand monitor calls.YesNoIf ‘Yes’, which phone number and time is most suitable?WorkMon-Fri9am-11amMon-Fri2pm-4pmMon-Fri6pm-8pmHomeMon-Fri11am-2pmMon-Fri4pm-6pmMobileYesNoIf ‘Yes’, which phone number and time is most suitable?WorkMon-Fri9am-11amMon-Fri2pm-4pmMon-Fri6pm-8pmHomeMon-Fri11am-2pmMon-Fri4pm-6pmMobilePRINTClick here to print this page only.Page 11<strong>Application</strong> <strong>Form</strong> – Part B

WORK, TOTAL COVER AND TRAVELIt’s very important you answer every question truthfully and accurately to ensure all valid claims are paid to protect you and your dependants. Ifyou don’t, it could mean a claim may not be paid and your policy may be cancelled. <strong>Legal</strong> & <strong>General</strong> won’t always write to your doctor to confirmyour answers.Client oneClient twoPlease tick to confirm you’ve read the abovestatement.Please tick to confirm you’ve read the abovestatement.Only answer this question if you’re applying for Income Protection Benefit with an occupation class 1 or 2.How many business miles do youdrive on average each year?milesPlease ignore travel to and from your usual place of work.milesIf you’re a Houseperson, retired, a student or unemployed, please ignore this question and proceed to the next question.Client oneClient twoDo you work in any of theoccupations or environmentsopposite?If ‘Yes’, tick all that apply.If ‘No’, tick ‘None of the above’.15 metres is the height of a typical3 storey house.Outside at heights over 15 metres (50 ft) for more than 5 hours duringa typical weekThe Armed Forces or as a member of the Army ReserveThe offshore fishing industryThe offshore oil or gas industryAs a full time barman, barmaid or landlord in a public house.Full time means working an average of 30 or more hours a week.UnderwaterUnderground, for example mining, tunnellingWith explosivesNone of the aboveClient oneClient twoPlease tell us your occupation ifyou haven’t told us already in thisform and you’ve ticked one of theoccupations in this question.Occupation*Occupation**If you have more than one, please state your main occupation only.Including this application, will thetotal amount of cover on your lifefor family and mortgage purposesexceed £1,500,000 life cover or£750,000 critical illness cover?Please ignore cover that will becancelled and applications that arefor comparison purposes only.Yes£NoIf ‘Yes’:How much family, mortgage and Inheritance Taxprotection life cover do you have?How much family and mortgage critical illnesscover do you have?Enter an amount if you answered yes to thisquestion and this application includes criticalillness cover.Yes£NoIf ‘Yes’:How much family, mortgage and Inheritance Taxprotection life cover do you have?How much family and mortgage critical illnesscover do you have?Enter an amount if you answered yes to thisquestion and this application includes criticalillness cover.£ £If you’ve answered ‘Yes’ to the above question, please complete the Personal Assurance Questionnaire (page 19) BEFORE continuingwith the next question.Page 12<strong>Application</strong> <strong>Form</strong> – Part B

Client oneClient twoDuring the last 5 years have youspent more than 90 consecutivedays in Africa, the Caribbean,Russia, Thailand or Ukraine?The Caribbean includes Antigua,Bahamas, Barbados, Bermuda,Cuba, Dominican Republic,Grenada, Haiti, Jamaica, Trinidadand Tobago and its other islands.YesNoIf ‘Yes’, which part of the world was this?(tick all that apply)Africa – Algeria, Egypt, Libya, Morocco, TunisiaAfrica – otherRussia or UkraineThe CaribbeanThailandYesNoIf ‘Yes’, which part of the world was this?(tick all that apply)Africa – Algeria, Egypt, Libya, Morocco, TunisiaAfrica – otherRussia or UkraineThe CaribbeanThailandDuring the next 2 years do youintend to spend more than 30consecutive days outside the UK?Please ignore travel as a memberof the Armed Forces.In this context, UK includesEngland, Scotland, Wales andNorthern Ireland.YesNoIf ‘Yes’, please give the following details:Will you be staying within the European Union,United States of America, Canada, Australia orNew Zealand?Yes NoDo you plan to leave the UK permanently?YesNoIf ‘Yes’, please give the following details:Will you be staying within the European Union,United States of America, Canada, Australia orNew Zealand?Yes NoDo you plan to leave the UK permanently?YesNoYesNoIf ‘Yes’ to leaving permanently, when do you intendto leave?If ‘Yes’ to leaving permanently, when do you intendto leave?Within 3 monthsLater than 3 monthsWithin 3 monthsLater than 3 monthsIf ‘No’ to leaving permanently:How long do you plan to be outside the UK orRepublic of Ireland during the next 2 years?If ‘No’ to leaving permanently:How long do you plan to be outside the UK orRepublic of Ireland during the next 2 years?weeksdaysweeksdaysWhich countries or islands outside the EuropeanUnion, United States of America, Canada, Australiaor New Zealand are you going to?Which countries or islands outside the EuropeanUnion, United States of America, Canada, Australiaor New Zealand are you going to?HAZARDOUS ACTIVITIESClient oneClient twoDo you regularly take part in any ofthe activities listed opposite or doyou intend to do so within the next6 months?Please ignore one off bungee andparachute jumps.If ‘Yes’, tick all that apply.If ‘No’, tick ‘None of the above’.Caving or PotholingFlying (other than as a fare-paying passengeror cabin crew)Hang gliding or ParaglidingMotor car sportMotorcycle sportMountaineering or Rock climbingParachuting, Sky diving or BASE jumpingPowerboat racingSailing other than inlandUnderwater divingAny Extreme Sport, for example bungeejumping, canyoning, white water raftingNone of the aboveCaving or PotholingFlying (other than as a fare-paying passengeror cabin crew)Hang gliding or ParaglidingMotor car sportMotorcycle sportMountaineering or Rock climbingParachuting, Sky diving or BASE jumpingPowerboat racingSailing other than inlandUnderwater divingAny Extreme Sport, for example bungeejumping, canyoning, white water raftingNone of the aboveIf you’ve ticked any of the activities listed in the question above, please complete the Hazardous Activities Questionnaire (page 22) BEFOREcontinuing with the next question.Page 13<strong>Application</strong> <strong>Form</strong> – Part B

GENERAL HEALTH AND LIFESTYLEPlease don’t assume that we’ll contact your doctor for confirmation of medical details.Genetic Testing.The Association of British Insurers (ABI) have a policy on genetics and insurance. Currently, you only need to tell us about any genetic test resultsconcerning Huntington’s disease, for life insurance over £500,000 in total. This is because the Government has approved this test for insurers to use.The total is for any life insurance application being made now together with any life insurance you have already. You don’t need to tell us about anyother genetic test result. However, you must tell us if you are experiencing symptoms of, or are having treatment for, a medical condition includingany genetically inherited condition. You must also tell us of any family history of a medical condition as asked for in the relevant question in thisapplication. If you want to tell us about a negative genetic test result, we’ll be willing to consider this when setting your premium. A copy of theConcordat and Moratorium on Genetics and Insurance is available from us on request or from the ABI website www.abi.org.ukClient oneClient twoWhat is your height(without shoes)?mORftinmORftinWhat is your weight(in indoor clothes)?kgORstlbkgORstlbIf you’re pregnant, please give your weight immediately prior to this pregnancy.What is your trouser size or, forfemales, your UK dress, skirt ortrouser size?Complete only one answer.ORcmORinUK dress, skirt or trouser sizeORcmORinUK dress, skirt or trouser sizeHow many cigarettes do yousmoke on average each day?Please use the size from the most recent clothing purchase you made for yourself.If you’re pregnant, please advise your size immediately prior to this pregnancy.cigarettes per daycigarettes per dayIf you don’t smoke cigarettes daily, please enter ‘0’.During the last 5 years have you usedany of the drugs listed opposite? – Recreational drugs other than cannabis, for – Recreational drugs other than cannabis, forexample cocaine, ecstasy, heroinexample cocaine, ecstasy, heroinWe’ll only use the answer to thisquestion to assess your application – Methadone– Methadoneand at claim stage. Therefore there – Anabolic steroids not prescribed by a doctor – Anabolic steroids not prescribed by a doctorare no ‘legal implications’ inanswering yes to this question. Yes NoYes NoHave you ever tested positive forHIV, or are you waiting for theresult of an HIV test?A negative HIV test result won’t,by itself, have any effect on youracceptance terms for insurance.Tested positive for HIVAwaiting results of HIV testNoTested positive for HIVAwaiting results of HIV testNoHow often do you drink alcohol?Tick only one answer.NeverMonthly or lessfrequentlyOn specialoccasions onlyTwo or threetimes a monthNeverMonthly or lessfrequentlyOn specialoccasions onlyTwo or threetimes a monthWeeklyWeeklyFor example, a drink is a glass ofwine or a glass or bottle of beer.If ‘Two or three times a month’, on atypical day when you have alcohol,how many alcoholic drinks do you have?If ‘Weekly’, during a typical week, howmany alcoholic drinks do you have?If ‘Two or three times a month’, on atypical day when you have alcohol,how many alcoholic drinks do you have?If ‘Weekly’, during a typical week, howmany alcoholic drinks do you have?Have you ever been seen by analcohol specialist or attended analcohol support group or been toldthat you have any liver damage?Tick all that apply.Seen by an alcohol specialist or attendeda support groupTold about liver damageNeitherSeen by an alcohol specialist or attendeda support groupTold about liver damageNeitherHave you ever been told by a healthprofessional that you should reducethe amount of alcohol you havebecause you were drinking toomuch?YesNoIf ‘Yes’, when was this?YesNoIf ‘Yes’, when was this?What were you drinking at the time?What were you drinking at the time?Page 14<strong>Application</strong> <strong>Form</strong> – Part B

HEALTH – EVERWhen answering the following questions, if you’re unsure whether to tell us about a medical condition, please tell us anyway. There’s no needto tell us about the same condition more than once in this application.Client oneClient twoHave you ever:a) had diabetes or a heart condition, for exampleangina, heart attack, heart valve problem,heart surgery?YesNoYesNob) had a stroke, mini stroke, transient ischaemicattack (TIA), brain haemorrhage or surgery toyour blood vessels?YesNoYesNoPlease ignore varicose veins unless there’s ulceration present.c) had cancer, Hodgkin lymphoma,Non-Hodgkin lymphoma, leukaemia or amelanoma?d) had a cyst, growth or tumour in either your brainor spine?YesYesNoNoYesYesNoNoe) had any neurological condition or visualdisturbance, for example epilepsy, multiplesclerosis, muscular dystrophy, cerebral palsy,motor neurone disease, Parkinson’s disease,optic neuritis?YesNoYesNoPlease ignore long and short sightedness that’s been corrected.f) been admitted overnight to hospital or referredto a psychiatrist for mental illness, anorexiaor bulimia?YesNoYesNoIf you’ve answered ‘Yes’ to ANY part of the above question, please complete one of the Medical Questionnaires (page 23) BEFOREcontinuing with the next question.HEALTH – LAST 5 YEARSApart from anything you’ve alreadytold us about in this application,during the last 5 years have youseen a doctor, nurse or other healthprofessional for:a) raised blood pressure, raised cholesterol orcondition affecting blood or blood vessels, forexample anaemia, excess sugar in the blood,blood clot, deep vein thrombosis?b) any condition affecting your kidneys, bladderor prostate, for example blood or protein inthe urine, kidney or bladder stones?c) any condition affecting your stomach,oesophagus or bowel, for example Crohn’sdisease, ulcerative colitis?YesYesYesNoNoNoYesYesYesNoNoNoPlease ignore diarrhoea, food poisoning, sickness or vomiting,stomach bug or upset, provided no hospital investigation was advisedor completed.d) any condition affecting your gall bladder, liver orpancreas, for example hepatitis, fatty liver?YesNoYesNoe) any condition affecting your lungs or breathing,for example asthma, emphysema, sleep apnoea,sarcoidosis?YesNoYesNoPlease ignore hay fever and one off chest infections from which you’vefully recovered.f) lupus, fibromyalgia, gout or any type of arthritis,neck, back, spine or joint trouble, for examplerheumatoid arthritis, sciatica?g) anxiety, depression or any mental illness that’srequired treatment or counselling, or chronicfatigue syndrome?YesYesNoNoYesYesNoNoh) a growth, lump, polyp or tumour of any kind?YesNoYesNoi) chest pain, palpitations or irregular heartbeat?paralysis, numbness, persistent tingling orpins and needles, tremor or facial pain otherthan dental pain?memory loss, dizziness or balance problems?Yes No Yes NoIf you’ve answered ‘Yes’ to ANY part of the above question, please complete one of the Medical Questionnaires (page 23) BEFOREcontinuing with the next question.Page 15<strong>Application</strong> <strong>Form</strong> – Part B

HEALTH – LAST 5 YEARS continuedWhen answering the following questions, if you’re unsure whether to tell us about a medical condition, please tell us anyway. There’s no needto tell us about the same condition more than once in this application.Only answer this question if you’re applying for Critical Illness Cover or Income Protection Benefit.Client oneClient twoApart from anything you’ve alreadytold us about in this application,during the last 5 years have youseen a doctor, nurse or other healthprofessional for:a) a mole or freckle?Please ignore birthmarks where no treatment or specialist referral hasbeen advised.b) any condition affecting your thyroid?Yes NoYesNoYesYesNoNoc) any condition affecting your ears or hearing, forexample Meniere’s disease, deafness?YesNoYesNoPlease ignore simple earache and ear infections that have resolved leavingno continuing hearing loss.d) any condition affecting your eyes or vision, notwholly corrected by spectacles, lenses or laser Yes Notreatment, for example cataract, blindness?This question is applicable for females only:YesNoe) any gynaecological condition for which you’venot yet been discharged from follow up, or acervical smear requiring further investigations?YesNoYesNoPlease ignore routine cervical smears if the results have been normal.Only answer this question if you’re applying for Income Protection Benefit:f) any other illness, injury or disability that’s keptyou off work for a continuous period of 2 weeksor more, for example stress, headaches,trapped nerve?Yes No Yes NoPlease ignore colds and flu from which you’ve fully recovered andpregnancy where no complications were present.If you’ve answered ‘Yes’ to ANY part of the above question, please complete one of the Medical Questionnaires (page 23) BEFOREcontinuing with the next question.HEALTH – LAST 12 MONTHSApart from anything you’ve alreadytold us about in this application,during the last 12 months have you:a) had any medical condition, illness or injurythat you’ve received treatment for over acontinuous period of 4 weeks or more?YesNoYesNoPlease ignore oral contraception pill, pregnancy and minor accidents andinjuries, for example pulled or strained muscle, torn ligament or tendon,sprained joint, provided they’ve not kept you off work for 2 weeks for more.b) been referred to or had any investigations inhospital, for example biopsy, scan, ECG?YesNoYesNoPlease ignore investigations related to pregnancy or infertility where theresults have been confirmed as normal.If you’ve answered ‘Yes’ to ANY part of the above question, please complete one of the Medical Questionnaires (page 23) BEFOREcontinuing with the next question.HEALTH – CONTINUEDApart from anything you’ve alreadytold us about in this application, doyou have any medical condition orsymptom that:a) your doctor or nurse told you to see themabout during the next 3 weeks?Please ignore consultations for repeat prescriptions and pregnancy.YesNoYesNoDuring the last 3 months have youhad any of the symptoms listedopposite?b) unexplained bleeding, weight loss, lump or growth– mole or freckle that’s bled or changed in appearance– a cough that’s lasted for 3 weeks or moreYes No Yes No– any other symptom that you may see a health professionalabout for the first time during the next 4 weeksIf you’ve answered ‘Yes’ to EITHER of the above questions, please complete one of the Medical Questionnaires (page 23) BEFOREcontinuing with the next question.Page 16<strong>Application</strong> <strong>Form</strong> – Part B

FAMILY HISTORYIf you’re aged over 50, only answer this question if your application includes Critical Illness Cover or Income Protection Benefit. If you’reaged 50 or under, please answer this question.Client one3No. ofrelativesaffectedYoungestageaffectedSecondyoungestage affectedClient two3No. ofrelativesaffectedYoungestageaffectedSecondyoungestage affectedHave any of your natural parents,brothers or sisters, before theage of 60, had any of theconditions opposite?If ‘Yes’, tick all that apply.If ‘No’, tick ‘None of the above’.Please answer in relation to thefamily members above that youknow about. If you don’t knowabout any of these relatives,answer ‘Don’t know’.For each condition selected,please give:• the total number of relativeswho had the condition• their age(s) at the time thecondition first occurred (exceptwhere indicated) – but only theyoungest (lowest) age(s).The conditions shown aren’talways hereditary and it’s notintended to imply that they are.Heart attack, Angina, Stroke or Type 2 DiabetesCancer of the BreastCancer of the OvaryCancer of the Bowel (Colon)Cancer of another siteIf ‘Cancer of another site’, for each relative pleasetell us the part of the body affected by the ‘primary’cancer, that is, where it first occurred in the body.Heart attack, Angina, Stroke or Type 2 DiabetesCancer of the BreastCancer of the OvaryCancer of the Bowel (Colon)Cancer of another siteIf ‘Cancer of another site’, for each relative pleasetell us the part of the body affected by the ‘primary’cancer, that is, where it first occurred in the body.Cardiomyopathy (primary disorder of the heart muscle)Cardiomyopathy (primary disorder of the heart muscle)Multiple SclerosisMultiple SclerosisN/AN/AN/AN/AIf ‘Multiple Sclerosis’, please tell us the familymember(s) affected:If ‘Multiple Sclerosis’, please tell us the familymember(s) affected:MotherFatherMotherFatherBrother(s)Sister(s)Brother(s)Sister(s)Myotonic DystrophyMyotonic DystrophyPolyposis coli (Familial adenomatous)Polyposis coli (Familial adenomatous)Polycystic Kidney DiseasePolycystic Kidney DiseaseMotor Neurone DiseaseMotor Neurone DiseaseHuntington’s DiseaseHuntington’s DiseaseParkinson’s DiseaseParkinson’s DiseaseAlzheimer’s DiseaseAlzheimer’s DiseasecontinuesPage 17<strong>Application</strong> <strong>Form</strong> – Part B

FAMILY HISTORY continuedClient one3No. ofrelativesaffectedYoungestageaffectedSecondyoungestage affectedClient two3No. ofrelativesaffectedYoungestageaffectedSecondyoungestage affectedAny other condition that runs in your family andthat you’re receiving regular follow up orscreening forAny other condition that runs in your family andthat you’re receiving regular follow up orscreening forIf ‘Any other condition’, please give details of thecondition(s) and the results of any investigations.If ‘Any other condition’, please give details of thecondition(s) and the results of any investigations.None of the aboveDon’t knowNone of the aboveDon’t knowTRUST AND OWNERSHIPClient oneClient twoAre any of the policies on thisapplication replacing an existingpolicy or policies held with<strong>Legal</strong> & <strong>General</strong>?We may need to get authority tocancel the policy if it is in trust orowned by someone else.YesNoIf ‘Yes’, please enter the policy number(s) to bereplaced.YesNoIf ‘Yes’, please enter the policy number(s) to bereplaced.Is it your intention to put any ofthe policies on this applicationunder Trust?YesNoIf ‘Yes’, which policy(ies)?YesNoIf ‘Yes’, which policy(ies)?If you’ve answered ‘Yes’ to the above question, please contact your financial adviser about the type of trust most appropriate to you andyour circumstances.Are any of the policies on thisapplication to be owned byanother individual or business?YesNoIf ‘Yes’, which policy(ies)?YesNoIf ‘Yes’, which policy(ies)?If you’ve answered ‘Yes’ to the above question, please complete a Policy Owner Questionnaire for each policy (page 25) BEFOREcontinuing with the next question.DOCTOR’S DETAILSPlease include your doctor’spractice name or clinic, postcodeand telephone number as thisis essential for processing yourapplication more quickly.Please don’t assume thatwe’ll contact your doctor forconfirmation of medical details.Doctor’s namePractice/clinic name and address(including postcode)Doctor’s namePractice/clinic name and address(including postcode)As client 1Telephone numberPostcodeTelephone numberPostcodeThis now completes the mandatory question and answer part of your application.The following five green sections are all additional questionnaires which you only need to complete if we’ve asked you to in one of theprevious questions, or if you need to provide us with additional information.Please now ensure you read and sign the Client Declaration and Consent in Part C1 and complete the Direct Debit instruction in Part C3.Page 18<strong>Application</strong> <strong>Form</strong> – Part B

QUESTIONNAIRE 1 – PERSONAL ASSURANCE QUESTIONNAIREThis questionnaire only applies if you have answered ‘Yes’ to the Total Cover question on page 12.Client oneClient two1. Do you have, or are you applyingfor, any other Life cover with<strong>Legal</strong> & <strong>General</strong> or with anotherinsurance company?This includes any Life coverprovided by your employer.If ‘Yes’ and you need morespace, please use the AdditionalInformation section on page 27.Yes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeYes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeTermyearsTermyearsAmount of cover £Amount of cover £Reason for coverReason for coverWill this policy remainin force/be going ahead?Do you have any otherpolicies to tell us about?YesYesNoNoWill this policy remainin force/be going ahead?Do you have any otherpolicies to tell us about?YesYesNoNoIf ‘Yes’, please give the same details as above for theother policy(ies), on page 27 (Additional Information)before continuing with this section.If ‘Yes’, please give the same details as above for theother policy(ies), on page 27 (Additional Information)before continuing with this section.2. Do you have, or are youapplying for, any otherCritical Illness cover with<strong>Legal</strong> & <strong>General</strong> or with anotherinsurance company?If ‘Yes’ and you need morespace, please use the AdditionalInformation section on page 27.Yes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeYes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeTermyearsTermyearsAmount of cover £Amount of cover £Reason for coverReason for coverWill this policy remainin force/be going ahead?Yes NoDo you have any otherpolicies to tell us about?Yes NoIf ‘Yes’, please give the same details as above for theother policy(ies), on page 27 (Additional Information)before continuing with this section.Will this policy remainin force/be going ahead?Yes NoDo you have any otherpolicies to tell us about?Yes NoIf ‘Yes’, please give the same details as above for theother policy(ies), on page 27 (Additional Information)before continuing with this section.3. Please give details of yourgross annual earned incomefor the last three years.Do not include anyunearned income, suchas investment income.Current yearLast yearPrevious yearEarnedIncome £EarnedIncome £EarnedIncome £Current yearLast yearPrevious yearEarnedIncome £EarnedIncome £EarnedIncome £If you are self employed – please give net taxable earnings after deduction of allowable business expenses.If your earned income for the current year is less than £10,000, please continue with question 4.Otherwise, please skip question 4 and continue with question 5.Page 19<strong>Application</strong> <strong>Form</strong> – Part B

Client oneClient two4. Please give details of all otherhousehold gross annual earnedincome for the last three years.Current yearLast yearEarnedIncome £EarnedIncome £Current yearLast yearEarnedIncome £EarnedIncome £Previous yearEarnedIncome £ £Previous yearEarnedIncome £5. What is the total value of yournet assets?£‘Net assets’ are your total assets (for example house, car, shares), less your total liabilities (for examplemortgage, outstanding debt). Where examples are shown, they are not intended to be a complete list.6. Have you been investigated,arrested, charged, convictedor do you have a prosecutionpending for any of the following?Bribery, Corruption, Counterfeiting,Embezzlement, Fraud, Moneylaundering, Tax evasion.Please ignore any conviction thatis spent under the Rehabilitationof Offenders Act.Please tick only one answer.InvestigatedArrestedChargedConvictedProsecution pendingNoIf you have been investigated, arrested or charged,please give details:InvestigatedArrestedChargedConvictedProsecution pendingNoIf you have been investigated, arrested or charged,please give details:If you require this policy for Mortgage Protection purposes, please go straight to question 11. Otherwise, please continue with the nextquestion.7. What is the total value ofyour liabilities?8. Please give details of the numberof dependants you have and theirrelationship to you.If you need space for moredependants, please use theAdditional Information sectionon page 27.££9. If this application is required tocover a liability for InheritanceTax or Capital Gains Tax, pleasetick whichever applies.If neither of these apply,tick ‘Neither’.Inheritance TaxCapital Gains TaxNeitherInheritance TaxCapital Gains TaxNeitherIf you ticked ‘Inheritance Tax’ in question 9 above, please continue with the next question.If you require this policy for Mortgage Protection purposes, please go straight to question 11. Otherwise you have completed thisquestionnaire and you should return to your application at page 13.Page 20<strong>Application</strong> <strong>Form</strong> – Part B

Client oneClient two10. Please give details of theInheritance Tax liabilityand reliefs.Estimated InheritanceTax liability £How was your liability calculated?Estimated InheritanceTax liability £How was your liability calculated?Please state all reliefs, if any, that will be availablefor mitigation of Inheritance Tax.For example business property relief oragricultural property relief.Please state all reliefs, if any, that will be availablefor mitigation of Inheritance Tax.For example business property relief oragricultural property relief.Is this policy required tocover the Inheritance Taxin respect of a gift?YesNoIf ‘Yes’, please give the date and value of the giftIs this policy required tocover the Inheritance Taxin respect of a gift?YesNoIf ‘Yes’, please give the date and value of the giftIf you require this policy for Mortgage Protection purposes, please continue with the next question. Otherwise, you have completed thisquestionnaire and you should return to your application at page 13.11. Please give details of themortgage(s) or loan(s) towhich the protection applies.What is this mortgage or loan being used to purchase?If ‘Other’, please give detailsMain privateresidenceBuy to LetpropertyOtherName(s)of lender(s)Name(s) ofborrower(s)HomeimprovementWhat is this mortgage or loan being used to purchase?If ‘Other’, please give detailsMain privateresidenceBuy to LetpropertyOtherName(s)of lender(s)Name(s) ofborrower(s)HomeimprovementMortgage orloan amount£Mortgage orloan amount£Mortgage or loan termyearsMortgage or loan termyearsInterest rate %Type of mortgage or loan:New orremortgageAre any other policiesbeing taken out to coverthis mortgage or loan?If ‘Yes’, please give detailsExistingarrangementRepayment basisIf ‘Other’, please give detailsInterest onlyCapitaland interestOtherYesNoInterest rate %Type of mortgage or loan:New orremortgageExistingarrangementRepayment basisIf ‘Other’, please give detailsInterest onlyCapitaland interestOtherAre any other policiesbeing taken out to cover Yesthis mortgage or loan?If ‘Yes’, please give detailsNoPlease now return to your application at page 13.Page 21<strong>Application</strong> <strong>Form</strong> – Part B

QUESTIONNAIRE 2 – HAZARDOUS ACTIVITIES QUESTIONNAIREThis questionnaire only applies if you have ticked any of the hazardous activities listed on page 13.Client oneClient two1. What is the name of the activitythat you have ticked in theHazardous Activities questionon page 13?If ‘Any Extreme Sport’, pleasetell us which oneIf you have ticked more than one activity in the Hazardous Activities question on page 13, you will need tocomplete a separate Hazardous Activities Questionnaire for each one. Use this page to give details of thefirst activity and then use the Additional Information section (page 27), or photocopy this page, to givethe same details for the other activity(ies).2. Do you take part in this asa professional?Yes No Yes No3. Are you a member of arecognised club, associationor professional body?YesNoYesNo4. Where is this activity carried out?If ‘Other’, please tell us whereUK onlyOtherEurope onlyUK onlyOtherEurope only5. Do you ever take part in thisactivity alone?YesNoYesNo6. Do you, or are you likely to, takepart in Aerobatics, Expeditions,Record attempts, Testing of anyequipment or Underwater internalwreck exploration in connectionwith this hobby or pursuit?YesNoYesNo7. On average, how many times ayear do you do this activity?8. On average, how many hours ayear do you spend on this activity?times a yearhours a yeartimes a yearhours a year9. If this activity is listed opposite,please answer these additionalquestions, as applicable.Motor car andMotorcyclesportType of motor sportMotor car andMotorcyclesportType of motor sportMaximum enginesize usedccMaximum enginesize usedccMountaineeringor RockclimbingMaximum heightyou climb tometresMountaineeringor RockclimbingMaximum heightyou climb tometresSeverity levelyou climb toSeverity levelyou climb toParachuting,Sky diving orBASE jumpingDo you take part in free-fallparachuting, competitions,sky diving or sky surfing?Parachuting,Sky diving orBASE jumpingDo you take part in free-fallparachuting, competitions,sky diving or sky surfing?YesNoYesNoSailingType of sailing – For example,offshore category 1 or 2SailingType of sailing – For example,offshore category 1 or 2Powerboatracing andExtreme SportsFull detailsPowerboatracing andExtreme SportsFull detailsUnderwaterdivingMaximum depthyou dive tometresUnderwaterdivingMaximum depthyou dive tometres10. Did you tick any otheractivity(ies) in theHazardous Activitiesquestion on page 13?YesNoIf ‘Yes’, please give the same details as above, forthe other activity(ies), on page 27 (AdditionalInformation).YesNoIf ‘Yes’, please give the same details as above, forthe other activity(ies), on page 27 (AdditionalInformation).You have completed this additional questionnaire. Please return to your application on page 14.Page 22<strong>Application</strong> <strong>Form</strong> – Part B

QUESTIONNAIRE 3 – MEDICAL QUESTIONNAIREPlease only complete this questionnaire if you have answered ‘Yes’ to any health questions on pages 15 or 16. If you have more than onecondition to tell us about, use this page to give details of the first condition, use the next questionnaire for the second, and then eitheruse the Additional Information section on page 27 or photocopy this page to give us the same details for any further conditions.MEDICAL QUESTIONNAIRE 1Client oneClient two1. Which health question (for exampleHealth – Last 5 Years, part f) doesthis information relate to?2. Name of actual medicalcondition, illness or injuryIf growth or lump, also state thepart of body affected.3. How long ago did the conditionfirst occur?yearsmonthsyearsmonths4. How often do you havesymptoms?Please tick appropriate box – donot enter anything else in the box.No symptoms nowYearlyMonthly Weekly DailyNo symptoms nowYearlyMonthly Weekly Daily5. How long ago was your last majorattack? This means a suddenincrease in the severity of symptoms,or need for treatment other thanyour usual medicine or tablets.Never had amajor attackCurrently orat presentOther years monthsNever had amajor attackCurrently orat presentOther years months6. In the last 5 years, have youhad surgery or an operation, orany other hospital admission(including an overnight stay) forthis condition?Please answer both parts ofthis question.Surgery or operationIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesYesNoNoIf ‘Yes’, how long ago? years monthsSurgery or operationIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesYesNoNoIf ‘Yes’, how long ago? years months7. In the last 5 years, in total, howmuch time off your normal work ordaily activities have you had forthis condition?8. If you have had time off, how longago was the most recent occasion?Not applicable if you haveanswered ‘0’ to the question above.weeks daysIf you haven’t taken time off, please enter ‘0’.years monthsIf you are currently off work, please enter ‘0’.weeks daysIf you haven’t taken time off, please enter ‘0’.years monthsIf you are currently off work, please enter ‘0’.9. Do you expect to have, or are youcurrently waiting for, surgery oran operation, any other hospitaladmission (including an overnightstay) or referral to a specialist forthis condition?Please answer all three parts ofthis question.Surgery or operationIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesYesNoNoSurgery or operationIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesYesNoNoReferral to a specialistYesNoReferral to a specialistYesNoIf ‘Yes’, when?If ‘Yes’, when?10. Are you currently receivingtreatment for this condition?YesNoIf ‘Yes’, please give the name of medicine or tablet, ordetails of other treatment, for example physiotherapy.If more than one treatment, please state them all.YesNoIf ‘Yes’, please give the name of medicine or tablet, ordetails of other treatment, for example physiotherapy.If more than one treatment, please state them all.11. Do you have any more medicalconditions to disclose as aresult of answering ‘Yes’ toa health question onpages 15 or 16?Yes No Yes NoIf ‘Yes’, please complete the second MedicalQuestionnaire overleaf before returning to yourapplication.If ‘Yes’, please complete the second MedicalQuestionnaire overleaf before returning to yourapplication.Page 23<strong>Application</strong> <strong>Form</strong> – Part B

MEDICAL QUESTIONNAIRE 2Client oneClient two1. Which health question (for exampleHealth – Last 5 Years, part f) doesthis information relate to?Use this page to give details of a second condition and then use the Additional Information section(page 27), or photocopy this page, to give the same details for any further medical condition(s).2. Name of actual medicalcondition, illness or injuryIf growth or lump, also state thepart of body affected.3. How long ago did the conditionfirst occur?yearsmonthsyearsmonths4. How often do you havesymptoms?Please tick appropriate box – donot enter anything else in the box.5. How long ago was your lastmajor attack? This means asudden increase in the severityof symptoms, or need fortreatment other than yourusual medicine or tablets.6. In the last 5 years, have youhad surgery or an operation,or any other hospital admission(including an overnight stay)for this condition?No symptoms nowMonthly Weekly DailyNever had amajor attackYearlyCurrently orat presentOther years monthsSurgery or operation Yes NoIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesNoIf ‘Yes’, how long ago? years monthsNo symptoms nowMonthly Weekly DailyNever had amajor attackYearlyCurrently orat presentOther years monthsSurgery or operation Yes NoIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesNoIf ‘Yes’, how long ago? years months7. In the last 5 years, in total, howmuch time off your normal workor daily activities have you hadfor this condition?8. If you have had time off, how longago was the most recent occasion?Not applicable if you have answered‘0’ to the question above.weeks daysIf you haven’t taken time off, please enter ‘0’.years monthsIf you are currently off work, please enter ‘0’.weeks daysIf you haven’t taken time off, please enter ‘0’.years monthsIf you are currently off work, please enter ‘0’.9. Do you expect to have, or are youcurrently waiting for, surgery oran operation, any other hospitaladmission (including an overnightstay) or referral to a specialist forthis condition?Surgery or operation Yes NoIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?If ‘Yes’, when?YesNoReferral to a specialist Yes NoSurgery or operation Yes NoIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesNoReferral to a specialist Yes NoIf ‘Yes’, when?10. Are you currently receivingtreatment for this condition?Yes No Yes NoIf ‘Yes’, please give the name of medicine ortablet, or details of other treatment, for examplephysiotherapy. If more than one treatment, pleasestate them all.If ‘Yes’, please give the name of medicine ortablet, or details of other treatment, for examplephysiotherapy. If more than one treatment, pleasestate them all.11. Do you have any more medicalconditions to provide as aresult of answering ‘Yes’ toa health question onpages 15 or 16?Yes No Yes NoIf ‘Yes’, please give the same details as above,for the other medical condition(s), on page 27(Additional Information).If ‘Yes’, please give the same details as above,for the other medical condition(s), on page 27(Additional Information).You have completed this questionnaire and you may return to your application.Page 24<strong>Application</strong> <strong>Form</strong> – Part B

QUESTIONNAIRE 4 – POLICY OWNER QUESTIONNAIREThis questionnaire only applies if any of the policies on this application are to be owned by another individual or business.If more than one policy is to be owned by someone else you must complete a separate Policy Owner Questionnaire for each – please askyour financial adviser for another questionnaire, as required.• Please note, if the Policy Owner is not the Applicant(s) they must be over 18 and have an insurableinterest in the Applicant(s).• Please consult your financial adviser if you wish to assign your policy to someone else once the policyhas been accepted and issued.• Your financial adviser can help you to complete this section.Policy OwnerSecond Policy Owner (if applicable)1. Is the Policy Owner anindividual or a business?An individualA businessAn individualA business2. What is the name of thePolicy Owner?Give the full name or businessname as applicable.Mr/Mrs/Miss/Ms/Dr/Rev/OtherOtherMr/Mrs/Miss/Ms/Dr/Rev/OtherOtherForename(s) and middle name(s) in fullForename(s) and middle name(s) in fullorSurnameBusinessnameorSurnameBusinessname3. Contact name within theorganisation?4. What is the Policy Owner’srelationship to the Applicant(s)?SpouseBusiness PartnerEmployerEx-spouseSpouseBusiness PartnerEmployerEx-spouseCo-habiting PartnerEx-partnerCo-habiting PartnerEx-partnerCivil PartnerTrusteeCivil PartnerTrusteeCreditorOtherCreditorOtherCo-shareholderCo-shareholder5. What is the Policy Owner’scurrent address?Please give the full address(including postcode) of theperson or business who is toown the policy(ies).PostcodePostcode6. What are the Policy Owner’scontact details?If the policy is to be owned bya business, please give thecontact details of the business’srepresentative.7. Declaration of the Policy Owner(s)(who is not the Client(s))This Declaration should beread, confirmed, signed anddated by the Policy Owner,not by the Client(s).PhonePhoneI declare that the answers given are, to the best of my knowledge and belief, true and complete.Use of personal information: <strong>Legal</strong> & <strong>General</strong> takes client privacy very seriously. I understand that<strong>Legal</strong> & <strong>General</strong> will use the personal information collected via this application and any other informationthat I provide to <strong>Legal</strong> & <strong>General</strong> (“my information”) for the purposes of:1. Providing me with <strong>Legal</strong> & <strong>General</strong> products and services and dealing with my enquiries and requests;2. Underwriting and administering my policy including processing claims; and3. Carrying out market research, statistical analysis and client profiling.I understand that given the global nature of <strong>Legal</strong> & <strong>General</strong>’s business, it may be necessary to transfermy information to countries outside the European Economic Area in order to provide <strong>Legal</strong> & <strong>General</strong>’sservices to me.<strong>Application</strong> <strong>Form</strong> – Part B Page 25

Disclosures: I understand that <strong>Legal</strong> & <strong>General</strong> will disclose my information to other companies withinthe <strong>Legal</strong> & <strong>General</strong> group of companies, regulatory bodies, law enforcement agencies, future owners of<strong>Legal</strong> & <strong>General</strong>’s business, suppliers engaged by <strong>Legal</strong> & <strong>General</strong> to process data on its behalf and whennecessary, to a reinsurer.If I have been dealing with a financial adviser, <strong>Legal</strong> & <strong>General</strong> will give them information about theproduct and, where appropriate, provide them with other information about my dealings with<strong>Legal</strong> & <strong>General</strong> to enable them to give me informed advice.Where I have been introduced to <strong>Legal</strong> & <strong>General</strong> by another company (e.g. a bank, insurer or buildingsociety) <strong>Legal</strong> & <strong>General</strong> may share my information with them to enable them to:(a) carry out market research, statistical analysis and client profiling; and(b) send me marketing information about their products and services and products and services ofcompanies in the <strong>Legal</strong> & <strong>General</strong> group and of third parties whose products and services<strong>Legal</strong> & <strong>General</strong> offers to its clients.By signing this Declaration I agree to receive the information as described in (b) above by post ortelephone, unless I indicate otherwise by writing with my full contact details to <strong>Legal</strong> & <strong>General</strong> P10290,5 Gemini Business Park, Europa Boulevard, Warrington, Cheshire, WA5 7YF.Access: I understand that I have the right to ask for a copy of my information in return for payment ofa small fee. To obtain a copy of your information please write to <strong>Legal</strong> & <strong>General</strong> at UKSO BusinessStandards, <strong>Legal</strong> & <strong>General</strong> Assurance Society, <strong>Legal</strong> & <strong>General</strong> House, St Monica’s Road, Kingswood,Surrey, KT20 6EU.Approaching fraud prevention agencies: <strong>Legal</strong> & <strong>General</strong> will check my details with fraud preventionagencies. If false or inaccurate information is provided and fraud is identified details will be passed tofraud prevention agencies. Law enforcement agencies may access and use this information.<strong>Legal</strong> & <strong>General</strong> and other organisations may also access and use this information to prevent fraud andmoney laundering, for example, when:• checking details on applications for credit and credit related or other facilities;• managing credit and credit related accounts or facilities;• recovering debt;• checking details on proposals and claims for all types of insurance;• checking details of job applicants and employees.<strong>Legal</strong> & <strong>General</strong> and other organisations may access and use from other countries the informationrecorded by fraud prevention agencies.8. Declaration of the PolicyOwner(s) (who is not theClient(s))This Declaration shouldbe read, confirmed,signed and dated by thePolicy Owner, not bythe Client(s).I understand that I can contact <strong>Legal</strong> & <strong>General</strong> at Group Financial Crime, <strong>Legal</strong> & <strong>General</strong> House, Kingswood,Tadworth, Surrey KT20 6EU if I want to receive details of the relevant fraud prevention agencies.I request that <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited issue the proposed policy in my name or thebusiness’s name and I understand that this request and Declaration, and any other statement signedby the Client(s) in connection with this application, will be used to determine whether to offer a policyand to assess how much premium should be paid. Alongside the Policy Schedule and Policy Terms andConditions this information will form part of the legal relationship between us and if any of it is incorrectit may mean that a claim will be declined and the policy cancelled. I understand that if more than onePolicy Owner has been requested, then each Policy Owner will be required to complete a version ofthis document.Policy OwnerPolicy Owner signatureSecond Policy owner (if applicable)Policy Owner signatureDate (DDMMYYYY)Date (DDMMYYYY)Date of birth (DDMMYYYY)Date of birth (DDMMYYYY)If you want another policy(ies) to be owned by someone else, please complete another Policy Owner Questionnaire(s) for each.Otherwise, please return to your application on page 18.PRINTClick here to print Policy Owner Questionnaire only.Page 26<strong>Application</strong> <strong>Form</strong> – Part B

ADDITIONAL INFORMATIONThis section only applies if you need more space to answer any questions. If you don’t need more space, please now go straight to Part C.Client oneClient twoSection Nameand Question No.Additional InformationSection Nameand Question No.Additional InformationcontinuesPage 27<strong>Application</strong> <strong>Form</strong> – Part B

ADDITIONAL INFORMATIONThis section only applies if you need more space to answer any questions. If you don’t need more space, please now go straight to Part C.Client oneClient twoSection Nameand Question No.Additional InformationSection Nameand Question No.Additional InformationPRINTThis is the end of Part B, please click here to print Part B only.Page 28<strong>Application</strong> <strong>Form</strong> – Part B

APPLICATION FORM – PART C<strong>OLP</strong> CONNECT – CLIENT DECLARATION,CONSENT AND DIRECT DEBIT.Family ProtectionMortgage ProtectionC1 – CLIENT DECLARATION AND CONSENT• Please ensure that you have read the notes at the beginning of this form.• You must read carefully the answers you have given to the questions before accepting the following Declaration.• In most instances the payments will be as originally quoted. <strong>Legal</strong> & <strong>General</strong> may sometimes offer revised terms and/or premiums andvery occasionally may not be able to offer the benefits requested. <strong>Legal</strong> & <strong>General</strong> will inform you as soon as possible if this is the case.• Please remember that all items of information asked for in this application are taken into account when assessing acceptance of theapplication and in calculating the premium. Please also remember that if you do not answer the questions fully and accurately it willvery likely mean that a claim will be declined and the policy(ies) cancelled. If you have given information to <strong>Legal</strong> & <strong>General</strong> in the past,please provide it again. If necessary, please return to the questions and amend your answer in the appropriate place.• <strong>Legal</strong> & <strong>General</strong> will try to rely on the information you provide and you must not assume that they will always clarify that informationwith your doctor (GP). However, as part of their administrative procedures, <strong>Legal</strong> & <strong>General</strong> may ask for information from your GP tocheck the medical information you provide. <strong>Legal</strong> & <strong>General</strong> may ask you to contact your doctor if they are waiting for information whichthey have asked for.• If <strong>Legal</strong> & <strong>General</strong> asks you to attend a medical examination, it may be necessary to share the application information with anothercompany which they have authorised. If so, that company will make the arrangements for the examination to take place.All Clients – it is important that you read and accept all of the following paragraphs. If you are unsure of anything or have any queries pleasespeak to your financial adviser.I/We declare that, to the best of my/our knowledge and belief all thestatements made, including anything I/we may have said, are true andcomplete and have been recorded accurately in this application.I/we acknowledge that <strong>Legal</strong> & <strong>General</strong> will use the information I/we givein this application to determine whether to offer me/us a policy and toassess how much premium I/we must pay. Alongside the Policy Scheduleand the Policy Terms and Conditions, this information will form part ofthe legal relationship between us.I/We understand that if I/we do not give all of the requested informationfully and accurately it will very likely mean that a claim will be declinedand the policy or policies cancelled.I/We agree to immediately inform <strong>Legal</strong> & <strong>General</strong> in writing if there areany changes to any answers under the following categories given on theapplication before the policy or policies start:• medical information;• occupation;• pastimes;• country of residence (other than for holidays);• family history.I/We understand that failure to tell <strong>Legal</strong> & <strong>General</strong> of any change maymean that a claim will be declined and the policy or policies may becancelled.I/We agree to <strong>Legal</strong> & <strong>General</strong> getting relevant information from anotherinsurance company about previous or concurrent applications for life,critical illness, sickness, disability, accident or private medical insurancethat I/we have applied for. I/We authorise them to give this information.I/We also agree to <strong>Legal</strong> & <strong>General</strong> sharing any medical informationobtained in connection with this application with another insurancecompany to whom I am/we are applying or may apply to in the future.Also, when necessary, sharing it with a reinsurer and/or third partyadministrator. See also the paragraph headed ‘Sensitive data’.I/We understand that Insurers share information with each other toprevent fraudulent claims via a Register of Claims and that a list ofparticipants is available on request. The information I/we supply in thisapplication, together with that provided on any additional medicalreports and any other information in the event of a claim, will be given tothe Register and made available to other participants.I/We agree that if the policy is to be set up as joint lives, it will be ownedjointly by us or by the survivor of us.For Income Protection Benefit onlyDefinition of earningsYou should only cover earnings and benefits that you will no longerreceive if you are unable to work.Employed – earnings are defined as your annual pre tax earnings forPAYE assessment purposes and can include your P11d benefits.Self employed – earnings are defined as your share of annual pre taxprofit. This means your share of the total income from the business,less the expenses from running that business as permitted by HMRCguidelines. Please refer to your Key Features Document for fullinformation.I understand that my monthly benefit can't be more than 60% of the first£30,000 of my pre-incapacity earnings and 50% of my pre-incapacityearnings over £30,000, up to a maximum of £16,667 per month. Iunderstand that if, at the time of a claim, the level of benefit stated in mypolicy exceeds this percentage then my benefit will be reduced.I understand that if I have applied for Housepersons cover, the maximummonthly benefit is £1,667 per month.For all applicants<strong>Data</strong> ProtectionUse of personal information: <strong>Legal</strong> & <strong>General</strong> takes client privacy veryseriously. I/We understand that <strong>Legal</strong> & <strong>General</strong> will use the personalinformation collected via this application and any other information thatI/we provide to<strong>Legal</strong> & <strong>General</strong> (“my/our information”) for the purposes of:1. Providing me/us with <strong>Legal</strong> & <strong>General</strong> products and services anddealing with my/our enquiries and requests;2. Underwriting and administering my/our policy(ies) includingprocessing claims;3. Carrying out market research, statistical analysis and client profiling;and4. Sending me/us marketing information (by post, telephone, emailand SMS) about products and services of companies in the<strong>Legal</strong> & <strong>General</strong> group and of third parties whose products andservices <strong>Legal</strong> & <strong>General</strong> offers to its clients.Please tick this box if you DO want to receive information described in 4.Client oneClient twoPage 29<strong>Application</strong> <strong>Form</strong> – Part C