Understanding the Basics - Servus Credit Union

Understanding the Basics - Servus Credit Union

Understanding the Basics - Servus Credit Union

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

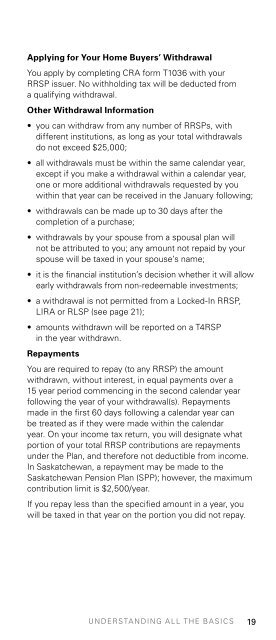

Applying for Your Home Buyers’ WithdrawalYou apply by completing CRA form T1036 with yourRRSP issuer. No withholding tax will be deducted froma qualifying withdrawal.O<strong>the</strong>r Withdrawal Information• you can withdraw from any number of RRSPs, withdifferent institutions, as long as your total withdrawalsdo not exceed $25,000;• all withdrawals must be within <strong>the</strong> same calendar year,except if you make a withdrawal within a calendar year,one or more additional withdrawals requested by youwithin that year can be received in <strong>the</strong> January following;• withdrawals can be made up to 30 days after <strong>the</strong>completion of a purchase;• withdrawals by your spouse from a spousal plan willnot be attributed to you; any amount not repaid by yourspouse will be taxed in your spouse’s name;• it is <strong>the</strong> financial institution’s decision whe<strong>the</strong>r it will allowearly withdrawals from non-redeemable investments;• a withdrawal is not permitted from a Locked-In RRSP,LIRA or RLSP (see page 21);• amounts withdrawn will be reported on a T4RSPin <strong>the</strong> year withdrawn.RepaymentsYou are required to repay (to any RRSP) <strong>the</strong> amountwithdrawn, without interest, in equal payments over a15 year period commencing in <strong>the</strong> second calendar yearfollowing <strong>the</strong> year of your withdrawal(s). Repaymentsmade in <strong>the</strong> first 60 days following a calendar year canbe treated as if <strong>the</strong>y were made within <strong>the</strong> calendaryear. On your income tax return, you will designate whatportion of your total RRSP contributions are repaymentsunder <strong>the</strong> Plan, and <strong>the</strong>refore not deductible from income.In Saskatchewan, a repayment may be made to <strong>the</strong>Saskatchewan Pension Plan (SPP); however, <strong>the</strong> maximumcontribution limit is $2,500/year.If you repay less than <strong>the</strong> specified amount in a year, youwill be taxed in that year on <strong>the</strong> portion you did not repay.UNDERSTANDING ALL THE BASICS 19