Understanding the Basics - Servus Credit Union

Understanding the Basics - Servus Credit Union

Understanding the Basics - Servus Credit Union

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

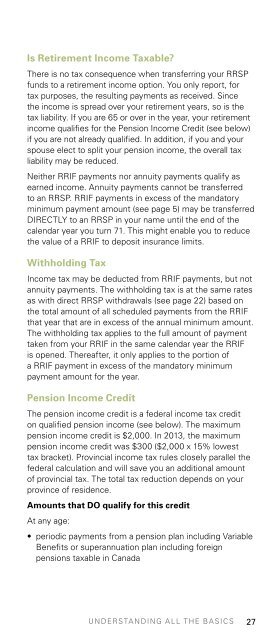

Is Retirement Income Taxable?There is no tax consequence when transferring your RRSPfunds to a retirement income option. You only report, fortax purposes, <strong>the</strong> resulting payments as received. Since<strong>the</strong> income is spread over your retirement years, so is <strong>the</strong>tax liability. If you are 65 or over in <strong>the</strong> year, your retirementincome qualifies for <strong>the</strong> Pension Income <strong>Credit</strong> (see below)if you are not already qualified. In addition, if you and yourspouse elect to split your pension income, <strong>the</strong> overall taxliability may be reduced.Nei<strong>the</strong>r RRIF payments nor annuity payments qualify asearned income. Annuity payments cannot be transferredto an RRSP. RRIF payments in excess of <strong>the</strong> mandatoryminimum payment amount (see page 5) may be transferredDIRECTLY to an RRSP in your name until <strong>the</strong> end of <strong>the</strong>calendar year you turn 71. This might enable you to reduce<strong>the</strong> value of a RRIF to deposit insurance limits.Withholding TaxIncome tax may be deducted from RRIF payments, but notannuity payments. The withholding tax is at <strong>the</strong> same ratesas with direct RRSP withdrawals (see page 22) based on<strong>the</strong> total amount of all scheduled payments from <strong>the</strong> RRIFthat year that are in excess of <strong>the</strong> annual minimum amount.The withholding tax applies to <strong>the</strong> full amount of paymenttaken from your RRIF in <strong>the</strong> same calendar year <strong>the</strong> RRIFis opened. Thereafter, it only applies to <strong>the</strong> portion ofa RRIF payment in excess of <strong>the</strong> mandatory minimumpayment amount for <strong>the</strong> year.Pension Income <strong>Credit</strong>The pension income credit is a federal income tax crediton qualified pension income (see below). The maximumpension income credit is $2,000. In 2013, <strong>the</strong> maximumpension income credit was $300 ($2,000 x 15% lowesttax bracket). Provincial income tax rules closely parallel <strong>the</strong>federal calculation and will save you an additional amountof provincial tax. The total tax reduction depends on yourprovince of residence.Amounts that DO qualify for this creditAt any age:• periodic payments from a pension plan including VariableBenefits or superannuation plan including foreignpensions taxable in CanadaUNDERSTANDING ALL THE BASICS 27