Pension Plan (Canada) - IUPAT

Pension Plan (Canada) - IUPAT

Pension Plan (Canada) - IUPAT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

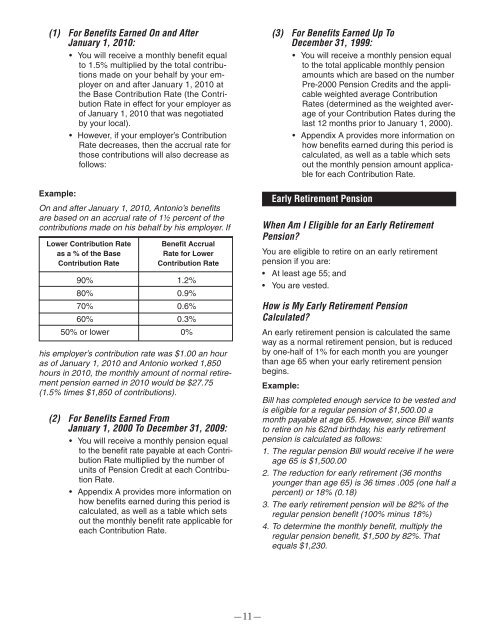

(1) For Benefits Earned On and AfterJanuary 1, 2010:• You will receive a monthly benefit equalto 1.5% multiplied by the total contributionsmade on your behalf by your employeron and after January 1, 2010 atthe Base Contribution Rate (the ContributionRate in effect for your employer asof January 1, 2010 that was negotiatedby your local).• However, if your employer’s ContributionRate decreases, then the accrual rate forthose contributions will also decrease asfollows:Example:On and after January 1, 2010, Antonio’s benefitsare based on an accrual rate of 1½ percent of thecontributions made on his behalf by his employer. IfLower Contribution Rateas a % of the BaseContribution RateBenefit AccrualRate for LowerContribution Rate90% 1.2%80% 0.9%70% 0.6%60% 0.3%50% or lower 0%his employer’s contribution rate was $1.00 an houras of January 1, 2010 and Antonio worked 1,850hours in 2010, the monthly amount of normal retirementpension earned in 2010 would be $27.75(1.5% times $1,850 of contributions).(2) For Benefits Earned FromJanuary 1, 2000 To December 31, 2009:• You will receive a monthly pension equalto the benefit rate payable at each ContributionRate multiplied by the number ofunits of <strong>Pension</strong> Credit at each ContributionRate.• Appendix A provides more information onhow benefits earned during this period iscalculated, as well as a table which setsout the monthly benefit rate applicable foreach Contribution Rate.(3) For Benefits Earned Up ToDecember 31, 1999:• You will receive a monthly pension equalto the total applicable monthly pensionamounts which are based on the numberPre-2000 <strong>Pension</strong> Credits and the applicableweighted average ContributionRates (determined as the weighted averageof your Contribution Rates during thelast 12 months prior to January 1, 2000).• Appendix A provides more information onhow benefits earned during this period iscalculated, as well as a table which setsout the monthly pension amount applicablefor each Contribution Rate.Early Retirement <strong>Pension</strong>When Am I Eligible for an Early Retirement<strong>Pension</strong>?You are eligible to retire on an early retirementpension if you are:• At least age 55; and• You are vested.How is My Early Retirement <strong>Pension</strong>Calculated?An early retirement pension is calculated the sameway as a normal retirement pension, but is reducedby one-half of 1% for each month you are youngerthan age 65 when your early retirement pensionbegins.Example:Bill has completed enough service to be vested andis eligible for a regular pension of $1,500.00 amonth payable at age 65. However, since Bill wantsto retire on his 62nd birthday, his early retirementpension is calculated as follows:1. The regular pension Bill would receive if he wereage 65 is $1,500.002. The reduction for early retirement (36 monthsyounger than age 65) is 36 times .005 (one half apercent) or 18% (0.18)3. The early retirement pension will be 82% of theregular pension benefit (100% minus 18%)4. To determine the monthly benefit, multiply theregular pension benefit, $1,500 by 82%. Thatequals $1,230.—11—