Pension Plan (Canada) - IUPAT

Pension Plan (Canada) - IUPAT

Pension Plan (Canada) - IUPAT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

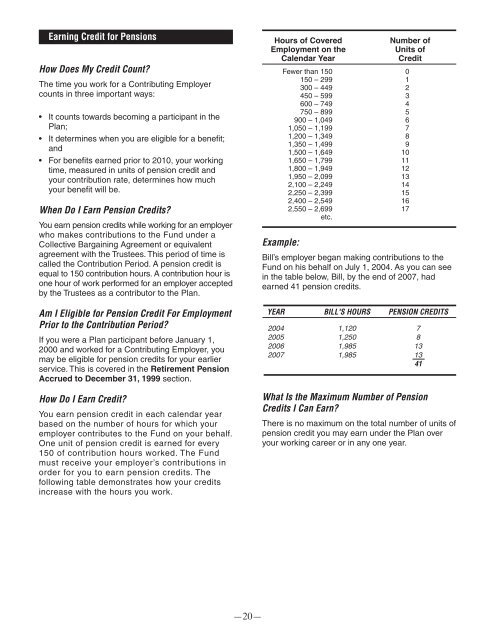

Earning Credit for <strong>Pension</strong>sHow Does My Credit Count?The time you work for a Contributing Employercounts in three important ways:• It counts towards becoming a participant in the<strong>Plan</strong>;• It determines when you are eligible for a benefit;and• For benefits earned prior to 2010, your workingtime, measured in units of pension credit andyour contribution rate, determines how muchyour benefit will be.When Do I Earn <strong>Pension</strong> Credits?You earn pension credits while working for an employerwho makes contributions to the Fund under aCollective Bargaining Agreement or equivalentagreement with the Trustees. This period of time iscalled the Contribution Period. A pension credit isequal to 150 contribution hours. A contribution hour isone hour of work performed for an employer acceptedby the Trustees as a contributor to the <strong>Plan</strong>.Hours of CoveredEmployment on theCalendar YearExample:Fewer than 150150 – 299300 – 449450 – 599600 – 749750 – 899900 – 1,0491,050 – 1,1991,200 – 1,3491,350 – 1,4991,500 – 1,6491,650 – 1,7991,800 – 1,9491,950 – 2,0992,100 – 2,2492,250 – 2,3992,400 – 2,5492,550 – 2,699etc.Number ofUnits ofCredit01234567891011121314151617Bill’s employer began making contributions to theFund on his behalf on July 1, 2004. As you can seein the table below, Bill, by the end of 2007, hadearned 41 pension credits.Am I Eligible for <strong>Pension</strong> Credit For EmploymentPrior to the Contribution Period?If you were a <strong>Plan</strong> participant before January 1,2000 and worked for a Contributing Employer, youmay be eligible for pension credits for your earlierservice. This is covered in the Retirement <strong>Pension</strong>Accrued to December 31, 1999 section.YEAR2004200520062007BILL'S HOURS1,1201,2501,9851,985PENSION CREDITS78131341How Do I Earn Credit?You earn pension credit in each calendar yearbased on the number of hours for which youremployer contributes to the Fund on your behalf.One unit of pension credit is earned for every150 of contribution hours worked. The Fundmust receive your employer’s contributions inorder for you to earn pension credits. Thefollowing table demonstrates how your creditsincrease with the hours you work.What Is the Maximum Number of <strong>Pension</strong>Credits I Can Earn?There is no maximum on the total number of units ofpension credit you may earn under the <strong>Plan</strong> overyour working career or in any one year.—20—