You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

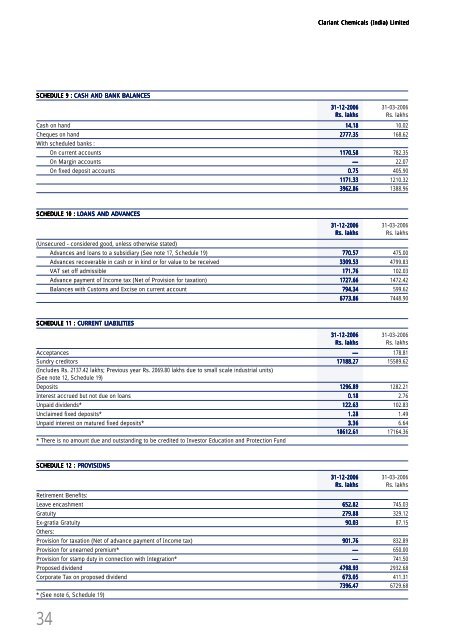

<strong>Clariant</strong> Chemicals (India) LimitedSCHEDULE 9 : CASH AND BANK BALANCES31-12-<strong>2006</strong> 31-03-<strong>2006</strong>Rs. lakhsRs. lakhsCash on hand 14.18 10.02Cheques on hand 2777.35 168.62With scheduled banks :On current accounts 1170.58 782.35On Margin accounts — 22.07On fixed deposit accounts 0.75 405.901171.33 1210.323962.86 1388.96SCHEDULE 10 : LOANS AND ADVANCES31-12-<strong>2006</strong> 31-03-<strong>2006</strong>Rs. lakhsRs. lakhs(Unsecured - considered good, unless otherwise stated)Advances and loans to a subsidiary (See note 17, Schedule 19) 770.57 475.00Advances recoverable in cash or in kind or for value to be received 3309.53 4799.83VAT set off admissible 171.76 102.03Advance payment of Income tax (Net of Provision for taxation) 1727.66 1472.42Balances with Customs and Excise on current account 794.34 599.626773.86 7448.90SCHEDULE 11 : CURRENT LIABILITIES31-12-<strong>2006</strong> 31-03-<strong>2006</strong>Rs. lakhsRs. lakhsAcceptances — 178.81Sundry creditors 17188.27 15589.62(Includes Rs. 2137.42 lakhs; Previous year Rs. 2069.80 lakhs due to small scale industrial units){See note 12, Schedule 19}Deposits 1296.89 1282.21Interest accrued but not due on loans 0.18 2.76Unpaid dividends* 122.63 102.83Unclaimed fixed deposits* 1.28 1.49Unpaid interest on matured fixed deposits* 3.36 6.6418612.61 17164.36* There is no amount due and outstanding to be credited to Investor Education and Protection FundSCHEDULE 12 : PROVISIONS31-12-<strong>2006</strong> 31-03-<strong>2006</strong>Rs. lakhsRs. lakhsRetirement Benefits:Leave encashment 652.82 745.03Gratuity 279.88 329.12Ex-gratia Gratuity 90.03 87.15Others:Provision for taxation (Net of advance payment of Income tax) 901.76 832.89Provision for unearned premium* — 650.00Provision for stamp duty in connection with Integration* — 741.50Proposed dividend 4798.93 2932.68Corporate Tax on proposed dividend 673.05 411.317396.47 6729.68* (See note 6, Schedule 19)34