You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

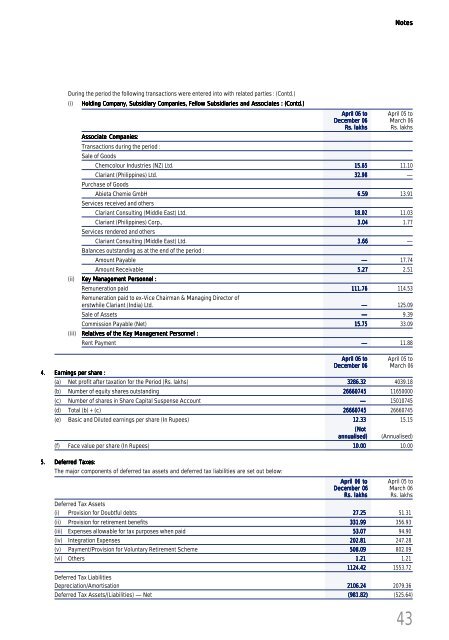

NotesDuring the period the following transactions were entered into with related parties : (Contd.)(i)Holding Company, Subsidiary Companies, Fellow Subsidiaries and Associates : (Contd.)Associate Companies:Transactions during the period :Sale of GoodsApril 06 toApril 05 toDecember 06 March 06Rs. lakhs Rs. lakhsChemcolour Industries (NZ) Ltd. 15.65 11.10<strong>Clariant</strong> (Philippines) Ltd. 32.98 —Purchase of GoodsAbieta Chemie GmbH 6.59 13.91Services received and others<strong>Clariant</strong> Consulting (Middle East) Ltd. 18.02 11.03<strong>Clariant</strong> (Philippines) Corp., 3.04 1.77Services rendered and others<strong>Clariant</strong> Consulting (Middle East) Ltd. 3.66 —Balances outstanding as at the end of the period :Amount Payable — 17.74Amount Receivable 5.27 2.51(ii) Key Management Personnel :Remuneration paid 111.76 114.53Remuneration paid to ex-Vice Chairman & Managing Director oferstwhile <strong>Clariant</strong> (India) Ltd. — 125.09Sale of Assets — 9.39Commission Payable (Net) 15.75 33.09(iii) Relatives of the Key Management Personnel :4. Earnings per share :Rent Payment — 11.88April 06 toApril 05 toDecember 06 March 06(a) Net profit after taxation for the Period (Rs. lakhs) 3286.32 4039.18(b) Number of equity shares outstanding 26660745 11650000(c) Number of shares in Share Capital Suspense Account — 15010745(d) Total (b) + (c) 26660745 26660745(e) Basic and Diluted earnings per share (In Rupees) 12.33 15.15(Notannualised)(<strong>Annual</strong>ised)(f) Face value per share (In Rupees) 10.00 10.005. Deferred Taxes:The major components of deferred tax assets and deferred tax liabilities are set out below:April 06 toApril 05 toDecember 06 March 06Rs. lakhs Rs. lakhsDeferred Tax Assets(i) Provision for Doubtful debts 27.25 51.31(ii) Provision for retirement benefits 331.99 356.93(iii) Expenses allowable for tax purposes when paid 53.07 94.90(iv) Integration Expenses 202.81 247.28(v) Payment/Provision for Voluntary Retirement Scheme 508.09 802.09(vi) Others 1.21 1.211124.42 1553.72Deferred Tax LiabilitiesDepreciation/Amortisation 2106.24 2079.36Deferred Tax Assets/(Liabilities) — Net (981.82) (525.64)43