You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

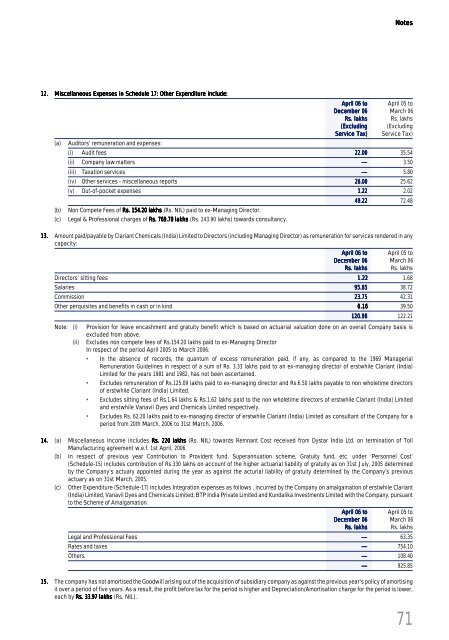

Notes12. Miscellaneous Expenses in Schedule 17: Other Expenditure include:(a)(b)(c)Auditors’ remuneration and expenses:April 06 toApril 05 toDecember 06 March 06Rs. lakhsRs. lakhs(Excluding(ExcludingService Tax)Service Tax)(i) Audit fees 22.00 35.54(ii) Company law matters — 3.50(iii) Taxation services — 5.80(iv) Other services - miscellaneous reports 26.00 25.62(v) Out-of-pocket expenses 1.22 2.02Non Compete Fees of Rs. 154.20 lakhs (Rs. NIL) paid to ex-Managing Director.Legal & Professional charges of Rs. 769.70 lakhs (Rs. 243.90 lakhs) towards consultancy.49.22 72.4813. Amount paid/payable by <strong>Clariant</strong> Chemicals (India) Limited to Directors (including Managing Director) as remuneration for services rendered in anycapacity:April 06 toApril 05 toDecember 06 March 06Rs. lakhsRs. lakhsDirectors’ sitting fees 1.22 1.68Salaries 95.85 38.72Commission 23.75 42.31Other perquisites and benefits in cash or in kind 0.16 39.50120.98 122.21Note: (i) Provision for leave encashment and gratuity benefit which is based on actuarial valuation done on an overall Company basis isexcluded from above.(ii) Excludes non compete fees of Rs.154.20 lakhs paid to ex-Managing DirectorIn respect of the period April 2005 to March <strong>2006</strong>:• In the absence of records, the quantum of excess remuneration paid, if any, as compared to the 1969 ManagerialRemuneration Guidelines in respect of a sum of Rs. 3.33 lakhs paid to an ex-managing director of erstwhile <strong>Clariant</strong> (India)Limited for the years 1981 and 1982, has not been ascertained.• Excludes remuneration of Rs.125.09 lakhs paid to ex-managing director and Rs.6.50 lakhs payable to non wholetime directorsof erstwhile <strong>Clariant</strong> (India) Limited.• Excludes sitting fees of Rs.1.64 lakhs & Rs.1.62 lakhs paid to the non wholetime directors of erstwhile <strong>Clariant</strong> (India) Limitedand erstwhile Vanavil Dyes and Chemicals Limited respectively.• Excludes Rs. 62.20 lakhs paid to ex-managing director of erstwhile <strong>Clariant</strong> (India) Limited as consultant of the Company for aperiod from 20th March, <strong>2006</strong> to 31st March, <strong>2006</strong>.14. (a) Miscellaneous Income includes Rs. 220 lakhs (Rs. NIL) towards Remnant Cost received from Dystar India Ltd. on termination of TollManufacturing agreement w.e.f. 1st April, <strong>2006</strong>.(b) In respect of previous year Contribution to Provident fund, Superannuation scheme, Gratuity fund, etc. under ‘Personnel Cost’(Schedule-15) includes contribution of Rs.330 lakhs on account of the higher actuarial liability of gratuity as on 31st July, 2005 determinedby the Company’s actuary appointed during the year as against the acturial liability of gratuity determined by the Company’s previousactuary as on 31st March, 2005.(c) Other Expenditure (Schedule-17) includes Integration expenses as follows , incurred by the Company on amalgamation of erstwhile <strong>Clariant</strong>(India) Limited, Vanavil Dyes and Chemicals Limited, BTP India Private Limited and Kundalika Investments Limited with the Company, pursuantto the Scheme of Amalgamation.April 06 toApril 05 toDecember 06 March 06Rs. lakhsRs. lakhsLegal and Professional Fees — 63.35Rates and taxes — 754.10Others — 108.40— 925.8515. The company has not amortised the Goodwill arising out of the acquisition of subsidiary company as against the previous year’s policy of amortisingit over a period of five years. As a result, the profit before tax for the period is higher and Depreciation/Amortisation charge for the period is lower,each by Rs. 33.97 lakhs (Rs. NIL).71