You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

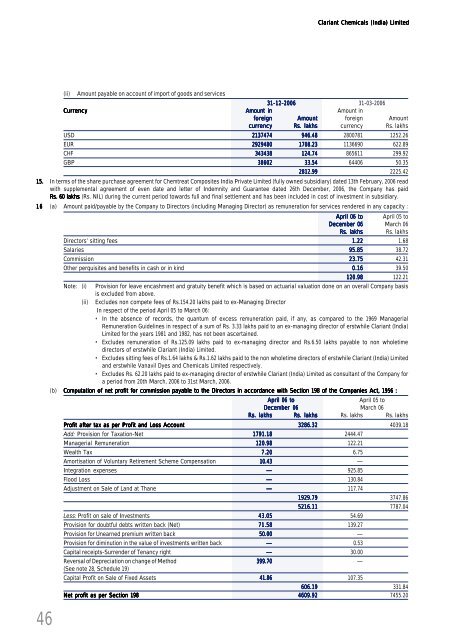

<strong>Clariant</strong> Chemicals (India) Limited(ii) Amount payable on account of import of goods and services31-12-<strong>2006</strong> 31-03-<strong>2006</strong>CurrencyAmount inAmount inforeignAmount foreign AmountcurrencyRs. lakhs currency Rs. lakhsUSD 2137474 946.48 2800781 1252.26EUR 2929480 1708.23 1136690 622.89CHF 343438 124.74 865611 299.92GBP 38602 33.54 64406 50.352812.99 2225.4215. In terms of the share purchase agreement for Chemtreat Composites India Private Limited (fully owned subsidiary) dated 13th February, <strong>2006</strong> readwith supplemental agreement of even date and letter of Indemnity and Guarantee dated 26th December, <strong>2006</strong>, the Company has paidRs. 60 lakhs (Rs. NIL) during the current period towards full and final settlement and has been included in cost of investment in subsidiary.16 (a) Amount paid/payable by the Company to Directors (including Managing Director) as remuneration for services rendered in any capacity :46April 06 toApril 05 toDecember 06 March 06Rs. lakhs Rs. lakhsDirectors’ sitting fees 1.22 1.68Salaries 95.85 38.72Commission 23.75 42.31Other perquisites and benefits in cash or in kind 0.16 39.50120.98 122.21Note: (i) Provision for leave encashment and gratuity benefit which is based on actuarial valuation done on an overall Company basisis excluded from above.(ii) Excludes non compete fees of Rs.154.20 lakhs paid to ex-Managing DirectorIn respect of the period April 05 to March 06:• In the absence of records, the quantum of excess remuneration paid, if any, as compared to the 1969 ManagerialRemuneration Guidelines in respect of a sum of Rs. 3.33 lakhs paid to an ex-managing director of erstwhile <strong>Clariant</strong> (India)Limited for the years 1981 and 1982, has not been ascertained.• Excludes remuneration of Rs.125.09 lakhs paid to ex-managing director and Rs.6.50 lakhs payable to non wholetimedirectors of erstwhile <strong>Clariant</strong> (India) Limited.• Excludes sitting fees of Rs.1.64 lakhs & Rs.1.62 lakhs paid to the non wholetime directors of erstwhile <strong>Clariant</strong> (India) Limitedand erstwhile Vanavil Dyes and Chemicals Limited respectively.• Excludes Rs. 62.20 lakhs paid to ex-managing director of erstwhile <strong>Clariant</strong> (India) Limited as consultant of the Company fora period from 20th March, <strong>2006</strong> to 31st March, <strong>2006</strong>.(b) Computation of net profit for commission payable to the Directors in accordance with Section 198 of the Companies Act, 1956 :April 06 toApril 05 toDecember 06 March 06Rs. lakhsRs. lakhs Rs. lakhs Rs. lakhsProfit after tax as per Profit and Loss Account 3286.32 4039.18Add: Provision for Taxation-Net 1791.18 2444.47Managerial Remuneration 120.98 122.21Wealth Tax 7.20 6.75Amortisation of Voluntary Retirement Scheme Compensation 10.43 —Integration expenses — 925.85Flood Loss — 130.84Adjustment on Sale of Land at Thane — 117.741929.79 3747.865216.11 7787.04Less: Profit on sale of Investments 43.05 54.69Provision for doubtful debts written back (Net) 71.58 139.27Provision for Unearned premium written back 50.00 —Provision for diminution in the value of investments written back — 0.53Capital receipts-Surrender of Tenancy right — 30.00Reversal of Depreciation on change of Method 399.70 —(See note 28, Schedule 19)Capital Profit on Sale of Fixed Assets 41.86 107.35606.19 331.84Net profit as per Section 198 4609.92 7455.20