Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

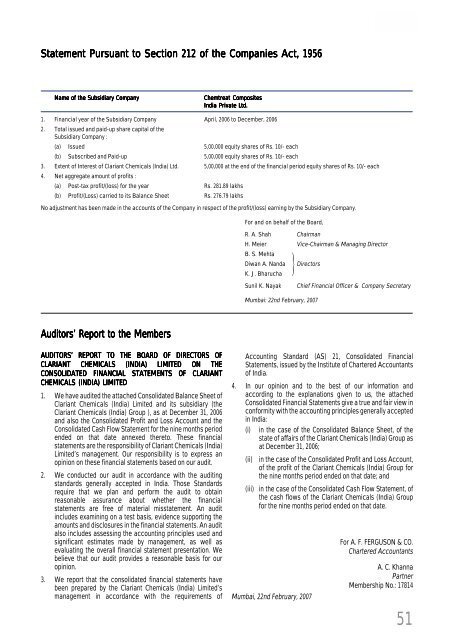

NotesStatement Pursuant to Section 212 of the Companies Act, 1956Name of the Subsidiary CompanyChemtreat CompositesIndia Private Ltd.1. Financial year of the Subsidiary Company April, <strong>2006</strong> to December, <strong>2006</strong>2. Total issued and paid-up share capital of theSubsidiary Company :(a) Issued 5,00,000 equity shares of Rs. 10/- each(b) Subscribed and Paid-up 5,00,000 equity shares of Rs. 10/- each3. Extent of Interest of <strong>Clariant</strong> Chemicals (India) Ltd. 5,00,000 at the end of the financial period equity shares of Rs. 10/- each4. Net aggregate amount of profits :(a) Post-tax profit/(loss) for the year Rs. 281.89 lakhs(b) Profit/(Loss) carried to its Balance Sheet Rs. 276.79 lakhsNo adjustment has been made in the accounts of the Company in respect of the profit/(loss) earning by the Subsidiary Company.For and on behalf of the Board,R. A. Shah ChairmanH. Meier Vice-Chairman & Managing DirectorB. S. MehtaDiwan A. Nanda Directors}K. J. BharuchaSunil K. NayakMumbai: 22nd February, 2007Chief Financial Officer & Company SecretaryAuditors’ <strong>Report</strong> to the MembersAUDITORS’ REPORT TO THE BOARD OF DIRECTORS OFCLARIANT CHEMICALS (INDIA) LIMITED ON THECONSOLIDATED FINANCIAL STATEMENTS OF CLARIANTCHEMICALS (INDIA) LIMITED1. We have audited the attached Consolidated Balance Sheet of<strong>Clariant</strong> Chemicals (India) Limited and its subsidiary (the<strong>Clariant</strong> Chemicals (India) Group ), as at December 31, <strong>2006</strong>and also the Consolidated Profit and Loss Account and theConsolidated Cash Flow Statement for the nine months periodended on that date annexed thereto. These financialstatements are the responsibility of <strong>Clariant</strong> Chemicals (India)Limited’s management. Our responsibility is to express anopinion on these financial statements based on our audit.2. We conducted our audit in accordance with the auditingstandards generally accepted in India. Those Standardsrequire that we plan and perform the audit to obtainreasonable assurance about whether the financialstatements are free of material misstatement. An auditincludes examining on a test basis, evidence supporting theamounts and disclosures in the financial statements. An auditalso includes assessing the accounting principles used andsignificant estimates made by management, as well asevaluating the overall financial statement presentation. Webelieve that our audit provides a reasonable basis for ouropinion.3. We report that the consolidated financial statements havebeen prepared by the <strong>Clariant</strong> Chemicals (India) Limited’smanagement in accordance with the requirements ofAccounting Standard (AS) 21, Consolidated FinancialStatements, issued by the Institute of Chartered Accountantsof India.4. In our opinion and to the best of our information andaccording to the explanations given to us, the attachedConsolidated Financial Statements give a true and fair view inconformity with the accounting principles generally acceptedin India:(i) in the case of the Consolidated Balance Sheet, of thestate of affairs of the <strong>Clariant</strong> Chemicals (India) Group asat December 31, <strong>2006</strong>;(ii) in the case of the Consolidated Profit and Loss Account,of the profit of the <strong>Clariant</strong> Chemicals (India) Group forthe nine months period ended on that date; and(iii) in the case of the Consolidated Cash Flow Statement, ofthe cash flows of the <strong>Clariant</strong> Chemicals (India) Groupfor the nine months period ended on that date.Mumbai, 22nd February, 2007For A. F. FERGUSON & CO.Chartered AccountantsA. C. KhannaPartnerMembership No.: 1781451