UACS Collection of Abstracts 2011 - University American College ...

UACS Collection of Abstracts 2011 - University American College ...

UACS Collection of Abstracts 2011 - University American College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

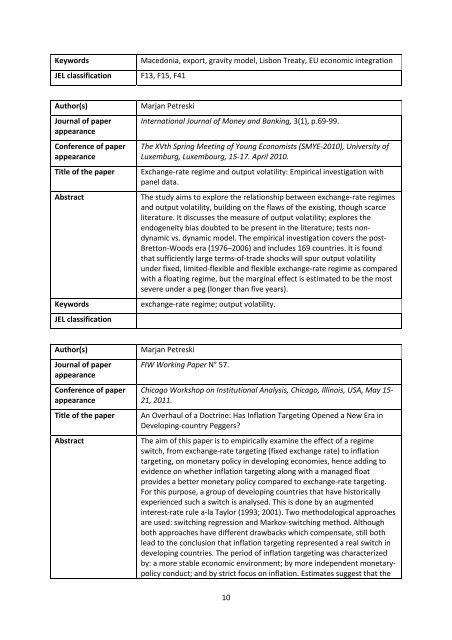

KeywordsJEL classificationMacedonia, export, gravity model, Lisbon Treaty, EU economic integrationF13, F15, F41Author(s)Journal <strong>of</strong> paperappearanceConference <strong>of</strong> paperappearanceTitle <strong>of</strong> the paperAbstractKeywordsJEL classificationMarjan PetreskiInternational Journal <strong>of</strong> Money and Banking, 3(1), p.69‐99.The XVth Spring Meeting <strong>of</strong> Young Economists (SMYE‐2010), <strong>University</strong> <strong>of</strong>Luxemburg, Luxembourg, 15‐17. April 2010.Exchange‐rate regime and output volatility: Empirical investigation withpanel data.The study aims to explore the relationship between exchange‐rate regimesand output volatility, building on the flaws <strong>of</strong> the existing, though scarceliterature. It discusses the measure <strong>of</strong> output volatility; explores theendogeneity bias doubted to be present in the literature; tests nondynamicvs. dynamic model. The empirical investigation covers the post‐Bretton‐Woods era (1976–2006) and includes 169 countries. It is foundthat sufficiently large terms‐<strong>of</strong>‐trade shocks will spur output volatilityunder fixed, limited‐flexible and flexible exchange‐rate regime as comparedwith a floating regime, but the marginal effect is estimated to be the mostsevere under a peg (longer than five years).exchange‐rate regime; output volatility.Author(s)Journal <strong>of</strong> paperappearanceConference <strong>of</strong> paperappearanceTitle <strong>of</strong> the paperAbstractMarjan PetreskiFIW Working Paper N° 57.Chicago Workshop on Institutional Analysis, Chicago, Illinois, USA, May 15‐21, <strong>2011</strong>.An Overhaul <strong>of</strong> a Doctrine: Has Inflation Targeting Opened a New Era inDeveloping‐country Peggers?The aim <strong>of</strong> this paper is to empirically examine the effect <strong>of</strong> a regimeswitch, from exchange‐rate targeting (fixed exchange rate) to inflationtargeting, on monetary policy in developing economies, hence adding toevidence on whether inflation targeting along with a managed floatprovides a better monetary policy compared to exchange‐rate targeting.For this purpose, a group <strong>of</strong> developing countries that have historicallyexperienced such a switch is analysed. This is done by an augmentedinterest‐rate rule a‐la Taylor (1993; 2001). Two methodological approachesare used: switching regression and Markov‐switching method. Althoughboth approaches have different drawbacks which compensate, still bothlead to the conclusion that inflation targeting represented a real switch indeveloping countries. The period <strong>of</strong> inflation targeting was characterizedby: a more stable economic environment; by more independent monetarypolicyconduct; and by strict focus on inflation. Estimates suggest that the10

![amerikan kolex ]e bide prv univerzitet od treta generacija vo ...](https://img.yumpu.com/47278343/1/190x252/amerikan-kolex-e-bide-prv-univerzitet-od-treta-generacija-vo-.jpg?quality=85)