UACS Collection of Abstracts 2011 - University American College ...

UACS Collection of Abstracts 2011 - University American College ...

UACS Collection of Abstracts 2011 - University American College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

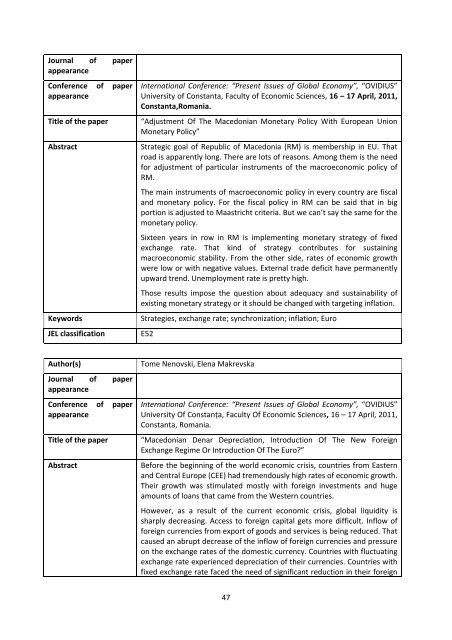

Journal <strong>of</strong> paperappearanceConference <strong>of</strong> paperappearanceTitle <strong>of</strong> the paperAbstractKeywordsJEL classificationInternational Conference: “Present Issues <strong>of</strong> Global Economy”, “OVIDIUS”<strong>University</strong> <strong>of</strong> Constanta, Faculty <strong>of</strong> Economic Sciences, 16 – 17 April, <strong>2011</strong>,Constanta,Romania.“Adjustment Of The Macedonian Monetary Policy With European UnionMonetary Policy”Strategic goal <strong>of</strong> Republic <strong>of</strong> Macedonia (RM) is membership in EU. Thatroad is apparently long. There are lots <strong>of</strong> reasons. Among them is the needfor adjustment <strong>of</strong> particular instruments <strong>of</strong> the macroeconomic policy <strong>of</strong>RM.The main instruments <strong>of</strong> macroeconomic policy in every country are fiscaland monetary policy. For the fiscal policy in RM can be said that in bigportion is adjusted to Maastricht criteria. But we can’t say the same for themonetary policy.Sixteen years in row in RM is implementing monetary strategy <strong>of</strong> fixedexchange rate. That kind <strong>of</strong> strategy contributes for sustainingmacroeconomic stability. From the other side, rates <strong>of</strong> economic growthwere low or with negative values. External trade deficit have permanentlyupward trend. Unemployment rate is pretty high.Those results impose the question about adequacy and sustainability <strong>of</strong>existing monetary strategy or it should be changed with targeting inflation.Strategies, exchange rate; synchronization; inflation; EuroE52Author(s)Journal <strong>of</strong> paperappearanceConference <strong>of</strong> paperappearanceTitle <strong>of</strong> the paperAbstractTome Nenovski, Elena MakrevskaInternational Conference: “Present Issues <strong>of</strong> Global Economy”, “OVIDIUS”<strong>University</strong> Of Constanța, Faculty Of Economic Sciences, 16 – 17 April, <strong>2011</strong>,Constanta, Romania.“Macedonian Denar Depreciation, Introduction Of The New ForeignExchange Regime Or Introduction Of The Euro?”Before the beginning <strong>of</strong> the world economic crisis, countries from Easternand Central Europe (CEE) had tremendously high rates <strong>of</strong> economic growth.Their growth was stimulated mostly with foreign investments and hugeamounts <strong>of</strong> loans that came from the Western countries.However, as a result <strong>of</strong> the current economic crisis, global liquidity issharply decreasing. Access to foreign capital gets more difficult. Inflow <strong>of</strong>foreign currencies from export <strong>of</strong> goods and services is being reduced. Thatcaused an abrupt decrease <strong>of</strong> the inflow <strong>of</strong> foreign currencies and pressureon the exchange rates <strong>of</strong> the domestic currency. Countries with fluctuatingexchange rate experienced depreciation <strong>of</strong> their currencies. Countries withfixed exchange rate faced the need <strong>of</strong> significant reduction in their foreign47

![amerikan kolex ]e bide prv univerzitet od treta generacija vo ...](https://img.yumpu.com/47278343/1/190x252/amerikan-kolex-e-bide-prv-univerzitet-od-treta-generacija-vo-.jpg?quality=85)