403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

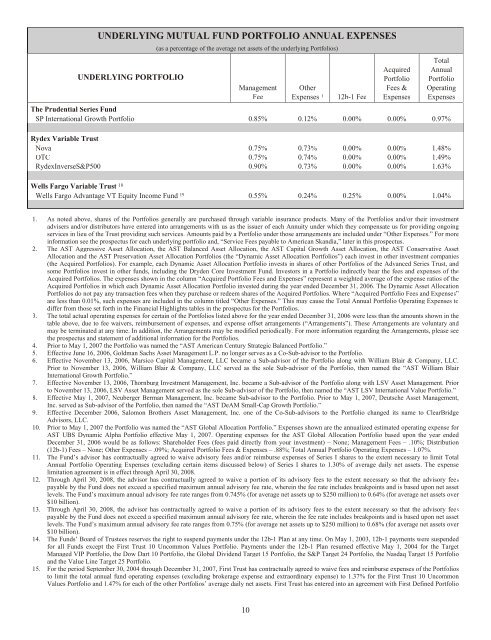

UNDERLYING MUTUAL FUND PORTFOLIO ANNUAL EXPENSESUNDERLYING PORTFOLIO(as a percentage of the average net assets of the underlying Portfolios)ManagementFeeOtherExpenses 112b-1 FeeAcquiredPortfolioFees &ExpensesTotalAnnualPortfolioOperatingExpensesThe <strong>Prudential</strong> Series FundSP International Growth Portfolio 0.85% 0.12% 0.00% 0.00% 0.97%Rydex Variable TrustNova 0.75% 0.73% 0.00% 0.00% 1.48%OTC 0.75% 0.74% 0.00% 0.00% 1.49%RydexInverseS&P500 0.90% 0.73% 0.00% 0.00% 1.63%Wells Fargo Variable Trust 18Wells Fargo Advantage VT Equity Income Fund 19 0.55% 0.24% 0.25% 0.00% 1.04%1. As noted above, shares of the Portfolios generally are purchased through variable insurance products. Many of the Portfolios and/or their investmentadvisers and/or distributors have entered into arrangements with us as the issuer of each Annuity under which they compensate us for providing ongoingservices in lieu of the Trust providing such services. Amounts paid by a Portfolio under those arrangements are included under “Other Expenses.” For moreinformation see the prospectus for each underlying portfolio and, “Service Fees payable to American Skandia,” later in this prospectus.2. The AST Aggressive Asset Allocation, the AST Balanced Asset Allocation, the AST Capital Growth Asset Allocation, the AST Conservative AssetAllocation and the AST Preservation Asset Allocation Portfolios (the “Dynamic Asset Allocation Portfolios”) each invest in other investment companies(the Acquired Portfolios). For example, each Dynamic Asset Allocation Portfolio invests in shares of other Portfolios of the Advanced Series Trust, andsome Portfolios invest in other funds, including the Dryden Core Investment Fund. Investors in a Portfolio indirectly bear the fees and expenses of theAcquired Portfolios. The expenses shown in the column “Acquired Portfolio Fees and Expenses” represent a weighted average of the expense ratios of theAcquired Portfolios in which each Dynamic Asset Allocation Portfolio invested during the year ended December 31, 2006. The Dynamic Asset AllocationPortfolios do not pay any transaction fees when they purchase or redeem shares of the Acquired Portfolios. Where “Acquired Portfolio Fees and Expenses”are less than 0.01%, such expenses are included in the column titled “Other Expenses.” This may cause the Total Annual Portfolio Operating Expenses todiffer from those set forth in the Financial Highlights tables in the prospectus for the Portfolios.3. The total actual operating expenses for certain of the Portfolios listed above for the year ended December 31, 2006 were less than the amounts shown in thetable above, due to fee waivers, reimbursement of expenses, and expense offset arrangements (“Arrangements”). These Arrangements are voluntary andmay be terminated at any time. In addition, the Arrangements may be modified periodically. For more information regarding the Arrangements, please seethe prospectus and statement of additional information for the Portfolios.4. Prior to May 1, 2007 the Portfolio was named the “AST American Century Strategic Balanced Portfolio.”5. Effective June 16, 2006, Goldman Sachs Asset Management L.P. no longer serves as a Co-Sub-advisor to the Portfolio.6. Effective November 13, 2006, Marsico Capital Management, LLC became a Sub-advisor of the Portfolio along with William Blair & Company, LLC.Prior to November 13, 2006, William Blair & Company, LLC served as the sole Sub-advisor of the Portfolio, then named the “AST William BlairInternational Growth Portfolio.”7. Effective November 13, 2006, Thornburg Investment Management, Inc. became a Sub-advisor of the Portfolio along with LSV Asset Management. Priorto November 13, 2006, LSV Asset Management served as the sole Sub-advisor of the Portfolio, then named the “AST LSV International Value Portfolio.”8. Effective May 1, 2007, Neuberger Berman Management, Inc. became Sub-advisor to the Portfolio. Prior to May 1, 2007, Deutsche Asset Management,Inc. served as Sub-advisor of the Portfolio, then named the “AST DeAM Small-Cap Growth Portfolio.”9. Effective December 2006, Salomon Brothers Asset Management, Inc. one of the Co-Sub-advisors to the Portfolio changed its name to ClearBridgeAdvisors, LLC.10. Prior to May 1, 2007 the Portfolio was named the “AST Global Allocation Portfolio.” Expenses shown are the annualized estimated operating expense forAST UBS Dynamic Alpha Portfolio effective May 1, 2007. Operating expenses for the AST Global Allocation Portfolio based upon the year endedDecember 31, 2006 would be as follows: Shareholder Fees (fees paid directly from your investment) – None; Management Fees – .10%; Distribution(12b-1) Fees – None; Other Expenses – .09%; Acquired Portfolio Fees & Expenses – .88%; Total Annual Portfolio Operating Expenses – 1.07%.11. The Fund’s advisor has contractually agreed to waive advisory fees and/or reimburse expenses of Series I shares to the extent necessary to limit TotalAnnual Portfolio Operating Expenses (excluding certain items discussed below) of Series I shares to 1.30% of average daily net assets. The expenselimitation agreement is in effect through April 30, 2008.12. Through April 30, 2008, the advisor has contractually agreed to waive a portion of its advisory fees to the extent necessary so that the advisory feespayable by the Fund does not exceed a specified maximum annual advisory fee rate, wherein the fee rate includes breakpoints and is based upon net assetlevels. The Fund’s maximum annual advisory fee rate ranges from 0.745% (for average net assets up to $250 million) to 0.64% (for average net assets over$10 billion).13. Through April 30, 2008, the advisor has contractually agreed to waive a portion of its advisory fees to the extent necessary so that the advisory feespayable by the Fund does not exceed a specified maximum annual advisory fee rate, wherein the fee rate includes breakpoints and is based upon net assetlevels. The Fund’s maximum annual advisory fee rate ranges from 0.75% (for average net assets up to $250 million) to 0.68% (for average net assets over$10 billion).14. The Funds’ Board of Trustees reserves the right to suspend payments under the 12b-1 Plan at any time. On May 1, 2003, 12b-1 payments were suspendedfor all Funds except the First Trust 10 Uncommon Values Portfolio. Payments under the 12b-1 Plan resumed effective May 1, 2004 for the TargetManaged VIP Portfolio, the Dow Dart 10 Portfolio, the Global Dividend Target 15 Portfolio, the S&P Target 24 Portfolio, the Nasdaq Target 15 Portfolioand the Value Line Target 25 Portfolio.15. For the period September 30, 2004 through December 31, 2007, First Trust has contractually agreed to waive fees and reimburse expenses of the Portfoliosto limit the total annual fund operating expenses (excluding brokerage expense and extraordinary expense) to 1.37% for the First Trust 10 UncommonValues Portfolio and 1.47% for each of the other Portfolios’ average daily net assets. First Trust has entered into an agreement with First Defined Portfolio10