403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

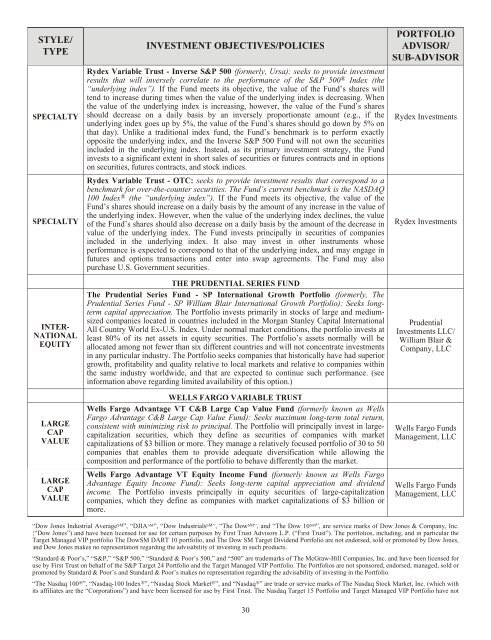

STYLE/TYPESPECIALTYSPECIALTYINTER-NATIONALEQUITYLARGECAPVALUELARGECAPVALUEINVESTMENT OBJECTIVES/POLICIESRydex Variable Trust - Inverse S&P 500 (formerly, Ursa): seeks to provide investmentresults that will inversely correlate to the performance of the S&P 500 ® Index (the“underlying index”). If the Fund meets its objective, the value of the Fund’s shares willtend to increase during times when the value of the underlying index is decreasing. Whenthe value of the underlying index is increasing, however, the value of the Fund’s sharesshould decrease on a daily basis by an inversely proportionate amount (e.g., if theunderlying index goes up by 5%, the value of the Fund’s shares should go down by 5% onthat day). Unlike a traditional index fund, the Fund’s benchmark is to perform exactlyopposite the underlying index, and the Inverse S&P 500 Fund will not own the securitiesincluded in the underlying index. Instead, as its primary investment strategy, the Fundinvests to a significant extent in short sales of securities or futures contracts and in optionson securities,futures contracts, and stockindices.Rydex Variable Trust - OTC: seeks to provide investment results that correspond to abenchmark for over-the-counter securities. The Fund’s current benchmark is the NASDAQ100 Index ® (the “underlying index”). If the Fund meets its objective, the value of theFund’s shares should increase on a daily basis by the amount of any increase in the value ofthe underlying index. However, when the value of the underlying index declines, the valueof the Fund’s shares should also decrease on a daily basis by the amount of the decrease invalue of the underlying index. The Fund invests principally in securities of companiesincluded in the underlying index. It also may invest in other instruments whoseperformance is expected to correspond to that of the underlying index, and may engage infutures and options transactions and enter into swap agreements. The Fund may alsopurchase U.S. Government securities.THE PRUDENTIAL SERIES FUNDThe <strong>Prudential</strong> Series Fund - SP International Growth Portfolio (formerly, The<strong>Prudential</strong> Series Fund - SP William Blair International Growth Portfolio): Seeks longtermcapital appreciation. The Portfolio invests primarily in stocks oflarge and mediumsizedcompanies located in countries included in the Morgan Stanley Capital InternationalAll Country World Ex-U.S. Index. Under normal market conditions, the portfolio invests atleast 80% of its net assets in equity securities. The Portfolio’s assets normally will beallocated among not fewer than six different countries and will not concentrate investmentsin any particular industry. The Portfolio seeks companies that historically have had superiorgrowth, profitability and quality relative to local markets and relative to companies withinthe same industry worldwide, and that are expected to continue such performance. (seeinformation above regarding limited availability of this option.)WELLS FARGO VARIABLE TRUSTWells Fargo Advantage VT C&B Large Cap Value Fund (formerly known as WellsFargo Advantage C&B Large Cap Value Fund): Seeks maximum long-term total return,consistent with minimizing risk to principal. The Portfolio will principally invest in largecapitalizationsecurities, which they define as securities of companies with marketcapitalizations of $3 billion or more. They manage a relatively focused portfolio of 30 to 50companies that enables them to provide adequate diversification while allowing thecomposition and performance of the portfoliotobehave differentlythan the market.Wells Fargo Advantage VT Equity Income Fund (formerly known as Wells FargoAdvantage Equity Income Fund): Seeks long-term capital appreciation and dividendincome. The Portfolio invests principally in equity securities of large-capitalizationcompanies, which they define as companies with market capitalizations of $3 billion ormore.PORTFOLIOADVISOR/SUB-ADVISORRydex InvestmentsRydex Investments<strong>Prudential</strong>Investments LLC/William Blair &Company,LLCWells Fargo FundsManagement, LLCWells Fargo FundsManagement, LLC“Dow Jones Industrial Average SM ”, “DJIA SM ”, “Dow Industrials SM ”, “The Dow SM ”, and “The Dow 10 SM ”, are service marks of Dow Jones & Company, Inc.(“Dow Jones”) and have been licensed for use for certain purposes by First Trust Advisors L.P. (“First Trust”). The portfolios, including, and in particular theTarget Managed VIP portfolio The DowSM DART 10 portfolio, and The Dow SM Target Dividend Portfolio are not endorsed, sold or promoted by Dow Jones,and Dow Jones makes no representation regarding theadvisability ofinvestingin such products.“Standard & Poor’s,” “S&P,” “S&P 500,” “Standard & Poor’s 500,” and “500” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed foruse by First Trust on behalf of the S&P Target 24 Portfolio and the Target Managed VIP Portfolio. The Portfolios are not sponsored, endorsed, managed, sold orpromoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in the Portfolio.“The Nasdaq 100 ® ”, “Nasdaq-100 Index ® ”, “Nasdaq Stock Market ® ”, and “Nasdaq ® ” are trade or service marks of The Nasdaq Stock Market, Inc. (which withits affiliates are the “Corporations”) and have been licensed for use by First Trust. The Nasdaq Target 15 Portfolio and Target Managed VIP Portfolio have not30