403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

403_b_ Sticker - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

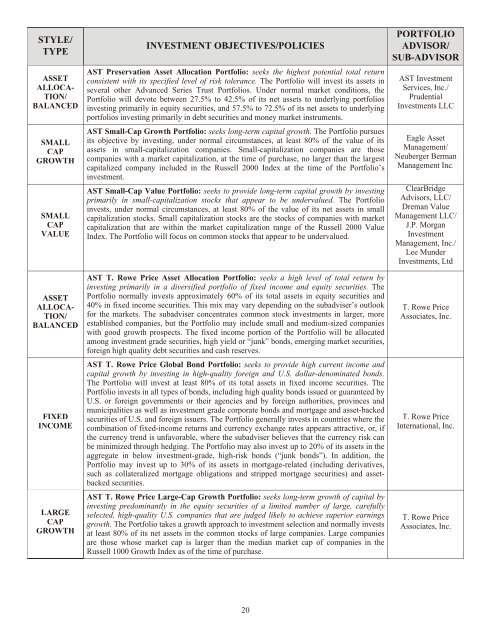

STYLE/TYPEASSETALLOCA-TION/BALANCEDSMALLCAPGROWTHSMALLCAPVALUEASSETALLOCA-TION/BALANCEDFIXEDINCOMELARGECAPGROWTHINVESTMENT OBJECTIVES/POLICIESAST Preservation Asset Allocation Portfolio: seeks the highest potential total returnconsistent with its specified level of risk tolerance. The Portfolio will invest its assets inseveral other Advanced Series Trust Portfolios. Under normal market conditions, thePortfolio will devote between 27.5% to 42.5% of its net assets to underlying portfoliosinvesting primarily in equity securities, and 57.5% to 72.5% of its net assets to underlyingportfolios investing primarily in debt securities and money market instruments.AST Small-Cap Growth Portfolio: seeks long-term capital growth. The Portfolio pursuesits objective by investing, under normal circumstances, at least 80% of the value of itsassets in small-capitalization companies. Small-capitalization companies are thosecompanies with a market capitalization, at the time of purchase, no larger than the largestcapitalized company included inthe Russell 2000 Index at the time of the Portfolio’sinvestment.AST Small-Cap Value Portfolio: seeks to provide long-term capital growth by investingprimarily in small-capitalization stocks that appear to be undervalued. The Portfolioinvests, under normal circumstances, at least 80% of the value of its net assets in smallcapitalization stocks. Small capitalization stocks are the stocks of companies with marketcapitalization that are within the market capitalization range of the Russell 2000 ValueIndex. The Portfoliowill focus on common stocksthat appear to beundervalued.AST T. Rowe Price Asset Allocation Portfolio: seeks ahigh level of total return byinvesting primarily inadiversified portfolio of fixed income and equity securities. ThePortfolio normally invests approximately 60% of its total assets in equity securities and40% in fixed income securities. This mix may vary depending on the subadviser’s outlookfor the markets. The subadviser concentrates common stock investments in larger, moreestablished companies, but the Portfolio may include small and medium-sized companieswith good growth prospects. The fixed income portion of the Portfolio will be allocatedamong investment grade securities, high yield or “junk” bonds, emerging market securities,foreignhigh quality debt securities and cash reserves.AST T. Rowe Price Global Bond Portfolio: seeks to provide high current income andcapital growth by investing in high-quality foreign and U.S. dollar-denominated bonds.The Portfolio will invest at least 80% of its total assets in fixed income securities. ThePortfolio invests in all types of bonds, including high quality bonds issued or guaranteed byU.S. or foreign governments or their agencies and by foreign authorities, provinces andmunicipalities as well as investment grade corporate bonds and mortgage and asset-backedsecurities of U.S. and foreign issuers. The Portfolio generally invests in countries where thecombination of fixed-income returns and currency exchange rates appears attractive, or, ifthe currency trend isunfavorable, where the subadviser believes that the currency risk canbe minimized through hedging. The Portfolio may also invest up to 20% of its assets in theaggregate in below investment-grade, high-risk bonds (“junk bonds”). In addition, thePortfolio may invest up to 30% of its assets in mortgage-related (including derivatives,such as collateralized mortgage obligations and stripped mortgage securities) and assetbackedsecurities.AST T. Rowe Price Large-Cap Growth Portfolio: seeks long-term growth of capital byinvesting predominantly in the equity securities of a limited number of large, carefullyselected, high-quality U.S. companies that are judged likely to achieve superior earningsgrowth. The Portfoliotakes a growth approach to investment selection and normally investsat least 80% of its net assets in the common stocks oflarge companies. Large companiesare those whose market cap is larger than the median market cap of companies in theRussell 1000 Growth Index as of the time of purchase.PORTFOLIOADVISOR/SUB-ADVISORAST InvestmentServices, Inc./<strong>Prudential</strong>Investments LLCEagle AssetManagement/Neuberger BermanManagement Inc.ClearBridgeAdvisors, LLC/Dreman ValueManagement LLC/J.P. MorganInvestmentManagement, Inc./Lee MunderInvestments, LtdT. Rowe PriceAssociates, Inc.T. Rowe PriceInternational, Inc.T. Rowe PriceAssociates, Inc.20