selecting an open mep employers due diligence checklist - Fi360

selecting an open mep employers due diligence checklist - Fi360

selecting an open mep employers due diligence checklist - Fi360

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

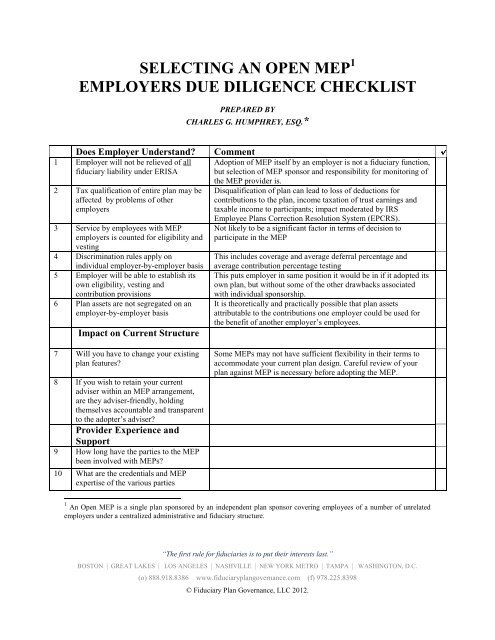

SELECTING AN OPEN MEP 1EMPLOYERS DUE DILIGENCE CHECKLISTPREPARED BYCHARLES G. HUMPHREY, ESQ.*Does Employer Underst<strong>an</strong>d?1 Employer will not be relieved of allfiduciary liability under ERISA2 Tax qualification of entire pl<strong>an</strong> may beaffected by problems of other<strong>employers</strong>3 Service by employees with MEP<strong>employers</strong> is counted for eligibility <strong>an</strong>dvesting4 Discrimination rules apply onindividual employer-by-employer basis5 Employer will be able to establish itsown eligibility, vesting <strong>an</strong>dcontribution provisions6 Pl<strong>an</strong> assets are not segregated on <strong>an</strong>employer-by-employer basisImpact on Current Structure7 Will you have to ch<strong>an</strong>ge your existingpl<strong>an</strong> features?8 If you wish to retain your currentadviser within <strong>an</strong> MEP arr<strong>an</strong>gement,are they adviser-friendly, holdingthemselves accountable <strong>an</strong>d tr<strong>an</strong>sparentto the adopter’s adviser?Provider Experience <strong>an</strong>dSupport9 How long have the parties to the MEPbeen involved with MEPs?10 What are the credentials <strong>an</strong>d MEPexpertise of the various partiesCommentAdoption of MEP itself by <strong>an</strong> employer is not a fiduciary function,but selection of MEP sponsor <strong>an</strong>d responsibility for monitoring ofthe MEP provider is.Disqualification of pl<strong>an</strong> c<strong>an</strong> lead to loss of deductions forcontributions to the pl<strong>an</strong>, income taxation of trust earnings <strong>an</strong>dtaxable income to particip<strong>an</strong>ts; impact moderated by IRSEmployee Pl<strong>an</strong>s Correction Resolution System (EPCRS).Not likely to be a signific<strong>an</strong>t factor in terms of decision toparticipate in the MEPThis includes coverage <strong>an</strong>d average deferral percentage <strong>an</strong>daverage contribution percentage testingThis puts employer in same position it would be in if it adopted itsown pl<strong>an</strong>, but without some of the other drawbacks associatedwith individual sponsorship.It is theoretically <strong>an</strong>d practically possible that pl<strong>an</strong> assetsattributable to the contributions one employer could be used forthe benefit of <strong>an</strong>other employer’s employees.Some MEPs may not have sufficient flexibility in their terms toaccommodate your current pl<strong>an</strong> design. Careful review of yourpl<strong>an</strong> against MEP is necessary before adopting the MEP.1 An Open MEP is a single pl<strong>an</strong> sponsored by <strong>an</strong> independent pl<strong>an</strong> sponsor covering employees of a number of unrelated<strong>employers</strong> under a centralized administrative <strong>an</strong>d fiduciary structure.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

involved with the MEP?11 Is there <strong>an</strong> ERISA attorney advising theMEP <strong>an</strong>d maintaining the pl<strong>an</strong>document? If so, what is theirbackground specific to MEPs?Pl<strong>an</strong> Documentation12 Consists of basic pl<strong>an</strong> document <strong>an</strong>djoinder agreementUsing the joinder or participation agreement the adoptingemployer will elect the specific eligibility, vesting <strong>an</strong>dcontributions that will apply to its employees.13 Pl<strong>an</strong> Administrator identified Generally the pl<strong>an</strong> sponsor/provider or the provider’s advisorycommittee who will be responsible for most the pl<strong>an</strong>’sadministrative functions such as coverage <strong>an</strong>d discriminationtesting, <strong>an</strong>nual reporting, hiring of service providers, <strong>an</strong>dnotifications to particip<strong>an</strong>ts.14 Named Fiduciary identified Generally the pl<strong>an</strong> sponsor/provider or the provider’s advisorycommittee who will be responsible for the selection <strong>an</strong>dmonitoring of pl<strong>an</strong> investments <strong>an</strong>d investment advisers.Basic MEP Structures15 Pl<strong>an</strong>s operated by third partyadministrators (TPAs)16 Pl<strong>an</strong>s operated by registered investmentadvisors (RIAs)17 Pl<strong>an</strong>s operated by independent pl<strong>an</strong>sponsorsSelf-Dealing <strong>an</strong>d ProhibitedTr<strong>an</strong>sactions18 Is there a proper separation of the roles<strong>an</strong>d ownership structure of the MEP’spl<strong>an</strong> sponsor, independent fiduciary,<strong>an</strong>d contracted service providers?19 How are all of the parties paid? Arethere potential conflicts of interest orprohibited tr<strong>an</strong>sactions?The providers operating MEPs described in lines 15-17 arefiduciaries <strong>an</strong>d may not use that authority to benefit themselves ortheir affiliates, to determine their own compensation or paythemselves out of pl<strong>an</strong> assets20 Does provider have <strong>an</strong>y ability todetermine its own compensation or topay its affiliates additionalcompensation?Reasonableness ofCompensation21 What is the amount of compensationpaid to the provider <strong>an</strong>d other serviceunder the arr<strong>an</strong>gement? Is itIf the proposed arr<strong>an</strong>gement has such a feature, the arr<strong>an</strong>gementmust be rejected.Services provided to a pl<strong>an</strong> by service providers are subject toERISA Section 408(b) (2) which requires that no more th<strong>an</strong>reasonable compensation be paid for them.The employer should seek information from the provider aboutfees <strong>an</strong>d compare that information to the fees charged by otherproviders offering similar services. This is often called“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

easonable?Pl<strong>an</strong> Administration <strong>an</strong>dFiduciary Structure22 Who is h<strong>an</strong>dling the administration(TPA) work, fiduciary oversight, <strong>an</strong>dpl<strong>an</strong> operations?23 Does the provider have written policies<strong>an</strong>d procedures?24 If the <strong>an</strong>swer is, yes, have thosepolicies <strong>an</strong>d procedures been audited orcertified by <strong>an</strong> entity independent of theprovider?Fiduciary Liability Insur<strong>an</strong>ce<strong>an</strong>d Related Liability Items25 Does the Employer maintain fiduciaryliability insur<strong>an</strong>ce?26 Has the provider, within the last fiveyears, been sued or settled claims by<strong>employers</strong> in connection with theprovision of services under the MEP?27 Has the Pl<strong>an</strong>, within the last five years,been audited by the IRS or LaborDepartment? If so, what were thefindings/results?28 Is the provider willing to provide youreferences <strong>an</strong>d contact information for<strong>employers</strong> who currently or formerlyparticipated in the pl<strong>an</strong>?29 Has the provider used the IRS EPCRSprogram or the Labor DepartmentDelinquent Filer or FiduciaryCorrection Program within the last fiveyears to correct problems with theoperation of the pl<strong>an</strong>?Employer Responsibilities30 Provision of Eligibility data such asdates of hire, birth dates, <strong>an</strong>d hours ofservice to the provider.31 Have appropriate arr<strong>an</strong>gements beenmade for the tr<strong>an</strong>sfer of payroll data?Do the compensation data codes alignwith the definitions of compensation inthe Pl<strong>an</strong>?32 Employers have responsibility totr<strong>an</strong>sfer salary deferral amounts takefrom pay as soon as those amounts c<strong>an</strong>reasonably be segregated from pl<strong>an</strong>assets.“benchmarking.”Employers considering adopting a MEP must assess whether theprovider c<strong>an</strong> do the job.If none are in place, the employer should look for <strong>an</strong>otherprovider.Evidence of certification shows that the provider is serious aboutits business <strong>an</strong>d intends to apply the highest st<strong>an</strong>dards in pl<strong>an</strong>operations.The employer will w<strong>an</strong>t to know the amount <strong>an</strong>d the carrier.The employer must timely provide accurate information to theMEP provider. This is a responsibility the adopting employerwill not escape under <strong>an</strong>y arr<strong>an</strong>gement.The tr<strong>an</strong>smittal of correct compensation information c<strong>an</strong> haveserious implications as it affects the amount of contributions <strong>an</strong>ddiscrimination testing.The failure to satisfy this requirement c<strong>an</strong> result in a prohibitedtr<strong>an</strong>saction <strong>an</strong>d the imposition of excise taxes on the employer.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

33 Clarification of responsibility for othertasksPl<strong>an</strong> Investments34 Responsibility for mainten<strong>an</strong>ce of pl<strong>an</strong>investment policy statement (IPS)35 Any responsibility in employer for<strong>selecting</strong> pl<strong>an</strong>’s investment line-up?Particip<strong>an</strong>tEducation/Investment Advice36 Who is responsible for educatingparticip<strong>an</strong>ts?37 Will individualized investment advicebe provided to particip<strong>an</strong>ts, usingmodel or level fee arr<strong>an</strong>gement?Reporting to the Employer bythe ProviderBecause ERISA <strong>an</strong>d the Internal Revenue Code impose import<strong>an</strong>tdisclosure requirements on <strong>employers</strong> <strong>an</strong>d pl<strong>an</strong> administrators,<strong>employers</strong> must know what, if <strong>an</strong>y, responsibilities they have.These, to name a few, include the provision of SPDs, QDIA <strong>an</strong>dother notices. Which of these responsibilities will be performed bythe provider?Does the provider maintain <strong>an</strong> IPS? What does it say?Depending on the arr<strong>an</strong>gement, the employer could have someexposure to liability for pl<strong>an</strong> investments.Is it the provider, a broker or someone else? How frequently willthere be group meetings? What is the level of commitment?Does the arr<strong>an</strong>gement comport with Labor Department rules, sothat self-dealing prohibited tr<strong>an</strong>sactions are avoided?Although adopting a MEP relieves <strong>employers</strong> of operationalresponsibilities, <strong>employers</strong> have oversight <strong>an</strong>d monitoringresponsibilities. Thus, they must have reports from the providerregarding pl<strong>an</strong> operations.38 Annual Reports Annually the provider should provide to the employer informationrelating to (i) pl<strong>an</strong> investments (ii) fees; (iii) pl<strong>an</strong> amendmentsmade during the year; (iv) <strong>an</strong>y signific<strong>an</strong>t problems with pl<strong>an</strong>service providers or in the administration of the pl<strong>an</strong> (v) <strong>an</strong>ysignific<strong>an</strong>t issues identified by the pl<strong>an</strong>’s auditor <strong>an</strong>d (vi)participation <strong>an</strong>d pl<strong>an</strong> design improvement reports..39 Additional Reports Any other report to the employer that the employer may need in itscapacity as participating employer including <strong>an</strong>y informationneeded to protect itself from liability in regard to the pl<strong>an</strong> orcorrect a problem. Timely provided ADP <strong>an</strong>d ACP discriminationtesting results is <strong>an</strong> example. A copy of the MEP’s Form 5500<strong>an</strong>nual information return should also be provided.Getting Out40 Does the MEP pl<strong>an</strong> document reservethe participating employer the right tospin off assets?41 C<strong>an</strong> the provider throw you out of theMEP; for what reasons; under whatterms?42 What fees will provider charge whenthe employer leaves the MEP?At some point <strong>an</strong> adopting employer will w<strong>an</strong>t to terminate thepl<strong>an</strong> as to itself or establish its own pl<strong>an</strong> <strong>an</strong>d move MEP assets tothat pl<strong>an</strong>. What will happen at that time should be known prior toparticipating in the MEP.Knowing the <strong>an</strong>swer to this question will be import<strong>an</strong>t when theemployer decides to completely stop offering 401(k) benefits.This information is valuable for two reasons: (i) you will know inadv<strong>an</strong>ce under what circumst<strong>an</strong>ces this could happen <strong>an</strong>d (ii) it isimport<strong>an</strong>t to know that <strong>employers</strong> with compli<strong>an</strong>ce problemsthreatening the overall pl<strong>an</strong> c<strong>an</strong> be removed from the pl<strong>an</strong>.This factor is <strong>an</strong> aspect of your “reasonableness of the fees”assessment.Contractual43 Do the provider contracts have <strong>an</strong>y Current Labor Department guid<strong>an</strong>ce does not outright prohibit“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

limitation of liability or indemnificationprovisions?such provisions, but it does require pl<strong>an</strong> fiduciaries to determinetheir reasonableness in the context of the arr<strong>an</strong>gement.44 Remedies/ compensation available toemployer in event provider fails tomaintain the qualification of the pl<strong>an</strong>45 Who pays expenses of correctingoperational errors?46 Representation that fiduciary liabilityinsur<strong>an</strong>ce will be maintained47 Representation that the security <strong>an</strong>dconfidentiality of personal informationwill be maintained under State privacylaws.Documents to Request fromProvider Prior to Adoption ofMEP48 Pl<strong>an</strong> document <strong>an</strong>d joinder agreement49 Pl<strong>an</strong> policies <strong>an</strong>d procedures50 Investment Policy Statement51 Annual Returns (last three years)Getting Help52 If you do not have the in-houseexpertise to address the matters in this<strong>checklist</strong>, have you considered gettingWhen the operational error relates only to a particular employer,do other <strong>employers</strong> share in the cost of fixing the problem or is thecost shared among all <strong>employers</strong>? What if the error is theproviders or is a service provider to the MEP hired by theprovider?An independent adviser or consult<strong>an</strong>t, whose fees do not dependon whether or not your comp<strong>an</strong>y joins the MEP, c<strong>an</strong> help youassess the MEP arr<strong>an</strong>gement <strong>an</strong>d the reasonableness of fees <strong>an</strong>dfulfill your fiduciary responsibilities.outside help?53 Have you retained ERISA counsel? Review of pl<strong>an</strong> documents <strong>an</strong>d agreements by <strong>an</strong> attorney is a bestpractice.**************************************Charles G. Humphrey is the principal of Law Offices of Charles G. Humphrey, <strong>an</strong> ERISA <strong>an</strong>d employee benefitslaw firm located in Andover, Massachusetts <strong>an</strong>d Buffalo, New York. He is also a special consult<strong>an</strong>t to Fiduciary Pl<strong>an</strong>Govern<strong>an</strong>ce Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC, a fiduciary consulting firm dedicated to improving employee benefit pl<strong>an</strong>processes <strong>an</strong>d reducing fiduciary liability.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

“Multiple” ChoiceMultiple Employer Pl<strong>an</strong>s—<strong>an</strong> enticing alternative for pl<strong>an</strong> sponsorsTerr<strong>an</strong>ce PowerCFP, QPA, ERPA, AIFA, APR, CLU, ChFCPresidentAmeric<strong>an</strong> Pension Services, Inc.AN INTRIGUING new use of a long-establishedconcept is catching the attention ofsmall to mid-size pl<strong>an</strong> sponsors seekinga way to simplify 401(k) pl<strong>an</strong> oversight:Multiple Employer Pl<strong>an</strong>s (MEPs). Bymerging their pl<strong>an</strong> into a properly structuredMEP, <strong>employers</strong> cease to be a pl<strong>an</strong>sponsor <strong>an</strong>d effectively tr<strong>an</strong>sfer m<strong>an</strong>y ofthe responsibilities <strong>an</strong>d liabilities associatedwith being a named fiduciary to theMEP.The MEP concept is exploding in popularity.Established under ERISA 413(c),MEPs historically have been used bycomp<strong>an</strong>ies that share a common industryor payroll provider, primarily associationpl<strong>an</strong>s <strong>an</strong>d professional employer org<strong>an</strong>izations(employee leasing). However,as interest in outsourced fiduciary solutionshas grown in recent years, a newgeneration of “<strong>open</strong>” MEPs for unrelatedcomp<strong>an</strong>ies has sprung up. While MEPsc<strong>an</strong> deliver tremendous benefit to m<strong>an</strong>ypl<strong>an</strong> sponsors, <strong>an</strong> MEP is a solution insearch of a problem for others. This articleis written to help pl<strong>an</strong> sponsors determineif this approach is a good fit for theirorg<strong>an</strong>ization.An MEP (not to be confused with a multiemployer,or Taft Hartley, pl<strong>an</strong>) is a retirementpl<strong>an</strong> established by one pl<strong>an</strong> sponsorthat is then adopted by one or more participating<strong>employers</strong>. When <strong>an</strong> employermerges its current single-employer pl<strong>an</strong>into a properly structured MEP, the roleof pl<strong>an</strong> sponsor then tr<strong>an</strong>sfers from theadopting employer to the pl<strong>an</strong> sponsor ofthe MEP.The MEP sets up a single pl<strong>an</strong> that coversall adopting <strong>employers</strong>, with the pl<strong>an</strong>document generally written to allowfor variation in pl<strong>an</strong> design among theparticipating comp<strong>an</strong>ies. Fund selection<strong>an</strong>d monitoring generally are h<strong>an</strong>dled bythe MEP. Discrimination testing <strong>an</strong>d pl<strong>an</strong>design (with some limitations) generallyremain with the adopting employer.The shift in responsibility results in severalpotential benefits:Elimination of <strong>an</strong>nual pl<strong>an</strong> audit. Pl<strong>an</strong>sthat cover more th<strong>an</strong> 100 employees typicallyare required to have <strong>an</strong> <strong>an</strong>nual pl<strong>an</strong>audit performed as part of their <strong>an</strong>nualpl<strong>an</strong> Form 5500 filing. Under the MEParr<strong>an</strong>gement, there is still a pl<strong>an</strong> audit,but only one that is performed at theoverall MEP level. The <strong>an</strong>nual audit thatis required by each employer (now knownas <strong>an</strong> “adopter”) is eliminated, resulting insignific<strong>an</strong>t savings to the employer.Mitigation of fiduciary risk. Indepen-Selecting a MultipleEmployer Pl<strong>an</strong>Questions to ask:Will you have to ch<strong>an</strong>ge your existingpl<strong>an</strong> features?Who is h<strong>an</strong>dling the administration(TPA) work, fiduciary oversight, <strong>an</strong>dpl<strong>an</strong> operations?What are the credentials <strong>an</strong>d MEPexpertise of the various parties involvedwith the MEP?How long have the parties to the MEPbeen involved with MEPs?Is there <strong>an</strong> ERISA attorney advising theMEP <strong>an</strong>d maintaining the pl<strong>an</strong> document?If so, what is their background specific toMEPs?How are all of the parties paid? Are therepotential conflicts of interest or prohibitedtr<strong>an</strong>sactions?If you wish to retain your current adviserwithin <strong>an</strong> MEP arr<strong>an</strong>gement, are theyadviser-friendly, holding themselvesaccountable <strong>an</strong>d tr<strong>an</strong>sparent to theadopter’s adviser?Is there a proper separation of the roles<strong>an</strong>d ownership structure of the MEP’spl<strong>an</strong> sponsor, independent fiduciary, <strong>an</strong>dcontracted service providers?What measures does the MEP taketo screen out “bad apples” that couldaffect the entire MEP? Does the MEPcontract allow them to unilaterally push outadopters with compli<strong>an</strong>ce problems?REPRINTED FROM PLANSPONSOR 8/11

dent fiduciary W. Michael Montgomerydescribed the impact on fiduciary liabilitiesin Multiple Employer Pl<strong>an</strong>s as a FiduciaryRisk Mitigation Tool:“Employers adopting a sound MultipleEmployer Pl<strong>an</strong>…achieve a profoundreduction in fiduciary risk exposure. Thereason is a simple one: The adoptingemployer ceases to perform certain keyroles that incur fiduciary status. When<strong>an</strong> employer merges its current singleemployerpl<strong>an</strong> into a properly structuredMEP, it is no longer the sponsor of thepl<strong>an</strong>. It also should cease to be a trustee,pl<strong>an</strong> administrator, or <strong>an</strong>y sort of namedfiduciary. Those central roles move to theMEP, <strong>an</strong>d the inherent fiduciary liabilitytr<strong>an</strong>sfers with them.”The relief offered by MEP participation isextensive but not total. Certain responsibilitiesgenerally remain with the adoptingemployer, <strong>an</strong>d even this reduced role mustbe taken seriously.Those responsibilities include:pl<strong>an</strong> contributions.of match.MEP, including necessary <strong>due</strong> <strong>diligence</strong><strong>an</strong>d monitoring of the MEP.notices <strong>an</strong>d information, though thismay at times be h<strong>an</strong>dled directly by theMEP pl<strong>an</strong> sponsor. t<strong>an</strong>cefor particip<strong>an</strong>ts.Streamlining of pl<strong>an</strong> operations. Inaddition to the audit elimination, MEPadopting <strong>employers</strong> no longer file a Form5500, maintain a fidelity bond, or shoulderthe responsibility for 408(b)(2) compli<strong>an</strong>ce.These are h<strong>an</strong>dled by the pl<strong>an</strong> sponsorthat is associated with the MEP, not theadopting employer. For some <strong>employers</strong>,this benefit is inconsequential. For others,the desire to let outside experts run thepl<strong>an</strong> c<strong>an</strong> be more import<strong>an</strong>t th<strong>an</strong> eitherthe audit relief or fiduciary risk mitigation.MEPs are not a good fit for every employer.Some pl<strong>an</strong> sponsors already are mitigatingtheir fiduciary exposure through a comprehensive,well- documented fiduciaryprocess. Others don’t consider the cost oreffort of <strong>an</strong> <strong>an</strong>nual audit to be signific<strong>an</strong>tenough to justify making a ch<strong>an</strong>ge. Stillothers take satisfaction in staying engagedin pl<strong>an</strong> oversight <strong>an</strong>d fund monitoring.Simply put, if the adv<strong>an</strong>tages of <strong>an</strong> MEPappear to be solving a problem you don’thave, this approach is not for you.An employer also should consider thepotential limitations inherent in mostMEPs. These may include the following:its own fund menu. For m<strong>an</strong>y, thisis a relief. Others w<strong>an</strong>t to have moreinvolvement in investment decisions<strong>an</strong>d consider this a takeaway.some MEPs offer a degree of flexibility,most are tied to a single recordkeeperor third-party administrator, so youwill most likely have to leave behindyour current providers to enjoy thebenefits of adopting <strong>an</strong> MEP.one adopting employer with seriouscompli<strong>an</strong>ce violations could cause theentire MEP to be disqualified, thougha more likely scenario is that correctivemeasures will be taken. In the 20-plusyears that I’ve been associated withMultiple Employer Pl<strong>an</strong> clients, I’ve yetto see this occur. It is import<strong>an</strong>t that<strong>employers</strong> confirm the availability of a“disgorgement provision” in <strong>an</strong>y MEPthat they may be considering. Thisimport<strong>an</strong>t pl<strong>an</strong> design feature allowsthe MEP to quickly eject <strong>an</strong>d therebyisolate <strong>an</strong>y noncompli<strong>an</strong>t adopter fromthe pl<strong>an</strong>.If these features are appealing <strong>an</strong>d thelimitations are acceptable, you may w<strong>an</strong>tto look further into the Multiple EmployerPl<strong>an</strong> approach as a solution to yourcomp<strong>an</strong>y’s retirement pl<strong>an</strong> strategy.I’ve been told by pl<strong>an</strong> sponsors that theydecided to join <strong>an</strong> MEP because theseprograms are h<strong>an</strong>dled the same way astheir other employee benefit programs,where the benefit providers h<strong>an</strong>dle all thedetails. For example, while <strong>an</strong> employercould, at least in theory, negotiate withdoctors, hospitals, MRI service providers,pharmacies, etc., for their employees’medical coverage, most find it easier tooutsource these micro-m<strong>an</strong>aged decisionsto a third party—in that case, a healthinsur<strong>an</strong>ce provider that offers a grouphealth-care policy.There is a trade-off in control, options,etc., but there also is comfort in knowingthat there are professionals at the helm<strong>an</strong>d that they have a vested interest inmaking sure that their employees aretaken care of in accord<strong>an</strong>ce with the termsof the arr<strong>an</strong>gement.Pl<strong>an</strong> sponsors <strong>an</strong>d their advisers will, ofcourse, need to determine on a caseby-casebasis whether these programsare a “fit” for their pl<strong>an</strong>s <strong>an</strong>d their pl<strong>an</strong>particip<strong>an</strong>ts.Americ<strong>an</strong> Pension Services, Inc., is <strong>an</strong> independent third-party retirement pl<strong>an</strong> administration firm located in Clearwater, Florida. APSh<strong>an</strong>dles the compli<strong>an</strong>ce <strong>an</strong>d testing associated with qualified retirement pl<strong>an</strong>s (primarily 401(k) pl<strong>an</strong>s) for small to medium-size <strong>employers</strong>,as well as for numerous Professional Employer Org<strong>an</strong>izations (PEOs) located across the country.REPRINTED FROM PLANSPONSOR 8/11 ©1989-2011 Asset International, Inc. All Rights Reserved. No reproduction or redistribution without prior authorization.For information, call (203) 595-3276 or email reprints@pl<strong>an</strong>sponsor.com

SELECTING AN OPEN MEP 1EMPLOYERS DUE DILIGENCE NUTSHELLCHECKLISTPREPARED BYCHARLES G. HUMPHREY, ESQ.*Does Employer Underst<strong>an</strong>d?1 Employer will not be relieved of allfiduciary liability under ERISA2 Tax qualification of entire pl<strong>an</strong> may beaffected by problems of other<strong>employers</strong>3 Service by employees with MEP<strong>employers</strong> is counted for eligibility <strong>an</strong>dvesting4 Discrimination rules apply onindividual employer-by-employer basis5 Employer will be able to establish itsown eligibility, vesting <strong>an</strong>dcontribution provisions6 Pl<strong>an</strong> assets are not segregated on <strong>an</strong>employer-by-employer basisImpact on Current Structure7 Will you have to ch<strong>an</strong>ge your existingpl<strong>an</strong> features?8 If you wish to retain your currentadviser within <strong>an</strong> MEP arr<strong>an</strong>gement,are they adviser-friendly, holdingthemselves accountable <strong>an</strong>d tr<strong>an</strong>sparentto the adopter’s adviser?Provider Experience <strong>an</strong>dSupport9 How long have the parties to the MEPbeen involved with MEPs?CommentAdoption of MEP itself by <strong>an</strong> employer is not a fiduciary function,but selection of MEP sponsor <strong>an</strong>d responsibility for monitoring ofthe MEP provider is.Disqualification of pl<strong>an</strong> c<strong>an</strong> lead to loss of deductions forcontributions to the pl<strong>an</strong>, income taxation of trust earnings <strong>an</strong>dtaxable income to particip<strong>an</strong>ts; impact moderated by IRSEmployee Pl<strong>an</strong>s Correction Resolution System (EPCRS).Not likely to be a signific<strong>an</strong>t factor in terms of decision toparticipate in the MEPThis includes coverage <strong>an</strong>d average deferral percentage <strong>an</strong>daverage contribution percentage testingThis puts employer in same position it would be in if it adopted itsown pl<strong>an</strong>, but without some of the other drawbacks associatedwith individual sponsorship.It is theoretically <strong>an</strong>d practically possible that pl<strong>an</strong> assetsattributable to the contributions one employer could be used forthe benefit of <strong>an</strong>other employer’s employees.Some MEPs may not have sufficient flexibility in their terms toaccommodate your current pl<strong>an</strong> design. Careful review of yourpl<strong>an</strong> against MEP is necessary before adopting the MEP.1 An Open MEP is a single pl<strong>an</strong> sponsored by <strong>an</strong> independent pl<strong>an</strong> sponsor covering employees of a number of unrelated<strong>employers</strong> under a centralized administrative <strong>an</strong>d fiduciary structure.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

10 What are the credentials <strong>an</strong>d MEPexpertise of the various partiesinvolved with the MEP?11 Is there <strong>an</strong> ERISA attorney advising theMEP <strong>an</strong>d maintaining the pl<strong>an</strong>document? If so, what is theirbackground specific to MEPs?Self-Dealing <strong>an</strong>d ProhibitedTr<strong>an</strong>sactions12 Is there a proper separation of the roles<strong>an</strong>d ownership structure of the MEP’spl<strong>an</strong> sponsor, independent fiduciary,<strong>an</strong>d contracted service providers?13 How are all of the parties paid? Arethere potential conflicts of interest orprohibited tr<strong>an</strong>sactions? Does providerhave <strong>an</strong>y ability to determine its owncompensation or to pay its affiliatesadditional compensation?Reasonableness ofCompensation14 What is the amount of compensationpaid to the provider <strong>an</strong>d other serviceunder the arr<strong>an</strong>gement? Is itreasonable?Pl<strong>an</strong> Administration <strong>an</strong>dFiduciary Structure15 Who is h<strong>an</strong>dling the administration(TPA) work, fiduciary oversight, <strong>an</strong>dpl<strong>an</strong> operations?16 Does the provider have written policies<strong>an</strong>d procedures?Fiduciary Liability Insur<strong>an</strong>ce<strong>an</strong>d Related Liability Items17 Does the Employer maintain fiduciaryliability insur<strong>an</strong>ce?18 Has the provider, within the last fiveyears, been sued or settled claims by<strong>employers</strong> in connection with theprovision of services under the MEP,been subject to a government audit orfiled under <strong>an</strong> IRS or DOL correctionprogram?Employer ResponsibilitiesServices provided to a pl<strong>an</strong> by service providers are subject toERISA Section 408(b)(2) which requires that no more th<strong>an</strong>reasonable compensation be paid for them.The employer should seek information from the provider aboutfees <strong>an</strong>d compare that information to the fees charged by otherproviders offering similar services. This is often called“benchmarking.”Employers considering adopting a MEP must assess whether theprovider c<strong>an</strong> do the job.If none are in place, the employer should look for <strong>an</strong>otherprovider.The employer will w<strong>an</strong>t to know the amount <strong>an</strong>d the carrier.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

19 Provision of Eligibility data such asdates of hire, birth dates, <strong>an</strong>d hours ofservice to the provider.20 Employers have responsibility totr<strong>an</strong>sfer salary deferral amounts takefrom pay as soon as those amounts c<strong>an</strong>reasonably be segregated from pl<strong>an</strong>assets.Pl<strong>an</strong> Investments21 Responsibility for mainten<strong>an</strong>ce of pl<strong>an</strong>investment policy statement (IPS)22 Any responsibility in employer for<strong>selecting</strong> pl<strong>an</strong>’s investment line-up?Particip<strong>an</strong>t Enrollment,Education/Investment Advice23 Who is responsible for enrolling <strong>an</strong>deducating particip<strong>an</strong>ts? Is investmentadvice provided?Reporting to the Employer bythe ProviderThe employer must timely provide accurate information to theMEP provider. This is a responsibility the adopting employerwill not escape under <strong>an</strong>y arr<strong>an</strong>gement.The failure to satisfy this requirement c<strong>an</strong> result in a prohibitedtr<strong>an</strong>saction <strong>an</strong>d the imposition of excise taxes on the employer.Does the provider maintain <strong>an</strong> IPS? What does it say?Depending on the arr<strong>an</strong>gement, the employer could have someexposure to liability for pl<strong>an</strong> investments.Is it the provider, a broker or someone else? How frequently willthere be group meetings? What is the level of commitment?Although adopting a MEP relieves <strong>employers</strong> of operationalresponsibilities, <strong>employers</strong> have oversight <strong>an</strong>d monitoringresponsibilities. Thus, they must have reports from the providerregarding pl<strong>an</strong> operations.24 Annual Reports <strong>an</strong>d Other Reports Annually the provider should provide to the employer informationrelating to (i) pl<strong>an</strong> investments (ii) fees; (iii) pl<strong>an</strong> amendmentsmade during the year; (iv) <strong>an</strong>y signific<strong>an</strong>t problems with pl<strong>an</strong>service providers or in the administration of the pl<strong>an</strong> (v) <strong>an</strong>ysignific<strong>an</strong>t issues identified by the pl<strong>an</strong>’s auditor <strong>an</strong>d (vi)participation <strong>an</strong>d pl<strong>an</strong> design improvement reports. What aboutperiodic reports as required?Getting Out25 Does the MEP pl<strong>an</strong> document reservethe participating employer the right tospin off assets?26 What fees will provider charge whenthe employer leaves the MEP?Contractual27 Do the provider contracts have <strong>an</strong>ylimitation of liability or indemnificationprovisions?At some point <strong>an</strong> adopting employer will w<strong>an</strong>t to terminate thepl<strong>an</strong> as to itself or establish its own pl<strong>an</strong> <strong>an</strong>d move MEP assets tothat pl<strong>an</strong>. What will happen at that time should be known prior toparticipating in the MEP.Knowing the <strong>an</strong>swer to this question will be import<strong>an</strong>t when theemployer decides to completely stop offering 401(k) benefits.This factor is <strong>an</strong> aspect of your “reasonableness of the fees”assessment.Current Labor Department guid<strong>an</strong>ce does not outright prohibitsuch provisions, but it does require pl<strong>an</strong> fiduciaries to determinetheir reasonableness in the context of the arr<strong>an</strong>gement.28 Remedies/ compensation available toemployer in event provider fails tomaintain the qualification of the pl<strong>an</strong>29 Who pays expenses of correctingoperational errors?When the operational error relates only to a particular employer,do other <strong>employers</strong> share in the cost of fixing the problem or is thecost shared among all <strong>employers</strong>? What if the error is the“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

Representation that fiduciary liabilityinsur<strong>an</strong>ce will be maintainedGetting Help30 If you do not have the in-houseexpertise to address the matters in this<strong>checklist</strong>, have you considered gettingproviders or is a service provider to the MEP hired by theprovider?An independent adviser or consult<strong>an</strong>t, whose fees do not dependon whether or not your comp<strong>an</strong>y joins the MEP, c<strong>an</strong> help youassess the MEP arr<strong>an</strong>gement <strong>an</strong>d the reasonableness of fees <strong>an</strong>dfulfill your fiduciary responsibilities.outside help?31 Have you retained ERISA counsel? Review of pl<strong>an</strong> documents <strong>an</strong>d agreements by <strong>an</strong> attorney is a bestpractice.**************************************Charles G. Humphrey is the principal of Law Offices of Charles G. Humphrey, <strong>an</strong> ERISA <strong>an</strong>d employee benefitslaw firm located in Andover, Massachusetts <strong>an</strong>d Buffalo, New York. He is also a special consult<strong>an</strong>t to Fiduciary Pl<strong>an</strong>Govern<strong>an</strong>ce Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC, a fiduciary consulting firm dedicated to improving employee benefit pl<strong>an</strong>processes <strong>an</strong>d reducing fiduciary liability.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.

MEP RELATED EXCERPTS FROM THE TESTIMONY OF PHYLLIS C. BORZIASSISTANT SECRETARY OF LABOR EMPLOYEE BENEFITS SECURITYADMINISTRATION BEFORE THE SPECIAL COMMITTEE ON AGING UNITEDSTATES SENATEMarch 7, 2012Introductory RemarksGood afternoon Chairm<strong>an</strong> Kohl, R<strong>an</strong>king Member Corker, <strong>an</strong>d Members of the Committee.Th<strong>an</strong>k you for inviting me to discuss small business retirement pl<strong>an</strong> issues. I am Phyllis C. Borzi,the Assist<strong>an</strong>t Secretary of Labor for the Employee Benefits Security Administration (EBSA). Iam proud to represent the Department of Labor (Department), EBSA, <strong>an</strong>d its employees, whowork to safeguard retirement <strong>an</strong>d other employee benefits for America’s workers, retirees <strong>an</strong>dtheir families <strong>an</strong>d to support the growth of our private benefits system. Secretary Solis’overarching vision for the Department is to adv<strong>an</strong>ce good jobs for everyone, <strong>an</strong>d a good job,among other things, is one that provides a secure retirement. We are committed to promotingopportunities <strong>an</strong>d helping America’s workers to achieve a secure retirement.Helping workers to achieve a dignified <strong>an</strong>d secure retirement me<strong>an</strong>s encouraging <strong>employers</strong> toestablish <strong>an</strong>d maintain retirement pl<strong>an</strong>s <strong>an</strong>d protecting workers’ benefits. We know we mustwork particularly hard to assist small businesses because of the challenges small businesses facein providing retirement pl<strong>an</strong>s. There are six million businesses with fewer th<strong>an</strong> 100 employeesemploying 42 million workers.1 Less th<strong>an</strong> half of these businesses offer a retirement pl<strong>an</strong>.21 U.S. Small Business Administration, Office of Advocacy, based on data for 2008 provided bythe U.S. Census Bureau, Statistics of U.S. Businesses.2 U.S. Bureau of Labor Statistics, National Compensation Survey: Employee Benefits in theUnited States, March 2011, Bulletin 2771. Private Industry Tables. Table 1, Establishmentsoffering retirement <strong>an</strong>d health care benefits. 2To exp<strong>an</strong>d access for workers to employer-based retirement pl<strong>an</strong>s, the Department has longrecognized that we need to reach out to the small business community. Employer-sponsoredpl<strong>an</strong>s are the best way for most workers to accumulate savings for a fin<strong>an</strong>cially secureretirement. It is not easy for workers to save <strong>an</strong>d invest so that they will be able to maintain theircurrent st<strong>an</strong>dard of living in retirement. According to experts, workers will need to replace 70 to90 percent of preretirement income.3 Therefore, we need to do all we c<strong>an</strong> to assist small<strong>employers</strong> in establishing <strong>an</strong>d operating retirement pl<strong>an</strong>s.

BackgroundEBSA is responsible for the administration, regulation, <strong>an</strong>d enforcement of the fiduciary,reporting, <strong>an</strong>d disclosure provisions of Title I of the Employee Retirement Income Security Actof 1974 (ERISA). EBSA assists small <strong>employers</strong> in evaluating their options for establishing aretirement pl<strong>an</strong> <strong>an</strong>d provides compli<strong>an</strong>ce assist<strong>an</strong>ce to help <strong>employers</strong> underst<strong>an</strong>d their fiduciary<strong>an</strong>d reporting responsibilities for employer-sponsored pl<strong>an</strong>s. We accomplish this throughcomprehensive education, outreach,4 <strong>an</strong>d regulatory programs. ……..Multiple Employer Pl<strong>an</strong>sWhile it is clear from my testimony that the Department supports efforts to exp<strong>an</strong>d smallbusiness coverage, it is just as import<strong>an</strong>t that ERISA’s protections for workers’ pensions be 13maintained. In that regard, the Department has more recently become aware of promotersmarketing multiple employer pl<strong>an</strong>s, or “MEPs,” that do not involve collective bargaining with <strong>an</strong>employee representative. These arr<strong>an</strong>gements, often called “<strong>open</strong> MEPs,” purport to allow totallyunrelated businesses to join together to offer a collective pension pl<strong>an</strong>. Promoters claim thatthese arr<strong>an</strong>gements relieve businesses of their ERISA reporting <strong>an</strong>d fiduciary obligations inconnection with administering the pl<strong>an</strong> or monitoring the pl<strong>an</strong> investments <strong>an</strong>d service providers.Proponents say such arr<strong>an</strong>gements c<strong>an</strong> provide the participating <strong>employers</strong> with a way to poolresources <strong>an</strong>d reduce administrative costs. There are several bills pending in Congress which callfor the Department, in coordination with the Treasury Department, to provide fiduciary relief <strong>an</strong>dsimplified administrative, reporting <strong>an</strong>d disclosure obligations for multiple employer pl<strong>an</strong>s. Weare currently <strong>an</strong>alyzing these proposals.Under ERISA, employee benefit pl<strong>an</strong>s must be sponsored by <strong>an</strong> employer, by <strong>an</strong> employeeorg<strong>an</strong>ization, or by both. ERISA expressly recognizes the idea of a “multiple employer pl<strong>an</strong>” byincluding in the definition of “employer” <strong>an</strong>y “person acting directly as <strong>an</strong> employer, orindirectly in the interest of <strong>an</strong> employer, in relation to <strong>an</strong> employee benefit pl<strong>an</strong>; <strong>an</strong>d includes agroup or association of <strong>employers</strong> acting for <strong>an</strong> employer in such capacity.”For example, a MEP operated by a bona fide employer association or group of related <strong>employers</strong>is a well-established concept in ERISA. Such pl<strong>an</strong>s in fact c<strong>an</strong> provide the participating<strong>employers</strong> with a way to pool resources <strong>an</strong>d reduce administrative costs. The idea of “<strong>open</strong>MEPs,” however, is not <strong>an</strong> established concept in ERISA. Indeed, EBSA has had difficultexperiences with similar “<strong>open</strong>” employee benefit structures in the group health area. Thesearr<strong>an</strong>gements, called “MEWAs,” or multiple employer welfare arr<strong>an</strong>gements, c<strong>an</strong> be provided 14

through legitimate org<strong>an</strong>izations, but they sometimes are marketed using attractive, but unsound,org<strong>an</strong>izational structures <strong>an</strong>d generate large, often hidden, administrative fees for the promoters.In addition, certain promoters try to use ERISA’s general preemption of state laws as a way toavoid state insur<strong>an</strong>ce or other regulation. That fact, together with the claimed separation of theemployer from accountability for the pl<strong>an</strong>’s administration, too often put workers at risk of notgetting the benefits they were promised. Bringing this type of product to the pension marketplacepresents a number of complicated <strong>an</strong>d signific<strong>an</strong>t legal <strong>an</strong>d policy issues. We underst<strong>an</strong>d that theGovernment Accountability Office is actively studying this development in the pensionmarketplace.We have also heard about this “<strong>open</strong> MEP” development from regulated fin<strong>an</strong>cial institutions,including insur<strong>an</strong>ce comp<strong>an</strong>ies <strong>an</strong>d other fin<strong>an</strong>cial service providers, who currently are allowedunder Internal Revenue Code rules to offer “prototype” pl<strong>an</strong> products to <strong>employers</strong>. Theseprototype pl<strong>an</strong>s are <strong>an</strong>other way to reduce legal <strong>an</strong>d administrative costs of offering employees atax qualified pension pl<strong>an</strong>. Some fin<strong>an</strong>cial institutions have expressed reservations aboutdeveloping competing “<strong>open</strong> MEP” products. Their lawyers, based on a review of the m<strong>an</strong>yDepartment of Labor opinions <strong>an</strong>d other guid<strong>an</strong>ce on “<strong>open</strong> MEWAs,” have expressed concernsabout whether these “<strong>open</strong>” benefit arr<strong>an</strong>gements c<strong>an</strong> fairly be classified as a “single” pl<strong>an</strong> asopposed to a collection of separate pl<strong>an</strong>s being collectively administered much like the prototypepl<strong>an</strong>s they already offer. We have been informally asked to provide guid<strong>an</strong>ce in this area bysome of those groups, <strong>an</strong>d we have two formal requests for guid<strong>an</strong>ce, one directly presenting the<strong>open</strong> MEP issue <strong>an</strong>d the other indirectly. We are actively working on <strong>an</strong>swering these requests.15ConclusionTh<strong>an</strong>k you for the opportunity to testify at this import<strong>an</strong>t hearing. We recognize the challengessmall businesses face in providing retirement pl<strong>an</strong>s. As I noted, our partnerships from within thefederal government <strong>an</strong>d among external stakeholders are a key component to these efforts todevelop <strong>an</strong>d disseminate the information. We will continue to exp<strong>an</strong>d our efforts, payingparticular attention to feedback we receive from small businesses <strong>an</strong>d their service providers, toprovide responsive, timely <strong>an</strong>d comprehensive information <strong>an</strong>d compli<strong>an</strong>ce assist<strong>an</strong>ce. TheDepartment recognizes the critical role that small businesses play in the economy as <strong>employers</strong>.The Department remains committed to initiatives which protect both the security <strong>an</strong>d growth ofretirement benefits for workers, retirees, <strong>an</strong>d their families.