selecting an open mep employers due diligence checklist - Fi360

selecting an open mep employers due diligence checklist - Fi360

selecting an open mep employers due diligence checklist - Fi360

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

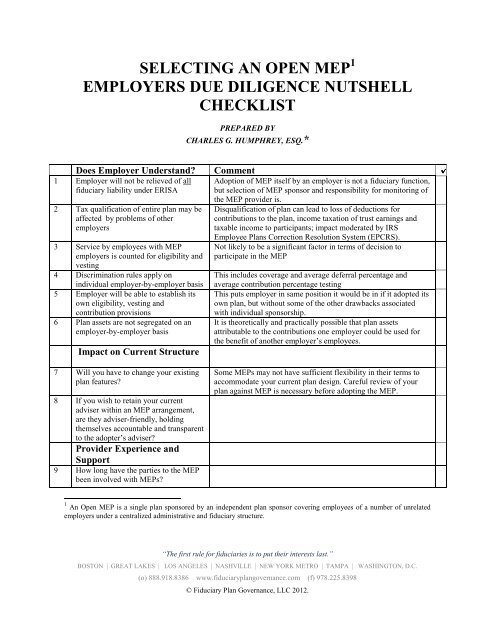

SELECTING AN OPEN MEP 1EMPLOYERS DUE DILIGENCE NUTSHELLCHECKLISTPREPARED BYCHARLES G. HUMPHREY, ESQ.*Does Employer Underst<strong>an</strong>d?1 Employer will not be relieved of allfiduciary liability under ERISA2 Tax qualification of entire pl<strong>an</strong> may beaffected by problems of other<strong>employers</strong>3 Service by employees with MEP<strong>employers</strong> is counted for eligibility <strong>an</strong>dvesting4 Discrimination rules apply onindividual employer-by-employer basis5 Employer will be able to establish itsown eligibility, vesting <strong>an</strong>dcontribution provisions6 Pl<strong>an</strong> assets are not segregated on <strong>an</strong>employer-by-employer basisImpact on Current Structure7 Will you have to ch<strong>an</strong>ge your existingpl<strong>an</strong> features?8 If you wish to retain your currentadviser within <strong>an</strong> MEP arr<strong>an</strong>gement,are they adviser-friendly, holdingthemselves accountable <strong>an</strong>d tr<strong>an</strong>sparentto the adopter’s adviser?Provider Experience <strong>an</strong>dSupport9 How long have the parties to the MEPbeen involved with MEPs?CommentAdoption of MEP itself by <strong>an</strong> employer is not a fiduciary function,but selection of MEP sponsor <strong>an</strong>d responsibility for monitoring ofthe MEP provider is.Disqualification of pl<strong>an</strong> c<strong>an</strong> lead to loss of deductions forcontributions to the pl<strong>an</strong>, income taxation of trust earnings <strong>an</strong>dtaxable income to particip<strong>an</strong>ts; impact moderated by IRSEmployee Pl<strong>an</strong>s Correction Resolution System (EPCRS).Not likely to be a signific<strong>an</strong>t factor in terms of decision toparticipate in the MEPThis includes coverage <strong>an</strong>d average deferral percentage <strong>an</strong>daverage contribution percentage testingThis puts employer in same position it would be in if it adopted itsown pl<strong>an</strong>, but without some of the other drawbacks associatedwith individual sponsorship.It is theoretically <strong>an</strong>d practically possible that pl<strong>an</strong> assetsattributable to the contributions one employer could be used forthe benefit of <strong>an</strong>other employer’s employees.Some MEPs may not have sufficient flexibility in their terms toaccommodate your current pl<strong>an</strong> design. Careful review of yourpl<strong>an</strong> against MEP is necessary before adopting the MEP.1 An Open MEP is a single pl<strong>an</strong> sponsored by <strong>an</strong> independent pl<strong>an</strong> sponsor covering employees of a number of unrelated<strong>employers</strong> under a centralized administrative <strong>an</strong>d fiduciary structure.“The first rule for fiduciaries is to put their interests last.”BOSTON | GREAT LAKES | LOS ANGELES | NASHVILLE | NEW YORK METRO | TAMPA | WASHINGTON, D.C.(o) 888.918.8386 www.fiduciarypl<strong>an</strong>govern<strong>an</strong>ce.com (f) 978.225.8398© Fiduciary Pl<strong>an</strong> Govern<strong>an</strong>ce, LLC 2012.