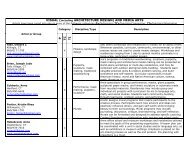

is greater. If a request <strong>for</strong> an extension of time has beengranted, the trust or estate can avoid a penalty <strong>for</strong> failure to paythe full amount due by the original due date if the fiduciary:• Pays at least 90% of the income tax shown to be due on thereturn on or be<strong>for</strong>e the original due date of the return; <strong>and</strong>• Pays the balance due with the return on or be<strong>for</strong>e theextended due date.The Commissioner of Revenue Services may impose a $50penalty <strong>for</strong> the late filing of any return or report required bylaw to be filed even if no tax is due.Penalty <strong>for</strong> Failure to FileIf the fiduciary does not file the return <strong>and</strong> DRS files a return<strong>for</strong> the trust or estate, the penalty <strong>for</strong> failure to file is 10% of thebalance due or $50, whichever is greater. If the fiduciary wasrequired to file an amended Form <strong>CT</strong>-<strong>1041</strong> <strong>and</strong> failed to do so,a penalty may be imposed. See Amended <strong>Return</strong> on Page 26.Waiver of PenaltyYou may request a waiver of penalty after you have filed thereturn <strong>and</strong> paid the tax <strong>and</strong> interest due. The penalty may bewaived if the failure to file or pay tax on time was due to areasonable cause <strong>and</strong> was not intentional or due to neglect.Interest cannot be waived.To apply <strong>for</strong> a waiver of penalty online, visit the DRS websiteat www.ct.gov/TSC, log into your account, <strong>and</strong> selectAccount Detail.If you submit your request in writing, you must include:• A clear <strong>and</strong> complete written explanation;• The name of the trust or estate <strong>and</strong> FEIN or SSN, if applicable;• The taxable filing period;• The name of the original <strong>for</strong>m filed or billing noticereceived; <strong>and</strong>• Documentation supporting your explanation.Attach your request to the front of the tax return or mailseparately with a copy of the tax return to:Department of Revenue ServicesPenalty Waiver UnitPO Box 5089Hart<strong>for</strong>d <strong>CT</strong> 06102-5089RecordkeepingKeep a copy of the tax return, worksheets you used, <strong>and</strong>records of all items appearing on the return (such as W-2<strong>and</strong> 1099 <strong>for</strong>ms) until the statute of limitations expires <strong>for</strong> thatreturn. Usually, this is three years from the date the return wasdue or filed, whichever is later. You may need this in<strong>for</strong>mationto prepare future returns or to file amended returns.Copies of <strong>Return</strong>sCopies of previously-filed <strong>Connecticut</strong> income tax returns maybe requested from DRS by completing LGL-002, Request<strong>for</strong> Disclosure of <strong>Tax</strong> <strong>Return</strong> or <strong>Tax</strong> <strong>Return</strong> In<strong>for</strong>mation.Requests are normally processed in three weeks.Order in Which to Complete Form <strong>CT</strong>-<strong>1041</strong> <strong>and</strong>SchedulesFor trusts or estates that do not meet the Quick-FileRequirements: See Form <strong>CT</strong>-<strong>1041</strong> Quick-File Requirementson Page 13 <strong>for</strong> verification.Complete Form <strong>CT</strong>-<strong>1041</strong> <strong>and</strong> the schedules <strong>for</strong> resident <strong>and</strong>nonresident estates, full-year resident <strong>and</strong> nonresident trusts,<strong>and</strong> part-year resident trusts in the following order.1. Resident trust or estate with resident beneficiaries:• Schedule A;• Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 1;• Schedule <strong>CT</strong>-<strong>1041</strong>C;• The front of Form <strong>CT</strong>-<strong>1041</strong>; <strong>and</strong>• Form <strong>CT</strong>-<strong>1041</strong> Schedule I, Parts 1 <strong>and</strong> 2, as necessary.2. Resident estate or full-year resident testamentarytrust with any nonresident beneficiaries or a full-yearresident inter vivos trust with nonresident, contingentbeneficiaries but without nonresident, noncontingentbeneficiaries:• Schedule A;• Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 1;• Schedule <strong>CT</strong>-<strong>1041</strong>FA, Parts 3 <strong>and</strong> 2;• Schedule <strong>CT</strong>-<strong>1041</strong>C;• The front of Form <strong>CT</strong>-<strong>1041</strong>; <strong>and</strong>• Form <strong>CT</strong>-<strong>1041</strong> Schedule I, Parts 1 <strong>and</strong> 2, as necessary.3. Full-year resident inter vivos trust with nonresident,noncontingent beneficiaries:• Schedule A;• Schedule <strong>CT</strong>-<strong>1041</strong>B, Parts 1 <strong>and</strong> 2;• Schedule <strong>CT</strong>-<strong>1041</strong>FA, Parts 3 <strong>and</strong> 2;• Schedule <strong>CT</strong>-<strong>1041</strong>C;• The front of Form <strong>CT</strong>-<strong>1041</strong>; <strong>and</strong>• Form <strong>CT</strong>-<strong>1041</strong> Schedule I, Parts 1 <strong>and</strong> 2, as necessary.4. Nonresident estate, full-year nonresident trust, orpart-year resident inter vivos trust without nonresident,noncontingent beneficiaries:• Schedule A;• Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 1;• Schedule <strong>CT</strong>-<strong>1041</strong>FA, Parts 3, 2, <strong>and</strong> 1;• The front of Form <strong>CT</strong>-<strong>1041</strong>; <strong>and</strong>• Form <strong>CT</strong>-<strong>1041</strong> Schedule I, Parts 1 <strong>and</strong> 2, as necessary.5. Part-year resident inter vivos trust with nonresident,noncontingent beneficiaries:• Schedule A;• Schedule <strong>CT</strong>-<strong>1041</strong>B, Parts 1 <strong>and</strong> 2;• Schedule <strong>CT</strong>-<strong>1041</strong>FA‚ Parts 3, 2, <strong>and</strong> 1;• The front of Form <strong>CT</strong>-<strong>1041</strong>; <strong>and</strong>• Form <strong>CT</strong>-<strong>1041</strong> Schedule I, Parts 1 <strong>and</strong> 2, as necessary.Form <strong>CT</strong>-8801, Credit <strong>for</strong> Prior Year’s <strong>Connecticut</strong> Minimum<strong>Tax</strong> <strong>for</strong> Individuals‚ <strong>Trusts</strong>‚ <strong>and</strong> Estates‚ must be completedas necessary <strong>for</strong> all types of trusts <strong>and</strong> estates that expect acredit or credit carry<strong>for</strong>ward of alternative minimum tax paidin a prior year.Page 12

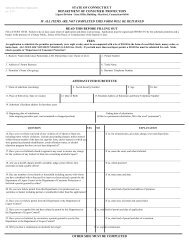

Instructions <strong>for</strong> Form <strong>CT</strong>-<strong>1041</strong>Filing YearAll in<strong>for</strong>mation on Form <strong>CT</strong>-<strong>1041</strong>, <strong>Connecticut</strong> <strong>Income</strong> <strong>Tax</strong><strong>Return</strong> <strong>for</strong> <strong>Trusts</strong> <strong>and</strong> Estates, should be <strong>for</strong> the calendar yearJanuary 1 through December 31, 2009, or any fiscal yearbeginning in 2009. If filing <strong>for</strong> a fiscal year or short taxableyear, enter the month <strong>and</strong> day the taxable year began <strong>and</strong> themonth, day, <strong>and</strong> year it ended at the top of Page 1.Federal Employer Identification Number(FEIN)The Department of Revenue Services (DRS no longerprocesses income tax returns <strong>for</strong> trusts <strong>and</strong> estates without anFEIN. You can no longer write “applied <strong>for</strong>” in the FEIN field.You must have applied <strong>for</strong> <strong>and</strong> been issued an FEIN be<strong>for</strong>eyou file a return. However, if you have not received the FEINby April 15 <strong>for</strong> the calendar year filers or <strong>for</strong> noncalendar yearfilers by the fifteenth day of the fourth month following theclose of the taxable year, file the return without the FEIN <strong>and</strong>pay the tax due. DRS will contact you upon receipt of thereturn <strong>and</strong> will hold the return until you receive the FEIN <strong>and</strong><strong>for</strong>ward the in<strong>for</strong>mation to DRS. For in<strong>for</strong>mation on how toobtain an FEIN, contact the IRS. See the back cover.Name, FEIN, <strong>and</strong> AddressEnter the name <strong>and</strong> FEIN of the trust or estate <strong>and</strong> the name <strong>and</strong>address of the fiduciary in the spaces on Page 1 of the return.Enter the name <strong>and</strong> FEIN of the trust or estate in the spacesprovided on all applicable schedules.Type of <strong>Return</strong>Check the applicable box if:• The trust or estate has been terminated <strong>and</strong> this is a finalreturn; or• This is an amended return. Attach a statement explainingthe reason <strong>for</strong> filing an amended return.Resident StatusEnter the date the trust or estate was created <strong>and</strong> the datethe trust or estate was terminated, if applicable, in the spaceprovided.Check only one applicable box to identify the residency statusof the trust or estate.The trust would be a part-year resident trust if:• It was revocable when property was transferred to it buthas become irrevocable subsequently; <strong>and</strong>• The residency status of the grantor, whether as a residentor nonresident individual, during the taxable year thetrust became irrevocable differs from the residency statusof the grantor during the taxable year that property wastransferred to the trust.Type of EntityCheck the applicable box to identify the type of trust or estate.Also check the appropriate box to indicate if the trust wascreated by the will of the decedent or is an inter vivos trust.Rounding Off to Whole DollarsYou must round off cents to the nearest whole dollar on yourreturn <strong>and</strong> schedules. If you do not round, DRS will disregardthe cents.Round down to the next lowest dollar all amounts that include1 through 49 cents. Round up to the next highest dollar allamounts that include 50 through 99 cents. However, if youneed to add two or more amounts to compute the amount toenter on a line, include cents <strong>and</strong> round off only the total.Example: Add two amounts ($1.29 + $3.21) to compute thetotal ($4.50) to enter on a line. $4.50 is rounded to $5.00 <strong>and</strong>entered on the line.Negative NumbersWhen entering a negative number, you must precede thenumber with a minus sign or bracket the amount.Form <strong>CT</strong>-<strong>1041</strong> Quick-File RequirementsThe fiduciary of a resident estate or full-year resident trust mayQuick-File Form <strong>CT</strong>-<strong>1041</strong> if the resident estate or full-yearresident trust has no:• Nonresident beneficiaries;• Schedule A‚ <strong>Connecticut</strong> fiduciary adjustments;• <strong>Connecticut</strong> alternative minimum tax;• Adjusted net <strong>Connecticut</strong> minimum tax credit; <strong>and</strong>• Federal election to be treated as an Electing Small BusinessTrust (ESBT).A trustee that files one aggregate federal Form <strong>1041</strong>-QFT,U.S. <strong>Income</strong> <strong>Tax</strong> <strong>Return</strong> <strong>for</strong> Qualified Funeral <strong>Trusts</strong>,<strong>for</strong> all qualified funeral trusts (QFT) may Quick-File oneaggregate Form <strong>CT</strong>-<strong>1041</strong> <strong>for</strong> all <strong>Connecticut</strong> resident QFTsas long as all grantors <strong>and</strong> all beneficiaries of every QFT are<strong>Connecticut</strong> residents.Form <strong>CT</strong>-<strong>1041</strong> Quick-File Line InstructionsLine 1 - <strong>Connecticut</strong> <strong>Tax</strong>able <strong>Income</strong>Enter federal taxable income of a trust or estate from federalForm <strong>1041</strong>, Line 22. If you are the trustee of the bankruptcyestate of a debtor who is an individual in a case underChapter 7 or Chapter 11 of the Bankruptcy Code, you may,in computing the estate’s federal taxable income, deduct theexemption amount under I.R.C. §151(d)(1), but may not deductthe personal exemption under I.R.C. §642(b).Page 13