The allowable credit must be separately computed <strong>for</strong>each qualifying jurisdiction. Use separate columns <strong>for</strong> eachjurisdiction <strong>for</strong> which you are claiming a credit. If you needmore than two columns, you should create an identicalworksheet. Attach a copy of all income tax returns filed withqualifying jurisdictions to the back of your Form <strong>CT</strong>-<strong>1041</strong>or the credit will be disallowed.If you are claiming credit <strong>for</strong> income taxes paid to another state<strong>and</strong> to one of its political subdivisions, follow these rules todetermine your credit:A. If the same amount of income is taxed by both the city<strong>and</strong> state:1. Use only one column of the worksheet to calculate yourcredit;2. Enter the same income taxed by both the city <strong>and</strong> stateon Line 2 on the worksheet; <strong>and</strong>3. Combine the amounts of tax paid to the city <strong>and</strong> thestate on that income <strong>and</strong> enter the total on Line 6.B. If the amounts of income taxed by both the city <strong>and</strong> stateare not the same:1. Use two columns on the worksheet;2. Enter only the income taxed by both jurisdictions onLine 2 in the first column; <strong>and</strong>3. Enter the excess income taxed by only one of thejurisdictions in the next column.The credit claimed cannot exceed the amount of tax dueto <strong>Connecticut</strong> on that portion of income taxed in anotherjurisdiction.Worksheet InstructionsLine 1 - <strong>Connecticut</strong> <strong>Tax</strong>able <strong>Income</strong> of ResidentTrust or EstateEnter:1. The <strong>Connecticut</strong> taxable income from Form <strong>CT</strong>-<strong>1041</strong>,Line 1; <strong>and</strong>2. Any net loss derived from or connected with sources in oneor more qualifying jurisdiction(s) where you were subjectto income taxation whether or not income tax was actuallypaid to the jurisdiction(s).Example: <strong>Tax</strong>payer B, a resident trust, has taxable incomeof $70,000, which includes income of $15,000 from businessactivities conducted in Massachusetts <strong>and</strong> a net loss of$15,000 from a business conducted in Rhode Isl<strong>and</strong>. Thefiduciary of this trust must add the $15,000 net loss to the$70,000 <strong>and</strong> enter $85,000 on Line 1.Part-Year Resident TrustEnter the amount from Schedule <strong>CT</strong>-<strong>1041</strong>FA, Part 1, Line 9,with the following exceptions:1. Add to the amount from Schedule <strong>CT</strong>-<strong>1041</strong>FA,Part 1, Line 9, any net loss derived from or connected withsources in one or more qualifying jurisdiction(s) where youwere subject to income taxation whether or not income taxwas actually paid to the jurisdiction(s); <strong>and</strong>2. For the period the trust is a <strong>Connecticut</strong> resident trust, addback any item of loss or deduction <strong>and</strong> subtract any itemof income or gain that is an item of special accrual.Enter the modified amount on Line 1 of the worksheet.Example: <strong>Tax</strong>payer L, a part-year resident trust, has taxableincome from its residency period of $60,000, which includesincome of $15,000 from business activities conducted inMassachusetts <strong>and</strong> a net loss of $20,000 from a businessconducted in Rhode Isl<strong>and</strong>. The fiduciary of this trust mustadd the $20,000 net loss to the $60,000 <strong>and</strong> enter $80,000on Line 1.Line 2 - Non-<strong>Connecticut</strong> <strong>Income</strong>Resident Trust or EstateEnter the total non-<strong>Connecticut</strong> income included on Line 1 <strong>and</strong>reported on another jurisdiction’s income tax return.Part-Year Resident TrustEnter the total non-<strong>Connecticut</strong> income <strong>for</strong> the period of<strong>Connecticut</strong> residency included on Line 1 <strong>and</strong> reported onanother jurisdiction’s income tax return.For the period the trust is a <strong>Connecticut</strong> resident trust, addback any item of loss or deduction <strong>and</strong> subtract any item ofincome or gain that is an item of special accrual.Line 3Resident <strong>and</strong> Part-Year Resident TrustDivide Line 2 by Line 1. The result cannot exceed 1.0000.Round to four decimal places.Line 4 - <strong>Connecticut</strong> <strong>Income</strong> <strong>Tax</strong> LiabilityResident Trust or EstateEnter the <strong>Connecticut</strong> tax liability as shown onForm <strong>CT</strong>-<strong>1041</strong>, Line 2.Part-Year Resident TrustEnter the allocated <strong>Connecticut</strong> income tax liability asshown on Schedule <strong>CT</strong>-<strong>1041</strong>FA, Line 12. To determine the<strong>Connecticut</strong> income tax liability of a part-year resident trust,the tax applies to the income derived from or connected withsources within this state. The income derived from or connectedwith sources within this state <strong>for</strong> a part-year resident trust isthe sum of the trust’s <strong>Connecticut</strong> taxable income during theresidency portion of the taxable year <strong>and</strong> the trust’s incomederived from or connected with sources within <strong>Connecticut</strong>during the nonresidency portion of the taxable year.Line 5Multiply Line 3 by Line 4 <strong>and</strong> enter the result.Line 6 - <strong>Income</strong> <strong>Tax</strong> Paid to Qualifying JurisdictionsResident Trust or EstateEnter the total amount of income tax paid to a qualifyingjurisdiction <strong>for</strong> the taxable year.Page 16

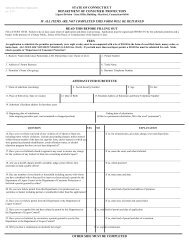

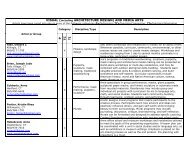

Worksheet <strong>for</strong> Credit <strong>for</strong> <strong>Income</strong> <strong>Tax</strong>es Paid to Qualifying JurisdictionsResident estates <strong>and</strong> full or part-year resident trusts only1. <strong>Connecticut</strong> taxable income ............................................ 1.Enter name of each qualifying jurisdiction. .....................2. Non-<strong>Connecticut</strong> income included on Line 1 above ....... 2.3. Divide Line 2 by Line 1 (may not exceed 1.0000). ........ 3. . .4. <strong>Connecticut</strong> tax liability .................................................. 4.5. Multiply Line 3 by Line 4. .............................................. 5.6. <strong>Income</strong> tax paid to a qualifying jurisdiction .................... 6.7. Enter the lesser of Line 5 or Line 6. ................................7.Column AColumn B8. Total Credit: Add the amount on Line 7 <strong>for</strong> each column. ..................................... 8..00<strong>Income</strong> tax paid means the lesser of the tax liability to thatjurisdiction or the tax the trust or estate paid to that jurisdiction,excluding any penalty or interest, as reported on a return filedwith that jurisdiction. Do not report taxes withheld <strong>for</strong> thequalifying jurisdiction.Part-Year Resident TrustEnter the total amount of income tax paid to a qualifyingjurisdiction <strong>for</strong> the period of <strong>Connecticut</strong> residency only.<strong>Income</strong> tax paid means the lesser of the trust’s tax liabilityto the qualifying jurisdiction or the tax the trust paid to thatjurisdiction, excluding any penalty or interest, as reported on areturn filed with that jurisdiction. Do not report taxes withheld<strong>for</strong> the qualifying jurisdiction.If the tax the trust paid to that jurisdiction was also based onincome earned during the nonresidency period, prorate theamount of tax <strong>for</strong> which you are claiming credit. The prorationis based upon the relationship that the income earned in thatjurisdiction during the period of <strong>Connecticut</strong> residency bears tothe total amount of income the trust earned in that jurisdictionin the taxable year.Example: <strong>Tax</strong>payer H, a part-year resident trust, conductedbusiness in Rhode Isl<strong>and</strong> all year <strong>and</strong> paid $1,200 in RhodeIsl<strong>and</strong> tax in 2009. The trust’s total Rhode Isl<strong>and</strong> income <strong>for</strong>2009 was $20,000 of which $15,000 was earned while thetrust was a <strong>Connecticut</strong> resident trust. The income tax paid toRhode Isl<strong>and</strong> during the <strong>Connecticut</strong> residency period is:$15,000$20,000X $1,200 = $900The fiduciary of this trust should enter $900 on Line 6.Line 7Enter the lesser of Line 5 or Line 6.Line 8 - Total Credit <strong>for</strong> <strong>Income</strong> <strong>Tax</strong>es Paid toQualifying JurisdictionsAdd the amounts from Line 7A, Line 7B, <strong>and</strong> Line 7 ofany additional worksheets. The amount on Line 8 cannotexceed the amount on Line 5. Enter the total here <strong>and</strong> onForm <strong>CT</strong>-<strong>1041</strong>, Line 4.Attach a copy of the income tax return filed with eachqualifying jurisdiction to the <strong>Connecticut</strong> income tax returnor the credit will be disallowed.<strong>Connecticut</strong> Fiduciary AdjustmentUse Schedule A to compute the <strong>Connecticut</strong> fiduciaryadjustment, which is then allocated among the trust or estate<strong>and</strong> its beneficiaries in Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 1. Thefiduciary adjustment is the net amount of the additions <strong>and</strong>subtractions enumerated on Schedule A, which relate to itemsof income, gain, loss, or deduction of the trust or estate.Amount Paid or Set Aside <strong>for</strong> Charitable PurposesWhen calculating the fiduciary adjustment on Schedule A,do not include the modifications <strong>for</strong> any amount paid orset aside <strong>for</strong> a charitable purpose during the taxable year.See instructions <strong>for</strong> federal Form <strong>1041</strong>-A, U.S. In<strong>for</strong>mation<strong>Return</strong> Trust Accumulation of Charitable Amounts, <strong>and</strong>federal Form 5227, Split-Interest Trust In<strong>for</strong>mation <strong>Return</strong>,<strong>for</strong> in<strong>for</strong>mation on charitable deductions.Member of a Pass-Through EntityIf the trust or estate has income as a member of a pass-throughentity, any additions or subtractions that apply to the incomeshould be included on Schedule A. You may obtain the trust’sor estate’s share of the entity’s items from Schedule <strong>CT</strong> K-1,Member’s Share of Certain <strong>Connecticut</strong> Items.Page 17