CT-1041 booklet, Connecticut Income Tax Return for Trusts and ...

CT-1041 booklet, Connecticut Income Tax Return for Trusts and ...

CT-1041 booklet, Connecticut Income Tax Return for Trusts and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

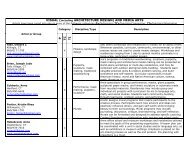

Example: Mr. Jones, a <strong>Connecticut</strong> resident, establishedan irrevocable trust in 2002 <strong>for</strong> the benefit of his threegr<strong>and</strong>children, Beneficiaries A, B, <strong>and</strong> C. Since the trustconsists of property transferred from a <strong>Connecticut</strong>resident, the trust is considered a resident trust. Becausethe trust was not created by the will of the decedent, thetrust is an inter vivos trust. The trust agreement permitsthe trustee to distribute income or corpus, or both, to allthree beneficiaries during the year. This makes all threebeneficiaries noncontingent beneficiaries. BeneficiariesA <strong>and</strong> B are <strong>Connecticut</strong> residents, but Beneficiary C is aVermont resident. Since there are one or more nonresident,noncontingent beneficiaries, the fiduciary of this trustmust complete Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 2, as follows:1. Indicate the number of residentnoncontingent beneficiaries, if any. 22. Indicate the number of nonresidentnoncontingent beneficiaries. 13. Add Lines 1 <strong>and</strong> 2. 34. Divide Line 1 by Line 3 <strong>and</strong> enter decimalto four places. 0.6667The decimal on Line 4, rounded to four decimal places, isentered on Schedule <strong>CT</strong>-<strong>1041</strong>C, Line 11.If the trust in the example is a part-year resident trust, theamount on Line 4 is entered on Schedule <strong>CT</strong>-<strong>1041</strong>FA,Part 1, Line 5.Instructions <strong>for</strong> Schedule <strong>CT</strong>-<strong>1041</strong>CVerify line references from federal Form <strong>1041</strong> at the time youcomplete this schedule.Resident estates or full-year resident trusts must complete thisschedule to calculate <strong>Connecticut</strong> taxable income.Resident estates or full year resident trusts with nonresidentbeneficiaries must complete <strong>and</strong> attach <strong>Connecticut</strong> ESBTworksheet, if applicable.Resident Trust or Estate With or WithoutNonresident BeneficiariesEach resident estate or full-year resident trust, except <strong>for</strong>Quick-Filers, must select the applicable box pertaining to thestatus of its beneficiaries. Inter vivos trusts with nonresident,noncontingent beneficiaries calculate <strong>Connecticut</strong> taxableincome differently than other trusts. See <strong>Connecticut</strong> <strong>Tax</strong>able<strong>Income</strong> <strong>for</strong> Certain Inter Vivos <strong>Trusts</strong> on Page 7.Type of Trust or EstateLine 1Resident trust or estate without nonresident beneficiaries:Check the box <strong>and</strong> complete Lines 4 through 6 <strong>and</strong>Line 14.Line 2Resident estate or a resident testamentary trust with oneor more nonresident beneficiaries or an inter vivos trustwith nonresident, contingent beneficiaries but withoutnonresident, noncontingent beneficiaries: Check the box,complete Schedule <strong>CT</strong>-<strong>1041</strong>FA, Parts 3 <strong>and</strong> 2, <strong>and</strong> completeLines 4 through 6 <strong>and</strong> Line 14.Line 3Resident inter vivos trust with one or more nonresident,noncontingent beneficiaries: Check the box <strong>and</strong> completeSchedule <strong>CT</strong>-<strong>1041</strong>FA, Parts 2 <strong>and</strong> 3. Then complete Lines 4through 14.Line 4 - Federal <strong>Tax</strong>able <strong>Income</strong>Enter the amount of federal taxable income from federalForm <strong>1041</strong>, Line 22, <strong>and</strong> federal ESBT taxable income.Attach federal ESBT worksheet.Line 5 - Trust or Estate’s Share of <strong>Connecticut</strong>Fiduciary AdjustmentEnter the fiduciary’s share of the <strong>Connecticut</strong> fiduciaryadjustment from Schedule <strong>CT</strong>-<strong>1041</strong>B, Part 1, Line e,Column 5. This may be a positive or negative number.Line 6 - <strong>Connecticut</strong> Gross <strong>Tax</strong>able <strong>Income</strong> asModifiedAdd Line 4 <strong>and</strong> Line 5.Full-year resident inter vivos trusts with one or morenonresident, noncontingent beneficiaries, complete Lines 7through 14. All others go to Line 14.Line 7 - Trust or Estate’s Share of <strong>Income</strong> From<strong>Connecticut</strong> SourcesEnter the trust or estate’s share of income derived from orconnected with sources within <strong>Connecticut</strong> from Schedule<strong>CT</strong>-<strong>1041</strong>FA, Part 2, Line e, Column 3, <strong>and</strong> <strong>Connecticut</strong>ESBT worksheet. Attach <strong>Connecticut</strong> ESBT worksheet.Line 8aEnter the amount from Schedule <strong>CT</strong>-<strong>1041</strong>FA, Part 3, Line 4,Column B.Line 8bEnter the amount from Schedule <strong>CT</strong>-<strong>1041</strong>FA, Part 3, Line 18,Column B.Line 8cSubtract Line 8b from Line 8a.Line 9 - <strong>Income</strong> From <strong>Connecticut</strong> Sources asModifiedAdd Line 7 <strong>and</strong> Line 8c.Page 21