Download - Mintek

Download - Mintek

Download - Mintek

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

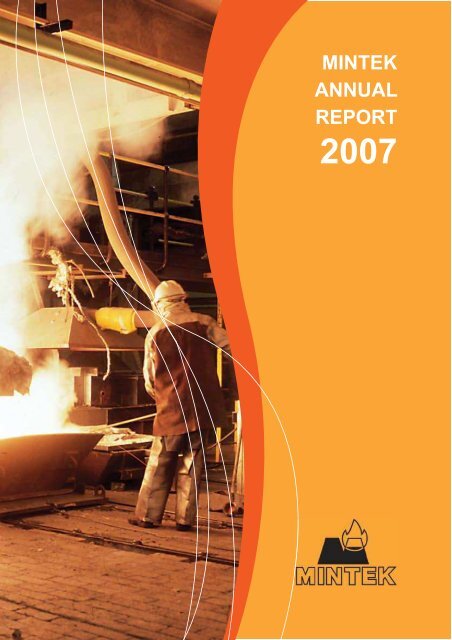

MINTEKANNUALREPORT2007

OUR MANDATE<strong>Mintek</strong>’s mandate is to serve the national interestthrough high-calibre research, development, and technology transferthat promotes mineral technology, and fosters the establishment andand products derived from them.OUR VISIONTo be a global leader in mineral and metallurgical R&D andtechnology transfer.OUR MISSIONTo serve our stakeholders by promoting technology, industrial growthand human development.OUR COMPACT• add value to South Africa’s mineral resources;• expand the country’s mineral technology industries;• develop the minerals industries in the SADC and throughout Africa;• support the growth of SMMEs in the minerals sector; and,

MINTEKANNUAL REPORT2007CONTENTS<strong>Mintek</strong> Mandate, Vision, Mission and Compact..................inside front coverHighlights 2006 - 2007..........................................................................2The Mining Value Chain.........................................................................3Chairman’s Review................................................................................4Board Structure...............................................................................................................4CEO’s Report.........................................................................................8Management Structure...................................................................................................8Performance against objectives...........................................................14Technical Review................................................................................16Gold................................................................................................17PGMs..............................................................................................20Ferrous metals..........................................................................................................22Non-ferrous metals.................................................................................................24Industrial minerals.................................................................................................28Quality, Environment and Safety........................................................................29Commercial Activities..................................................................30Participation in operating companies............................................................31<strong>Mintek</strong> business development projects........................................................31Process control products..............................................................................33Capital equipment........................................................................................35South African Reference Materials............................................................35Minerals Policy and Sustainable Development....................36Mineral Economics and Strategy...............................................................37Resource-Based Sustainable Development............................................38 Kgabane Jewellery Initiative....................................................................41People................................................................................42Human Capital Managment..................................................................43Transformation and Employment Equity................................................43Black Economic Empowerment (BEE)...............................................44Participative Approach: <strong>Mintek</strong> and NUM................................................44HIV and AIDS..........................................................................................44Wellness................................................................................44Diversity.................................................................................................45SAP and Human Economics...................................................................45Human Capital Development..................................................................45<strong>Mintek</strong> Publications.............................................................48Financial Statements 2007..................................................51Corporate Governance..............................................................................52Audit Committee Report..............................................................................55Directors’ Report.........................................................................................57Report of the Auditor-General.......................................................................59Financial statements and notes....................................................................62Glossary..............................................................inside back coverContact details.......................................................inside back coverannual report 2007

HIGHLIGHTS OF2006-2007• Independence Platinum agreed to fund a three-year worktechnology.preliminary in vitroin 2007/08.® annual report 2007 2

THE MINING VALUE CHAINTechnologies and services developed by <strong>Mintek</strong>Exploration• Geochemical sample analysis;• Mineral/ore characterisation;• Artisanal and small-scale mining (ASSM) projectevaluation.Mining• ASSM technology;• Mining inputs economic studies.ConcentrationComminution/Flotation• • Plant audits;• • Control and optimisation strategies.Physical separation• Bulk sample preparation;• • Separation.Pyrometallurgy• Pelletisation and briquetting;• Pre-heating and pre-reduction;• Modelling and simulation;• SAF control strategy;• Fluidised bed and condenser technologies;• High-temperature solid state and phase• – zinc (PWG to SHG)• Titanium chlorination technology.Hydrometallurgy andBiotechnology• Atmospheric and pressure leaching;metals);• Solvent extraction and ion exchange;• Electrowinning;• Process simulation;• Activated carbon regeneration; 3O 8recovery;• Leach circuit control.Value addition• – Catalysis;– Biomedical;– Nanotechnology;• “Smart” materials and sensors;• PGM-based superalloys;• Low-nickel stainless alloys;Generalprocess mineralogy;and development;installation and commissioning;.3 annual report 2007

<strong>Mintek</strong> Board of DirectorsMzi KhumaloChairman of the BoardChairman: MawenziResources Ltd. andMetallon Corporation Ltd.Dr. Paul Jourdanof <strong>Mintek</strong>Abe MngomezuluChief Director: MineralInvestment and Policy,Department of Minerals andEnergyDr. Nozibele MjoliManaging Director:Hlathi DevelopmentServicesDr. Frank CrundwellConsultant:CrundwellManagement SolutionsProf. Phuti NgoepeDirector: MaterialsModelling Centre,School of Physicaland Mineral Sciences,University of LimpopoGugu MthethwaManager: AcquisitionsFinance Group,Standard BankRalph HavensteinCEO: Anglo AmericanPlatinum Corporation Ltd.Vinogaren PillayExecutive Director: CSIRMining Technologyannual report 2007 4

CHAIRMAN’S REVIEWI am pleased to report another year of above-averagegrowth – the second such year in succession - for <strong>Mintek</strong>’s coreresearch and development (R&D) business. Total income for theto R322.02 million, a year-on-year increase of 13.2 per cent, to which theScience Vote (core funding) contributed 32.4 per cent. Total expenditureR13.48 million in the sale of an associated company, as well as earned a sharemillion.Mr Mzi Khumalo,Chairman of Board.Fuelled by the resources boom, which shows little sign of abating, globalspending on mineral exploration reached a new high estimated at US$7.5 billionThis windfall has seen substantial investment in mineral exploration anda long time, and have required relatively little exploration investment, buthave required resolution of technical problems, a change in commodityprice, or changes in political environment, to make them commercialopportunities. Late-stage exploration, which involves a substantialcomponent of metallurgical test work, has also become increasinglydecision.The market for minerals technology is strongly dependent on capitalspending in the mining and metals industries. The current strengthof the market is due to the increasing consumption of metals andthe tight supply-and-demand balance. Supply is constrained bygrade (higher-cost) ore bodies and increased environmental andtechnological requirements.During the year under review, <strong>Mintek</strong> experienced substantialgrowth in its activities related to the platinum-group metals(PGMs), as a result of the continuing high level of interest in newon the optimisation of gold circuits, cyanide auditing and consulting,cyanide analyser and LeachStar advanced process control strategyhave been rapidly adopted by industry.5annual report 2007

particularly in the areas of PGMs and non-ferrous metals,has focused on the smaller companies, who do not have thebelieve that our ongoing efforts in this regard have made aconsiderable contribution to increasing the competitiveness ofof industrial minerals is usually fairly low-intensity, owing to therelatively small size of the market. However, this year therewas considerable activity in our new diamond characterisationfacility.<strong>Mintek</strong> is growing its capacity to lead and support multipleemployment in mining, manufacturing, and agriculture at the localand rural levels. Substantial growth was experienced in the areaof sustainable development, due to strong support from the DME,although this activity is expanding rapidly off a low base, and theremust be some caution in future years regarding the potential forcontinued increases.<strong>Mintek</strong> is playing an increasingly important role in developing the mineralsbased organisation, it is important for <strong>Mintek</strong> to grow sustainably bythe development of future technologies. In this regard, our biggest challengeis attracting and retaining experienced scientists and engineers in the face of<strong>Mintek</strong> also initiated a programme to recruit a small number of highly-skilled,experienced engineers from overseas.growth will depend on upgrades to existing technical and pilot-plant infrastructure.Perhaps the most critical bottleneck in operations is our analytical capacity, whichservices the pilot-plant operations as well as external contract work. During the yearbut still approximately twice that of preceding years.annual report 2007 6

Mr Harold Motaung, and new members Mr Simon Sikhosana, MrMohlomi Ntilane, Ms Lindiwe Mhlabeni, Dr The current period is a tremendously exciting time to be involved in theminerals and metals industries. <strong>Mintek</strong> is well positioned as a premiumprovider of services, products, and technology to the minerals industryworldwide. It has a comprehensive set of strategies that should enable it tomaintain, if not grow, its market share in a highly competitive environment.both realistic and attainable, and adequate provision has been made to covertherefore to be secure. Following its strategic R&D framework, <strong>Mintek</strong> willcontinue to invest in long-term applied R&D, contributing to the technologiesof the future to underpin the future competitiveness of our minerals sector andhis contribution to strengthening and growing <strong>Mintek</strong> into the globallylike to wish him well in his future endeavours.Mr Mzi Khumalo7annual report 2007

Dr Paul JourdanDr Roger PaulVimlan GovenderPetrus Fusiannual report 2007 8

CEO’S REPORTAs a result of the phenomenal global commoditiesboom, remains a major producer of the world’s most strategic minerals, andCEO of <strong>Mintek</strong>.Africa, as well as projects in Zambia and the Democratic Republic of thehave been started around applications for fuel cells and dieselunder our wing, and new projects are planned for the automotiveissues at all levels in South Africa, including participation in theNew Partnership for Africa’s Development (NEPAD) and the AfricanMain pic:An aerial viewof the <strong>Mintek</strong>campus.9annual report 2007

Pics from topto bottom:The AtomicForce Microscope.The bioleachingminiplant.Beadmakingfrom recycledglass.Samplepreparation.of granitewaste.economic growth and development issues around mining andresources” for United Nations Economic Commission for Africawhere a large number of potential new projects are beingplan was also formulated for the national and international craftDr Paul JourdanDr Roger PaulVimlan GovenderPetrus FusiDr Nellie MutemeriAgit SinghMuzi NcgoboDr Johan NellAmanda QuadlingDr Elma van derLingenDr Johan Nellas at 31 March 2007Busi Ntuliannual report 2007 10

income grew frommillion in 2006/07,incurring as income fromIncome, R Million Income per employee R ‘000the Compact, which I signed with the then Minister of Minerals and both fundamental and applied research, which has led to a numberPics from topto bottom:Visitors fromthe GambianGeologicalSurvey.Olive spoonsmade by ruralwomen of SouthAfrica.Testingprecious-metalcatalystsfor cleaningup dieselemissions.A sample ofAUROlite TMgold-basedcatalyst.11annual report 2007

Pics from topto bottom:An industrialCIL goldplant.Minfurncarbonregenerationfurnaces.Potterymaking.Transformationinthe industry.SSM trainingat Giyane.success, and plans to scale up the process to a commercial levelthe SADC but also in the rest of the African continent andand products and have provided process development andassisted NEPAD, UNECA and the AfDB in developing coherentgreat potential for creating sustainable livelihoods, it has been ourScience Vote, decentralised divisions into strategic business units (SBUs), andOur concerted drive towards internal transformation has made the organisation muchmore annual report 2007 12

of the Mineral Development Branch at the Department of Minerals andcombines a little focus, a lot of heart, and a pool of talentedPics from topto bottom:The Biomedicalscreeninglaboratory.APIC jiggingtechnology.HaroldMotaung,new boardchairmanand CEOof AnooraqResources.Morake AbielMngomezulu,the newlyappointedCEO of<strong>Mintek</strong>, as per1 September2007.The Diamondcharacterisationlaboratory.Magnesiummetalproduction.13annual report 2007

PERFORMANCE AGAINST OBJECTIVESStakeholder perspectiveCritical objective KPA Target Summary Performance resultsMandateFinancial perspective Sources of income 2005/2006 2006/2007R million Income, R million Target } Ratio of contract/total income 53.6% 52.4%annual report 2007 14

Organisational perspective Measure 2005/2006 2006/2007 Learning and growth perspective output Transformational perspective Employment equity demographics 15annual report 2007

annual report 2007 16

TECHNICAL REVIEWGOLD INDUSTRYAuTEK – extending the industrial uses of goldProject AuTEK, the joint R&D initiative between <strong>Mintek</strong> and the three majorSouth African gold producers to develop new industrial uses for gold, is nownanotechnology and biomedical applications.AuTEK BiomedicalBiomedical research under Project AuTEK, jointly funded by Harmony Goldand <strong>Mintek</strong>, focuses on developing new types of metal-based therapeuticagents, with the emphasis on cancer, malaria, and HIV/AIDS. The past yearin the in-house team. <strong>Mintek</strong>’s HIV BSL II biomedical laboratory was fullycommissioned, and funding receivedfrom the Technology and HumanResources for Industry Programme(THRIP) allowed for the acquisitionof a Nuclear Magnetic Resonance(NMR) instrument, which will becommissioned in early 2008. Newdevelopment opportunities are beinginvestigated through networkingand collaborative approachesto the large pharmaceuticalcompanies, with the emphasison HIV.More than 170 compoundshave been screened so far foranti-tumour activity, with 30per cent showing promisingresults. Structure-based“Biomedical researchunder Project AuTEK,jointly funded by HarmonyGold and <strong>Mintek</strong>, focuseson developing new typesof metal-based therapeuticagents, with the emphasison cancer, malaria, andHIV/AIDS.”design has resulted in an increase in the “hit rate” (activity plusselectivity) to 10 per cent. The pharmacological work is largelyundertaken at the universities of Cape Town, Western Cape, andPretoria, with synthetic efforts taking place in-house and at threelocal universities (Cape Town, Johannesburg, and KwaZulu-USA for possible assistance with the further development of themost promising compounds.Under the HIV programme, more than 100 compounds werescreened in the past year (the majority of them in-house), with aninhibitor rate of 16 per cent. Advanced studies on 19 interestingcandidates are under way, and it is planned to submit samples topartners in the USA for further evaluation as a step towards preclinicaltrials.Steady progress has also been made in the anti-malarialprogramme, which like the cancer programme is also largelyuniversity-based. More than 40 ligands have been prepared, andMain pic:Solvent dryingin the AuTEKbiomedicalscreeninglaboratory.17annual report 2007

Pics fromtop tobottom:Thebiomedicallaboratory –preparationof in vitrocell assays.The AtomicForceMicroscopein the nanotechnologycentre.A respiratorcanister andAUROlite TMgold-basedcatalyst.Evaluatingpreciousmetal-basedcatalystsfor dieselexhaustaftertreatmentapplications.complexation studies are in progress. Initial data from screeningtests are expected in the last quarter of 2007.To date, the AuTEK biomedical programme has produced twoPhD and three MSc graduates, and a further eight PhD, six MSc,and four post-doctoral candidates are currently registered. Workunder the programme has won seven awards, and resulted in100 contributions to professional journals and conferences, with49 being international.AuTEK NanotechnologyThe AuTEK nanotechnology programme, which is co-funded byelectrochemistry, molecular recognition (biolabelling), anddrug delivery systems. A novel method has been developedfor producing anisotropic precious-metal nanoparticles, andfurther work is being carried out to control product quality, particlesize distribution, and reproducibility with the aim of impartingdesirable electronic, magnetic, optical, and catalytic properties.Certain systems are being investigated for their possible use inelectrochemical sensors for the detection of glucose and otherbiological structures.The production of organically stabilised gold nanoparticlesfor application in molecular recognition (biolabelling) has beensuccessfully scaled up to 2 litre batches. These will be stabilised andfunctionalised by attaching bio-molecules, with the goal of developingmalaria, HIV, and diabetes. Similar technology involving multiplexing of theunderlying structure will be utilised to adapt the particles for drug delivery awell as diagnostics.To ensure that South Africa remains internationally competitive in this fast-ordinated at national level by the Department of Science and Technology (DST)through its National Nanotechnology Strategy. One of the main pillars of thisinitiative is establishing a number of innovation centres around the country. Twocentres will be established in 2007, one at <strong>Mintek</strong> and the other at the CSIR. Theprimary aims of the centre at <strong>Mintek</strong> are to train young scientists who will stimulatethe growth of an emerging nanotechnology industry in South Africa, developprototype products, and add value to the precious metals being produced locally.The DST, the Medical Research Council, and the Water Research Commissionwill be participating in the initiative, which will initially have three focal areas aroundsensors, molecular recognition, and nanotechnology for the water industry.AuTEK CatalysisThe AuTEK catalysis programme, which is co-sponsored by AngloGold Ashanti,seeks to develop gold catalysts for industrial applications. One of the major hurdles toestablishing a gold catalyst market has been a lack of commercially viable quantitiesof material for product testing and screening. Large-scale production of gold catalystsis not easy, owing to issues such as gold particle size, reproducibility, and deactivation,and involves synthesis techniques that are completely different to those currentlyemployed in PGM catalyst production. Research at AuTEK has been directed atovercoming these hurdles and has led to the development of the AUROlite TM range ofgold catalysts.Under the AuTEK catalysis programme, the current production capacity of 20 kgper batch is currently being further scaled-up to the 65 kg scale to meet demand.Construction of the plant, which is sponsored by the DST’s Precious Metals Initiative, isannual report 2007 18

expected to be complete by the fourth quarter of 2007.AuTEK, in conjunction with the World Gold Council (WGC), isactively marketing these gold-based catalysts under the trademarkAUROlite TM , and supplying end-users. The typical AUROliteproduct range includes Au/Al2O3, Au/Fe2O3, Au/TiO2, Au/ZnO. Jointmarketing displays have been held at the North American CatalystsConference and Europacat – generating much interest, which hastranslated into further orders. AUROlite materials have been supplied topetrochemicals, oleochemicals, and respirators and other safety equipment.Gold catalysts are unique in terms of their ability to catalyse oxidationreactions at low temperature and/or by the use of molecular oxygen.Examples of such reactions include:• Carbon monoxide oxidation.• Oxidation/selective oxidation of organics – e.g. glucose to gluconic acid,cyclohexane to nylon precursors.• Epoxidation – e.g. propene to propene oxide.Gold catalysts have also been found to be suitable for the removal of mercuryfrom coal power plant emissions, and the hydrodechlorination (destruction) ofground water pollutants such as trichloroethene.Gold catalysts also offer the ability to oxidise the carbon monoxide inhydrogen feedstock for fuel cells, converting it to “inert” carbon dioxide andthereby preventing degradation of the cell’s performance. <strong>Mintek</strong> is stillseeking commercial partners to assist in the further development of thistechnology, which has been tested at Johnson Matthey’s laboratoriesand subsequently trademarked and patented under the nameAUROPureH 2TM.Pics from top tobottom:AUROlite TMgold-basedcatalyst.Inspectingemergencyequipmentduring an ICMIaudit of a goldplant.Cyanidespeciation bysegmentedanalysis.Calibratinga Cynoprobebeforeinstallation on agold plant.Cyanide services<strong>Mintek</strong> took part in full compliance audits of Sasol Polymers’Sasolburg sodium cyanide plant and of Sasol Infrachem to assessfor compliance with the Producers’ and Transportation codes of theInternational Cyanide Management Institute (ICMI). ICMI-based“gap” audits were also undertaken at the Navachab gold mine inNamibia and Geita in Tanzania. The audits planned for Iduapriemand Bibiani in Ghana were re-scheduled, and will now takeplace in 2007. <strong>Mintek</strong> takes the role of technical Expert Auditoraccreditation as Lead Auditor.At the end of the year under review, the Cyanide CentreLaboratory underwent an audit in terms of ISO 17025 (TestingLaboratories), and <strong>Mintek</strong> expects to achieve full compliance withthis standard in mid-2007.<strong>Mintek</strong> has built a solid foundation in soil, solution, and gas-phaseanalysis and mass-balancing of cyanide, and is currently lookingat extending this expertise to other metals. As part of this process,an advance gold-leach reactor is being commissioned that willenable conditions such as agitation intensity, shear characteristics,temperature, pressure, pH value, and redox potential to becarefully monitored and controlled. The pulp can be sampled duringoperation, with sub-samples taken for analysis and returned to theleach without distorting the mass balance. Cyanide concentration andspecies are monitored using the Cynoprobe on-line analyser, and aSCADA system is used for data capture and trending. The new reactor19annual report 2007

Pics from topto bottom:Apparatusfordeterminingthe rateof oxygenuptakeduring goldleaching.Elutionthe MINIX TMgold-selectiveresin.The controlroom in<strong>Mintek</strong>’sDC arcdemonstrationsmeltingfacility.will initially be used in development work on high-arsenic goldores, incorporating arsenic speciation and mass-balancing. Theequipment will eventually form part of a comprehensive facilityfor characterisation and problem-solving on gold leach andadsorption circuits, from both the process and the environmentalaspects.Process developmentAn extensive suite of testwork, including mineralogy,comminution and gravity concentration, leaching, adsorption,and carbon-in-pulp/carbon-in-leach (CIP/CIL) modelling, wasGold’s Modder East project. On the commercial plant, which isbeing designed by Bateman, about 40 per cent of the gold willbe extracted in a gravity circuit, with the remainder recovered byCIL. The work showed that recoveries of between 87 per cent andnew gold mine on the East Rand in almost 30 years, is scheduledto start production in the third quarter of 2009, and will reach a levelof 110 000 ounces (3.42 tons) a year at full output.Laboratory testwork was conducted to evaluate processing options aspart of the feasibility study, carried out by MDM Engineering, for ManoRiver Resources’ New Liberty gold project in Liberia. This project isproduction targeted for the latter part of 2007.A visit was paid to CVG Minerven in Venezuela to carry out a basicRecommendations were made regarding options for upgrading the plants’capacities and introducing new technology, as well as for tailings retreatmentand cyanide management. Further work, including testing of a bulksample for process development, is anticipated in 2007.The MINIX TM gold-selective resin was tested in a resin-in-leach (RIL) pilot plantat Fairview gold mine, which was run by Gold Fields in collaboration with thethen owners of the mine. Gold Fields, who supply the Biox® technology used atFairview, are continuing work with <strong>Mintek</strong> to reduce the thiocyanate concentrationin the tailings. The MINIX resin was also tested successfully for scavengingdissolved gold from slimes-dam return water at a Witwatersrand gold mine.A number of service projects were carried out for projects in Botswana, the DRC,Ghana, Mali, Romania, Zambia, and Zimbabwe, as well as South Africa. Ongoingtesting of surfactants (wetting agents) for application in heap leaching was conductedin collaboration with the manufacturer. A new CIP/CIL and resin-in-pulp/resin-in-leach(RIP/RIL) computer modelling programme was developed to interface with standardMicrosoft®Windows-based processes.PLATINUM-GROUP METALS (PGM) INDUSTRYDemonstration of the smelting step of the proposed ConRoast process for recoveringPGMs from high-chromium low-sulphur concentrates continued until the end of the yearunder review. Four major DC furnace campaigns have now been conducted, treating atotal of 28 000 tons of revert tailings and other materials with Cr 2O 3contents of up to 5per cent, at feed rates exceeding 1 000 tons per month. During the last campaign, whichran continuously for 17 months, the availability of the furnace was 91 per cent.The full ConRoast process involves the smelting of dead-roasted sulphide concentrates,with recovery of the PGMs and base metals into an iron-based alloy rather than a sulphideannual report 2007 20

of ore types and concentrate compositions - it removes the limitson the minimum quantities of contained base metals or sulphur, andcan tolerate the high chromite levels in concentrates characteristicof UG2 ores without the necessity for copper cooling elements in thefurnace sidewalls.of material was smelted in a 200 kilovolt-ampere DC arc furnace. A highrecovery was obtained, with 98% of the platinum, palladium, and rhodiumreporting to the iron alloy phase. An engineering feasibility study of theprocess is under way, with <strong>Mintek</strong> providing design inputs for the proposedcommercial furnace.Laboratory and pilot-plant testwork was carried out in support of thefeasibility study, by SRK Consulting, on Platmin’s Pilanesberg project. Thebench-scale testwork was conducted on diamond drill core samples andthe silicate and UG2 ores in industry-standard primary and secondary circuits,were performed using ore from a trial pit excavated at the Tuschenkomstproperty. The data generated during this work will be used to design theprocessing plant, which will consist of separate concentrators for the silicateore and UG2.A 60-ton representative sample from Ridge Mining’s Sheba’s Ridge projectwas piloted to provide metallurgical design data for the feasibility study.towards the pre-feasibility study (Annual Report 2006), with recoveriesof 86 per cent for copper, 69 per cent for nickel, and 73 per cent foris scheduled for completion at the end of calendar 2007. According tothe pre-feasibility study, completed in March 2005, Sheba’s Ridge willproduce 24 000 ton of nickel, 12 000 tons of copper, and 390 000ounces of PGMs and gold per annum.Three pilot runs, plus extensive laboratory-scale work, werecompleted on different ore types for Barrick Gold’s Sedibeloproject, and this work is continuing into 2007. Other investigationswere carried out for Sylvania Resources on the recovery of PGMsfrom chromite tailings, and for AfriOre’s Akanani project (nowowned by Lonmin).A considerable number of quantitative mineralogicalinvestigations, using the QEMScan and Mineral Liberationcharacteristics of the PGMs, were carried out in conjunction withthe process development work. <strong>Mintek</strong> also worked closely withthe suppliers of both these technologies to increase the accuracyof the results from rapid, automated scans of PGM-bearingsamples. This is a particular issue with the PGMs, because of theoverlap in spectral windows. In a new development, a quantitativescanning electron microscope was set up on site at <strong>Mintek</strong> forone of the major PGM producers. <strong>Mintek</strong> has been running theinstrument on the client’s behalf to provide prioritised mineralogicalsupport during studies of the various plant streams for mass-balancepurposes and other research projects.As part of its research into more cost-effective comminutiontechnologies, <strong>Mintek</strong> commissioned a pilot-scale high-pressure grindingPics from top tobottom:A furnace tapduring theConRoastsmeltingcampaign.Flotation pilotPilanesbergPics 3 and 4:The QEMSCANand MineralLiberationAnalyserare usedextensively forPGM processdevelopment.21annual report 2007

Pics from topto bottom:A pilot-scalehigh-pressuregrindingroll .Pouringmoltenmetal intoatomisercup.Product fromroll (HPGR). This is a relatively new technology, which uses theprinciple of interparticle crushing between two counter-rotatingconventional crushing in certain applications, the HPGR generatesa product with very favourable characteristics for downstreamprocessing, from incipient crack formation to complete particledisintegration.Testwork has been carried out on a number of ore types, mainlyfrom the PGM sector. While UG2 ores are generally too abrasivefor effective processing, considerable success has been realisedwith Merensky ores. The results show that incorporating a HPGRbefore the primary milling stage could lead to lower comminutioncosts and enhanced metallurgical performance. Locked-cycle teststo investigate whether the HPGR could in some instances replacethe primary milling circuit have indicated that a grind of 100 per centpassing 600 micrometres can be achieved with a circulating load of70 per cent. <strong>Mintek</strong> is planning to install a second, larger HPGR during2007.Phase 1 of a study in minor element deportment in PGM smelting,which was conducted as part of the AMIRA P671 Project, wascompleted. The results showed the need for further development ofanalytical techniques, which would form a basis for the likely extensionof the project.The Platinum Development Initiative (PDI) is a collaborative programme,supported by the three major platinum producers, to develop new industrialuses for platinum. The initial work of the programme focused on developingplatinum-based analogues of nickel-based superalloys. Experimentalphase-diagram work on the platinum-aluminium-chromium and platinumnickel-rutheniumsystems has been completed, while the establishment of athermodynamic database for the platinum-aluminium-chromium-ruthenium alloysystem is almost complete. The outstanding phase diagram work will be doneat the University of the Witwatersrand under the Centre of Excellence in StrongMaterials.The DST-funded programme for fast-tracking the commercialisation of platinumbasesuperalloys has progressed according to plan. Three projects were initiallyenvisaged – the glass industry, coatings, and powder metallurgy. After a review, theglass component was terminated, since it was felt that this project could not competewith the well-established technology offered by the major players in the sector. A R2million physical vapour deposition system has been commissioned for the coatingswork, which is being undertaken in collaboration with the University of the Free Statealloyed buttons produced at <strong>Mintek</strong>, and are being characterised at UFS as part of aPhD study.An Atomijet atomisation rig, capable of producing platinum powders in the size rangefrom 30 to 150 micrometres has been commissioned, and an uniaxial compaction pressis being re-furbished and should be delivered in the second half of 2007.In September, six members of the PDI research team gave presentations at theJapanese-South African-German Workshop and Summer School in Bayreuth, Germany.This comprised a gathering of scientists from Germany, Japan, Russia and South AfricaFERROUS METALS INDUSTRYThe titaniferous magnetite layers in the Upper Zone of the Bushveld Complex containsannual report 2007 22

vast resources of iron, vanadium, and titanium, but to date noprocess has been developed that can economically recoverall three of these metals. The high titania levels make the oreunsuitable for smelting in a traditional blast furnace, and theand Vanadium, which operate the Mapochs Mine, processes the ore foriron and vanadium, but discards the low-grade titanium slag.Veremo Holdings has begun an evaluation of the feasibility of utilisingpart of the titaniferous magnetite ore from the Bushveld Complex toproduce iron units that could be used as feed for foundries and steel plants.The initial feasibility study includes the potential recovery of titania andvanadium from the slag.Approximately 5 tons of concentrate was produced from 14 tons of trenchedmaterial and smelted in <strong>Mintek</strong>’s 200 kilovolt-ampere DC arc furnace.The testwork was aimed at producing slag that could be used in furtherdevelopment work, as well as evaluating the deportment of iron, titanium,and vanadium under varied reducing conditions.additions, the process could be controlled to produce good-quality iron withhigh recoveries and a wide range of titania-containing slag compositions.Further development work will investigate the feasibility of upgrading 2andrecovering the vanadium from the slag.Oriel Resources Plc (Oriel) has been engaged in developing itsShevchenko Nickel project in Kazakhstan since 2004, and conducted amajor ferronickel smelting campaign at <strong>Mintek</strong> in 2005 (Annual Report2005). Bateman was appointed in late 2004 to conduct a feasibilitystudy that was completed at the end of 2005 based on the work at<strong>Mintek</strong> . The process includes an Aerofall mill and Polcal calcinerfrom Polysius, Germany, and the twin electrode DC arc furnaceis similar to the approach envisaged for the Koniambo ferronickelproject in New Caledonia, now owned by Xstrata.Oriel has continued to develop the Shevchenko project andto evaluate the selected process options so that the mostappropriate approach can be chosen for the project to proceed.<strong>Mintek</strong> has been conducting additional testwork on these processoptions for Oriel to assist with the project development.In 2005, <strong>Mintek</strong> began a major collaborative project, fundedby the Innovation Fund and supported by Anglo Platinum, theUniversity of Pretoria, and an industrial partner, to developa more cost-effective grinding ball for the minerals industry.Samples produced in laboratory-scale melts are undergoingscreening, and in parallel with this, reference balls are beingproduced so that the casting methods can be optimised. Batchtests of balls cast from the most promising materials are plannedTrials of the “smart” rockbolt, or SmartBolt TM , are continuing in“highly critical” areas on two deep-level gold mines. <strong>Mintek</strong> isworking with a team of specialists towards the commercialisation ofboth the SmartBolt and the Hercules TM low-nickel austenitic stainlesssteel, and the Innovation Fund has indicated that it will supportcommercialisation if the two projects merit it.Pics from topto bottom:Small-scalesmeltingtitaniferousmagnetite.Conductinga ferronickelsmeltingcampaign at<strong>Mintek</strong> forOriel ResourcesPlc.A grinding ballsectioned formetallurgicalanalysis.Smartbolt TMausteniticstainless steel.23annual report 2007

Pics from topto bottom:Spiralseparation ofchromite.Densityfractions ofan iron-oresample.TheSarcheshmehmine in Iran.The project proposals and funding agreements for the ferrousand base metals pillars of the Advanced Metals Initiative, whichquarter of 2007. Three projects have been proposed under thisinitiative, all of which are aligned strongly with the automotiveindustry.An investigation was begun on the pre-reduction of manganeseore and the possibility of recovering energy from the liquid slag.These processes hold potential for reducing the carbon dioxideemissions produced during smelting, and possibly for theproduction of hydrogen.Work continued on iron ore characterisation for KumbaResources in support of the Sishen Expansion Project. Inaddition, investigations were carried out on the upgrading ofelutriation, and magnetic separation.Metallurgical testwork, involving investigations of the sizedistribution, comminution characteristics, washability using heavyliquid separation, and gravity separation using tables and spirals,was conducted on material from Chromex Mining’s Mecklenburgchromite project. The results were used as input for the detaileddesign and costing exercise, and to forecast the product split intochemical, and foundry grade).NON-FERROUS METALS INDUSTRYThe bioleaching work package under the European Union’s BioMinEproject, which is co-ordinated by <strong>Mintek</strong>, has continued to progress well.During the year under review, a number of project partners investigatedthe process engineering development, as well as the more fundamentaltechnology, related to the bio-hydrometallurgical treatment of two low-gradeIntegrated pilot campaigns on the complex polymetallic concentrates from bothof these deposits is scheduled to begin at <strong>Mintek</strong> in the second half of 2007,and will run through to mid-2008. It is anticipated that a number of our Europeancolleagues in BioMinE will participate in this programme, which, if successful, willlead to pre-feasibility studies. Although the resources are of European origin, theoutcome of the work will be directly relevant to similar deposits in southern Africaand in other parts of the world. BioMinE is funded under the EU’s Sixth FrameworkProgramme (FP6), and is also supported by a major strategic investment by theDST.Large-scale piloting of <strong>Mintek</strong>’s heap bioleaching technology for chalcopyritebearingcopper ores continued at the Sarcheshmeh Copper Complex in southern2005, a further three 20 kt heaps were commissioned at approximately three-monthlyCopper Industries Company (NICICO) has decided to proceed with the developmentof a commercial plant, with a capacity of 12 kt of copper metal per annum, at theDahrezar copper mine. <strong>Mintek</strong> will be contributing to the feasibility study for the project,which is scheduled for completion towards the end of 2007, and will remain closelyinvolved in the engineering and commissioning of the planned commercial plant.The successful heap bioleaching of chalcopyritic ores depends on the generation andpreservation of heat of chemical reaction in the heap, and prolonging the permeabilityof the heap. These objectives have been realised by a combination of certain heapconstruction features and operational tactics, and the life cycle of each heap has beenannual report 2007 24

partitioned into several operating stages, each with its own targetsand criteria for completion. This approach has required a newlevel of sophistication in heap leaching. For the Iranian pilot plant,a spreadsheet-based operator advisory and administration systemhas been developed, which tracks the life cycle of each individual cellwithin a heap, and provides operator support for the most essential dailydecisions. These include the allocation of irrigant (intermediate leachor to intermediate leach solution), and adjustment of the irrigation andaeration rates to satisfy the stoichiometry of the reaction and maximiseheat accumulation within the heap. For commercial applications, a moresophisticated package with additional features is being developed, that willintegrate with current industry-standard SCADA and database software.As a result of the success at NICICO, <strong>Mintek</strong> has undertaken a considerableamount of heap-bioleaching amenability testwork, which could lead to thistechnology being further evaluated for application to low-grade copper, nickel(sulphides and laterites), and uranium deposits in southern and central Africa.Development continued on a novel technique for inoculating bacteria intoleach heaps, with the aim of obtaining a more rapid start-up and enhancedoxidation rates, which will lead to higher heap temperatures and fastercopper leaching. A set of 6 m column leach tests were conducted on a lowgradechalcopyrite ore, and further work is being conducted on techniquesto monitor the process. This project is being carried out with an industrialpartner, with funding from the Biotechnology Partnership and Development(BioPAD) initiative.<strong>Mintek</strong> is continuing with research on the development and optimisationof molecular techniques for identifying the micro-organisms involved intank and heap leaching, in order to gain an improved understandingviceversa. Work at the University of the Free State and Rhodes Universityon the production of precious-metal nanoparticles by biosynthesisis focusing on the isolation of the proteins and enzymes involved,with the aim of linking these to the varios sizes and shapes ofparticles that are produced. A second round of THRIP funding hasbeen received for investigations into the bioleaching of silicateminerals. Two MSc projects are under way, on nickel laterites (atthe University of KwaZulu-Natal) and the bio-assisted weatheringof kimberlites (at the University of the Witwatersrand), and willbe completed in March 2008. Two BTech projects are beingundertaken at Tshwane University of Technology on the biologicaldegradation of cyanide species.In support of a study of a major expansion at the Nkomatinickel mine, an 80 ton bulk sample of the Chromititic PeridotiteMineralised Zone (PCMZ) was processed in <strong>Mintek</strong>’s milling andThe plant incorporated a scavenger cleaner circuit and employedoptimised residence times to enhance the recovery of the slow-undertaken on a sample from the Main Mineralised Zone (MMZ).ore, previously regarded as uneconomic, can be processed toyield a saleable concentrate. This, together with improved metalpriceforecasts, made it possible to lower the cut-off grade applied toportions of the resource, thus increasing the open-pit reserves.As a result of applying the lower cut-off grades and including thePics from topto bottom:Heap bioleachingatSarcheshmeh.• Pregnantleach solutionponds.• Pond underconstruction.• Inoculumpreparationplant.• Augersampling ofheap.25annual report 2007

Pics from topto bottom:Flotationpilot-plantcampaign onNkomati ore.The NkomatiNickel Mine(photocourtesyNkomatiNickel).Pilot-plantoperatorstake samplesfrom themanganesesolventextractioncircuitto purifythe cobaltelectrolytebeforeelectro-Copperelectro-the KOVPCMZ, Nkomati’s nickel reserves have increased by 50 percent – to 485 377 tons. The by-product reserves have also43 per cent, and 4.181 million ounces of PGMs, a 70 per centincrease. Based on these positive results, LionOre and ARMcommissioned DRA to proceed with a bankable feasibility studyfor the large-scale expansion of the concentrator plants.The proposed large-scale expansion, planned for 2010, willincorporate mining of the PCMZ, increasing annual productionto approximately 20 000 tons of nickel and extending the life ofthe mine to beyond 2020. An interim expansion exploiting thedisseminated MMZ will maintain nickel production at its currentlevel of about 5 000 tons per year after the massive sulphidemineralisation is depleted in 2008.<strong>Mintek</strong> has carried out process development work for a numberof copper-cobalt projects in Zambia and the DRC. Among thesea South African mining company in the DRC for many years. Thestarted up in September 2006. The second phase, which will involvecobalt metal on-site at Ruashi, is under construction.<strong>Mintek</strong> began bench and pilot work, which would be used in the bankablefeasibility study for phase II of the project, in April 2006. Three campaignswere conducted, and the work was completed during March 2007.In the design of the solvent-extraction and electrowinning circuit, <strong>Mintek</strong>worked closely with Metorex’s design company, TWP Matomo ProcessPlant. The plant has been designed for a capacity of 120 000 tons of ore permonth. When the phase II expansion is completed, production at Ruashi isexpected to increase to 45 000 tons of copper cathode and approximately 3500 tons of cobalt metal and cobalt carbonate per annum.A major process development campaign was conducted for the KOV coppercobaltproject, also in the DRC. A total of 27 tons of material was delivered tolaboratory tests to determine the optimum leach conditions, integrated piloting of theleaching, copper solvent extraction and electrowinning circuit, and Aspen simulationLME Grade A standard (higher than 99.95 per cent copper), were produced. The KOVcomplex, which contains one of the world’s largest high-quality copper and cobaltresources, is being re-developed by Nikanor plc. The project will include a major27 500 tons per year of cobalt products.Dense-media separation, milling, and leaching testwork were carried out to investigate aGreen Team Consultants International.<strong>Mintek</strong> has been involved in numerous projects to remove iron and manganese fromdilute cobalt sulphate solutions by oxidative precipitation using air/SO 2. This technologyis attractive as it can be done at ambient temperature, relatively low pH, and ferrousiron is quantitatively removed within 1-2 hours. In order to produce cobalt cathode of thedesired quality, iron, manganese, copper, zinc, and aluminium must generally be removedfrom the feed to electrowinning. The requirements to produce an intermediate cobalt saltare generally less stringent, but usually iron, aluminium, and manganese still need to beremoved.annual report 2007 26

The recent interest shown in this technology by emergingcopper-cobalt producers in central Africa has encouraged <strong>Mintek</strong>to do some work to identify potential scale-up issues. Variousagitators and gas induction systems were investigated, and a highshearimpeller designed and supplied by Outotec was selected forfurther testwork on a 2 m 3 scale to examine the effects of parameterssuch as SO 2and temperature on the process. Optimisation tests remain to be doneon power consumption and various aspects around gas induction.Two smelting campaigns were conducted on discard slag from BCL inBotswana to compare the use of AC and DC furnaces for recoveringnickel and copper. The results showed that both technologies were equallyeffective, and that the company could substantially improve the recoveriesin its slag-cleaning operation by adding reductant to the existing settlingfurnaces.Pics from top tobottom:The Outotechigh-shearimpeller.LaboratoryNicksyn TMreagent insupport of theat Tali Nickel.The thermalMagnesiumProcess demonstrationplant.The <strong>Mintek</strong>-developed nickel synergist (Nicksyn) was evaluated tooptimise nickel recovery and nickel-calcium separation at Tati Nickel inBotswana. Laboratory test work was conducted at <strong>Mintek</strong> on the feed to thenickel solvent-extraction circuit to optimise the combination of the synergistand the Versatic 10 commercial extractant, and the results applied on theActivox® hydrometallurgical demonstration plant at Tati using a 0.5 toncommercial batch of Nicksyn.on the organic phase, which could result in gypsum formation inthe extraction circuit if the feed becomes saturated with calcium.Previously, Tati Nickel minimised the problem by diluting the feedstream with fresh water, but this would increase the size of theproduction. Furthermore, with Versatic 10, the pH of extractioncannot be increased as this causes higher calcium loadings -extraction stages).With the synergistic system, the calcium loading was aboutone-tenth that obtained previously, and gypsum formation canbe completely avoided. The Versatic-Nicksyn combination alsoachieved higher nickel recoveries (99.7 per cent comparedwith about 99.3 per cent) using only four stages. In addition,lower reagent losses were experienced, which can be ascribedto the much lower pH of operation and the reduction in crudeformation.Work continued on the production of titanium-aluminium masteralloys by aluminothermic reduction, and a project is in progressat the University of Cape Town on the fundamental aspects of thetitanium-aluminium-oxygen-carbon-nitrogen system to determinethe best criteria for scale-up.Following a review of the economics of the <strong>Mintek</strong> ThermalMagnesium Process, Anglo American has decided not to pursuecommercialisation, since it is felt that it would not be able tocompete with the low-cost Chinese producers. <strong>Mintek</strong> will continue tolook for opportunities for applying the technology.27annual report 2007

Pics from topto bottom:Small-scalepressureleaching ofa uraniumcontentrate.uraniumleach liquor.Uraniumoxideprecipitation.Hydrophobicitya diamondbearingconcentrate.INDUSTRIAL MINERALSambient and pressure leaching, gold diagnostic leaching,and CIL adsorption, was done for the Buffelsfontein tailingsrecovery project owned by First Uranium, the gold and uraniumsubsidiary of Simmer and Jack Mines. Based in this preliminaryto recover an uranium concentrate, then pressure leaching,solvent extraction and ion exchange using NIMCIX continuousleach residues would be treated in a CIL plant for gold recovery.Also for First Uranium, pilot-scale leaching was conducted on abulk underground sample from the Ezulweni project to producea feed for solid-liquid separation, countercurrent decantation,and ion-exchange testwork. The results will be used to generatedesign criteria for a possible NIMCIX plant. Both these projectsare continuing into 2007.Testwork was completed on the development of the processMalawi, as part of the bankable feasibility study by GRD Minproc.Paladin gave the go-ahead for the development of the project inFebruary 2007, and commissioning is scheduled for the third quarterof 2008. Kayelekera will be Paladin’s second uranium mine in southernAfrica – Langer Heinrich in Namibia, for which <strong>Mintek</strong> conducted2007.<strong>Mintek</strong>’s uranium business continues to grow, and an increasing numberof approaches are being received concerning proposed projects onWitwatersrand-type materials, particularly tailings re-processing for bothuranium and gold. Some of these are potentially very large projects. <strong>Mintek</strong>’sstrength in this area is the comprehensiveness of the services it can provide,from initial investigations up to large scale piloting.During the year, a new laboratory facility for characterising diamonds accordingto their hydrophobicity (response to grease-table recovery) and luminescence(recovery by X-ray methods) was fully commissioned. The laboratory has met withan extremely favourable response form major industry players, including De Beers,SouthernEra, and Bateman, and work on optimising recovery processes has beendone for a number of projects in South Africa and overseas. <strong>Mintek</strong> has engagedan internationally recognised expert in kimberlite petrology and diamond studies,and this project will be expanded in 2007/08 to include diamond characterisation forpurposes of marketing valuation and population discrimination.Ongoing heavy-liquid separation testwork was carried out for De Beers to evaluate<strong>Mintek</strong>’s capabilities in chlorination technology were further developed with thecan handle kilogram-size samples, resulting in a much-improved mass balance.A suite of testwork, including sample characterisation, heavy-liquid separation, shaking-conducted on a sample of bauxite. The aim of the work was to simulate a processingannual report 2007 28

oute to remove the quartz and hematite/goethite from thematerial. It was found that around two-thirds of the total silica,and more than half of the Fe 2O 3, could be removed, which as wellas resulting in a higher-quality product, would reduce the formationof “red mud” in the Bayer process.QUALITY, ENVIRONMENT AND SAFETY<strong>Mintek</strong>’s Environmental Management System underwent a successfulaudit, for OHSAS 18001 (Occupational Health and Safety), will take placein 2007, and that for IS0 9001 (Quality) the following year. Re-assessmentThe Analytical Services laboratories underwent a successful surveillanceaudit for ISO 17025 compliance in 2006.At the end of the period under review, the Lost Time Injury Frequency Rate(LTIFR) was 2.0, compared with the target of 1.0. The Client DissatisfactionFrequency Rate (CDFR), after consistently achieving the target of lessthan 10, rose sharply in the second half of the year. This was due to latedelivery of results, and communication problems with the clients, onseveral minor projects undertaken by one of <strong>Mintek</strong>’s divisions. Stepshave been taken to remedy these problems.Pics from topto bottom:PersonalProtectionEquipment(PPE) forradiationMonitoring abulk sample ofuranium ore.<strong>Mintek</strong>’s HIVCommittee.Access topotentiallyhazardousareas isrestrictedto trainedpersonnel.During 2006, two new indices were established: the MajorEnvironmental Incidents Frequency Rate (MEIFR) and PublicDissatisfaction Frequency Rate (PDFR). <strong>Mintek</strong>’s MEIFR is above thetarget of 5 at the moment. The upward trend is possibly the result ofas corrective action is implemented. The PDFR (which is a subsetof the MEIFR) is also above the target – however, the public<strong>Mintek</strong> is registered as a uranium testwork facility with the NNRand the Department of Minerals and Energy (DME). A RadiationProtection Programme (RPP) has been incorporated as part ofthe overall Safety, Health, and Environment programme, andan internal audit schedule, incorporating site inspections by theNNR, has been implemented.“During the year, a new laboratory facilityfor characterising diamonds according to theirhydrophobicity (response to grease-table recovery)and luminescence (recovery by X-ray methods) wasfully commissioned.”29annual report 2007

annual report 200730

COMMERCIALACTIVITIES<strong>Mintek</strong>’s commercial activities comprise participation in operatingcompanies and joint ventures, sales of equipment and technology licensingagreements. <strong>Mintek</strong> also actively promotes the establishment of mineralbaseddevelopment projects that could utilise its technologies.PARTICIPATION IN OPERATING COMPANIESMindev (Pty) Ltd. (Mindev) is a wholly owned local holding company thatwas established by <strong>Mintek</strong> in 2002 to support the commercialisation of itstechnologies via partnerships in operating business ventures.Mogale Alloys (Pty) Ltd. was formed in2003 to recover nickel and chromiumfrom furnace dust produced by ColumbusStainless at Middelburg, using the DCarc furnace at Samancor Ferrochrome’sKrugersdorp facility. During the periodunder review, Mindev concluded the saleof its 25 per cent interest in Mogale anda licence agreement for the DC smeltingtechnology to PGR 17 Investments (Pty)Ltd., the existing management team,for a total consideration of R43.15from the premium that the remainingshareholders were prepared topay in order to gain control of thecompany.Mindev is in the processof divesting its 25 per centshareholding in TollSort (Pty) Ltd., to MikroSort (Pty) Ltd. thevendors of the optical sorting technology, following a decisionbeen made in the optical sorting of low-grade gold, PGM, andother ores, it was decided that the additional investment andtime required to fully develop the technology to a point where itunacceptably high risk.MINTEK BUSINESS DEVELOPMENT PROJECTS<strong>Mintek</strong>’s Business Development group is pursuing severalopportunities for commercialisation of the organisation’sintellectual property.“Several independentanalyses have concludedthat, depending on theimplementation of smelterexpansions by the majorproducers and the numberof new PGM projects thatcome on stream, the SouthAfrican PGM sector willrequire additional smeltingcapacity within the next”Independence ConRoast PGM ProjectIn June 2006, <strong>Mintek</strong> and Independence Platinum Ltd. (IPt), asubsidiary of Braemore Resources plc, entered into an exclusiveagreement for the commercial development and implementationof the ConRoast process. In terms of the agreement, IPt will fund aMain pic:TappingPGM-bearingalloy duringa Consmeltcampaign.31annual report 2007

Pics from topto bottom:tion testwork.The SAVMINpilot plantat Grootvleigold mine.Metallographiccharacterisationofgrindingballs.US$15 million work programme over three years, including aemerging PGM producers in South Africa.Several independent analyses have concluded that, dependingon the implementation of smelter expansions by the majorproducers and the number of new PGM projects that come onstream, the South African PGM sector will require additionalthan half of the new production will come from UG2 ores,which pose technical challenges for conventional six-in-lineparticularly for nickel, will be needed to enable the processingof Platreef ores.As part of the development programme, IPt will continue with thedemonstration work at a commercial scale (from 1 000 - 2 000tons per month) at <strong>Mintek</strong>, using a range of high-chromium PGMconcentrates.IPt is evaluating the project in terms of a smelter with a targetcapacity of 360 000 tons of concentrate per annum. The feasibilityannum), which is being conducted by engineering project house TWPSAVMIN development and licence agreements<strong>Mintek</strong>’s SAVMIN process for purifying sulphate-polluted mine drainagehas undergone two highly successful large-scale demonstrations,Negotiations are now underway to license the technology, on a non-satisfy the environmental obligations of the mining companies in the area, andpilot plant is currently underway.Iron and steelmaking projectsA study was completed for the IDC on cataloguing iron-ore resources in SouthThe results indicated that an expansion of South Africa’s steelmaking capacity tosupply some of the requirements of the increased world demand for steel couldbe feasible.testing and feasibility study services. These include:• Maputo Metallurgical Complex - a plant to produce 3 million tons per annum ofsteel and 1.5 million tons per annum of iron ore pellets using Palabora magnetite.• Coega Steel Complex - a plant to produce 3 million tons per annum of steel and 5million tons per annum of iron ore pellets using Kumba concentrate.• Northern Cape Steel - a plant to produce 3 million tons per annum of steel using• A plant to produce around 1 million tons of steel per annum using Foskor magnetite.• A plant to produce around 1 million tons per annum of iron or steel using BushveldComplex magnetite.annual report 2007 32

Heap leaching of nickel lateritesHeap leaching of low grade nickel laterite ores is receivingconsiderable attention from nickel producers internationally. Iftechnically and commercially viable, it will represent a paradigm shiftin the industry. <strong>Mintek</strong> is drawing on its experience in heap leaching inother areas to develop expertise in nickel laterite processing, under theauspices of a project with an industry partner. The <strong>Mintek</strong> technology,at this stage, is not unique - it is rather a general competency in thiswork in this exciting area.Thermal magnesiumFollowing a review of the economics of the <strong>Mintek</strong> Thermal MagnesiumProcess, Anglo American has decided not to pursue commercialisation,since it is felt that it would not be able to compete with the low-cost Chineseproducers. <strong>Mintek</strong> will continue to look for opportunities for applying thetechnology.Pics from topto bottom:Columns forheap bioleachprocess development.The FloatStarand optimisationstrategyis installed onthe majority ofSouth Africa’sPGM concentrators.An industrialmilling circuit.PROCESS-CONTROL PRODUCTSthan expected, mainly as a result of timing problems at various clients’sites. FloatStars were implemented on a trial basis at Aquarius Platinum’sEverest operation, and at a major nickel producer in Australia. At thewhich set the limits within which the level setpoints can be moved, wereincorporated into the Grade-Recovery Optimiser. Five more banks ofcells were incorporated into the FloatStar control scheme at Tati Nickelin Botswana, and a successful re-installation was undertaken atthe Crocodile River PGM plant. Service contracts were concludedmajor copper producer in Chile.of minerals in a sample. Such a technique, if successfullydeveloped, could be used to assist in the design andof control schemes.MillStar milling control was implemented on two ball mills at azinc producer in Mexico, and this will probably be followed by aFloatStar installation during 2007. Following a successful trialperiod, MillStar stabilising control was installed on the 3 000ton-per-hour SAG mill - one of the world’s largest - in Chile. Thecompany has requested <strong>Mintek</strong> to investigate the feasibility ofinstalling stabilising control on two further SAG mills.A new version of the mill power optimiser, which uses dynamicdata to optimise the load setpoint, was implemented at the Mixedand UG2 plants at Lonmin’s Karee operations, and at EasternPlatinum C Stream. The optimiser previously underwent trials interms of the corporate service contract with Lonmin (Annual Report2006), which as well as the servicing of all current process-controlinstallations and software upgrades, includes an agreement for<strong>Mintek</strong> to trial-install new technology at Lonmin’s plants in return forreduced prices on purchases.33annual report 2007

Pics from topto bottom:A Cynoprobewas installedat Polymetallin Russia, andthis will befollowed bya LeachStarcontroller in2007.The measurementcell inthe Cynoprobe.<strong>Mintek</strong>’s ArcMonitor, orArcmon, isan adjunct tothe FurnStarMinstralsystem thatprovidesadditionalinformationabout theconductionbehaviourwithin theburden in submerged-arcfurnaces.AngloGold Ashanti’s Mponeng gold mine, which installed thepurchased a Cynoprobe online cyanide analyser to complementthe control strategy. Four WAD Cynoprobes, which are ableto measure the concentration of both “free” and weak-aciddissociablecyanide, were installed at local gold plants – twoat Beatrix and two at Driefontein. A unit was purchased byAngloGold Ashanti’s Siguiri gold mine in Guinea and willbe commissioned in 2007, and a very successful trial wasconcluded at Geita in Tanzania.A Cynoprobe was installed at Polymetall in Russia, and thiswill be followed by a LeachStar controller in 2007. Cynoprobeswere purchased by Newmont Mining Corporation’s Midasoperation in Nevada and (together with a LeachStar controller)at Waihi in New Zealand. A trial installation was begun at theNewmont/Peñoles La Herradura joint venture in Mexico, andBarrick’s Henty gold mine in western Tasmania, which previouslyhad an older version installed on a trial basis, purchased anupgrade.Further development of the Cynoprobe is under way, withmeasurement range of the instrument to both higher and lowerconcentrations while retaining the accuracy across the range. Inparticular, the monitoring of “post-mixing” aquatic systems requires themeasurement of free cyanide at parts-per-billion levels.The latest version of the FurnStar Minstral TM control strategy forsubmerged-arc furnaces, which includes power optimisation andresistance optimisation modules, was released. FurnStar control wasimplemented at South Africa’s two newest ferrochromium producers – theXstrata-Merafe Lion project and International Ferro Metals’ Buffelsfonteinsmelter – which have a combined annual capacity of 627 000 tons offerrochromium. Lion Ferrochrome, near Steelpoort in Mpumalanga, whichbegan production in September 2006, utilises two 63 MVA furnaces. Thein mid-January, and the second of the two 66 MVA furnaces came on line in earlyFebruary.New FurnStar installations were also completed on a further two furnaces atupgraded with the latest version of the software.<strong>Mintek</strong>’s Arc Monitor, or Arcmon, is an adjunct to the FurnStar Minstral system thatprovides additional information about the conduction behaviour within the burden insubmerged-arc furnaces. Arcmon makes it possible to study the detailed behaviourof the electrical circuit in a submerged-arc furnace in real time. Its ability to distinguishbetween arcing and resistive conduction provides useful information about the burdenof a furnace within its reactive zone, including the carbon balance and the metalbath level. Arcing information can also be used to improve the regulation of electrodeExtensive Arcmon studies have been undertaken on the electrical conduction in siliconmetal, ferrosilicon and ferrochromium furnaces, and during 2006 a further trial was2007.annual report 2007 34

CAPITAL EQUIPMENTA 125 kilogram per hour Minfurn carbon-regeneration furnace wascommissioned at Compañia Minera San Simon SA in Peru. Thiswas the second installation of the higher-capacity Minfurn, which wasin a larger unit. The larger furnace has a capacity comparable withconventional regeneration equipment such as rotary kilns, while retainingthe advantages of the unique resistive-heating technology employed in theMinfurn. A 75 kilogram per hour furnace was installed at Yamana Gold’s SãoFrancisco operation in Brazil. Orders were received for a further 75 kilogramper hour unit (Mineração Turmalina, Brazil) and a 125 kilogram per hour unit(COMARSA, Peru), and these will be commissioned early in 2007. These twofurnaces are the latest PLC-based models, with the ability to allow remoteaccess via Ethernet if the appropriate hardware is installed.hopes to break into this market shortly.The latest version of the Atomijet atomiser was installed and commissionedcapacity of 50 kilograms per batch, can operate at temperatures up to morethan 1 600°C, compared with 1 100°C in earlier models. This extends therange of materials that can be processed.SOUTH AFRICAN REFERENCE MATERIALSFour new standards in the series of South African Reference Materials– a ferrochromium metal, a ferrochromium slag, a low-grade nickel-PGM sulphide, and a feed-grade Merensky Reef material. In addition,four uranium standards were produced for a consulting company. Auranium ore standard and a UG2 PGM standard will be releasedFurther gold, uranium, and rock reference materials are plannedto replenish stock levels, as well as new materials for copper,cobalt, nickel, and tantalite ores, Toxicity Characteristic LeachingProcedure (TCLP) standards, and polluted soils and sediments. Avertical stirred mill has been purchased for the fast production ofmicrometres) and a small standard deviation.Metallurgical accounting and geological resource evaluationsdepend to a large degree on the quality of analytical results,and <strong>Mintek</strong> is seeking opportunities to grow its SARMs business.The SARM programme has joined the recently formed SouthAfrican branch of the ISO Committee on Reference Materials(REMCO), whose aim is to co-ordinate a broad international effortPics from top tobottom:A 125 kilogramper hourMinfurn carbonregenerationfurnace wascommissioned atCompañiaMinera SanSimon SA inPeru.The latestversion ofthe Atomijetatomiser wasinstalled andcommissioned atImpala PlatinumSprings.Four newstandards in theseries of SouthAfrican ReferenceMaterials(SARMs) weremanufacturedMetallurgicalaccountingand geologicalresource evaluationsdepend toa large degreeon the qualityof analyticalresults. <strong>Mintek</strong>is seeking opportunitiestogrow its SARMsbusiness.“Further development of the Cynoprobe is undercircuitry to extend the measurement range of theinstrument to both higher and lower concentrations”35 annual report 2007

annual report 200736

MINERAL POLICYAND SUSTAINABLEDEVELOPMENTMINERAL ECONOMICS AND STRATEGY<strong>Mintek</strong>’s Mineral Economics and Strategy Unit (MESU) conductsregional commodity-based mineral economic studies to promote valueaddition and sustainable development through the minerals industry, both inSouth Africa and elsewhere in Africa.Regional Mineral EconomicsStrategic regional minerals scans are undertaken to highlight infrastructurerequirements, advantages of ordered development and clustering ofprojects, preliminary economic analysis, and identify downstream and valueadded developmental opportunities frommineral-based projects. Two detailedscans investigated the mineralpotentials of Limpopo and KwaZulu-Natal.The Limpopo scan will be used todevelop a mineral strategy for theyear. The KwaZulu-Natal projectre-investigated the remainingcoal mining potential forthe province, reviewed theindustrial minerals sector,“<strong>Mintek</strong> also contributed tothe strategy for sustainabledevelopment in mining,of development, indicatorsfor and the development ofguidelines for various aspectsof the environmentaloperations.”impactsof miningthat could be exploited. A key feature of both projects was theuse of GIS software that allowed for different scenarios to beevaluated. Interactive GIS-based datasets formed an integralpart of the deliverables for these projects.MESU played a central role in studies of a number of ironand steel projects in southern Africa. MESU also acted assecretariat in Maputo Metallurgical Corridor Project, whichinvestigated the potential to establish a steel complex in Maputothat would utilise magnetite resources from the Palabora MiningCompany dumps.RESOURCE BASED SUSTAINABLEDEVELOPMENTThe Resource Based Sustainable Development (RBSD) strategyhas three principal themes.• A capital equipment and services focus that supportsMain Hand-sorting pic:magnesite ore small-scale at aoperation the Limpopo inprovince.37annual report 2007

Pics to from bottom: topdevelopingMESU isforaLimpopostrategyProvince supporting forclusteringindustrialof industries. supplierSustainable TheDevelopmentcontinued(SD) unitwithDME’stheDevelopment“SustainableMining”throughprogramme.andWithenergywaterincreasinglybecomingonlyscarce,in SouthnotacrossAfrica butAfricanthethese continent,prove majorcouldconstraintsminingto newinvestments.programmeThe SDundertook alsoa studyto thetourto engageEUwithmineralsthe EUcommunity, and metalsincludingEuropeantheCommission.technology equipment and services solutions to miningcustomers around the globe.• Encouraging the lateral migration of technology from theminerals sector to elsewhere in the economy.products, RBSD brings a perspective of opportunitiesfor industrial, technological, and trade development“upstream” and “side-stream” to the mining industry.MESU is developing a strategy for Limpopo Province forsupporting industrial clustering of supplier industries. Theclient in this project needs to develop a set of responses andincentives to create sustainable industries in some of its miningnodes to ensure that a manufacturing industrial cluster can beestablished that is able to outlive the mining sector. The projectadvice to industry and government on strategies to maximiseeconomic linkages and growth.Economics SupportMESU conducted various empirical analytical studies of miningcommodities, and tracked and evaluated commodity prices cycles.A diagnostic approach was used to identify key challenges facing thesector and design appropriate responses. Models that predict and explainthe current commodities booms were developed. MESU was representedat the G20 Energy and Resources Meeting in Banff, Canada.Sustainable DevelopmentSustainable Development through Mining programmeThe Sustainable Development (SD) unit continued with the DME’s“Sustainable Development through Mining” programme. One of the majorprojects completed was the development of an auditable checklist forprogramming into the Site Inspection Assistance tool being developed for DMEfor sustainable development in mining, and the development of guidelines forvarious aspects of the environmental impacts of mining operations.The SD unit is actively pursuing links with various local and internationalprocessing. The Unit started preliminary work on a project funded by the DST thatinvestigates new technology mixes to conserve water during mining and processing.becoming increasingly scarce, not only in South Africa but across the African continent,these could prove major constraints to new mining investments.annual report 2007 38

REACHAt the beginning of 2006, MESU started investigating the impactof the European Union’s (EU) REACH policy on South Africa’sand Africa’s mining industry. South African mineral exports intothe EU were analysed in terms of REACH and other trade policies.The SD programme also undertook a study tour to the EU to engagewith the EU minerals and metals community, including the EuropeanCommission.SMALL-SCALE MINING AND BENEFICIATIONthe artisanal and small-scale mining sector through researching anddeveloping appropriate technologies, and by providing training andsupport to ensure that development can be as sustainable as possible,even when based on limited resources.A wood-fuelled pottery kiln was designed and commissioned for thepotters at Mapuve village in Limpopo, under the project sponsored byresulting in a higher-quality, more durable product.A pilot plant was installed at the Lyttelton dolomite mine in Marble Halltrials, in which the product was compared with commercial fertiliseron a number of farms in the area, showed this material to be verysuccessful at improving the growth of a variety of vegetables.These trials are continuing into 2007.and mill were set up in Giyani, Limpopo province, and testson vegetable plots have started. Acidulation trials are beingcarried out to test the release of phosphorus from mixtures ofA small iGoli (mercury-free gold-recovery) plant was setup near Springs on the East Rand to recover gold fromconcentrates produced by a small-scale operator. A pilotsizedplant has been commissioned at <strong>Mintek</strong> to demonstratethe process to potential users. A small group of artisanalminers from Tanzania were trained in the process, anda small iGoli plant will be commissioned and an on-sitedemonstration will be conducted in Tanzania towards the endof 2007.Pics to bottom: from Topconducted MESUempirical variousstudies analyticalmining sector ofas data supply suchanalysis and demandcommodities,and evaluated trackedprices commodity cycles.pottery A wood-fuelleddesigned kiln and wasfor commissionedat Mapuve the pottersLimpopo, village inthe project underthe sponsored WF Kellogg byfoundation.millA crusherwere setandLimpopoup in Giyani,andprovince,vegetabletests onhave started.plots(mercury-freeA small iGoliplantgold-recovery)set upwasSpringsnearthe Eastonto recoverRandconcentratesgold fromaproducedsmall-scalebyoperator.participated <strong>Mintek</strong>planning inthe technical offor programme(World the CASMannualBank)Madagascar. conference in<strong>Mintek</strong> participated in the planning of the technical programme<strong>Mintek</strong> technology for the manufacture of glass has beentransferred to groups of rural people in Limpopo, Kwa Zulu Natal,Gauteng and Mpumalanga.39annual report 2007