FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

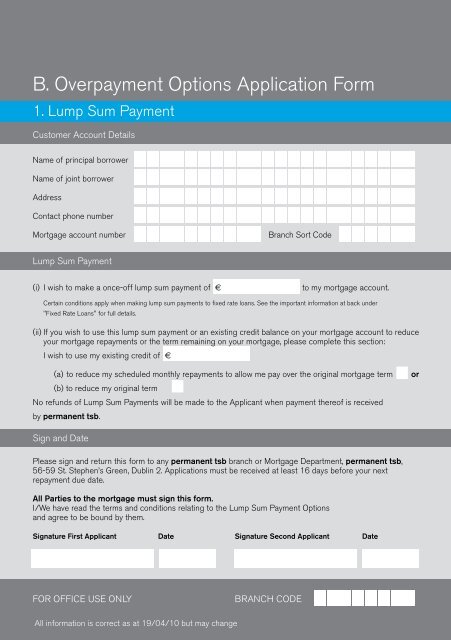

2. Regular OverpaymentsB. Overpayment Options Application Form1. Lump Sum PaymentCustomer Account DetailsName of principal borrowerName of joint borrowerAddressContact phone numberMortgage account numberLump Sum Payment(i) I wish to make a once-off lump sum payment of €Branch Sort Codeto my mortgage account.Certain conditions apply when making lump sum payments to fixed rate loans. See the important information at back under"Fixed Rate Loans" for full details.(ii) If you wish to use this lump sum payment or an existing credit balance on your mortgage account to reduceyour mortgage repayments or the term remaining on your mortgage, please complete this section:I wish to use my existing credit of €Regular overpayments are where you make an overpayment on yourmortgage by a nominated amount. The overpayments will be credited to yourmortgage account.The great benefits of overpaying on your mortgage are that you• Reduce the term of your mortgage and• Save on the interest chargedWe are unable to receive overpayments on• Annual interest mortgages• Endowment mortgages• Interest only mortgages• Pension backed mortgagesCertain conditions apply when making regular overpayments to fixed rateloans. See the important information at the inside back cover under “FixedRate Loans” for full details.(a) to reduce my scheduled monthly repayments to allow me pay over the original mortgage term(b) to reduce my original termNo refunds of Lump Sum Payments will be made to the Applicant when payment thereof is receivedby permanent tsb.Sign and DatePlease sign and return this form to any permanent tsb branch or Mortgage Department, permanent tsb,56-59 St. Stephen’s Green, Dublin 2. Applications must be received at least 16 days before your nextrepayment due date.All Parties to the mortgage must sign this form.I/We have read the terms and conditions relating to the Lump Sum Payment Optionsand agree to be bound by them.Signature First Applicant Date Signature Second Applicant DateorWhen overpayments or lump sums are made to permanent tsb they are notrefundable to customers.3. Preferred Payment DateChoosing your preferred payment date gives you the flexibility to choosethe specific date you make your mortgage repayment on each month. As aresult, you can now arrange to make your repayment on the day that suitsyou best.This option is currently not available on former Irish <strong>Permanent</strong> mortgages.If you use this option you may have to pay extra interest over the term ofthe loan. Should you wish to avail of this option please fill in the preferredpayment date section in the form attached.Terms and conditions applyFOR OFFICE USE ONLYBRANCH CODEAll information is correct as at 19/04/10 but may change