FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

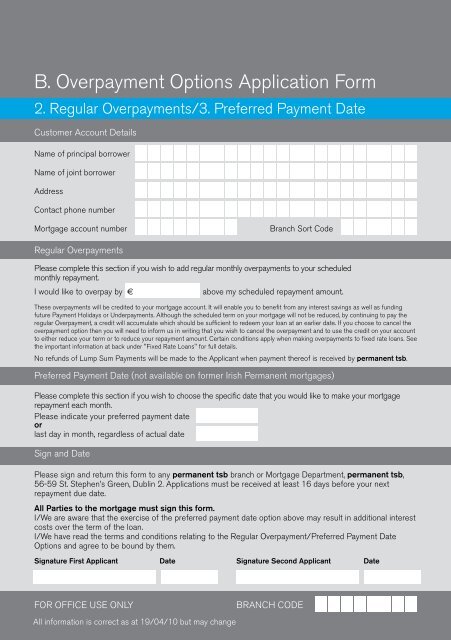

B. Overpayment Options Application Form2. Regular Overpayments/3. Preferred Payment DateCustomer Account DetailsName of principal borrowerName of joint borrowerAddressContact phone numberMortgage account numberRegular OverpaymentsPreferred Payment Date (not available on former Irish <strong>Permanent</strong> mortgages)Sign and DateFOR OFFICE USE ONLYBranch Sort CodePlease complete this section if you wish to add regular monthly overpayments to your scheduledmonthly repayment.I would like to overpay by €above my scheduled repayment amount.These overpayments will be credited to your mortgage account. It will enable you to benefit from any interest savings as well as fundingfuture Payment Holidays or Underpayments. Although the scheduled term on your mortgage will not be reduced, by continuing to pay theregular Overpayment, a credit will accumulate which should be sufficient to redeem your loan at an earlier date. If you choose to cancel theoverpayment option then you will need to inform us in writing that you wish to cancel the overpayment and to use the credit on your accountto either reduce your term or to reduce your repayment amount. Certain conditions apply when making overpayments to fixed rate loans. Seethe important information at back under "Fixed Rate Loans" for full details.No refunds of Lump Sum Payments will be made to the Applicant when payment thereof is received by permanent tsb.Please complete this section if you wish to choose the specific date that you would like to make your mortgagerepayment each month.Please indicate your preferred payment dateorlast day in month, regardless of actual datePlease sign and return this form to any permanent tsb branch or Mortgage Department, permanent tsb,56-59 St. Stephen’s Green, Dublin 2. Applications must be received at least 16 days before your nextrepayment due date.All Parties to the mortgage must sign this form.I/We are aware that the exercise of the preferred payment date option above may result in additional interestcosts over the term of the loan.I/We have read the terms and conditions relating to the Regular Overpayment/Preferred Payment DateOptions and agree to be bound by them.Signature First Applicant Date Signature Second Applicant DateAll information is correct as at 19/04/10 but may changeBRANCH CODETerms & conditions relating to flexible repayment optionsDefinitions“Scheduled Monthly or Other Periodic Repayment” isthe scheduled repayment amount based on the original loanagreement and is referred to as the monthly or other periodicinstallment in the Loan Approval as amended from time to time.“permanent tsb” means Irish Life & <strong>Permanent</strong> plc.“permanent tsb loan” means a loan facility for which applicationhas been made to permanent tsb on or after the 4th of June2002 and includes an application made prior to that date but notprocessed until after that date.“Month” is a calendar month.“Overpayment” is any regular monthly or other periodic paymentwhich exceeds the Scheduled Monthly or Other PeriodicRepayment. Such payments will be credited to the mortgageaccount immediately and interest will be adjusted accordingly,thus accelerating repayment of the loan and reducing the interestcharge.“Underpayment” is any monthly or other periodic payment whichis less than the Scheduled Monthly or Other Periodic Repayment.“Payment Holiday” is a period during which no ScheduledMonthly or Other Periodic Repayment is made and may beexercised with or without Overpayments in accordance with theseterms and conditions. Where there is a Payment Holiday, withoutOverpayments, a nominal sum of €1 (or such other lesser amountas permanent tsb in its absolute discretion thinks fit) togetherwith any insurance payments will continue to be collected.Flexible repayment optionsThe following options are available to Applicants:A. Payment holiday options1. Moratorium/ Payment Holiday(i) The Applicant may choose a period where no ScheduledMonthly or Other Periodic Repayment is made and wherethere is no Overpayment made with which to fund thePayment Holiday. However a nominal sum of €1 (or suchother lesser amount as permanent tsb in its absolutediscretion thinks fit) together with any insurance paymentswill continue to be collected. This option will be available fora period of 3 months, consecutively or separately, in any3-year period provided that the total number of months inwhich this option may apply will not exceed 9 (that is tosay 3 periods of 3 months over the term of the Mortgage).The interest portion of the monthly repayments which theApplicant has elected not to make (including interest onthat unpaid interest) will be added at the end of the 3month period (or a lesser monthly period if the Applicantchooses a lesser number of months under this option) tothe capital due under the mortgage and will be repayableover the remaining term of the loan. permanent tsb may,at its discretion, alter the number of periods or the durationof any period as it may deem fit. This option can only beexercised where:• the first 12 months of the Mortgage term has elapsedand,• the ratio which the Loan amount bears to the value ofthe property is less than 90% and,• there have not been more than 1 month’s arrearswithin the previous 2 years prior to the application toexercise this option.permanent tsb reserves the right to alter the number ofperiods, the duration of the periods and the percentagereferred to in this condition at any time and from time totime.(ii)(iii)(iv)The term of the mortgage will not be extended where thisoption is exercised.This option cannot be exercised in conjunction with theSkip Months Payment holiday and Low Start Option.This option is not available on Annual Interest, Interest Only,Endowment, Pension-Backed, Residential Investment orCommercial Mortgages.2. Moratorium/Payment Holidays with Overpayment(i) The Applicant may use a period where no ScheduledMonthly or Other Periodic Repayment is made, providedsufficient Overpayments have been made in order toprovide for the Payment Holiday. In such circumstances,the Overpayments will be applied towards the funding ofthe Payment Holiday.(ii) If the Overpayment made is insufficient to meet fully, theScheduled Monthly or Other Periodic Repayment at a timewhen the Applicant has decided to take a Payment Holidayor where, having taken a Payment Holiday, the Applicantwishes to continue the Payment Holiday, the PaymentHoliday facility will not be available to the Applicant.permanent tsb will then seek the Scheduled Monthly orOther Periodic Repayment by direct debit on the next duedate. If no direct debit is in place, repayment arrangementsmust be made by the Applicant in a manner satisfactory topermanent tsb.(iii) The term of the mortgage will not be extended where thisoption is exercised.(iv) This option is not available on Annual Interest, Interest Only,Endowment or Pension-Backed Mortgages.(v) This option cannot be exercised in conjunction with theSkip Months Payment Holidays and Low Start Option.3. Skip Months Payment Holidays(i) The Applicant may elect not to make a monthly repaymentfor any month or months not exceeding 2 months (or suchother longer period as permanent tsb, in its absolutediscretion allows) consecutively or separately, in any 12month period and the amount of the monthly repaymentsdue thereafter will be increased from the date of theacceptance of the application and over the remainder ofthe term of the mortgage to take account of the amountnot paid by reason of such election. If the Applicant decidesto terminate the exercise of this option, the Applicants’monthly repayments will be recalculated accordingly forthe remainder of the term of the mortgage to take accountof such termination.(ii) The term of the mortgage will not be extended where thisoption is exercised.(iii) This Option cannot be exercised in conjunction with thePayment Holiday or the Low Start Option.(iv) This option is not available on Annual Interest, Endowment,Interest Only, Pension-Backed, Commercial or ResidentialInvestment Mortgages.(v) This option is not available on accounts where there is noDirect Debit in place.4. Underpayment where there is no Overpayment(i) Where agreed with permanent tsb, the Applicant maymake an Underpayment where there are no Overpaymentsto fund the Underpayment. This option will be available fora period of 3 months, consecutively or separately, in any3-year period provided that the total number of months inwhich this option may apply will not exceed 9 (that is tosay 3 periods of 3 months over the term of the Mortgage).permanent tsb may, at its discretion, alter the number ofperiods or the duration of any period as it may deem fit.This option can only be exercised where:• the first 12 months of the Mortgage term has elapsedand,• the ratio which the Loan amount bears to the value ofthe property is less than 90% and,• there have not been more than 1 month’s arrearswithin the previous 2 years prior to the applicationto exercise this option.