FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

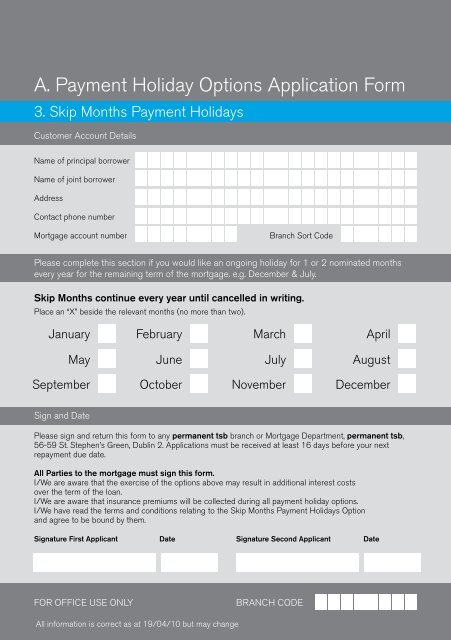

B. Overpayment OptionsA. Payment Holiday Options Application Form3. Skip Months Payment HolidaysCustomer Account DetailsName of principal borrowerName of joint borrowerWith overpayment options it’s possible to clear your mortgage soonerthan originally planned. By making a lump sum payment or making smallincreases to your regular repayments, you can reduce the term of yourmortgage and the amount of interest you pay.You can also make an overpayment to pay for a payment holiday or to coverthe shortfall in previous payments.1. Lump-Sum PaymentAddressContact phone numberMortgage account numberBranch Sort CodeTypically, lump sum payments are made from a customer’s bonus,investments, or perhaps an inheritance. Unfortunately when overpaymentsor lump-sums are made to permanent tsb, they are not refundable tocustomers.Please complete this section if you would like an ongoing holiday for 1 or 2 nominated monthsevery year for the remaining term of the mortgage. e.g. December & July.Skip Months continue every year until cancelled in writing.Place an “X” beside the relevant months (no more than two).January February March AprilMay June July AugustFor Annual Interest loans, the lump-sum payments will only be taken intoaccount at the end of the year in which the lump-sum was made and willonly affect the interest calculation following that timeCertain conditions apply when making lump-sum payments to fixed rateloans. See the important information at the inside back cover under “FixedRate Loans” for full details.September October November DecemberSign and DatePlease sign and return this form to any permanent tsb branch or Mortgage Department, permanent tsb,56-59 St. Stephen’s Green, Dublin 2. Applications must be received at least 16 days before your nextrepayment due date.All Parties to the mortgage must sign this form.I/We are aware that the exercise of the options above may result in additional interest costsover the term of the loan.I/We are aware that insurance premiums will be collected during all payment holiday options.I/We have read the terms and conditions relating to the Skip Months Payment Holidays Optionand agree to be bound by them.Signature First Applicant Date Signature Second Applicant DateFOR OFFICE USE ONLYBRANCH CODEAll information is correct as at 19/04/10 but may change