FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

FLEXIBLE MORTGAGE REPAYMENT OPTIONS - Permanent TSB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

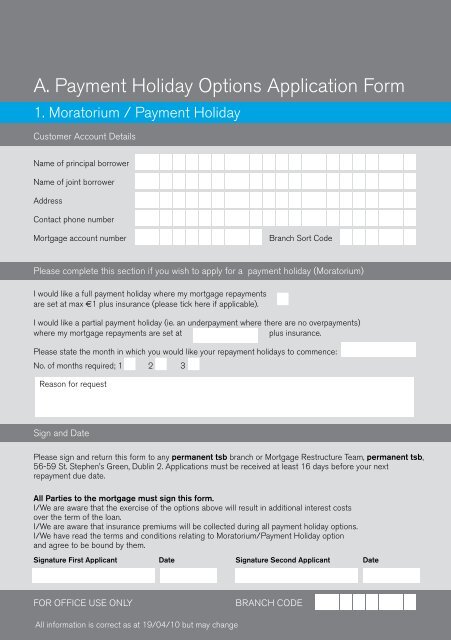

2. UnderpaymentA. Payment Holiday Options Application Form1. Moratorium / Payment HolidayCustomer Account DetailsName of principal borrowerName of joint borrowerAddressIf you have previously made regular overpayments and have built up crediton your mortgage, you can use this credit for a payment holiday.Depending on the amount of credit built up, you can extend the length of thepayment holiday beyond three months. You can also underpay a payment bythe amount of credit built up.You can avail of the underpayment option up to three times during the life ofyour mortgage.Who can apply for payment holidays?Contact phone numberMortgage account numberBranch Sort CodePayment holidays are only available on annuity home loans where• You have your mortgage with permanent tsb for at least 2 years.Please complete this section if you wish to apply for a payment holiday (Moratorium)I would like a full payment holiday where my mortgage repaymentsare set at max €1 plus insurance (please tick here if applicable).I would like a partial payment holiday (ie. an underpayment where there are no overpayments)where my mortgage repayments are set atplus insurance.Please state the month in which you would like your repayment holidays to commence:No. of months required; 1 2 3Reason for requestSign and DatePlease sign and return this form to any permanent tsb branch or Mortgage Restructure Team, permanent tsb,56-59 St. Stephen’s Green, Dublin 2. Applications must be received at least 16 days before your nextrepayment due date.All Parties to the mortgage must sign this form.I/We are aware that the exercise of the options above will result in additional interest costsover the term of the loan.I/We are aware that insurance premiums will be collected during all payment holiday options.I/We have read the terms and conditions relating to Moratorium/Payment Holiday optionand agree to be bound by them.Signature First Applicant Date Signature Second Applicant Date• You have a loan for no more than 90% of the property’s value.• You have been no more than one month in arrears in the last two years.• You pay the loan by direct debit or standing order.You cannot receive a payment holiday on• Commercial and residential investment mortgages unless you haveenough credit on your account from previous overpayments.• Endowment, annual interest or pension-backed mortgages.If you do not meet the above criteria please visit your local branch to discussthe options available to you.If you take a payment holiday, we will change your repayments to ensurethat your mortgage is still repaid within the original agreed term. The term ofthe mortgage will not be extended where this option is exercised. Insurancepremiums will be still be billed during all payment holiday options.Please read the terms and conditions section of this brochure for moreinformation.FOR OFFICE USE ONLYBRANCH CODEAll information is correct as at 19/04/10 but may change