You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annual report<br />

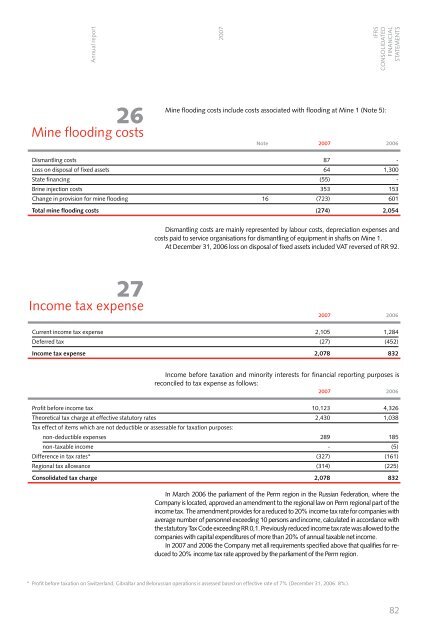

26<br />

Mine flooding costs<br />

<strong>2007</strong><br />

iFRS<br />

coNSoliDATED<br />

FiNANciAl<br />

STATEMENTS<br />

Dismantling costs 87 -<br />

loss on disposal of fixed assets 64 1,300<br />

State financing (55) -<br />

Brine injection costs 353 153<br />

change in provision for mine flooding 16 (723) 601<br />

Total mine flooding costs (274) 2,054<br />

27<br />

income tax expense<br />

current income tax expense 2,105 1,284<br />

Deferred tax (27) (452)<br />

Income tax expense 2,078 832<br />

Profit before income tax 10,123 4,326<br />

Theoretical tax charge at effective statutory rates 2,430 1,038<br />

Tax effect of items which are not deductible or assessable for taxation purposes:<br />

Mine flooding costs include costs associated with flooding at Mine 1 (Note 5):<br />

<strong>2007</strong> 2006<br />

non-deductible expenses 289 185<br />

non-taxable income - (5)<br />

Difference in tax rates* (327) (161)<br />

Regional tax allowance (314) (225)<br />

Consolidated tax charge 2,078 832<br />

Note<br />

Dismantling costs are mainly represented by labour costs, depreciation expenses and<br />

costs paid to service organisations for dismantling of equipment in shafts on Mine 1.<br />

At December 31, 2006 loss on disposal of fixed assets included VAT reversed of RR 92.<br />

income before taxation and minority interests for financial reporting purposes is<br />

reconciled to tax expense as follows:<br />

<strong>2007</strong><br />

2006<br />

in March 2006 the parliament of the Perm region in the Russian Federation, where the<br />

company is located, approved an amendment to the regional law on Perm regional part of the<br />

income tax. The amendment provides for a reduced to 20% income tax rate for companies with<br />

average number of personnel exceeding 10 persons and income, calculated in accordance with<br />

the statutory Tax code exceeding RR 0,1. Previously reduced income tax rate was allowed to the<br />

companies with capital expenditures of more than 20% of annual taxable net income.<br />

in <strong>2007</strong> and 2006 the company met all requirements specified above that qualifies for reduced<br />

to 20% income tax rate approved by the parliament of the Perm region.<br />

* Profit before taxation on Switzerland, Gibraltar and Belorussian operations is assessed based on effective rate of 7% (December 31, 2006: 8%).<br />

<strong>2007</strong><br />

2006<br />

82