investor's guide to commodities - PRI Signatory Extranet - Principles ...

investor's guide to commodities - PRI Signatory Extranet - Principles ...

investor's guide to commodities - PRI Signatory Extranet - Principles ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

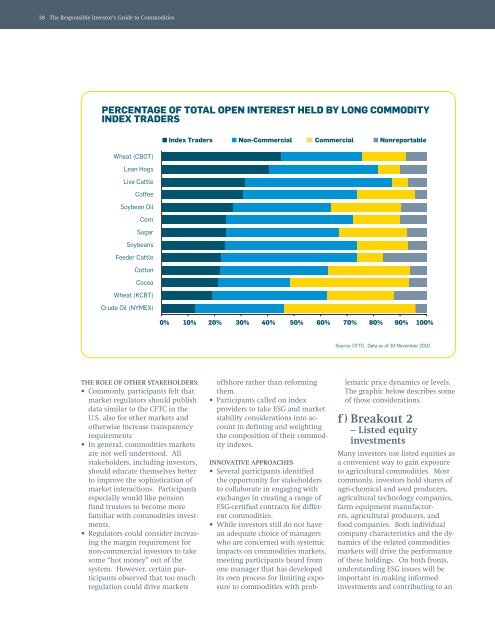

38 The Responsible Inves<strong>to</strong>r’s Guide <strong>to</strong> CommoditiesPERCENTAGE OF TOTAL OPEN INTEREST HELD BY LONG COMMODITYINDEX TRADERS■ Index Traders ■ Non-Commercial ■ Commercial ■ NonreportableWheat (CBOT)Lean HogsLive CattleCoffeeSoybean OilCornSugarSoybeansFeeder CattleCot<strong>to</strong>nCocoaWheat (KCBT)Crude Oil (NYMEX)0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%Source: CFTC. Data as of 30 November 2010THE ROLE OF OTHER STAKEHOLDERS:• Commonly, participants felt thatmarket regula<strong>to</strong>rs should publishdata similar <strong>to</strong> the CFTC in theU.S. also for other markets andotherwise increase transparencyrequirements• In general, <strong>commodities</strong> marketsare not well unders<strong>to</strong>od. Allstakeholders, including inves<strong>to</strong>rs,should educate themselves better<strong>to</strong> improve the sophistication ofmarket interactions. Participantsespecially would like pensionfund trustees <strong>to</strong> become morefamiliar with <strong>commodities</strong> investments.• Regula<strong>to</strong>rs could consider increasingthe margin requirement fornon-commercial inves<strong>to</strong>rs <strong>to</strong> takesome “hot money” out of thesystem. However, certain participantsobserved that <strong>to</strong>o muchregulation could drive marketsoffshore rather than reformingthem.• Participants called on indexproviders <strong>to</strong> take ESG and marketstability considerations in<strong>to</strong> accountin defining and weightingthe composition of their commodityindexes.INNOVATIVE APPROACHES• Several participants identifiedthe opportunity for stakeholders<strong>to</strong> collaborate in engaging withexchanges in creating a range ofESG-certified contracts for different<strong>commodities</strong>.• While inves<strong>to</strong>rs still do not havean adequate choice of managerswho are concerned with systemicimpacts on <strong>commodities</strong> markets,meeting participants heard fromone manager that has developedits own process for limiting exposure<strong>to</strong> <strong>commodities</strong> with problematicprice dynamics or levels.The graphic below describes someof those considerations.f ) Breakout 2– Listed equityinvestmentsMany inves<strong>to</strong>rs use listed equities asa convenient way <strong>to</strong> gain exposure<strong>to</strong> agricultural <strong>commodities</strong>. Mostcommonly, inves<strong>to</strong>rs hold shares ofagri-chemical and seed producers,agricultural technology companies,farm equipment manufacturers,agricultural producers, andfood companies. Both individualcompany characteristics and the dynamicsof the related <strong>commodities</strong>markets will drive the performanceof these holdings. On both fronts,understanding ESG issues will beimportant in making informedinvestments and contributing <strong>to</strong> an