ib-economics-quantitative

ib-economics-quantitative

ib-economics-quantitative

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

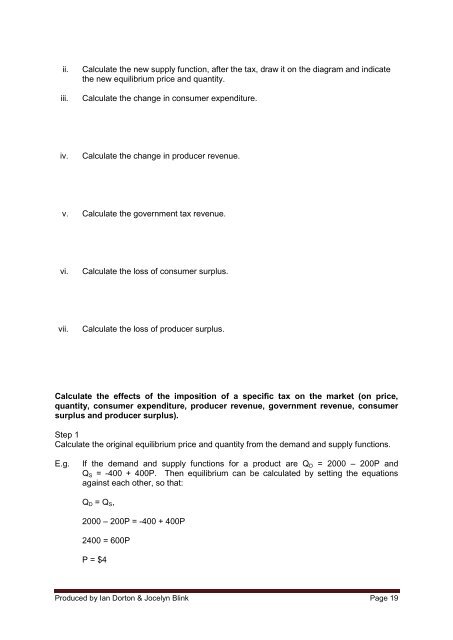

ii.iii.Calculate the new supply function, after the tax, draw it on the diagram and indicatethe new equil<strong>ib</strong>rium price and quantity.Calculate the change in consumer expenditure.iv.Calculate the change in producer revenue.v. Calculate the government tax revenue.vi.Calculate the loss of consumer surplus.vii.Calculate the loss of producer surplus.Calculate the effects of the imposition of a specific tax on the market (on price,quantity, consumer expenditure, producer revenue, government revenue, consumersurplus and producer surplus).Step 1Calculate the original equil<strong>ib</strong>rium price and quantity from the demand and supply functions.E.g.If the demand and supply functions for a product are Q D = 2000 – 200P andQ S = -400 + 400P. Then equil<strong>ib</strong>rium can be calculated by setting the equationsagainst each other, so that:Q D = Q S ,2000 – 200P = -400 + 400P2400 = 600PP = $4Produced by Ian Dorton & Jocelyn Blink Page 19