MBU Informe Anual 2009 Ingles24may10:maquetaci..n 1

MBU Informe Anual 2009 Ingles24may10:maquetaci..n 1

MBU Informe Anual 2009 Ingles24may10:maquetaci..n 1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(1) Legal requirements for gross loans at June 30, <strong>2009</strong>.<br />

(2) Legal requirements for gross loans at December 31, 2008.<br />

(3) Legal requirements for average gross loan portfolio balances at<br />

December 31, 2008 and 2007.<br />

(4) Legal requirements for gross loans at March 31, <strong>2009</strong>.<br />

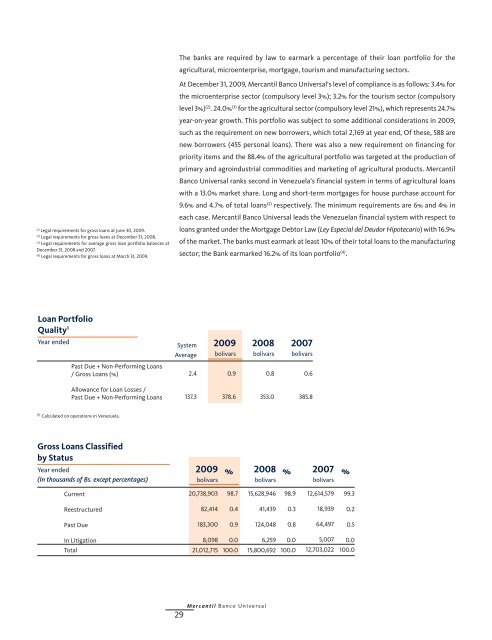

Loan Portfolio<br />

Quality 1<br />

Year ended<br />

Past Due + Non-Performing Loans<br />

/ Gross Loans (%)<br />

Allowance for Loan Losses /<br />

Past Due + Non-Performing Loans<br />

(1) Calculated on operations in Venezuela.<br />

Gross Loans Classified<br />

by Status<br />

Year ended<br />

(In thousands of Bs. except percentages)<br />

Current<br />

Reestructured<br />

Past Due<br />

In Litigation<br />

Total<br />

The banks are required by law to earmark a percentage of their loan portfolio for the<br />

agricultural, microenterprise, mortgage, tourism and manufacturing sectors.<br />

At December 31, <strong>2009</strong>, Mercantil Banco Universal’s level of compliance is as follows: 3.4% for<br />

the microenterprise sector (compulsory level 3%); 3.2% for the tourism sector (compulsory<br />

level 3%) (2) . 24.0% (3) for the agricultural sector (compulsory level 21%), which represents 24.7%<br />

year-on-year growth. This portfolio was subject to some additional considerations in <strong>2009</strong>,<br />

such as the requirement on new borrowers, which total 2,169 at year end, Of these, 588 are<br />

new borrowers (455 personal loans). There was also a new requirement on financing for<br />

priority items and the 88.4% of the agricultural portfolio was targeted at the production of<br />

primary and agroindustrial commodities and marketing of agricultural products. Mercantil<br />

Banco Universal ranks second in Venezuela’s financial system in terms of agricultural loans<br />

with a 13.0% market share. Long and short-term mortgages for house purchase account for<br />

9.6% and 4.7% of total loans (2) respectively. The minimum requirements are 6% and 4% in<br />

each case. Mercantil Banco Universal leads the Venezuelan financial system with respect to<br />

loans granted under the Mortgage Debtor Law (Ley Especial del Deudor Hipotecario) with 16.9%<br />

of the market. The banks must earmark at least 10% of their total loans to the manufacturing<br />

sector; the Bank earmarked 16.2% of its loan portfolio (4) .<br />

System<br />

Average<br />

2.4<br />

137.3<br />

<strong>2009</strong><br />

bolivars<br />

20,738,903<br />

82,414<br />

183,300<br />

<strong>2009</strong><br />

bolivars<br />

0.9<br />

378.6<br />

Mercantil Banco Universal<br />

29<br />

% 2008 % 2007 %<br />

98.7<br />

0.4<br />

0.9<br />

8,098 0.0<br />

21,012,715 100.0<br />

2008<br />

bolivars<br />

0.8<br />

353.0<br />

bolivars<br />

15,628,946<br />

41,439<br />

124,048<br />

98.9<br />

0.3<br />

0.8<br />

6,259 0.0<br />

15,800,692 100.0<br />

2007<br />

bolivars<br />

0.6<br />

385.8<br />

bolivars<br />

12,614,579<br />

18,939<br />

64,497<br />

5,007<br />

12,703,022<br />

99.3<br />

0.2<br />

0.5<br />

0.0<br />

100.0