U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

U.S. <strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> SPD Effective January 2011<br />

termination of employment that produces the highest average. Years before 2001 and years that<br />

you did not work at least 1,000 hours are not counted in determining your Final Average Base<br />

Pay.<br />

Base <strong>Pension</strong> Pay in your year of termination will be included if it produces a higher average.<br />

Base <strong>Pension</strong> Pay includes only your base pay and the following items:<br />

� shift differentials<br />

� premium pay<br />

� vacation and holiday pay<br />

� short-term disability pay, and<br />

� pre-tax elective contributions to a 401(k) plan, a cafeteria plan, or a qualified<br />

transportation fringe benefit.<br />

Like Total <strong>Pension</strong> Pay, Base <strong>Pension</strong> Pay does not include certain items of compensation,<br />

including, but not limited to, expense reimbursements, imputed income, income from stock<br />

option exercises, restricted stock, restricted stock units, retention bonuses, and amounts paid<br />

under the U.S. Bancorp Incentive Cash Bonus and Retention <strong>Plan</strong>. It also does not include any<br />

pay for service in a position that is not an eligible position (i.e., a position that is not eligible to<br />

earn benefits under the <strong>Plan</strong>). In addition, Base <strong>Pension</strong> Pay does not include bonuses,<br />

commissions and overtime.<br />

If you earned a benefit in the <strong>Plan</strong> prior to January 1, 2010, but became a participant in the U.S.<br />

<strong>Bank</strong> 2010 Cash Balance <strong>Plan</strong> on or after January 1, 2010 (by default or otherwise), your Final<br />

Average Base Pay and your Base <strong>Pension</strong> Pay were frozen and compensation earned on and after<br />

January 1, 2010 will not be considered for purposes of earning a benefit in the <strong>Plan</strong>. In addition,<br />

your service performed on and after January 1, 2010 will not be considered for purposes of<br />

determining the amount of your benefit under the <strong>Plan</strong>’s final average pay formula. (Note,<br />

however, that your service will count for purposes of your vesting service.)<br />

In addition, tax laws do not allow annual earnings over $245,000 (in 2011) to be considered in<br />

determining pension benefits. This amount will be adjusted for increases in the cost of living as<br />

required by federal law.<br />

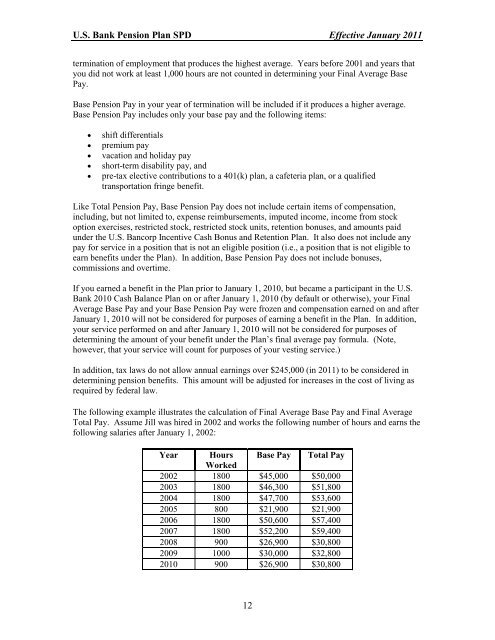

The following example illustrates the calculation of Final Average Base Pay and Final Average<br />

Total Pay. Assume Jill was hired in 2002 and works the following number of hours and earns the<br />

following salaries after January 1, 2002:<br />

Year Hours<br />

Worked<br />

Base Pay Total Pay<br />

2002 1800 $45,000 $50,000<br />

2003 1800 $46,300 $51,800<br />

2004 1800 $47,700 $53,600<br />

2005 800 $21,900 $21,900<br />

2006 1800 $50,600 $57,400<br />

2007 1800 $52,200 $59,400<br />

2008 900 $26,900 $30,800<br />

2009 1000 $30,000 $32,800<br />

2010 900 $26,900 $30,800<br />

12