U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

U.S. <strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> SPD Effective January 2011<br />

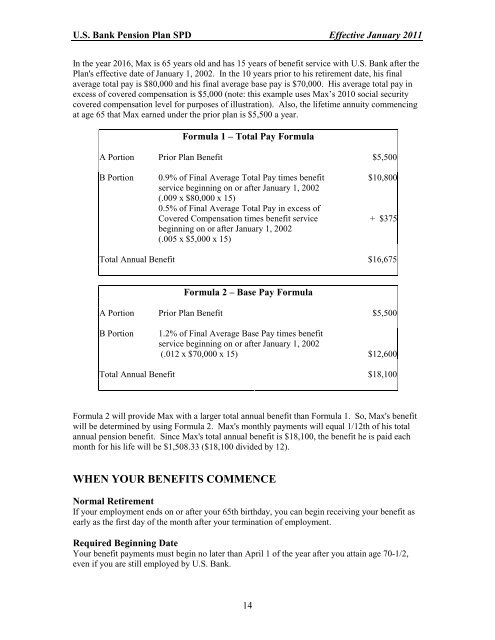

In the year 2016, Max is 65 years old and has 15 years of benefit service with U.S. <strong>Bank</strong> after the<br />

<strong>Plan</strong>'s effective date of January 1, 2002. In the 10 years prior to his retirement date, his final<br />

average total pay is $80,000 and his final average base pay is $70,000. His average total pay in<br />

excess of covered compensation is $5,000 (note: this example uses Max’s 2010 social security<br />

covered compensation level for purposes of illustration). Also, the lifetime annuity commencing<br />

at age 65 that Max earned under the prior plan is $5,500 a year.<br />

Formula 1 – Total Pay Formula<br />

A Portion Prior <strong>Plan</strong> Benefit $5,500<br />

B Portion 0.9% of Final Average Total Pay times benefit<br />

service beginning on or after January 1, 2002<br />

(.009 x $80,000 x 15)<br />

0.5% of Final Average Total Pay in excess of<br />

Covered Compensation times benefit service<br />

beginning on or after January 1, 2002<br />

(.005 x $5,000 x 15)<br />

14<br />

$10,800<br />

+ $375<br />

Total Annual Benefit $16,675<br />

Formula 2 – Base Pay Formula<br />

A Portion Prior <strong>Plan</strong> Benefit $5,500<br />

B Portion 1.2% of Final Average Base Pay times benefit<br />

service beginning on or after January 1, 2002<br />

(.012 x $70,000 x 15) $12,600<br />

Total Annual Benefit $18,100<br />

Formula 2 will provide Max with a larger total annual benefit than Formula 1. So, Max's benefit<br />

will be determined by using Formula 2. Max's monthly payments will equal 1/12th of his total<br />

annual pension benefit. Since Max's total annual benefit is $18,100, the benefit he is paid each<br />

month for his life will be $1,508.33 ($18,100 divided by 12).<br />

WHEN YOUR BENEFITS COMMENCE<br />

Normal Retirement<br />

If your employment ends on or after your 65th birthday, you can begin receiving your benefit as<br />

early as the first day of the month after your termination of employment.<br />

Required Beginning Date<br />

Your benefit payments must begin no later than April 1 of the year after you attain age 70-1/2,<br />

even if you are still employed by U.S. <strong>Bank</strong>.