U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

U.S. Bank Pension Plan Summary Plan Description

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

U.S. <strong>Bank</strong> <strong>Pension</strong> <strong>Plan</strong> SPD Effective January 2011<br />

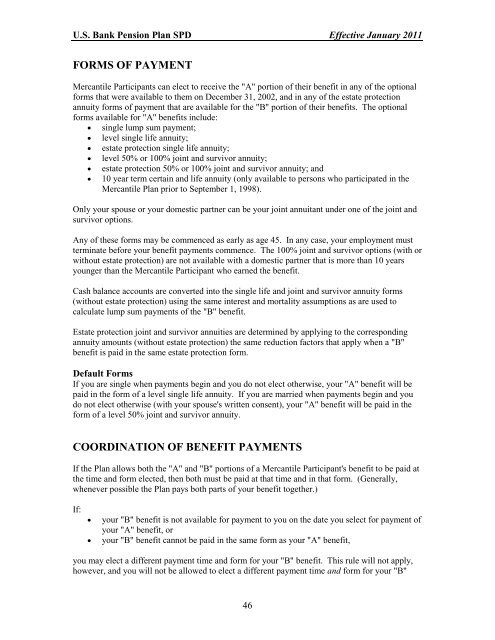

FORMS OF PAYMENT<br />

Mercantile Participants can elect to receive the "A" portion of their benefit in any of the optional<br />

forms that were available to them on December 31, 2002, and in any of the estate protection<br />

annuity forms of payment that are available for the "B" portion of their benefits. The optional<br />

forms available for "A" benefits include:<br />

� single lump sum payment;<br />

� level single life annuity;<br />

� estate protection single life annuity;<br />

� level 50% or 100% joint and survivor annuity;<br />

� estate protection 50% or 100% joint and survivor annuity; and<br />

� 10 year term certain and life annuity (only available to persons who participated in the<br />

Mercantile <strong>Plan</strong> prior to September 1, 1998).<br />

Only your spouse or your domestic partner can be your joint annuitant under one of the joint and<br />

survivor options.<br />

Any of these forms may be commenced as early as age 45. In any case, your employment must<br />

terminate before your benefit payments commence. The 100% joint and survivor options (with or<br />

without estate protection) are not available with a domestic partner that is more than 10 years<br />

younger than the Mercantile Participant who earned the benefit.<br />

Cash balance accounts are converted into the single life and joint and survivor annuity forms<br />

(without estate protection) using the same interest and mortality assumptions as are used to<br />

calculate lump sum payments of the "B" benefit.<br />

Estate protection joint and survivor annuities are determined by applying to the corresponding<br />

annuity amounts (without estate protection) the same reduction factors that apply when a "B"<br />

benefit is paid in the same estate protection form.<br />

Default Forms<br />

If you are single when payments begin and you do not elect otherwise, your "A" benefit will be<br />

paid in the form of a level single life annuity. If you are married when payments begin and you<br />

do not elect otherwise (with your spouse's written consent), your "A" benefit will be paid in the<br />

form of a level 50% joint and survivor annuity.<br />

COORDINATION OF BENEFIT PAYMENTS<br />

If the <strong>Plan</strong> allows both the "A" and "B" portions of a Mercantile Participant's benefit to be paid at<br />

the time and form elected, then both must be paid at that time and in that form. (Generally,<br />

whenever possible the <strong>Plan</strong> pays both parts of your benefit together.)<br />

If:<br />

� your "B" benefit is not available for payment to you on the date you select for payment of<br />

your "A" benefit, or<br />

� your "B" benefit cannot be paid in the same form as your "A" benefit,<br />

you may elect a different payment time and form for your "B" benefit. This rule will not apply,<br />

however, and you will not be allowed to elect a different payment time and form for your "B"<br />

46